The main reason Boston condo mortgage rates are so high

Boston Condos for Sale and Apartments for Rent

the jobless claims data again showed why Boston condo for sale mortgage rates continue to be elevated, confirming that the labor market isn’t breaking. The labor market is getting softer but hasn’t broken yet, as it has before every recession post World War II.

Mortgage rates have remained mostly in a range over the past two years, fluctuating between 6% and 8%. In late 2022, global markets faced turmoil and economic indicators suggested a weakening economy, leading the 10-year yield to drop to around 3.37% before rebounding. This was my “Gandalf line in the sand” because I believed the 10-year yield couldn’t head lower since labor wasn’t breaking.

In 2023, the Fed continued to hike rates. When they eventually stopped hiking it created another key level for me in 2024 — the “hold the door” line of 3.80%. We held that line very late in the year 2023.

In 2024, as the labor market showed weakness, the 10-year yield fell, briefly, below that 3.80% level. This broke after three softer reports in jobs week pushed the 10-year yield down to 3.62%. However, that concern dissipated when jobless claims began to decline again.

As we can see from today’s data, jobless claims came in better than expected, causing the 10-year yield to rise by a few basis points. As I am writing this, the 10-year yield is at 4.59%, rising three basis points after the positive claims data.

![]()

Boston Beacon Hill condos for Sale Ford Realty I37 Charles St Beacon Hill

Click Here to view: Google Ford Realty Inc Reviews

Click to View Google Reviews 2025

Click Here to view: Google Ford Realty Inc Reviews

Boston Beacon Hill condos for sale priced under $500k

Boston Beacon Hill condos $500k

Boston Beacon Hill condos $500k -$700k

Boston Beacon Hill condos priced $1M and under

Boston Beacon Hill condos priced above $1M

Boston Beacon Hill condos sale stats for the last 30 days

View Beacon Hill condos for sale. Updated in real-time.

Click to view The Most Recent Beacon Hill Condo Sales Data Reports

- Buying a Beacon Hill condo for sale

- Tips on buying a Beacon Hill condo

- Boston Beacon Hill condo buyers how to beat all-cash offers

- 5 tips on buying a Beacon Hill condo for sale

- Benefits of buying a Beacon Hill condo

- Design tips for Beacon Hill condo buyers

- Boston Beacon Hill condos for sale 5 must-know terms

- The difference between a Beacon Hill condo and a Beacon Hill loft

- Common mistakes when buying a Beacon Hill condo

- Buying a Beacon Hill condo with kids

- Is it time to ditch my Beacon Hill condo agent?

- Beacon Hill condos for sale: Do I need 20% down?

- 3 signs you’re going to buy a Boston Beacon Hill condo

- 6 principles to know when buying a Beacon Hill condo

- How to select a Boston Beacon Hill condo agent

- Boston Beacon Hill condos for sale down payment

- Boston Beacon Hill condos finance

- Beacon Hill condos for sale what is negotiable

- Beacon Hill condos for sale: What it takes to get a mortgage.

- Boston Beacon Hill condos for sale. Understand the condo association

- How much do Boston Beacon Hill condos cost?

- How to select a Beacon Hill broker

- Beacon Hill condos for sale: Clutter-Free

- Beacon Hill condos for sale: Security Tips

- Beacon Hill condo renters are misinformed

- Boston Beacon Hill condos for sale: Design trends

- Boston Beacon Hill condos: Fixer up

- 8 Beacon Hill condo designs

- How to sell your Beacon Hill condo using social media

- Boston Beacon Hill condo sales volume

- Wage increases make Beacon Hill condos more affordable

- Boston Beacon Hill condos the importance of high owner occupancy

- Why you should buy a Beacon Hill condo off-season

- What do these Boston Beacon Hill condo terms mean?

Click Here: Back to Boston Real Estate Home Search

Back to homepage: Boston condos for sale

Ford Realty – Boston Real Estate Google Reviews 2000 – 2025

____________________________________________________________________________________________________________________________

Today’s Boston condo mortgage rates are on the mind for many Boston condo buyers right now. As a result, if you’re thinking about buying for the first time or selling your current condominium to move into a home that better fits your needs, you may be asking yourself these two questions:

- Why Are Mortgage Rates So High?

- When Will Rates Go Back Down?

Here’s context you need to help answer those questions.

1. Why Are Mortgage Rates So High?

The 30-year fixed-rate mortgage is largely influenced by the supply and demand for mortgage-backed securities (MBS). According to Investopedia:

“Mortgage-backed securities (MBS) are investment products similar to bonds. Each MBS consists of a bundle of home loans and other real estate debt bought from the banks that issued them . . . The investor who buys a mortgage-backed security is essentially lending money to home buyers.”

