The highest property taxes in the US

Boston Condos for Sale and Apartments for Rent

The highest property taxes in the US

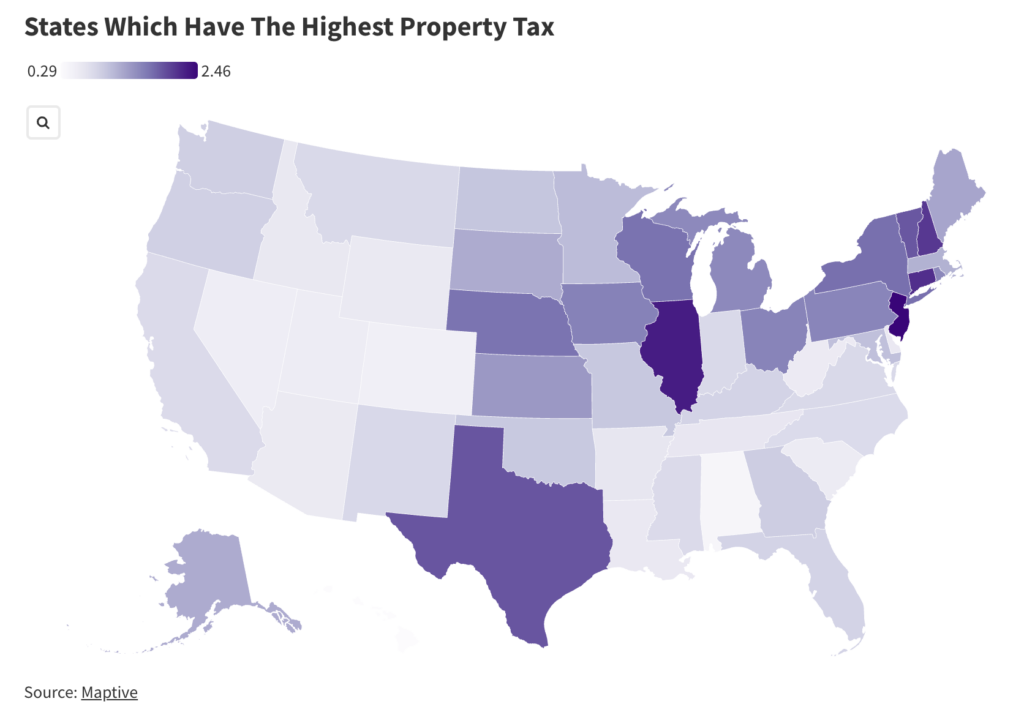

In recent years, property tax rates have been on the rise across the U.S., driven by increasing home values and changing local government needs. The year 2024 has seen significant changes in property taxes, with states implementing various measures to either alleviate or increase the tax burden on homeowners.

Nationally, the average property tax bill for single-family homes has increased by 4.1 percent in 2023, driven largely by rising home values.

From 2019 to 2023, the median property tax bill for single-family homes in the U.S. increased by around 24 percent. This trend has particularly affected new homeowners, many of whom are surprised by higher-than-expected property tax bills.

If you’re thinking about placing your Boston condo for sale. Well, here are the states with the lowest property-tax rates:

- Hawaii: Hawaii boasts the lowest property tax rate in the country at 0.29 percent. Homeowners here pay an average of $1,915 annually on a median-priced home.

- Alabama: With a property tax rate of 0.43 percent, Alabama residents pay approximately $742 in annual property taxes on a median-priced home.

- Colorado: Colorado has a property tax rate of 0.52 percent, resulting in an average annual tax of $2,125 on a median-priced home.

- Nevada: In Nevada, the effective property tax rate is 0.55 percent, with homeowners paying about $1,793 annually on a median-priced home.

- Utah: Utah rounds out the list with a property tax rate of 0.57 percent, leading to an average annual tax of $1,972 on a typical home.

https://www.newsweek.com/map-states-paying-highest-property-tax-1941692

The highest property taxes in the US

Massachusetts ranked one of the worst states for property taxes

A new report ranks Massachusetts as one of the worst states in the country when it comes to property taxes.

The index is designed to help business leaders, taxpayers, and government officials gauge how their states’ tax systems compare to others in terms of how they are structured and can be improved.

While it wasn’t in the top 10 or bottom 10, the Tax Foundation’s 2022 State Business Tax Climate Index ranked Bay State 34th on its list. Wyoming was the best state in the nation, while New Jersey was the worst.

States were compared on more than 120 variables in the five major areas of taxation. Each state’s overall ranking was based on how it ranked in several categories: Corporate tax, individual income tax, sales tax, property tax, and unemployment insurance tax.

Massachusetts did well coming in just outside the top 10 in individual income tax rank (11th) and ranking 12th for sales tax. However, when it comes to corporate taxes, it ranked 36th, and 45th for property taxes, and came in as the worst state in the nation for unemployment insurance tax.

