State of the national housing market 2024

Boston Condos for Sale and Apartments for Rent

State of the national housing market 2024

Florida and San Antonio look cheap and getting cheaper!

Forty-seven out of 50 metropolitan areas in the U.S. saw an uptick in for-sale listings with price cuts this June as compared with last year, the company said. The biggest annual increases were in Tampa and Jacksonville, Fla., and in Denver, Colo.

The drop in home prices comes during one of the most expensive housing markets in U.S. history. Mortgage rates remain close to 7%, and home prices in May hit an all-time high, with the median price for a home hitting $419,300.

But buyers in the South are seeing a relatively cooler market, due to higher levels of inventory.

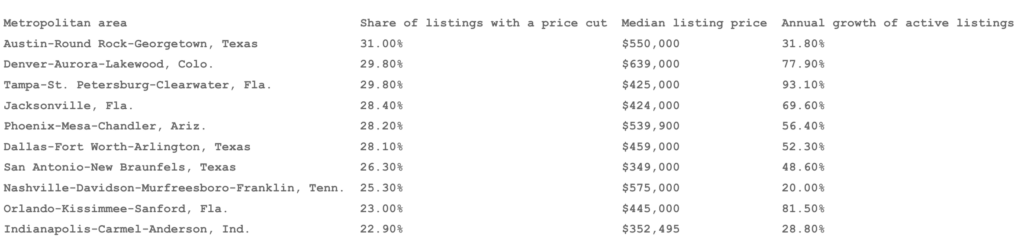

Among the largest 50 metropolitan areas in the U.S., those that had the highest share of homes with lowered prices were Austin-Round Rock-Georgetown, Texas; Denver-Aurora-Lakewood, Colo.; and Tampa-St. Petersburg-Clearwater, Fla.

The median listing price in Austin fell by 5.2% from last June. In Denver it fell by 6%, and in Tampa by 4.5%.

Tampa was also the place that saw the highest growth in housing supply from last year. In June, the inventory of homes for sale in Tampa grew by 93% as compared with last year. Tampa was followed by Orlando, where housing inventory grew by 82%. The South as a whole saw listings grow by 49% from a year ago.

Nationally, the share of homes with a price cut was 18.3% in June, Realtor.com said.

State of the national housing market 2024

Antitrust settlements took center stage during another lackluster earnings season for residential brokerages.

Real estate firms reported another round of losses, as mortgage rates and low inventory continued to hinder the market. Several companies’ quarterly results were impacted by multi-million dollar deals to resolve class-action claims over broker commissions.

Despite the financial hits, executives still projected confidence, with many touting advantages and projecting confidence ahead of looming changes to agent commissions.

“The bigger scale players are going to have a lot of advantage here,” Anywhere Real Estate CEO Ryan Schneider said during the company’s earnings call last week. “I like our assets relative to others to go through [these changes].”

Redfin announced the latest settlement just a day before its earnings call last week. The discount brokerage and listing platform agreed to pay $9.25 million to settle several lawsuits brought by home sellers, including the Missouri-based case known as Gibson.

On the company’s earnings call, CEO Glenn Kelman said the settlement was “worthwhile” and “small relative to what other brokerages paid, consistent with our having been a consumer advocate.”

Redfin is still facing two lawsuits brought by home buyers, which Kelman said are still in the early stages.

Brokerages with deals already on the table also spelled out timelines for upcoming payments. Anywhere, REMAX and Keller Williams — the first of the firms to settle — are now approaching final deadlines following the judge’s approval of their proposals last week.

Anywhere — which lost $101 million last quarter — has already paid $10 million of its total $83.5 million settlement. The company must pay its next installment, $20 million, in less than two weeks and the remaining balance in less than 21 days.

Douglas Elliman more than doubled its losses last quarter compared to 2023, which the company, in part, chalked up to the $17.75 million it set aside under the terms of its settlement agreement.

The firm, which lost $42 million, will pay the initial $7.75 million settlement charge by June 12, with two contingency payments of $5 million each between December 2025 and December 2027, depending on the firm’s cash on hand.

