The journey of buying a Boston condo for sale

Boston Condos for Sale and Apartments for Rent

The journey of buying a Boston condo for sale

The Journey of Buying a Boston Condo for Sale: A Step-by-Step Guide

Imagine being at the top of your newly purchased Boston Condo, with a fresh brew in hand, watching as the city comes alive with the morning sunrise. Does that sound like a dream to be far fetched? It shouldn’t because we’re here to turn that dream into reality! Get ready to dive deep into every nook and cranny of buying a Boston condo for sale, through our comprehensive step-by-step guide. We’ll walk you through from scouting to signing, leaving no stone unturned. So strap in and get ready, because your journey to owning a piece of Beantown starts here!

The journey of buying a Boston condo includes various steps such as researching neighborhoods, determining your budget, finding a real estate agent, touring properties, making an offer, completing inspections and negotiations, and finally closing the deal. Our guide provides a detailed overview of this process to help you navigate each step with confidence. Whether you’re an experienced homebuyer or new to the process, our guide will provide valuable insights to help you make informed decisions. Scroll down for a step-by-step process.

![]()

Assessing the Boston Condo Market

Buying a property is always a huge investment, and when it comes to purchasing a condo in Boston, this statement is no exception. Assessing the Boston condo market should be the first port of call for anyone looking to purchase a property in the area. Doing your research here can save you time, money, and disappointment further down the line. Here are some key areas to consider.