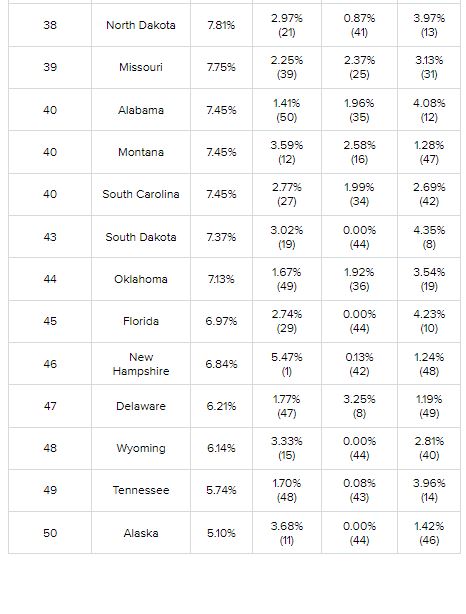

States in the top 10 of the index shared a common factor – the absence of a major tax. While property and unemployment insurance taxes are collected in all states, several don’t have a corporate income tax, individual income tax, or sales tax, and some only have one of the latter three taxes.

Nevada, South Dakota, and Wyoming, which ranked seventh, second, and first respectively, don’t have corporate or individual income taxes. No. 3 ranked Alaska doesn’t have an individual income tax or a state-level sales tax, while No. 4 ranked Florida and No. 8 ranked Tennessee don’t have an individual income tax. Both New Hampshire, which ranked sixth, and Montana, which ranked fifth, do not have a sales tax.

Source: Boston Real Estate Agent Magazine

Click Here to view: Google Ford Realty Inc Reviews

Updated: Boston Real Estate Blog 2022

Boston Real Estate Search

The highest property taxes in the US

If you are thinking about moving out-of-state, here’s another data point to consider:

This year, Uncle Sam took his cut of the past year’s earnings on May 17, slightly later than usual due to the COVID-19 pandemic. Many taxpayers are undoubtedly wondering how this year’s Tax Day will affect their finances, as a lot of people are struggling financially as a result of the pandemic.

Since the tax code is so complicated and has rules based on individual household characteristics, it’s hard for the average person to tell how they will be impacted.

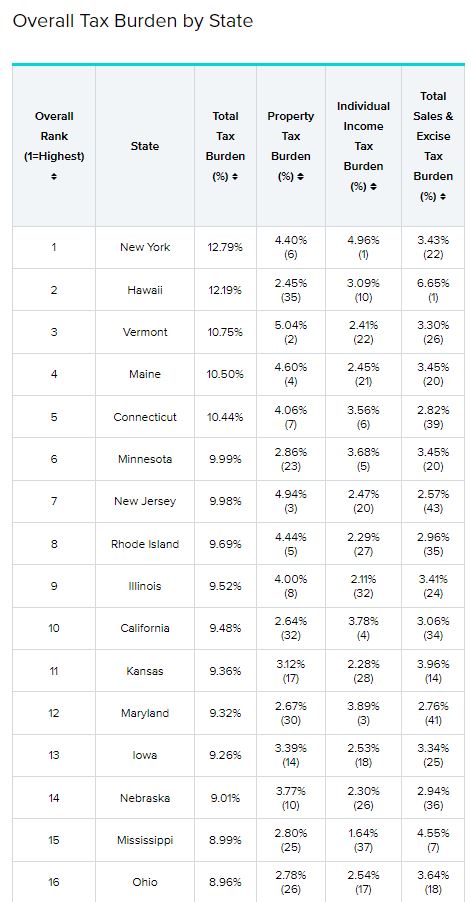

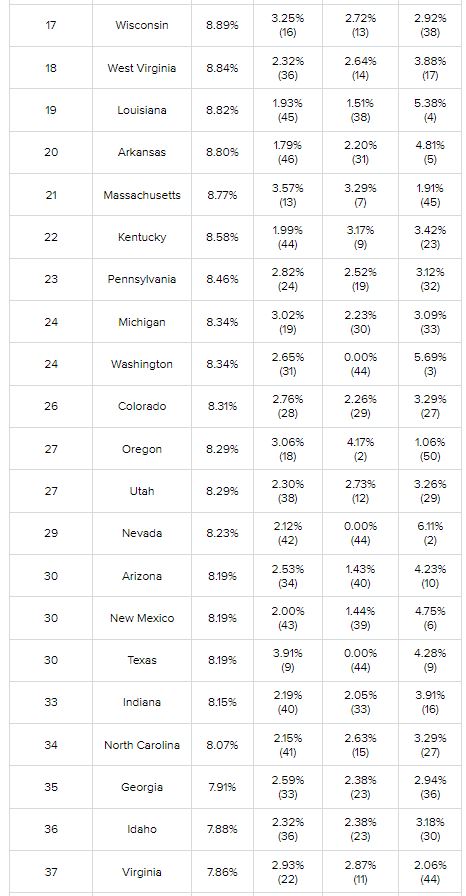

One simple ratio known as the “tax burden” helps cut through the confusion. Unlike tax rates, which vary widely based on an individual’s circumstances, tax burden measures the proportion of total personal income that residents pay toward state and local taxes. And it isn’t uniform across the U.S., either.

