Will foreclosures rise in Massachusetts?

Boston Condos for Sale

Loading...

Will foreclosures rise in Massachusetts?

Even with the latest data coming in, the experts agree there’s no chance of a large-scale foreclosure crisis here in Massachusetts. While headlines may be calling attention to a slight uptick in foreclosure filings recently, the bigger picture is that we’re still well below the number we’d see in a more normal year for the housing market. As a report from BlackKnight explains:

“The prospect of any kind of near-term surge in foreclosure activity remains low, with start volumes still nearly 40% below pre-pandemic levels.”

That’s good news. It means the number of homeowners at risk is very low compared to the norm.

But, there’s a small percentage who may be coming face to face with foreclosure as a possibility. That’s because some homeowners may have an unexpected hardship in their life, which unfortunately can happen in any market.

For those homeowners, there are still options that could help them avoid having to go through the foreclosure process. If you’re facing difficulties yourself, an article from Bankrate breaks down some things to explore:

- Look into Forbearance Programs: If you have a loan from Fannie Mae or Freddie Mac, you may be able to apply for this type of program.

- Ask for a loan modification: Your lender may be willing to adjust your loan terms to help bring down your monthly payment to something more achievable.

- Get a repayment plan in place: A lender may be able to set up a deferral or a payment plan if you’re not in a place where you’re able to make your payment.

And there’s something else you may want to consider. That’s whether you have enough equity in your home to sell it and protect your investment.

You May Be Able To Use Your Equity To Sell Your House

In today’s real estate market, many homeowners have far more equity in their homes than they realize due to the rapid home price appreciation we’ve seen over the past few years. That means, if you’ve lived in your house for a while, chances are your home’s value has gone up. Plus, the mortgage payments you’ve made during that time have chipped away at the balance of your loan. That combo may have given your equity a boost. And if your home’s current value is higher than what you still owe on your loan, you may be able to use that increase to your advantage. Freddie Mac explains how this can help:

“If you have enough equity, you can use the proceeds from the sale of your home to pay off your remaining mortgage debt, including any missed mortgage payments or other debts secured by your home.”

Lean on Experts To Explore Your Options

To find out how much equity you have, partner with a local real estate agent. They can give you an estimate of what your house could sell for based on recent sales of similar homes in your area. You may be able to sell your house to avoid foreclosure.

Boston Condos and the Bottom Line

If you’re a homeowner facing hardship, lean on a real estate professional to explore your options or see if you can sell your house to avoid foreclosure.

____________

Will foreclosures rise in Massachusetts? If you’ve been following the news recently, you might have seen articles about an increase in foreclosures and bankruptcies. That could be making you feel uneasy, especially if you’re thinking about the Boston for sale market.

But the truth is, even though the numbers are going up, the data shows the housing market isn’t headed for a crisis.

Foreclosure Activity Rising, but Less Than Headlines Suggest

In recent years, the number of foreclosures has been very low. That’s because, in 2020 and 2021, the forbearance program and other relief options were put in place to help many homeowners stay in their homes during that tough time.

When the moratorium ended, there was an expected rise in foreclosures. But just because they’re up, that doesn’t mean the housing market is in trouble.