Elliman’s settlement has not yet received final approval from the judge, the hearing for which is slated for no later than Nov. 26.

Compass in March agreed to pay $57.5 million to settle the lawsuits, but the proposal is still waiting for approval. The company expects the judge to preliminarily approve the deal in the second quarter and to deposit the first half of the sum within 30 days of the order, according to SEC filings. Compass will pay the remaining half within a year of preliminary approval.

Among the brokerages that have yet to pull out of the antitrust spotlight is eXp Realty, which is named in several lawsuits across the nation including Gibson.

Company executives only briefly addressed the litigation during its earnings call, with CEO Leo Paraja pointing to online tools and regional rallies hosted by the firm and geared toward answering agents’ questions about the lawsuits.

But the brokerage — which lost $13.8 million last quarter — is also facing allegations that two of its employees sexually assaulted women and violated sex trafficking laws. Pareja replaced Glenn Sanford as CEO in April, about a month after sexual misconduct lawsuits expanded to include the former chief executive as a defendant.

Source: The Real Deal

Peace be with you

Boston Beacon Hill Condos for Sale

Updated: Boston Real Estate Blog 2024

Condo Broker 137 Charles St. Boston, MA 02114

Visit our office at 137 Charles Street, Beacon Hill MA 02114

Sorry we are experiencing system issues. Please try again.

Where is Ford Realty Located?

Ford Realty is located in 137 Charles Street in Beacon Hill

Click Here to view: Google Ford Realty Inc Reviews

View Boston condos for sale. Updated every 8 minutes

Boston Condos for Sale and Apartments for Rent

State of the national housing market 2024

___________

State of the national housing market 2024

Over the last few years, the real estate disrupters have figured that the high-tech environment should produce an easier/cheaper way to buy and sell homes. No matter how it’s presented though, the message is clear. We’re hoping to beat the agents out of their commission.

Saving the commission is a noble aspiration and sounds very feasible when consumers run into most agents. Usually they come away thinking, “what do they do to deserve that much commission?” Some consumers get so defiant that they will sell their home without an agent just to be right about not paying a commission – even if they sell for less.

There is a gap between wholesale and retail pricing that is about 10%. A good listing agent will sell your home towards the top end of the range, and the average agent will sell it for less. The message that agents should be offering is to Get Good Help, because the top agents pay for themselves by selling your house for full retail!

Why can’t a for-sale-by-owner sell for full retail? Because they always price too high, and buyers aren’t as comfortable with the process or the price when there isn’t a good agent involved. You need one or the other – a good agent, or a very attractive price to compensate.

Are homeowners going to risk giving their house away? No, they will just price at full retail and wait until somebody comes along – and we know who comes along – realtors, by the dozens.

The disrupters will put all sorts of spin on it – remember Make Me Move by Zillow? Now gone.

But none of them are able to change the fact that buyers aren’t comfortable paying full retail unless somebody is there to instill ease and comfort. Price didn’t matter as much during the frenzy, but it matters now, and the best thing any seller can do is to Get Good Help who pays for themselves by getting full retail while making the process easier and more predictable for you.

Updated: Boston Condos for Sale Blog 2024

John Ford Boston Beacon Hill Condo Broker 137 Charles Street Boston, MA. 02114

Where is Ford Realty Located?

Ford Realty is located in 137 Charles Street in Beacon Hill

___________

State of the national housing market 2024

State of the National Housing Market 2024: Trends and Predictions

State of the national housing market 2024. As we step into the final quarter of 2024, what better time to examine the pulse of the national housing market? It’s a world of towering skyscrapers, charming bungalows, and futuristic smart homes – but with ever-shifting economic factors and rapidly changing societal trends, where does American housing truly stand? Dive into our comprehensive review that unravels the trends shaping this complex market and forecasts what we can anticipate moving forward. Knowledge is power, particularly when looking to buy or invest. Let’s decipher what 2024 means for you in real estate terms.