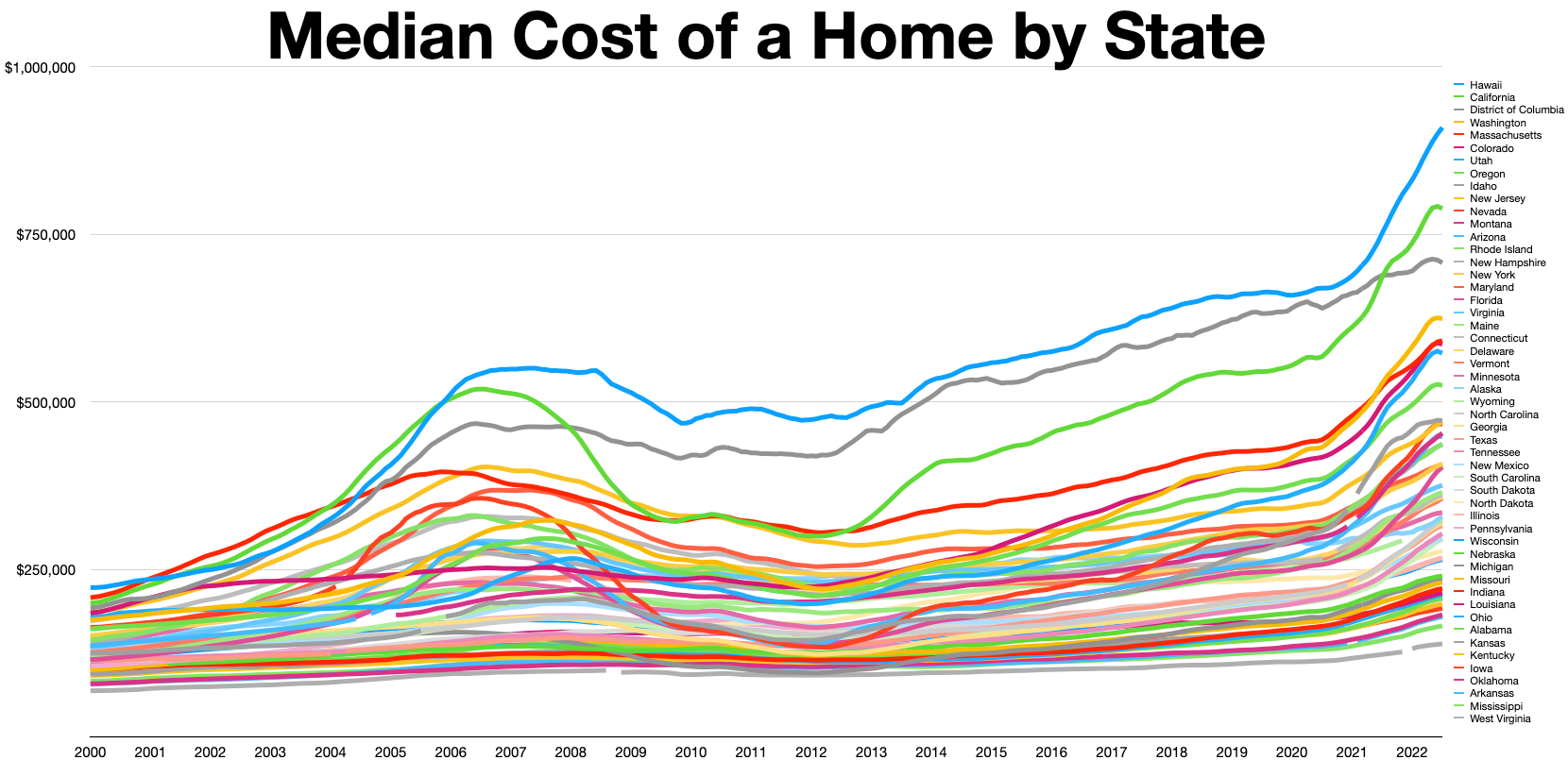

First things first, take time to explore different neighborhoods within your budget. Known as one of America’s most expensive cities, Boston has roughly 15 neighborhoods and each one varies in terms of real estate prices. For instance, Beacon Hill and Back Bay may have prestige and historic charm, but they also tend to be more expensive than other nearby neighborhoods. In comparison, you may find that Jamaica Plain or Roslindale are more affordable. Take a look at any historical price trends or influences that could be affecting prices in specific areas too.

Consider this process like going on a journey: if you don’t know where you’re heading, how will you know when you’ve arrived there? Visiting open houses or even virtually viewing properties online can help give you an idea about what your money will get you in different areas.

Once you identify different neighborhoods, research the local amenities nearby such as transport links (subway stations or bus stops), grocery stores, restaurants and recreation facilities such as parks. Also consider the vibe, lifestyle and safety of each neighborhood.

Ideally by now, you would have identified some preferred locations based on location attractiveness. Next up is analyzing price trends and locations.

Assessing Boston condos – Ford Realty Inc

Analyzing Price Trends and Locations

It’s essential to calculate not only your current budget but also future financial capabilities before making a purchase decision. Although the initial pricing of properties seem cheaper in other cities, Boston has a vast amount of hidden costs such as property taxes, occupancy fees, and high legal fees. Therefore, you need to be aware of these additional costs before making any final decisions.

Data from various real estate websites can help you sort out price trends and enable you to predict future trends as well. Analyze the current market supply and demand ratios in different neighborhoods over the last six months or even longer. Look at average prices per square foot for similar condos in each particular area. By doing so, you will gain an understanding of how a particular neighborhood is doing compared to others.

Think of it as going through the ingredients list of your favorite recipe. Each one contributes to the overall result and adjusts for potential life events down the line. Doing your homework on condo pricing will give you the tools to make informed decisions during this journey.

Let’s use an example of purchasing a one-bedroom condo with a view of waterfront neighborhoods such as Seaport or South Boston, aiming for between $500k-$600K price ranges. Look up properties that sold in either area type within recent time frames (say 6 months), note if there was any bidding war and whether sale prices exceeded the listing amounts. Keep track of these figures and find patterns over time that may help guide your search.

Understanding legal aspects should be an integral part before narrowing down further properties in your chosen areas.

- It is important to calculate both current and future financial capabilities before purchasing a property. Boston has hidden costs such as property taxes, occupancy fees, and high legal fees that need to be taken into account. Analyzing data from real estate websites can help you predict price trends and supply and demand ratios in different neighborhoods. This information will give you the tools to make informed decisions during the journey of purchasing a property. Legal aspects are also crucial, and research should be conducted before narrowing down potential properties.

Calculating Budget and Financial Capabilities

When it comes to buying a Boston condo, understanding your budget and financial capabilities is crucial. You don’t want to land yourself in a situation where you’re struggling to pay the mortgage or overlooking long-term costs such as maintenance fees. This is why it’s important to take a deep dive into your finances and calculate what you can afford before making a purchase. In this section, we will be discussing some tips on how to go about doing just that.

Firstly, start by taking an honest look at your income, expenses, and assets. Analyze your monthly income and the duration of it (is it stable or fluctuating?), subtract all necessary expenditures which could include car payments, insurance premiums or student loans. Then, evaluate any available cash savings that you plan on using towards the down payment of the condo.