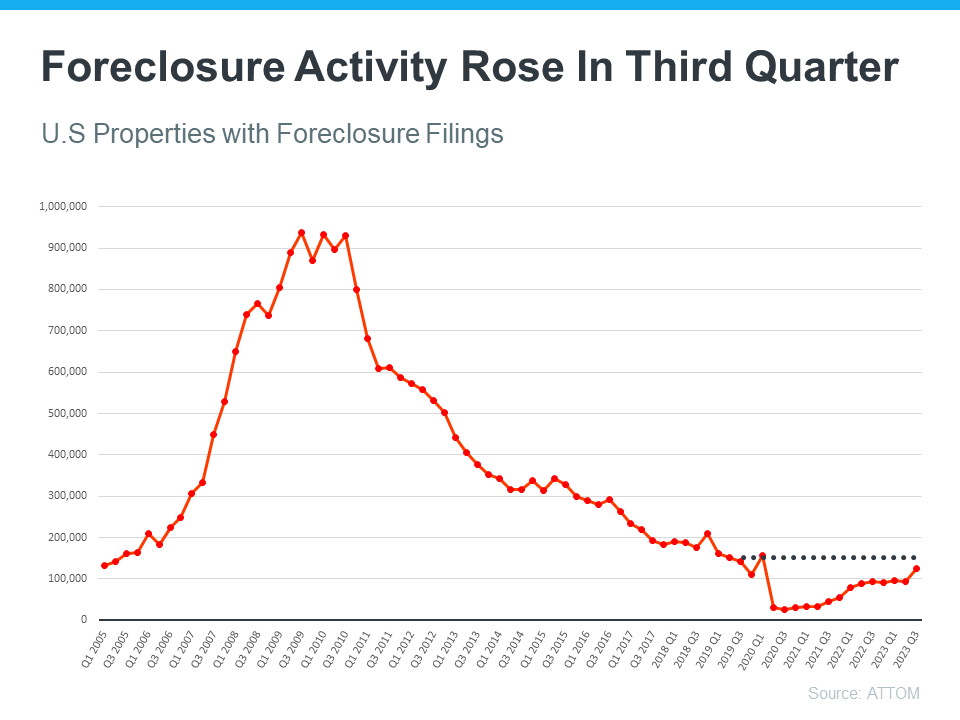

To help you see how much things have changed since the housing crash in 2008, check out the graph below using research from ATTOM, a property data provider. It looks at properties with a foreclosure filing going all the way back to 2005 to show that there have been fewer foreclosures since the crash.

As you can see, foreclosure filings are inching back up to pre-pandemic numbers, but they’re still way lower than when the housing market crashed in 2008. And today, the tremendous amount of equity American homeowners have in their homes can help people sell and avoid foreclosure.

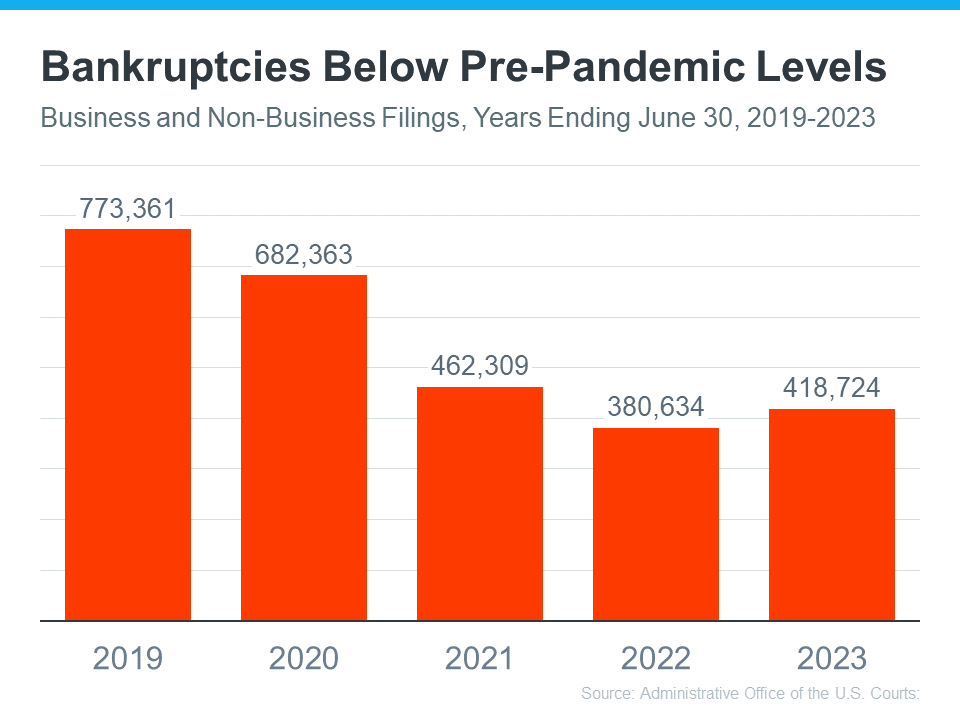

The Increase in Bankruptcies Isn’t Dramatic Either

As you can see below, the financial trouble many industries and small businesses felt during the pandemic didn’t cause a dramatic increase in bankruptcies. Still, the number of bankruptcies has gone up slightly since last year, nearly returning to 2021 levels. But that isn’t cause for alarm.

