What’s the status of the Boston real estate for sale market? Is it a buyers or sellers market?

Boston Condos for Sale

Loading...

What’s the status of the Boston real estate for sale market? Is it a buyers or sellers market?

Selling prices moderate as sale pace slows across Greater Boston

Despite a summer marked by falling mortgage rates and increased inventory, homebuying activity in Greater Boston has cooled since late spring, according to the Greater Boston Association of Realtors® (GBAR) August housing report.

The cooling trend resulted in fewer home sales and a softening of prices throughout August. It didn’t, however, impact the condo market, which last month saw sales climb modestly.

Nevertheless, the median selling prices of single-family homes and condominiums declined for the second consecutive month, following June’s record highs. According to GBAR, this trend highlights ongoing affordability concerns, particularly for first-time and entry-level buyers.

August single-family home sales fell 4% year over year, with 1,055 homes sold, compared to 1,099 homes sold in August 2023, reflecting the lowest single-family home-sales volume for the month since 2010. Sales also declined month over month, at a more significant number, down 14.6% from July.

Condo sales, meanwhile, increased last month, rising 2%, with 820 units sold compared to 804 last August. Month-over-month, however, condo sales slowed, falling 13.4% from July.

Jared Wilk, GBAR president and a broker with COMPASS in Wellesley, said quite a few buyers opted to take a break from the market near the end of the school year as mortgage rates topped 7% and selling prices reached record highs in June, causing the market to lose some of its momentum.

“Buyers are showing a little less sense of urgency and are being more selective in their home search of late, with many taking a wait-and-see attitude in the hopes the Fed lowers interest rates or prices decline due to a weakening economy. That’s resulted in softening demand this summer,” he said.

In both the single-family home and condominium markets, median selling prices continued to rise year over year in August. However, these prices have moderated since the spring and are now at their lowest levels since March and April.

August’s median single-family home price rose 4.3% to $915,000 from August 2023’s $877,000. It was the 14th consecutive month of year-over-year growth in the median single-family home price. Month over month, the August median home price slid 0.5% from July. According to the report, the monthly median selling price for single-family homes hasn’t been this low since March, when it was $900,500.

“Even though demand has cooled in the last few months, buyers still outnumber property listings in many communities and that imbalance continues to keep upward pressure on prices,” Wilk said. “The lack of inventory is most pronounced in the single-family home market where listings remain at less than a two-month supply, which is why properties that are well maintained and in a desirable location have been able to retain their value and even command close to top dollar.”

Last month, the majority of properties sold at or above their full asking price. Single-family homes typically sold for 101% of their original list price, while condominiums garnered 99.4% of their initial sale price.

Wilk said with buyers now fewer and further between than what we saw this spring, it’s a less competitive market and that’s resulted in some softening in prices.

“In today’s market, we’re seeing fewer multiple-offer situations, more bids under asking price, and homes taking longer to sell. That’s giving buyers more of an opportunity to negotiate and sellers have had to become more flexible, with an increasing number having to make price adjustments in order to sell,” Wilk said.

Market conditions could continue into the fall market, with more inventory giving potential buyers a larger selection of homes to choose from.

Active single-family home listings increased in August, rising 15% year over year, while active condo listings rose 11.3%. And listings keep growing.

From Labor Day weekend until Sept. 16, GBAR said single-family home listings rose 44% and condo sales rose 34%.

Wilk cautioned sellers not to be too aggressive with their pricing, as it could limit buyer interest.

“Many of today’s buyers have been in the market for months, if not years, so they know a property that’s overpriced when they see it,” he said. “On top of that, with purchasing power more limited, few are willing to overextend themselves financially.

“As a result, we’re finding that properties that get priced too aggressively often draw fewer offers, including less attractive ones, and many don’t sell until a price reduction or seller concession is made. Those who are able to adjust their expectations and price their property in line with others currently listed for sale will have the most success in this market.”

What’s the status of the Boston real estate for sale market? Is it a buyers or sellers market?