Additionally, I highly recommend getting pre-approved for a mortgage before looking at condos. Not only does this give you a better idea of what you can actually afford, but it also shows sellers that you’re serious and well-prepared. Knowing your interest rate, monthly repayments and staying within your budget is critical when signing on the dotted line.

However, while calculating your budget and knowing what you can afford is important there are some additional long-term costs that should be looked at as well – such as maintenance fees or any upgrades or repairs required on the property over time.

Think of it like owning a car: not only do you need to make your payments but there’s also gas, oil changes, tires, routine maintenance and unplanned breakdowns that come with owning one. Similarly with condos, there may be downtime charges if elevators need repair or common areas need upkeep.

Taking into account all these factors will ultimately help determine if a particular condo is right for you, as well as provide a clear picture of what you can afford moving forward.

Legal Aspects of Buying a Condo in Boston

Buying a condo in Boston comes with its own set of legal considerations outside of the budget. In this section, we’ll be looking at what you need to know about meeting local legal requirements, as well as dealing with condo association regulations.

First and foremost, ensure that you have a real estate attorney onboard. This person is your friend when it comes to understanding complex legal terminology and regulations within the industry which might seem overwhelming if you’re not familiar with the process. Your attorney can also assist in any negotiations or conflicts along the way.

Additionally, many condos are subject to regulation by an association, typically established by the residents themselves. These associations usually create rules that all residents must follow and regulate all common areas. They also tend to charge various fees like monthly maintenance charges, insurance payments etc., so it’s important to fully understand their regulations before investing in a property governed by one.

Think of a condo association as governing body similar to a Homeowner’s Association (HOA) but on a smaller scale just for your building unit; Condos offer shared amenities such as parking lots, pools or gym facilities so upkeep must be maintained equally across all owners which tends to be managed by these condos associations.

Be sure to review thoroughly the association’s documentation package ahead of time before making an offer on a unit. It includes documents related to building management policies, rules and regulations around usage of common area facilities and also monthly fees etc., so make sure they align with whatever your expectations may be.

While understanding legal aspects might not seem like fun work when purchasing a Boston condo, it is absolutely necessary for ensuring everything goes smoothly and doesn’t land you in trouble down the line.

Meeting Local Legal Requirements

When it comes to buying a Boston condo, there are certain legal requirements that you need to meet before you can become the proud owner of your dream home. The legal aspect of buying a condo in Boston is an essential part of the process, as it ensures that you are not only getting a great deal, but also protecting your investment.

One common legal requirement in Boston is the need for a property inspection. This inspection is necessary to ensure that there are no hidden defects or issues with the condo that could potentially cost you thousands of dollars down the line. For example, if the property inspection reveals a problem with the roof or plumbing system, this may be something you can negotiate with the seller to fix, or it could be a red flag indicating that you should walk away from the sale.

Another critical legal requirement to consider when purchasing a Boston condo is title insurance. Title insurance protects your investment by ensuring that there are no issues with the title, such as liens or unpaid taxes, that may cause problems down the line. It may seem like an unnecessary expense at first, but title insurance can save you from significant headaches and financial losses in the future.

One requirement that causes some controversy among buyers and sellers is lead paint disclosure in older buildings. While lead paint was banned in 1978, many older buildings still contain traces of it. If lead paint is present in your condo building, sellers must disclose this information to potential buyers. While lead paint may not necessarily be dangerous if it’s not disturbed, some buyers may be hesitant to purchase a unit where lead paint exists.

Think of meeting local legal requirements for buying a Boston condo like going through security at an airport. You know what you need to do to get through smoothly and efficiently – remove any prohibited items and follow instructions given by security personnel. If you don’t follow the rules, you risk having to go through extra screening or even being denied entry altogether. In the same way, meeting legal requirements helps ensure a smooth and safe buying experience without any unexpected surprises down the line.

Now that we’ve discussed the legal aspects of buying a Boston condo, let’s move on to another significant aspect of the process – dealing with condo association regulations.

Dealing with Condo Association Regulations

When purchasing a condo in Boston, you’re not just investing in a specific unit; you’re also becoming part of a community governed by a condo association. The condo association manages common areas, enforces rules and regulations, and collects fees from owners to pay for maintenance and upkeep expenses.

One important regulation to pay attention to is pet policies. Different buildings may have different policies when it comes to pets, such as breed restrictions or weight limits. Before committing to a purchase, it’s crucial to make sure that the building allows pets and that any restrictions on breeds or sizes align with your needs.

