Will the weaker dollar bring in foreign investors the condo market?

Boston Condos for Sale and Apartment Rentals

Will the weaker dollar bring in foreign investors the condo market?

The Federal Reserve took the first step toward “the new normal” by cutting its target rate by 50 basis points, to 4.75%-5.0%, in what analysts believe to be the first of several downward adjustments (US News, 2024). This rate cut comes as a relief to the US real estate industry, where more than two years of mortgage rates at over 5%— and at times as high as 7.5%— have led to a decrease in both supply and demand. But what will lower US interest rates mean for the value of the dollar, and ultimately, will it make the Boston condo for sale market residential real estate market more attractive to foreign investors, as an investment class as a whole?

In general, higher interest rates in the US mean more money flooding into the country, which pushes the value of the dollar upward. Conversely, when US interest rates trend downward, the demand for dollar-denominated fixed income assets diminishes, and the dollar’s exchange rate loses terrain to other major currencies like the euro. If the dollar depreciates sufficiently, foreign investors in the Boston condo for sale market could be poised to get more “bang for their buck” when buying— capitalizing on the ability to invest in larger properties (e.g., one bedroom vs. studio) or nicer properties (e.g., new development vs. resale).

Correlation between exchange rates and new development pricing

To demonstrate this correlation, we evaluated the price per ft. of new development condominiums in downtown Boston— a favorite among foreign investors due to impressive sales galleries and an extended sales cycle— and compared this data with the monthly exchange rate of the US dollar to the euro, Chinese yuan, Japanese yen, Brazilian real, and the Mexican peso.

The NAR National Foreign Buyers Survey

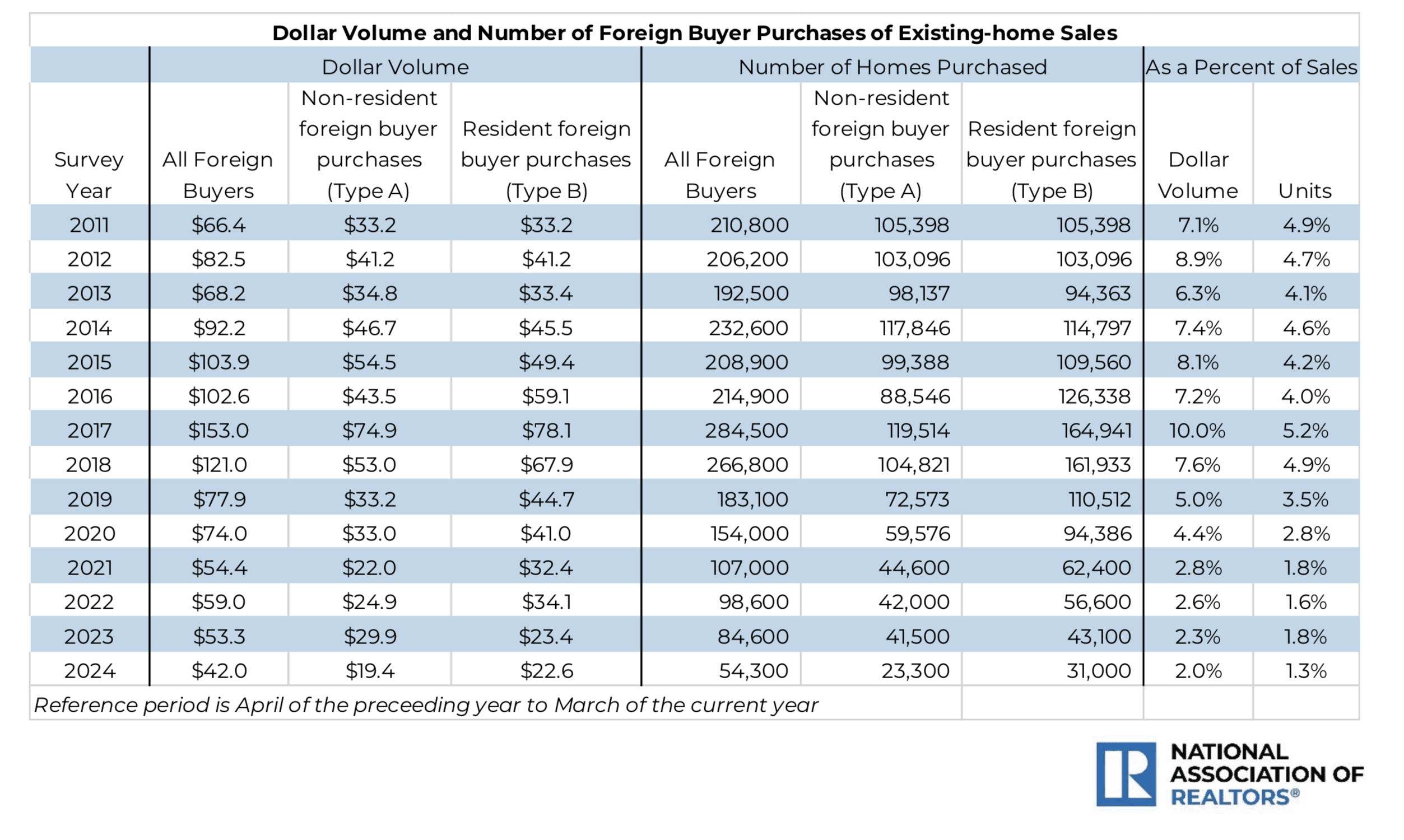

Now let us compare our findings to the NAR 2024 Profile of International Transactions in US Residential Real Estate, representing information regarding REALTOR® transactions with international clients who purchased and/or sold US residential property from 2011 to 2024.

It is indeed clear that the highest volume, as well as the highest percentage of sales nationally occurred in the years between 2011 and 2018. Sales have been at much lower levels since the pandemic, having reached their lowest number within the last year, when interest rates and the value of the dollar were both at their highest. This correlation leads one to wonder— will we see foreign buyers return when rates are cut further and the dollar becomes more affordable to them?

Conclusion

Due to the high price points (often in the multi-millions) and their status as a safe-haven for international investors, new development sales in downtown Boston are sensitive to shifts in the dollar exchange rate seen in, for example, the Brazilian real, the Canadian dollar, and the Chinese yuan. If the dollar weakens, it may bring investors back who have been sidelined by their currency over the course of the last 7 years, increasing the velocity at which remaining luxury new products are absorbed. With so few projects in the Boston Seaport condo pipeline, will the mere scarcity of “new” product, combined with lower mortgage rates and a weaker dollar drive up the price per ft. of new developments once more?

Click Here: Back to Boston Real Estate Home Search

Back to homepage: Boston condos for sale

Ford Realty – Boston Real Estate Google Reviews 2024

Click Here to view: Google Ford Realty Inc Reviews