The numbers for 2021 and 2022 were lower than more typical years. That’s in part because the government provided trillions of dollars in aid to individuals and businesses during the pandemic. So, let’s instead focus on the bar for this year and compare it to the bar on the far left (2019). It shows the number of bankruptcies today is still nowhere near where it was before the pandemic. Both of these two factors are reasons why the housing market isn’t in danger of crashing.

Boston Condos for Sale and the Bottom Line

Right now, it’s crucial to understand the data. Foreclosures and bankruptcies are rising, but these leading indicators aren’t signaling trouble that would cause another crash.

Updated: Boston condos for sale website 2023

_________________________________________________________________________________________________

Are U.S foreclosures rising?

Will foreclosures rise in Massachusetts? In August alone, lenders in the United States began the foreclosure process on 23,952 properties. Numbers that high haven’t been seen since before the COVID-19 pandemic.

A total of 117,383 U.S. properties started the foreclosure process in the first six months of 2022, up 219 percent from the first half of last year and up 19 percent from the first half of 2020

Boston condos

Which states have the highest foreclosures?

The states with the greatest increases in foreclosure starts include Oklahoma, Tennessee, Virginia, Arkansas, and Washington, although the highest amount of foreclosure starts occurred in Cook County, IL with 798. Illinois also saw the highest foreclosure rate in 2022, with one out of every 4,072 houses filing for foreclosure.

boston condos

What are the stats on completed foreclosures?

In addition to an increase in foreclosure starts and filings, completed foreclosures (REOs) are also up 59% compared to August 2021. Illinois topped the list of REOs in the first quarter of 2022, with 493 completed foreclosures by April of 2022.

Boston condos

Do any of these foreclosures have equity in their homes?

Over 90% of borrowers in foreclosure have positive equity in their homes and would benefit from selling these properties at a profit rather than risk losing everything to a foreclosure auction or lender repossession.

Boston condos

Boston Real Estate Blog Updated 2022

![]()

____________________________________________________________________________________________________

While the expiration of the federal moratorium on foreclosure filings continues to impact homeowners struggling with the economic effects of the pandemic, the pace of filings has slowed from the initial shock that followed the end of the moratorium on July 31.

Nationally, auctions, or bank repossessions, rose 5% in October

According to real estate data provider ATTOM Data Solutions, foreclosure filings, which include default notices, scheduled auctions, or bank repossessions, rose 5% in October on a monthly basis and 76% from October 2020, to 20,587 filings.

“As expected, now that the moratorium has been over for three months, foreclosure activity continues to increase,” said Rick Sharga, executive vice president at RealtyTrac, an ATTOM company. “But it’s increasing at a slower rate, and it appears that most of the activity is primarily on vacant and abandoned properties or loans that were in foreclosure prior to the pandemic.”

Among the 220 U.S. metropolitan statistical areas tracked by ATTOM, Miami and Chicago had some of the highest foreclosure rates, alongside Trenton, N.J., St. Louis, and Cleveland. At the state level, Illinois, Florida, New Jersey, Nevada, and Ohio had the highest foreclosure rates.

The start of the foreclosure process picked up speed in October nationwide, with a 5% month-over-month increase and a 115% surge from October 2020. New York, Miami, Los Angeles, Houston, and Atlanta led the way among major metro areas by foreclosure starts.

“Most foreclosure activity for the next few months is likely to be foreclosure starts since virtually nothing entered the foreclosure process during the past year,” Sharga said in the release. “The ratio of foreclosure starts to foreclosure completions will normalize over time as we get back to normal levels of activity.”

Foreclosure completions rose 13% month over month and 17% year over year, ATTOM said. Major urban areas with the highest foreclosure completions were St. Louis, Chicago, Baltimore, Philadelphia, and New York.

Boston Condos for Sale

The big question will downtown Boston condos be next?

Click Here to view: Google Ford Realty Inc Reviews

________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Boston Condos for Sale

Loading...

Will condo foreclosures rise in Massachusetts?

With forbearance plans coming to an end, many are concerned the Boston condo for sale market will experience a wave of foreclosures similar to what happened after the housing bubble 15 years ago. Here are a few reasons why that won’t happen.

There are fewer homeowners in trouble this time

After the last housing crash, about 9.3 million households lost their homes to a foreclosure, short sale, or because they simply gave it back to the bank.