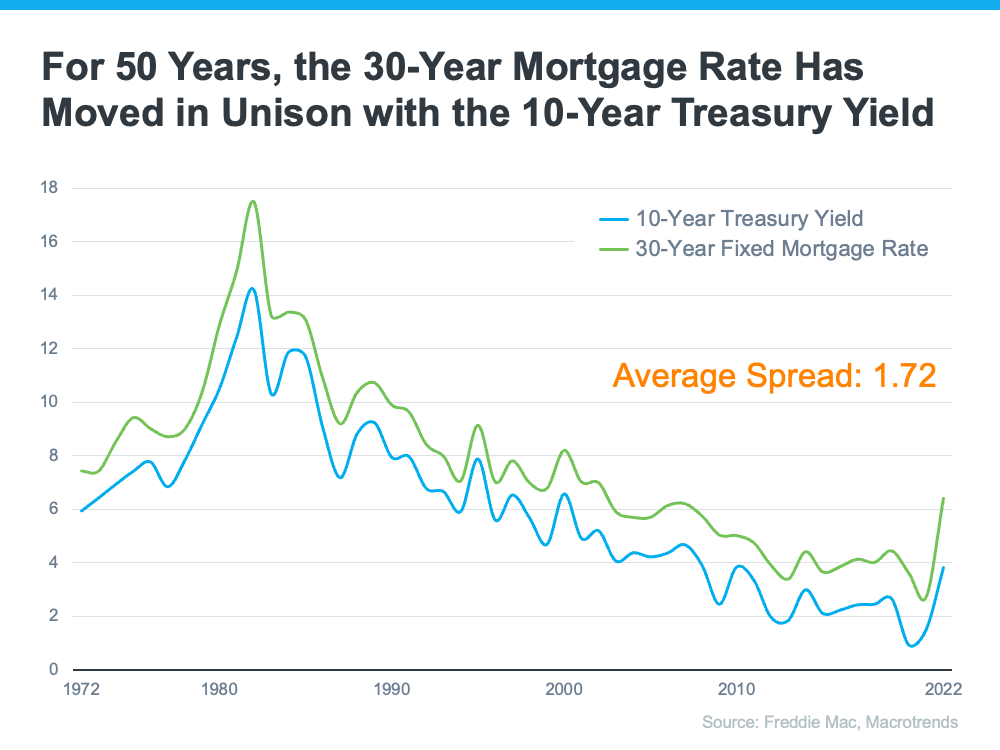

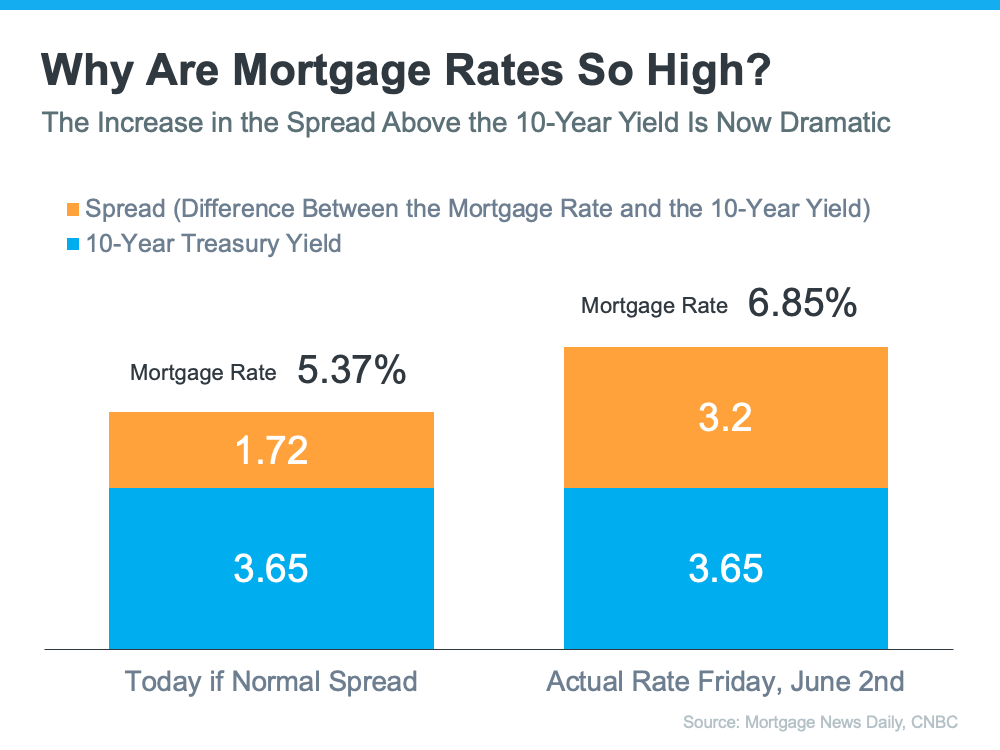

Demand for MBS helps determine the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate. Historically, the average spread between the two is 1.72 (see chart below):

Last Friday morning, the mortgage rate was 6.85%. That means the spread was 3.2%, which is almost 1.5% over the norm. If the spread was at its historical average, mortgage rates would be 5.37% (3.65% 10-Year Treasury Yield + 1.72 spread).