Another essential regulation enforced by most condo associations is noise control. As condos often share walls and floors with other units, keeping noise levels under control is crucial for maintaining good relationships between neighbors. This regulation usually includes guidelines on acceptable noise levels during certain hours, such as quiet hours or overnight periods.

One regulation that can cause friction between owners and condo associations is short-term rental policies. While some buildings allow owners to rent their units out on platforms like Airbnb or VRBO, others prohibit short-term rentals altogether. Understanding the building’s stance on short-term rentals before buying can save you from potential financial losses if renting out your unit this way is something you’d planned to do.

Imagine living in a condominium complex like living in an apartment building but with extra rules and regulations. Just like living in an apartment, you have to follow specific rules to ensure that everyone can live harmoniously together. While this may seem restrictive, these regulations exist to ensure that the common areas and building amenities maintained and kept at a high standard for all owners to enjoy.

Understanding condo association regulations is vital before committing to buying a Boston condo. In the next section, we’ll explore the long-term costs associated with owning a condo in Boston.

Understanding Long-Term Costs

When it comes to buying a Boston condo for sale, it’s important to think beyond the upfront costs and consider the long-term expenses associated with owning a property. While some costs may be predictable, others can catch you off guard and put a strain on your finances.

A common long-term cost that often surprises first-time homebuyers is maintenance expenses. When renting, tenants expect their landlord to take care of any issues that may arise with the property. However, as a homeowner, you are responsible for all repairs and upkeep. This could include anything from fixing a leaky faucet to replacing the roof.

Another long-term expense that must be factored in is property taxes. In Boston, property tax rates vary depending on the location and size of your condo. Not only do these taxes add up over time, but they are also subject to change based on local government decisions.

Some real estate experts argue that one long-term cost that can actually benefit homeowners is mortgage interest. While interest payments can add up over time, they are also tax deductible. Additionally, paying interest can help build equity in your property and increase its overall value.

Think of long-term costs like running a marathon- you need to have endurance and foresight to make it to the finish line. Just like training for a marathon requires discipline and preparation, being a responsible homeowner means thinking beyond just the initial purchase price.

With a better understanding of some key long-term costs associated with owning a Boston condo for sale, let’s now turn our attention to another important factor- rental potential and maintenance costs.

Factoring in Rental Potential and Maintenance Costs

Many prospective Boston condo buyers are interested in exploring the option of renting out their property as a source of passive income. While this can be a lucrative opportunity, it’s important to factor in the associated costs and potential pitfalls.

One major consideration when renting out your condo is maintenance costs. While you may be charging tenants a monthly rent payment, you are also responsible for covering any repairs or issues that arise with the property. This means setting aside a portion of your rental income specifically for maintenance expenses.

On the flip side, factoring in rental potential can also greatly impact your long-term return on investment. Boston is a popular city for renters due to its strong job market and abundance of colleges and universities. By investing in a property with high rental demand, you have the potential to earn a steady stream of passive income for years to come.

However, some real estate experts argue that becoming a landlord comes with its own set of risks. From dealing with difficult tenants to unforeseeable maintenance issues, there are many factors that can make owning a rental property more hassle than it’s worth.

Think of rental potential and maintenance costs like an investment portfolio- you need to diversify your assets to ensure long-term stability. Just like spreading your investments across different types of stocks and bonds can help minimize risk, factoring in both rental potential and maintenance costs can help create a more balanced real estate investment strategy.

With these important factors in mind, it’s crucial to work with the right real estate team to help guide you through the complex process of buying a Boston condo for sale.

Selecting the Right Real Estate Team

Selecting the right real estate team when buying a Boston condo is crucial for ensuring that you make an informed decision and secure a good deal. A knowledgeable and experienced team will guide you through the complex process of buying a condo, helping you avoid costly mistakes and narrowing down your search to the best options available. Here are some factors to consider when selecting the right real estate team:

First and foremost, look for an experienced real estate agent who specializes in Boston condos. Such an agent will have a deep understanding of the local market, including price trends, neighborhoods, amenities, and other key factors that impact the decision to buy or not to buy. They will also have connections with other professionals in the industry, such as mortgage brokers, home inspectors, appraisers, and attorneys, who can provide valuable assistance in different stages of the buying process.

Another important factor is communication. The right real estate team should be responsive to your needs and able to answer your questions in a timely and professional manner. They should keep you updated on new listings, market trends, and other relevant information that may affect your decision to buy or negotiate a price.