The national housing market in 2024 is expected to see a marginal increase in existing home prices, with potential declines in high-priced areas. Existing home sales may rise as mortgage rates decline, and new home sales are predicted to continue their upward trend. Rent increases may flatten or slightly decline in some markets due to an abundance of multifamily units. Housing starts will vary by sector, with rebounds expected for single-family homes while the multifamily sector continues to decline. Building permits may rise for single-family homes but fall for multifamily units due to rising costs and an overbuilt apartment sector in certain markets. Mortgage rates are expected to decrease but remain above 6% amid slowly declining inflation and investor demand. It is important to note that fluctuations and regional variations are possible.

2024 National Housing Market Overview

The 2024 national housing market is expected to continue experiencing changes that may influence the affordability of owning a home. As noted earlier, millennials and generation Z are projected to be the driving force behind this year’s real estate market. The demand for houses in suburban areas is also expected to rise due to the global pandemic’s impacts. Since many jobs became remote, people started prioritizing more living space outside urban settings. This shift toward suburban living could continue holding sway even after the pandemic subsides.

While the trend towards increased suburban living is likely, it remains unclear whether any factors could challenge this market shift. One potential problem might be the high taxes usually associated with suburban living, which tend to be more exorbitant than those incurred while living in cities or towns. Also, although it is projected that technology will continue playing a vital role in real estate markets nationally, some states’ laws favor traditional operations, limiting the impact of technology.

- The National Association of Realtors anticipates a modest rise of 0.7% in existing home prices across the nation in 2024.

- According to the US Census Bureau and Department of Housing, new home sales are expected to continue their upward trend, garnering an increasingly larger share of the single-family detached home sales in 2024.

- The Federal Reserve reports that 30-year fixed mortgage rates are projected to decline, yet will remain over 6% due to factors like slowly ebbing inflation and investor expectations of refinancing within a few years.

- The national housing market in 2024 is expected to be influenced by changes that may impact the affordability of owning a home. Millennials and generation Z are projected to be the driving force behind the real estate market this year. The demand for houses in suburban areas is expected to rise due to the effects of the global pandemic, as remote work has made people prioritize more living space outside of urban settings. This shift towards suburban living may continue even after the pandemic subsides.

However, there are potential challenges to this market shift. High taxes associated with suburban living could pose a problem, as they tend to be more expensive than taxes incurred while living in cities or towns. Additionally, while technology will continue to play a vital role in the real estate market nationally, some states have laws that favor traditional operations, which can limit the impact of technology.

Overall, the 2024 housing market will likely see increased demand for suburban homes driven by younger generations and remote work preferences, but factors such as high taxes and limited technological influence may pose challenges.

Current Home Prices and Value

Home prices remain expectedly high as scarce supply plus strong competition drive up prices in many regions of the country. According to projections from Redfin and Zillow, there’s likely to be a buyer’s market due to improvements in inventory and prices, but the change may still be slow [TABLE]. In this context, affordability remains a primary concern for prospective buyers since an increase in home prices may limit their purchase options. However, all hope is not lost since mortgage rates are projected to remain low, presenting an opportunity for interested buyers willing to take advantage of low-interest rates.

| Redfin | Zillow |

|---|---|

| Home Prices – Decrease approx. 1% | Home Prices – Decrease approx. 0.2% |

| Inventory trends – Increase approx. 3% | Inventory trends – Increase approx. 7% |

At present, millions of Americans are struggling to afford homes due to ever-increasing home prices. As a result, some people are forced to opt for renting as an alternative . More importantly, experts recommend a cautious approach when seeking to invest in real estate amidst uncertainty in current market conditions.

For instance, consider if you’re paying $1,500 monthly for rent on a small apartment in the suburbs. The same money could potentially cover the monthly mortgage cost of a decent house provided down payments and credit scores are high enough.

Now that we have examined the state of current home prices let’s look at housing demand and conditions.

Housing Demand and Conditions

As 2024 looms, the state of the national housing market indicates a continued trend of high demand outstripping low inventory. In turn, experts expect higher home prices and an increase in median sale price. This seller’s market, which characterized most of 2023, is unlikely to shift markedly because of tight supply. Conversely, high mortgage rates can also mean fewer people are willing to buy homes hurting sales even though economic outlook indicators are positive.