This large spread is very unusual. As George Ratiu, Chief Economist at Keeping Current Matters (KCM), explains:

“The only times the spread approached or exceeded 300 basis points were during periods of high inflation or economic volatility, like those seen in the early 1980s or the Great Financial Crisis of 2008-09.”

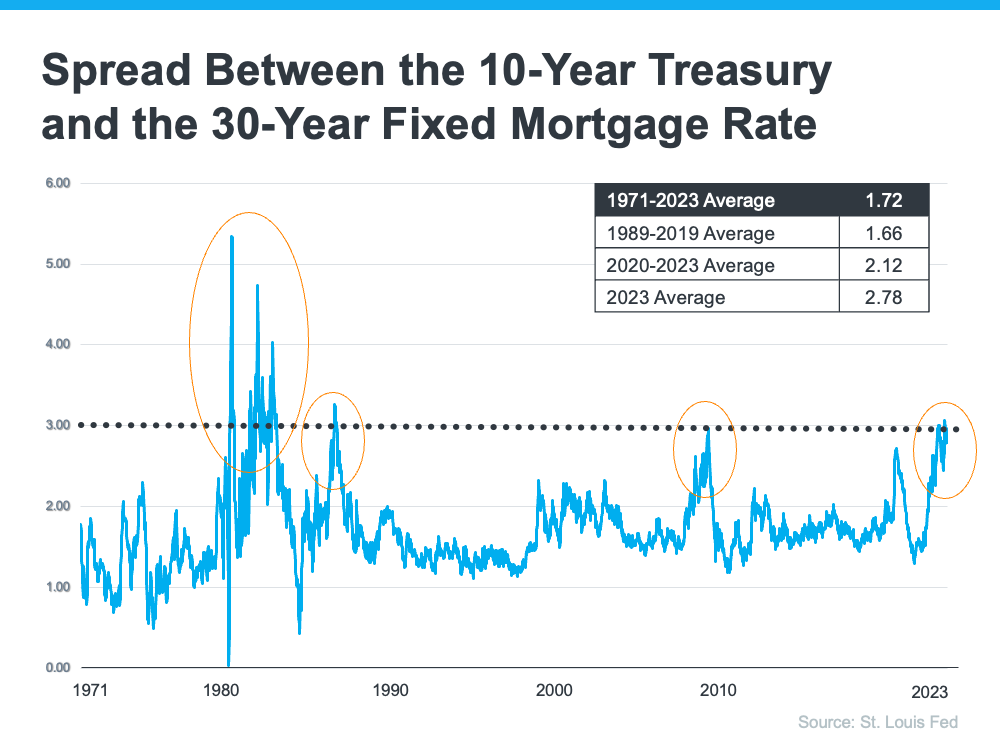

The graph below uses historical data to help illustrate this point by showing the few times the spread has increased to 300 basis points or more:

The graph shows how the spread has come down after each peak. The good news is, that means there’s room for mortgage rates to improve today.

So, what’s causing the larger spread and making mortgage rates so high today?

The demand for MBS is heavily influenced by the risks associated with investing in them. Today, that risk is impacted by broader market conditions like inflation and fear of a potential recession, the Fed’s interest rate hikes to try to bring down inflation, headlines that create unnecessarily negative narratives about home prices, and more.

Simply put: when there’s less risk, demand for MBS is high, so mortgage rates will be lower. On the other hand, if there’s more risk with MBS, demand for MBS will be low, and we’ll see higher mortgage rates as a result. Currently, demand for MBS is low, so mortgage rates are high.

2. When Will Rates Go Back Down?

Odeta Kushi, Deputy Chief Economist at First American, answers that question in a recent blog:

“It’s reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal and provides investors with more certainty. However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.”

Boston Condo Mortgage Rates and Bottom Line

The spread will shrink when the fear investors feel is eased. That’ll mean we should see mortgage rates moderate as the year goes on. However, when it comes to forecasting mortgage rates, no one can know for sure exactly what will happen.