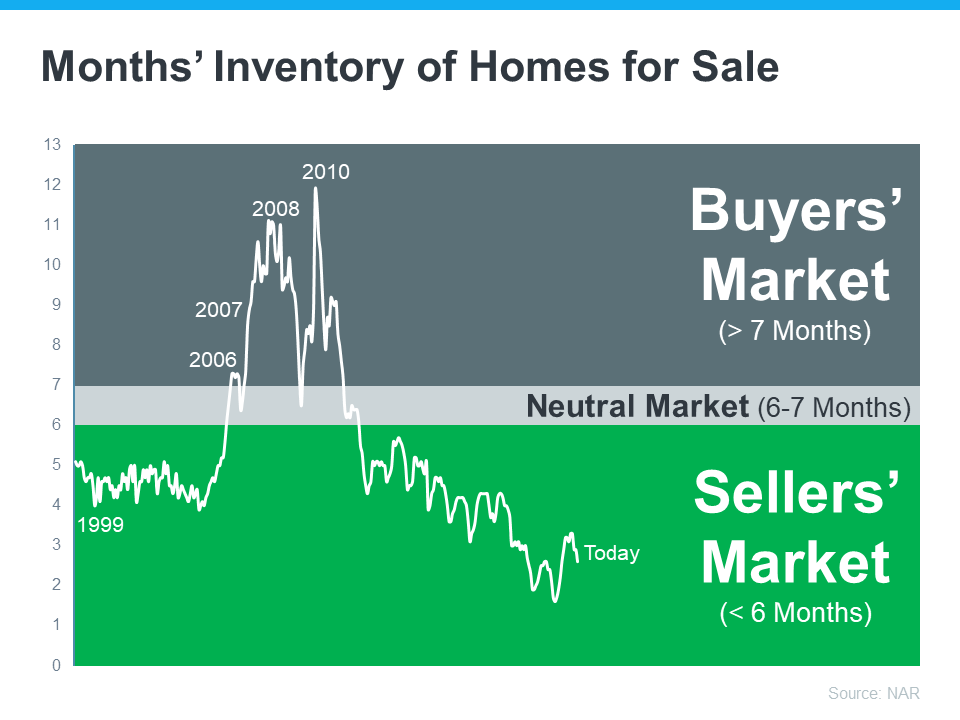

Even though activity in the Boston condo for sale market has slowed from the frenzy we saw over a year ago, today’s low supply of homes for sale is still a sellers’ market. But what does that really mean? And why are conditions today so good if you want to list your house?

It starts with the number of Boston condos available for sale. The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows housing supply is still astonishingly low. Today, we have a 2.6-month supply of homes at the current sales pace. Historically, a 6-month supply is necessary for a ‘normal’ or ‘neutral’ market in which there are enough homes available for active buyers (see graph below):

What Does This Mean for You?

When the supply of homes for sale is as low as it is right now, it’s much harder for buyers to find one to purchase. That creates increased competition among purchasers and keeps upward pressure on prices. And if buyers know they’re not the only one interested in a home, they’re going to do their best to submit a very attractive offer. As this happens, sellers are positioned to negotiate deals that meet their ideal terms. Lawrence Yun, Chief Economist at NAR, says:

“Inventory levels are still at historic lows. Consequently, multiple offers are returning on a good number of properties.”

Right now, there are still Boston condo buyers who are ready, willing, and able to purchase a home. If you list your house right now in good condition and at the right price, it could get a lot of attention from competitive buyers.

Boston Condos for Sale and the Bottom Line

Today’s sellers’ market holds great opportunities for homeowners ready to make a move. Listing your house now will maximize your exposure to serious, competitive buyers. Let’s connect to discuss how to jumpstart the selling process.

____________________________________________________________________________________________________________________________

Dawn Templeton, Templeton Real Estate Group, joins ‘Power Lunch’ to discuss a cooling housing market, how buyer and seller sentiment has fared amidst housing market volatility and more.

Updated: Boston Real Estate Blog 2022

____________________________________________________________________________________________________________________________

With mortgage rates climbing above 5%, serious buyers are more motivated than ever to find a home before the end of the year. Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), puts it best, saying:

“Housing demand remains strong as buyers likely want to secure a home before mortgage rates increase even further next year.”

But the sense of urgency they feel is complicated by the lack of homes for sale in today’s market. According to the latest Existing Home Sales Report from NAR:

“From one year ago, the inventory of unsold homes decreased 13%. . . .”

What Does This Mean for Sellers Today?

With buyers eager to purchase but so few homes available, sellers who list their houses this fall have a tremendous advantage – also known as leverage – when negotiating with buyers. That’s because, in today’s market, buyers want three things:

- To be the winning bid on their dream home.

- To buy before rates rise

- To buy before prices go even higher.

Your Leverage Can Help You Negotiate Your Best Terms

These three buyer needs give homeowners a leg up when selling their house. You might already realize this leverage enables you to sell at a good price, but it also means you can negotiate the best terms to suit your needs.

And since buyer demand is still high, there’s a good chance you’ll get offers from multiple buyers who are willing to compete for your house. When you do, look closely at the terms of each offer to find out which one has the best perks for you.

If you have questions about what’s best for your situation, your trusted real estate advisor can help. They have the expertise and are skilled negotiators in all stages of the sales process.

Boston Condos for Sale and the Bottom Line

Today’s buyers are motivated to purchase a home this year, and that’s great news if you’re thinking of selling. Let’s connect today to discuss how much leverage you have as a seller in today’s market.

![]()

________________________________________________________________________________________________________________________________________

Boston Real Estate for Sale Search

What’s the status of the Boston real estate for sale market? Is it a buyer’s or seller’s market?