To determine the residents with the biggest tax burdens, WalletHub compared the 50 states across the three tax types of state tax burdens — property taxes, individual income taxes and sales and excise taxes — as a share of total personal income in the state.

https://wallethub.com/edu/states-with-highest-lowest-tax-burden/20494

Boston Condos for Sale

___________________________________________________________________________________________________________________________________________________________________________

The highest property taxes in the US

The highest property taxes in the US

As we all know the Boston real estate market prices keep climbing, but so will property tax.

Boston Real Estate Taxes

Homeowners in Massachusetts face some of the largest annual property tax bills of any state in the country. The median annual property tax payment in the state is $4,899. The state’s average effective tax rate of 1.17% is higher than the national average, according to SmartAsset.

The state requires an assessment every year.

[ Census Bureau: 89,000 Mass. tenants have ‘no confidence’ they can pay rent ]

“Properties in Massachusetts do get re-assessed every year,” said Keren Horn who is an Associate Economics Professor at UMass Boston.

And she says lifelong residents will really feel that pinch.

“People who will be surprised or already may have been surprised are the long-term homeowners,” said Horn.

As home prices continue to climb plenty of people are concerned property taxes could soon follow. We asked how long it could take before some people are priced out of their own neighborhoods.

“We are getting priced out. I mean I have to think about moving in the next couple of years,” said Ferragamo.

So, what can residents do?

“Most towns have exemptions for people on fixed incomes,” said Horn.

[ Realtor: 4 things first-time Massachusetts home buyers need to do ]

That’s something to check on in your town. The city of Everett saw this and actually lowered its property tax rate to retain residents.

“They’re very aware that people are struggling they can’t make their payments… so what do they do? They responded by reducing their property tax rate,” said Horn.

But Horn says property tax is something most towns may not want to tinker with and that leaves people like Ferragamo with little choice but to move.

“I’m going to have to do what I have to do. I don’t have a choice. Or I’m going to be working for the rest of my life just to have my house,” said Ferragamo

Boston Real Estate Search

——————————————————————————————————————————————————————————————————————————————————————————————

CNN Money has a good chart, via the Tax Policy Center, on the highest property taxes by state and by county in the US.

The good news: Massachusetts isn’t No. 1. The bad news: It’s No. 7, as measured by mean dollars paid per housing unit.

Guess which New England state is ranked No. 2? New Hampshire. Sure, they don’t have sales or income taxes in the Granite State. But they do have extremely high property taxes. The average rate in Massachusetts, for instance, is $3,805, while the average in N.H. is $5,230.

Who’s the worst? New York’s Westchester County at $9,647. New York and New Jersey generally seem to have the highest rates by far.

Filed under: Thank goodness for Proposition 2.5

Note: The entire Tax Policy Center study (pdf) can be found here. The screen-capture chart above via CNN Money; click on the first link to get to CNN Money’s

Pet-Friendly Boston condo for sale.

Pet-friendly luxury condo for sale at the Ritz Carlton with price reduction.

Back Bay luxury pet-friendly condominium with a recent price reduction.

Boston South End Condos is pet-friendly for sale under $1,000,000.

Boston South End price reduction for the pet-friendly property.

Downtown Boston Financial District luxury condo with a price reduction dogs and cats welcome.

Boston Waterfront pet-friendly properties with the reduced asking price.

To learn more about the Boston pet-friendly real estate market please feel free to call our office at 617-595-3712. You can also stop by our Beacon Hill office at 137 Charles Street, Boston MA.

Source: MLS

Three-bedroom Charlestown condo for sale.

Boston condo for sale in Charlestown.

One bedroom Boston condo for sale in Charlestown Massachusetts.

Boston condominiums for sale in the Back Bay area.

New Boston condos for sale in Back Bay.

Luxury Boston condos for sale in Back Bay.

The best Back Bay condos for sale.

View luxury Back Bay condominiums and homes for sale.

View new Beacon Hill condos and townhouses for sale in all price ranges.

Today’s newest Boston condos for sale in one of the finest areas of Boston.

Boston South End condos and homes for sale, new to the market.

Source: MLS

View Back Bay condos for sale:

Newest Back Bay real estate listing for sale.

Back Bay luxury condominium for sale.

Use the quick search box to view new Back Bay condos for sale.

For more information on how to be a Boston condo owner please contact John Ford at 617-595-3712. You can also email at realtyford@yahoo.com

Back to Boston condos for sale homepage

Contact me to find to set up an appointment to start your Boston condo-buying process.

SEARCH FOR CONDOS FOR SALE AND RENTALS

For more information please contact one of our on-call agents at 617-595-3712.

Boston Condos for Sale

Boston Real Estate and Boston condos for sale Updated 2021