While the volume of home sales has declined over the past few years due to increased mortgage rates, experts predict that sales will rise by as much as 15% next year if mortgage rates continue to dip.

This cautious optimism stems from the potential decline in mortgage rates, with talks on the Federal Reserve cutting rates currently underway. Though they remain relatively high compared to historical averages, such a dip shows promising signs for both buyers and sellers and may provide some much-needed impetus in kickstarting these markets.

Changes in Home Sales and Mortgage Rates

To put things into perspective, suppose a borrower borrowed $200k at a 5% interest rate over thirty years for their mortgage payments. If they pay off this loan entirely in three decades time, they’ll have made monthly payments of around $1065 with a total interest accrued at $186k. However, suppose this individual had managed to acquire the same loan when interest rates were at 3%. In that case, monthly payments would have been around $843 with the total amount paid in interest standing at approximately $103k only.

As discussed previously, current projections suggest that mortgage rates will drop between .2-0.4 percent creating yet another opportunity for homeowners to save hundreds, if not thousands of dollars each year in monthly combined payments and interest payments.

Indeed many borrowers have already begun refinancing their mortgages – where they essentially take out a new loan at a lower interest rate, with different terms to suit their current financial circumstances – all while saving on monthly payments and retaining the same level of equity.

Dealing with plummeting home sales particularly in metropolitan areas is an ongoing issue that may need a diverse range of initiatives to counteract. These initiatives include increasing income limits and providing low-cost public housing to ensure readily accessible housing for citizens of all backgrounds and credit backgrounds while reducing mortgage rates may give some respite.

However, some may argue that such measures may stimulate demand without addressing the core structural issue of insufficient inventory levels, which also leads to increased pricing. Tackling this problem requires creating new supply via legislation involving construction companies in implementing practices that keep expenses low.

While it’s unclear whether this deficit will be fully addressed anytime soon, these trends, coupled with potentially higher mortgage rates and steep home prices in 2024, will continue shaping the national housing market narrative as we move forward into the new year.

Expected Trends in Home Sales

After a sluggish 2023, experts predict a slight improvement in home sales for 2024. Although the pace of growth is likely to be modest, this trend represents a welcome change after several years of declining home sales. This uptick can primarily be attributed to lower mortgage rates, which could improve affordability and encourage buyers to enter the market. However, it’s important to note that low inventory levels remain an issue in many markets, leading to increased competition among buyers.

Suppose we consider Austin’s real estate market, where this pattern of limited inventory availability and high buyer demand persists. Even with prospective improvements in demand resulting from lower mortgage rates, it would still prove challenging for most first-time homebuyers trying to overcome high down payment costs and competing with buyers who can purchase properties using all-cash offers.

Therefore, although home sales may slightly increase across different regions, prospective buyers must be equipped with strategies such as unconventional financing options and acting quickly on purchase opportunities.

Anticipated Mortgage Rate Shifts

Multiple factors influence mortgage rate shifts – the global economy, inflation rates, housing demand and more. Despite being considered unpredictable by many people concerned with the housing market long-term trends experts expect that mortgage rates will decrease slightly throughout 2024.

If projections hold true, this shift could lead to greater affordability for potential buyers currently struggling due to high-interest rates during the previous year.

However, it’s essential for borrowers not to get carried away with these changes since any drops are also dependent on individual creditworthiness. A slight drop might sound appealing now but minor variations in interest rates today may translate into significant differences tomorrow in either direction.

Think of chasing interest-rates like purchasing stock. While it might appear that luck holds sway initially; ultimately, you should focus on making managed investments informed by your comprehensive analysis.

As we know, fluctuations in interest rates can impact monthly payments and overall home affordability. Buyers must be aware of how these slips and increments may affect their financial situation over the lifetime of their mortgage.

