Boston Condos for Sale and Apartments for Rent

Will Boston have another real estate bubble? No here’s why (video)

I’ve written in past Boston real estate blog posts why I’m concerned about the Boston condo for sale market moving forward.

Today, I’ll take the opposite side of why we aren’t heading into a housing bubble.

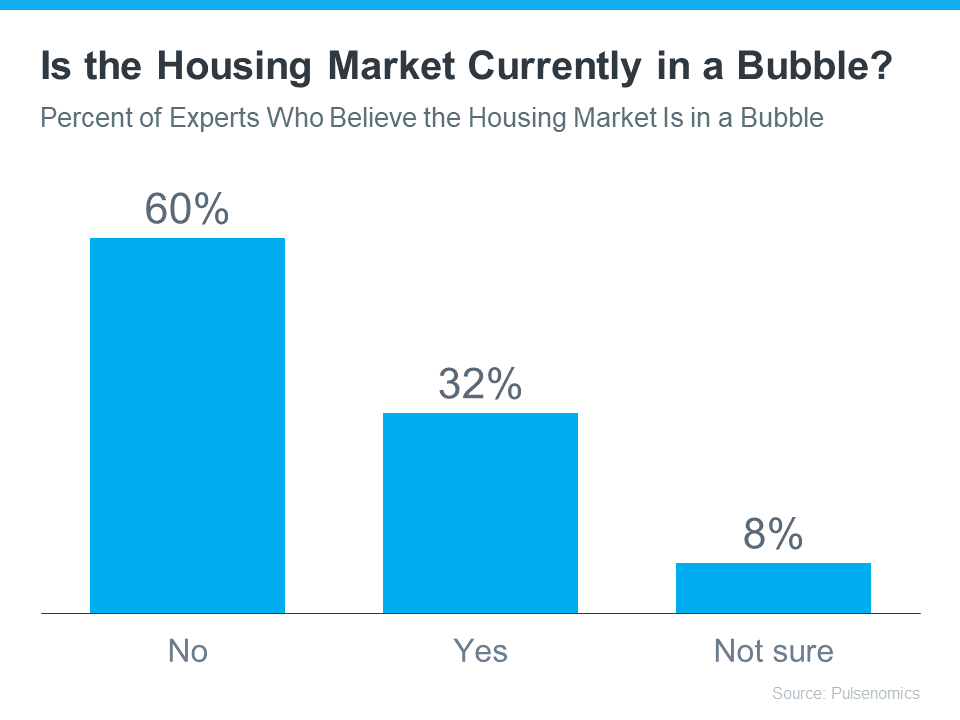

You may be reading headlines and hearing talk about a potential housing bubble or a crash, but it’s important to understand that the data and expert opinions tell a different story. A recent survey from Pulsenomics asked over one hundred housing market experts and real estate economists if they believe the housing market is in a bubble. The results indicate most experts don’t think that’s the case (see graph below):

As the graph shows, a strong majority (60%) said the real estate market is not currently in a bubble. In the same survey, experts give the following reasons why this isn’t like 2008:

- The recent growth in home prices is because of demographics and low inventory

- Credit risks are low because underwriting and lending standards are sound

If you’re concerned a crash may be coming, here’s a deep dive into those two key factors that should help ease your concerns.

1. Low Boston Condo for Sale Inventory Is Causing Home Prices To Rise

The supply of Boston condos for sale available for sale needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued price appreciation.

As the graph below shows, there were too many homes for sale from 2007 to 2010 (many of which were short sales and foreclosures), and that caused prices to tumble. Today, there’s still a shortage of inventory, which is causing ongoing home price appreciation (see graph below):

Boston condo for sale inventory is nothing like the last time. Prices are rising because there’s a healthy demand for homeownership at the same time there’s a limited supply of homes for sale. Odeta Kushi, Deputy Chief Economist at First American, explains:

“The fundamentals driving house price growth in the U.S. remain intact. . . . The demand for homes continues to exceed the supply of homes for sale, which is keeping house price growth high.”

2. Mortgage Lending Standards Today Are Nothing Like the Last Time

During the housing bubble, it was much easier to get a mortgage than it is today. Here’s a graph showing the mortgage volume issued to purchasers with a credit score less than 620 during the housing boom, and the subsequent volume in the years after:

This graph helps show one element of why mortgage standards are nothing like they were the last time. Purchasers who acquired a mortgage over the last decade are much more qualified than they were in the years leading up to the crash. Realtor.com notes:

“. . . Lenders are giving mortgages only to the most qualified borrowers. These buyers are less likely to wind up in foreclosure.”

Boston Condos for Sale and the Bottom Line

A majority of experts agree we’re not in a housing bubble. That’s because home price growth is backed by strong housing market fundamentals and lending standards are much tighter today. If you have questions, let’s connect to discuss why today’s housing market is nothing like 2008.

Boston Real Estate for Sale

Will Boston have another real estate bubble?

No here’s why (video).

Mark Zandi of Moody’s Analytics says even though U.S. housing prices are high, people are not flipping properties to make a quick profit like how it was during the financial crisis of 2008.

Boston Condos for Sale

____________________________________________________________________________________________________________________________________________________________________________________________________

Another interesting article from the Banker & Tradesman entitled: Setting the stage for the next housing bubble? To summarize, this year in the Boston area, just 3,500 homes were built. In 2005 at the height of the boom, more than 15,000 homes were built.

The following are excerpts from Scott Van Voorhis’s article on a disturbing trend:

That trend is the plunge in new housing construction. While there recently have been some bright signs of a modest turnaround here – stay tuned readers – 2009 saw the number of new homes built in the Boston area plunge to its lowest tally in decades.

When it comes to producing new housing, the Boston area has been running on empty for quite a few years.

And as the market heats up, this is one trend that is surely bound to come back to haunt us.

What are your thoughts? Are you concerned?