As stay-at-home orders were issued early last year, the fear was the pandemic would impact the housing industry in a similar way. Many projected up to 30% of all mortgage holders would enter the forbearance program. In reality, only 8.5% actually did, and that number is now down to 2.2%.

As of last Friday, the total number of mortgages still in forbearance stood at 1,221,000. That’s far fewer than the 9.3 million households that lost their homes just over a decade ago.

Most of the mortgages in forbearance have enough equity to sell their homes

Due to rapidly rising home prices over the last two years, of the 1.22 million homeowners currently in forbearance, 93% have at least 10% equity in their homes. This 10% equity is important because it enables homeowners to sell their homes and pay the related expenses instead of facing the hit on their credit that a foreclosure or short sale would create.

The remaining 7% might not have the option to sell, but if the entire 7% of those 1.22 million homes went into foreclosure, that would total about 85,400 mortgages. To give that number context, here are the annual foreclosure numbers for the three years leading up to the pandemic:

- 2017: 314,220

- 2018: 279,040

- 2019: 277,520

The probable number of foreclosures coming out of the forbearance program is nowhere near the number of foreclosures that impacted the housing crash 15 years ago. It’s actually less than one-third of any of the three years prior to the pandemic.

The current real estate market can absorb listings coming to the market

When foreclosures hit the market back in 2008, there was an oversupply of houses for sale. It’s exactly the opposite today. In 2008, there was over a nine-month supply of listings on the market. Today, that number is less than a three-month supply. Here’s a graph showing the difference between the two markets.

Boston Condos and the Bottom Line

The data indicates why Ivy Zelman, founder of the major housing market analytical firm Zelman and Associates, was on point when she stated:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

______________________________________________________________________________________________________________________________________

Boston Condos for Sale Search

Loading...

Will foreclosures rise in Massachusetts?

Regardless where the inventory goes (likely to retreat), the potential home buyers should stay interested, just because of rates staying low. Many of them may be looking forward to when the foreclosures start pouring in.

What’s the latest on the delinquencies/forbearances? From Black Knight:

Total U.S. loan delinquency rate (loans 30 or more days past due, but not in foreclosure): 4.37%

– Month-over-month change: -7.62%

– Year-over-year change: -42.39%

Total U.S. foreclosure pre-sale inventory rate: 0.27%

– Month-over-month change: -1.73%

– Year-over-year change: -24.23%

Total U.S. foreclosure starts: 4,400

– Month-over-month change: 15.79%

– Year-over-year change: -25.42%

Top 5 states by 90-plus days delinquent percentage:

Mississippi: 4.89%

Louisiana: 4.59%

Hawaii: 4.14%

Nevada: 4.14%

Maryland: 4.08%

The takeaway:

The national delinquency rate is at its lowest level since the pandemic hit, even below the pre-Great Recession average.

While there’s been improvement, however, there are still 1.5 million homeowners 90 or more days past due on their mortgages but who are not in foreclosure—nearly four times pre-pandemic levels.

There are 1.5 million homeowners who are 90+ days late but who are not in foreclosure? Do you need any more evidence that lenders aren’t interested in foreclosing? They will give loan mods when they get around to it.

Boston condos for sale and the bottom line

Will foreclosures rise in Massachusetts? At this point very unlikely. But time will tell.

______________________________________________________________________________________________________________________

- As of this week, 3.7 million borrowers are still in government and private sector mortgage forbearance programs. That’s about 7% of all active mortgages, according to Black Knight, a mortgage technology and data firm.

- The number of seriously delinquent mortgages, that’s at least 90 days past due, more than doubled from May to June, hitting its highest level in more than five years, according to CoreLogic.

It’s a signal that homeowners still need a lot more help in order to recover from the ongoing economic ills of the pandemic. There are also indications that a new foreclosure crisis could be on the horizon.

As of this week, 3.7 million borrowers are still in government and private sector mortgage forbearance programs. That’s about 7% of all active mortgages, according to Black Knight, a mortgage technology and data firm. These plans allow borrowers to delay monthly payments for at least three months and, in some cases, up to a year.

Contact me to find out more about this property or to set up an appointment to see it.

SEARCH FOR CONDOS FOR SALE AND RENTALS

For more information please contact one of our on-call agents at 617-595-3712.

Updated:2021