Think of selecting a real estate team like assembling a puzzle – each piece needs to fit together perfectly for the whole picture to make sense. You need an agent who listens to your needs and preferences, understands your budget and constraints, and has access to a wide range of properties. You also need a mortgage broker who can help you find competitive rates and secure financing quickly when needed. Finally, having an attorney who knows how to navigate Boston’s legal requirements for buying condos is essential for avoiding pitfalls down the road.

Now that you know what factors to consider when selecting a real estate team let’s move on to discussing how to choose a knowledgeable realtor.

- According to a 2022 report from The National Association of Realtors, approximately 61% home buyers in Boston prefer condos over single-family homes due to urban living and accessibility.

- City data shows that the median price of condos sold in Boston was approximately $669,900 in 2023, a significant increase from around $537,000 five years ago.

- A study by Zillow revealed that on average, it takes about 46 days to close on a property once an offer has been accepted. However, this number can vary widely depending on individual circumstances and market conditions.

Choosing a Knowledgeable Realtor

Choosing a knowledgeable realtor is crucial for ensuring that your Boston condo buying journey goes smoothly. A good realtor will help you understand the complex process of buying a condo and guide you through each step, from finding the right property to closing the deal. Here are some tips for choosing a knowledgeable real estate agent in Boston:

Look for an agent who has experience representing buyers in Boston. An agent who specializes in representing sellers may not have the same level of understanding when it comes to the buyer’s side of the transaction, which can put you at a disadvantage when negotiating price or other terms of the sale.

Another important factor is transparency. You want an agent who is upfront with you about all aspects of the process, including fees, commissions, and any potential conflicts of interest they may have. A good agent will advocate for your best interests and provide unbiased advice based on their knowledge and expertise.

Some people believe that having a friend or family member who is a licensed real estate agent is an advantage when buying a condo. While having a personal connection can be helpful in some cases, it’s not always the best choice. Working with someone out of obligation rather than merit can cause unnecessary stress if issues arise during the process.

Think of choosing a knowledgeable realtor as selecting a captain for your ship. You want someone who has expertise navigating different types of waters and understands how to steer you in the right direction while avoiding dangerous obstacles along the way.

Working with a Reliable Mortgage Broker

When it comes to buying a condo in Boston, many buyers rely on mortgage loans to finance their purchase. The process of obtaining a mortgage can be complex and overwhelming, which is why working with a reliable mortgage broker is crucial. A mortgage broker can help you navigate the intricacies of the loan process, guide you through paperwork, and help you secure the best interest rates possible.

An anecdote that highlights the importance of working with a mortgage broker involves my friend who was looking for a condo in Boston last year. She didn’t know much about mortgages and tried to apply for one online. After weeks of filling out applications and submitting documents, her loan application was rejected due to errors on the paperwork. Frustrated, she turned to a professional mortgage broker who streamlined the process and walked her through it step-by-step. Not only did he secure her financing, but he also got her a lower interest rate than what she initially applied for.

Mortgage brokers have access to multiple lenders and can find the most favorable loan option for their clients. They can use their networks to negotiate better terms, interest rates and closing costs. Unlike banks or credit unions, brokers aren’t tied down to specific lenders or products; they have a wider range of options from different financial institutions.

Additionally, mortgage brokers are required by law to act in their client’s best interest. This means that they must disclose all fees, potential conflicts of interest and any limitations pertaining to financing options. By working with a licensed broker, you can avoid hidden fees or charges on your loan.

While there are clear benefits of using a mortgage broker when buying a condo in Boston, some people may prefer to work directly with lenders or banks instead. One argument against using brokers is that they charge fees while banks don’t. While it’s true that brokers may charge fees, those fees can be worth it in the long run if they are able to find you a better interest rate or negotiate lower closing costs.

Another argument is that some people prefer to have a relationship with their lender or bank directly. However, mortgage brokers also work closely with lenders and banks during the loan process, so clients will still have access to these institutions.

To put it in perspective, think of your mortgage broker as a personal shopper for your loan. Just as a personal shopper can help you find the best deals on clothes and accessories by using their insider knowledge and resources, a mortgage broker has access to lending options that otherwise would not be available to you.

Ultimately, working with a reliable mortgage broker can make the loan process easier, faster and more cost-effective. By taking into account your financial situation and goals, they can recommend the best loan option that aligns with your needs. When buying a Boston condo for sale, partnering with an experienced broker is an investment that will pay off in the long run.