Updated: Boston Real Estate Blog 2023

Byline – John Ford Boston Condo Broker

What’s up with interest rates?

Lower mortgage rates are the one thing that could draw buyers back into the housing market, according to a new survey from Realtor.com. The magic number? Around 5%.

Approximately one-fifth of Americans say buying a home would be possible in the next year if rates fall below 6%. An even larger proportion — about one third — say rates would need to drop below 5% for their homeownership dreams to come true.

“Small changes in mortgage rates indeed have an outsized impact on monthly mortgage payments,” Danielle Hale, chief economist at Realtor.com, said in the report. “For first-time homebuyers, if mortgage rates drop in the [5% range], that will boost their purchasing power. For a lot of repeat buyers who already own a home, the lower rates go, the less of a jump they will take in their mortgage payments.”

Mortgage rates have been steadily falling since they neared 8% last autumn. However, they’ve yet to drop below the mid-6% range.

“Mortgage rates are down more than a whole percentage point from their peak,” Hale added. “For the same monthly payment, you can afford to purchase a more expensive home or you have a lower monthly payment at the same home price. Either way, it’s a win for the buyer.”

Despite this, many would-be homebuyers say they’d be willing to purchase a home even if rates don’t continue to drop. Almost half of millennials and over a third of Gen Z say they’d buy a home even if rates exceeded 8%.

Younger buyers are also the most optimistic — almost half of Gen Z buyers surveyed said they’d be able to afford a home in the next five years, compared to 32% of millennials, 36% of Gen X and 26% of Baby Boomers.

“It makes sense that younger buyers are more optimistic,” said Hale. “There are certainly more challenges; they tend to have lower incomes and lower savings. But they’ve also got their whole life in front of them. With incomes now outpacing inflation, we’re looking at real increases in their purchasing power.”

Boston Condos for Sale & Boston Apartments

What’s up with interest rates?

_____________________________________________________

If you’re following mortgage rates because you know they impact your ability to purchase a Boston condo for sale, you may be wondering what the future holds for them. Unfortunately, there’s no easy way to answer that question because mortgage rates are notoriously hard to forecast.

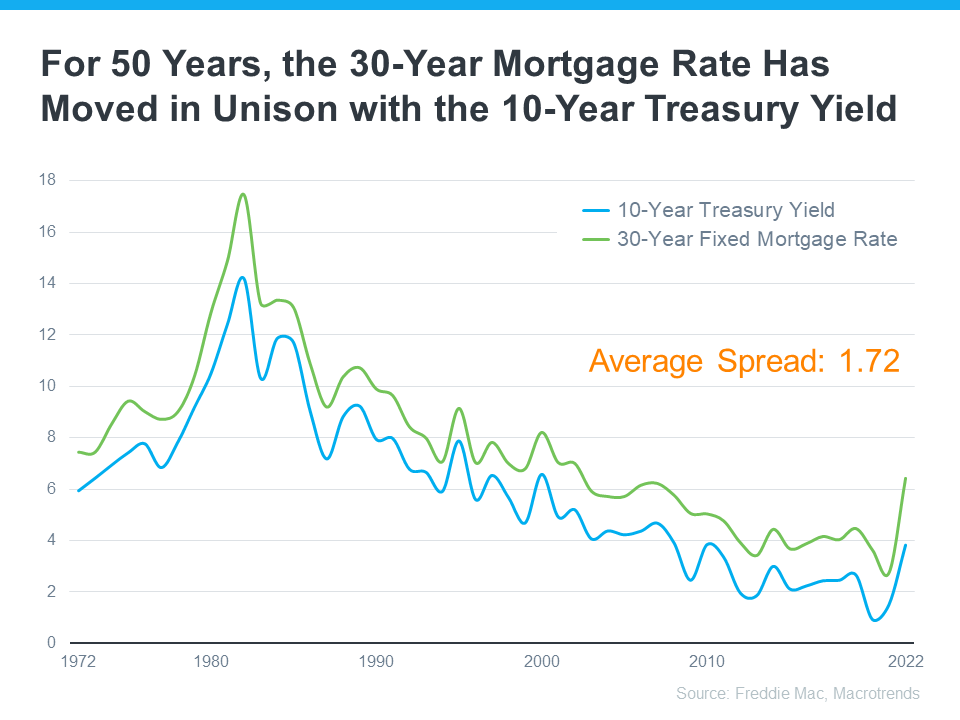

But, there’s one thing that’s historically a good indicator of what’ll happen with rates, and that’s the relationship between the 30-Year Mortgage Rate and the 10-Year Treasury Yield. Here’s a graph showing those two metrics since Freddie Mac started keeping mortgage rate records in 1972:

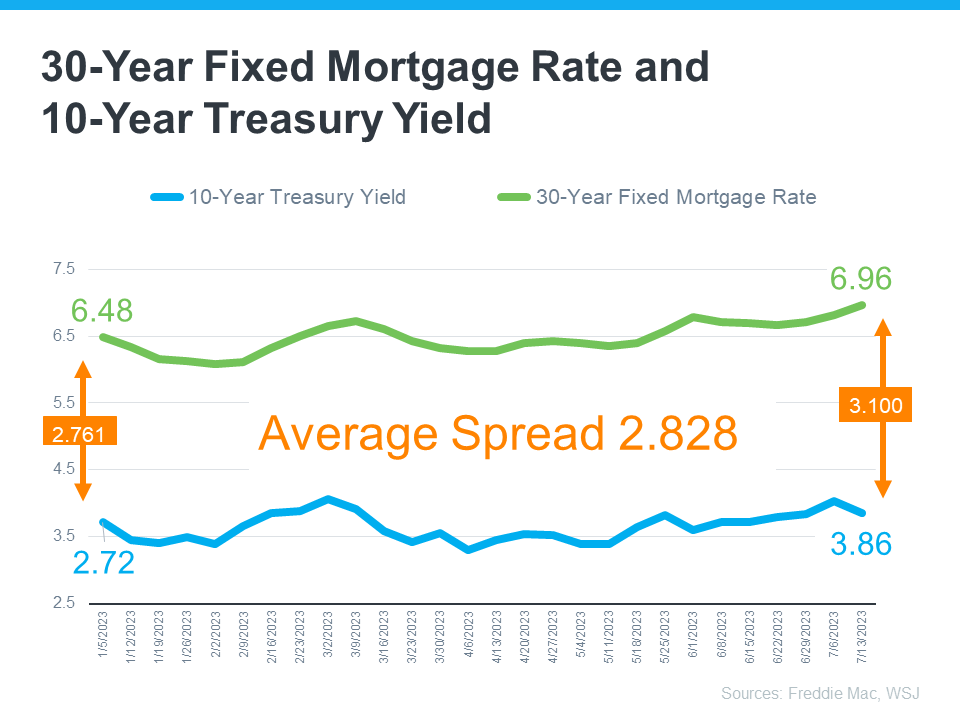

As the graph shows, historically, the average spread between the two over the last 50 years was 1.72 percentage points (also commonly referred to as 172 basis points). If you look at the trend line you can see when the Treasury Yield trends up, mortgage rates will usually respond. And, when the Yield drops, mortgage rates tend to follow. While they typically move in sync like this, the gap between the two has remained about 1.72 percentage points for quite some time. But, what’s crucial to notice is that spread is widening far beyond the norm lately (see graph below):

If you’re asking yourself: what’s pushing the spread beyond its typical average? It’s primarily because of uncertainty in the financial markets. Factors such as inflation, other economic drivers, and the policy and decisions from the Federal Reserve (The Fed) are all influencing mortgage rates and a widening spread.

Why Does This Matter for You?

This may feel overly technical and granular, but here’s why homebuyers like you should understand the spread. It means, based on the normal historical gap between the two, there’s room for mortgage rates to improve today.

And, experts think that’s what lies ahead as long as inflation continues to cool. As Odeta Kushi, Deputy Chief Economist at First American, explains:

“It’s reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal . . . However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.”

Similarly, an article from Forbes says:

“Though housing market watchers expect mortgage rates to remain elevated amid ongoing economic uncertainty and the Federal Reserve’s rate-hiking war on inflation, they believe rates peaked last fall and will decline—to some degree—later this year, barring any unforeseen surprises.”

Boston Condos for Sale and the Bottom Line

If you’re either a first-time home buyer or a current homeowner thinking of moving into a home that better fits your current needs, keep on top of what’s happening with mortgage rates and what experts think will happen in the coming months.

________________________________________________________________________________________________

OK, Standard & Poor’s downgrades the U.S. government. Investors are supposed to panic and flee government bonds. Interest rates should go up. The cost of borrowing gets more expensive for everyone — including those seeking home mortgages.

But look what’s actually happening: Interest rates are going down. It seems investors still believe in the stability of the U.S. government over other investments. It’s not supposed to work this way.

Guy Cecala, publisher of Inside Mortgage Finance Publications, puts it bluntly to the LA Times: “The stock market continues to be in the toilet. Investors don’t really have the choice to abandon Fannie and Freddie debt or Treasuries, so actual rates are going down.”

S&P is going to have a lot of explaining to do if this keeps up. The markets are saying the complete opposite of what S&P warned about in its downgrade report. It wouldn’t be the first time S&P screwed up.