Americans believe it’s a much better time to sell a home than to buy one, according to Fannie Mae’s latest survey of home purchase sentiment. This marks the first time in the survey’s 10-year history that has happened.

The monthly survey of about 1,000 homeowners and renters showed that more people thought April was a bad time to buy a home than a good time, the first time that’s happened in the survey’s 10-year history.

The survey uses the Home Purchase Sentiment Index (HPSI) to track consumers’ housing-related attitudes, intentions and perceptions using six questions from the National Housing Survey (NHS) regarding homebuying sentiment, selling sentiment, home price expectations, mortgage rate expectations, job concerns and household income.

In April, the net share of homebuyers and renters who said it’s a good time to buy fell 14% month over month, becoming negative for the first time in the survey’s history. Last month, 47% of respondents thought it was a good time to buy, down from 53% in March. Those who said it was a bad time to buy jumped from 40% in March to 48% in April.

This can largely be attributed to market competition from diminishing inventory and soaring home prices, despite improving economic conditions, especially for less-affluent buyers.

“Consumers in the household income range of $50,000 to $100,000, a range inclusive of the Census Bureau’s reported median household income level, showed a particularly large decrease in overall housing sentiment,” said Doug Duncan, Fannie Mae senior vice president and chief economist, in a press release. “We know that the housing market serving the affordable segment has been particularly competitive.”

He added that recent data does not indicate that inventory is likely to improve any time soon and these sentiments are likely to stick around for quite some time.

On the other hand, the net percentage of consumers who say it’s a good time to sell increased 8%, consistent with recent upward trends and is back to its pre-pandemic peak. More than two-thirds (67%) of survey respondents agreed it’s a good time to sell right now, up from March (61%).

The survey also reported that most Americans (54%) expect mortgage rates to rise in the next 12 months, while 7% expect them to go down and 33% expect them to stay the same.

Nearly half (49%) expect home prices to continue to climb in the next 12 months, 17% expect prices to go down, and 27% expect prices to stay the same.

About 80% of respondents said they don’t have concerns about losing their job in the next year, which is a positive for homebuying demand.

Regarding household income, a majority of respondents (57%) don’t expect their income to change in the next 12 months, while 16% expect it to decrease and 7% expect it to increase.

After considering all these factors, the HPSI decreased to 79.0 in April (down 2.7 points). The index hit a record-low of 63.0 in April 2020, as the housing market was still suffering from the dawn of the pandemic.

Boston Real Estate for Sale Search

____________________________________________________________________________________________________________________________________________________________________________

Low Boston condo for sale inventory, whether due to a hesitation to sell during the Covid-19 pandemic or other market factors, has driven housing prices up and made the market more competitive for buyers.

That means that borrowers who may have been approved for a loan at the beginning of the year could now face an uphill battle.

Online loan marketplace Lending Tree looked at where homebuyers are the most competitive, based on the share of buyers with credit scores over 720, average down payment percentage, and share of buyers who try to secure a mortgage before they buy a house.

Boston Real Estate Downpayment

The average down payment for the most competitive buyers (top 11 metros) was 21.4%, with nearly 71% of buyers having credit scores of 720 or higher. Among these buyers, 72% shopped for a mortgage before looking for a house.

Among the least competitive buyers, the average down payment was 18.5%, and the percentage of buyers with higher credit scores, 63%. Around 60% of potential buyers in the 10 least competitive metros pre-shopped for mortgages.

See how the 50 largest metropolitan areas in the United States ranked here.

Boston Real Estate for Sale Search

Original Boston Real Estate Blog Post

What’s the status of the Boston real estate for sale market? Is it a buyers or seller’s market?l Sales of Boston condos increased in September compared with the year before, according to a new report from the Boston real estate research firm the Warren Group and the Greater Boston Association of Realtors.

The concern for many sellers in Boston— is the Boston condo for sale prices were in many areas of downtown Boston were down. And there were generally more Boston condos for sale for prospective buyers to choose from in September than the previous year at the same time.

These new Boston real estate stats have some wondering the unimaginable a year ago—might we be turning in favor of buyers.

One thing is certain the Boston real estate bidding wars have cooled off with the Fall season

As for Boston-area condos, the median sales price was $549,000 in September, down 4.1 percent from September 2018 and 3.5 percent from August. However, Boston condo sales were up annually 3.4 percent, to 790. They were down month to month— by more than 32 percent.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19312661/Screen_Shot_2019_10_23_at_10.42.44_AM.png)

Boston real estate sales chart

Click Here: Back to Boston Real Estate Home Search

Boston Real Estate for Sale and Apartments for Rent

New Boston Condos for sale just listed TODAY

Sorry we are experiencing system issues. Please try again.

Source: The Warren Group