What I’m about to tell you will have huge impact on Boston condos for sale

What I’m about to tell you will have huge impact on Boston condos for sale

How Mortgage Rate Changes Impact Your Homebuying Power

If you’re thinking about buying or selling a home, you’ve probably have mortgage rates on your mind. That’s because you’ve likely heard that mortgage rates impact how much you can afford in your monthly mortgage payment, and you want to factor that into your planning. Here’s what you need to know.

What’s Happening with Mortgage Rates?

Boston condo mortgage rates have been trending down recently. While that’s good news for your homebuying plans, it’s important to know that rates can be unpredictable because they’re affected by many factors.

Things like the economy, job market, inflation, and decisions made by the Federal Reserve all play a part. So, even as rates go down, they can still bounce around a bit based on new economic data. As Odeta Kushi, Deputy Chief Economist at First American, says:

“The ongoing deceleration in inflation, coupled with the Federal Reserve’s recent indication of potential rate cuts [in 2024], suggests an environment supportive of modest declines in mortgage rates. Barring any unforeseen circumstances and resurgence in inflation, lower mortgage rates could be on the horizon, but the journey towards them might be slow and bumpy.”

How Do These Changes Affect Boston condo buyers and sellers?

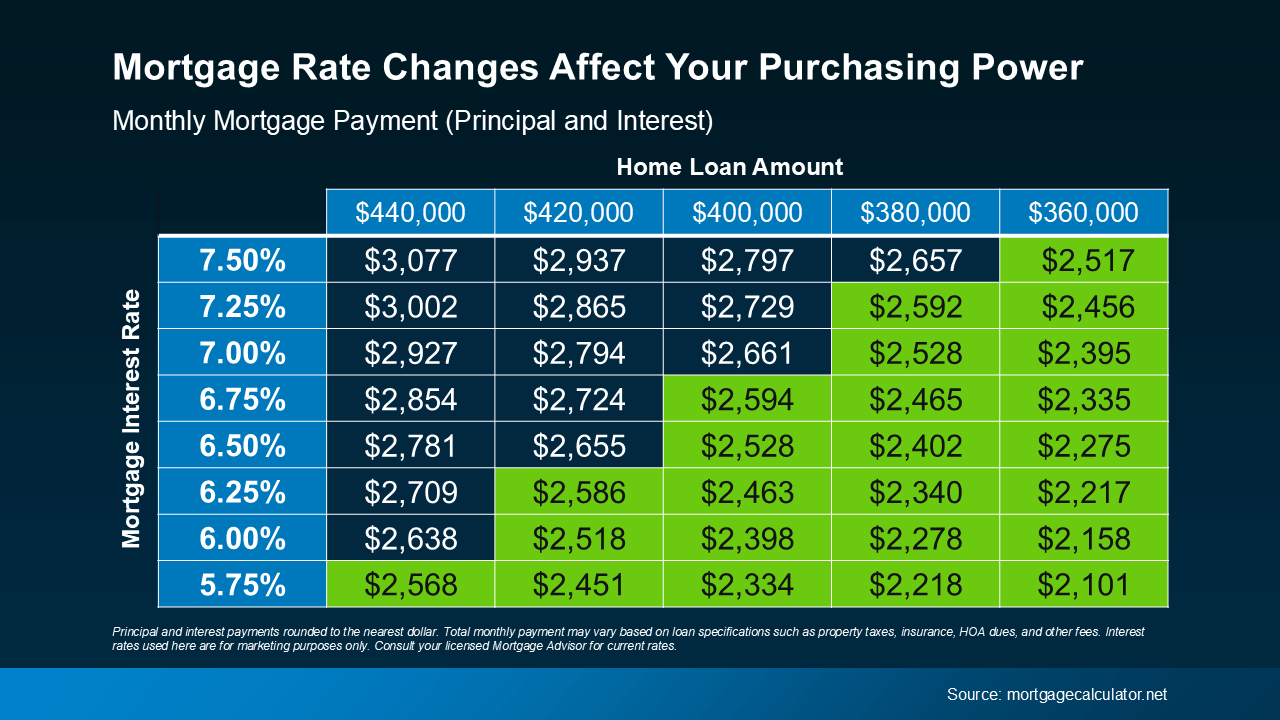

When mortgage rates change, it affects how much you pay each month for your home loan. Even a small rate change can make a big difference to your monthly bill.

Take a look at the chart below to see how different mortgage rates impact your house payment each month for various loan amounts. Imagine you can afford a monthly payment of $2,600 for your home loan. The green part in the chart shows payments in that range or lower based on varying mortgage rates (see chart below):

Understanding how mortgage rates impact your payment helps you make better real estate decisions.

Understanding how mortgage rates impact your payment helps you make better real estate decisions.

How Can You Keep Track of the Latest on Rates?

Real estate agents have the expertise to help you understand what’s happening and what it means for you. They can provide tools and visuals, like the chart above, to show how rate changes impact your buying power.

You don’t need to be a mortgage expert; you just need a professional by your side. Someone who can help you make sense of the market and guide you through your Boston condo buying or selling journey.

Boston Condos for Sale and the Bottom Line

If you have questions about the housing market, reach out to a local real estate agent. They can help you understand what’s going on and how to navigate it.

What I’m about to tell you will have huge impact on Boston condos for sale

If you considered the Covid-related stimulus of seven trillion dollars considerable, reconsider.

It is a drop in the bucket when compared to the immense economic stimulus totaling more than $80 trillion expected to happen over the next 20 years! By decreasing and annulling estate taxes (which some view as double taxation, even though largely unrealized gains are not subjected to taxes) this boom has facilitated new records. Absolutely, the remarkable shift of wealth has commenced and Ray Dalio believes it is helping to sustain the US economy’s strength.

Here are some extra considerations regarding the MASSIVE WEALTH SHIFT:

1. Due to an increase in the life expectancy among those with greater means, the shift of wealth will be put off.

A portion of funds will be reduced in order to finance the rising expense of medical care.

A considerable amount of money will be passed on ahead of passing away, both for tax rationales and to protect from negative judgment at family gatherings such as Thanksgiving.

While the image of typical inheritors is often focused on 20-year-olds, in truth, money is most commonly handed down to individuals between the ages of 40 and 60. The offspring of an octogenarian is usually not a twentysomething!

Not all who bestow money are extremely wealthy individuals. Most individuals possess considerably less riches. However, a bequest of fifty to one hundred thousand dollars can recalibrate the entire course of events for those who are hoping to purchase a residence yet have been having difficulty gathering money for the initial payment. while 21% of millionaires obtained some sort of heritage from their family or friends, only a meager 3% were gifted with more than a million dollar’s worth. The remaining 79% had no such luck.

Inheritances and gifts are frequently bequeathed to grandchildren as well, so this practice is not limited to a particular group.

Frequently, the wealthiest clans have implemented a wealth distribution precedure well before passing away (most often to reduce federal estate taxes that become applicable at more than $13 million), usually spanning a long period of time, so those descendants may not have to depend as much on bequests to purchase a house. Less than one percent of citizens in the United States possess a net worth equaling or exceeding this amount .

The most beneficial aspect of inheritance: usually, bequests, inheritable assets and trusts push for or call for funds from an estate to be utilized on educational courses and……housing.

Boston condos for sale and the bottom line

This could potentially make it more expensive to buy a house, leading to increased home values, and even higher costs overall. If the ‘other stimulus’ boosted demand, why wouldn’t this? Stimulus in any form has a tendency to drive up demand and prices.