New Construction and Property Availability

The housing market experienced setbacks in 2023 caused by high mortgage rates, leading to a low inventory of available properties. However, new construction and property availability have seen an uptick in 2024, suggestive of a positive turn of events. The increase in construction output is projected to continue throughout the year. With demand for affordable homes still present in the marketplace, builders are capitalizing on this opportunity by offering affordable options.

For instance, in Miami, a City located within Florida’s real estate hub, construction permits reached their highest point since 2020. A significant number of these permits were for multiunit buildings or high-density development zones. This fact implies that the area has available space for future buildings.

Bringing forth more developments could also help balance out supply-and-demand ratios, thus potentially improving the affordability of housing projects.

That said, new construction alone is not enough to bring prices down or expand supply quickly — another vital metric to consider is market potential.

Market Potential and Predictions for 2024

The current housing market presents clear challenges for both buyers and sellers alike due to mortgage rate fluctuations and inventory shortages. Home values have increased over five consecutive months YoY (year-over-year) based on NAR statistics as of November 2023. However, the projections show a sudden drop which favors buyers -the demand side- during 2024 with Realtor.com projecting a decrease in home prices by 1.7%.

Fannie Mae predicts that rates will average at 6.7% with total sales jumping up to $4.8 million a decade high should this become reality. Higher sales volumes coupled with lower interest rates could restore balance to supply-and-demand economics giving rise to greater access to affordable homes. Housing lenders like Goldman Sachs suggest buying into already established markets such as San Francisco Bay Area and Boston.

Until then, it is wise to seek guidance from experienced local real estate agents in your area. Agents could help you make informed decisions about whether to buy or wait, given the state of prices within the market.

Just like a surgeon consults with their clients before going into surgery, an experienced real estate agent should help you navigate through the complex nature of today’s housing landscape.

State of the national housing market 2024 – FAQ

How has the national housing market evolved since the previous year?

The national housing market has seen steady growth since the previous year, driven by a combination of low mortgage rates, increased demand for housing, and favorable government policies. According to recent statistics, home sales have increased by 10% compared to the previous year, with a significant rise in first-time buyers entering the market. Additionally, there has been a noticeable shift towards sustainable and energy-efficient homes as more buyers prioritize environmental factors.

What factors are influencing the current state of the housing market in 2024?

The current state of the housing market in 2024 is being influenced by several factors including low mortgage rates, increased demand for suburban homes, and the impact of new housing policies. Mortgage rates have remained historically low, encouraging more people to purchase homes. Additionally, the COVID-19 pandemic has led to a rise in remote work, increasing the desire for larger suburban homes with dedicated office spaces. Finally, new policies aimed at promoting affordable housing and sustainable development are impacting the availability and pricing of properties in certain areas.

What trends can be observed in terms of housing prices and affordability?

In 2024, the national housing market is experiencing a trend of rising prices and decreasing affordability. This can be attributed to several factors such as high demand, limited supply, and inflationary pressures. According to recent statistics, nationwide home prices have increased by an average of 10% compared to the previous year. Additionally, the income growth rate hasn’t kept pace with the housing price growth, leading to decreased affordability for many potential homebuyers.

Are there any particular regions or cities that are experiencing significant growth or decline in their housing markets?

Yes, there are several regions and cities experiencing significant growth in their housing markets. Among them, Austin, Texas stands out as a hot market due to its booming tech industry and favorable business environment. According to recent statistics, Austin saw a 13% increase in home prices and a 15% increase in sales compared to the previous year. On the other hand, cities like San Francisco, California are experiencing a decline. The high cost of living and exodus of tech companies have led to a decrease in demand, resulting in a 10% drop in home prices.

Are there any government policies or initiatives that are impacting the national housing market in 2024?

Yes, the government has implemented several policies and initiatives that are impacting the national housing market in 2024. One of the key initiatives is the expansion of affordable housing programs, which aim to address the shortage of affordable homes by providing subsidies and incentives for developers. Additionally, there has been a focus on revitalizing urban areas through initiatives such as smart city projects, which are attracting investments and driving up the demand for housing in those areas. These policies have contributed to a slight dip in overall housing prices by around 5% as compared to the previous year.

=========================================================

State of the national housing market 2024

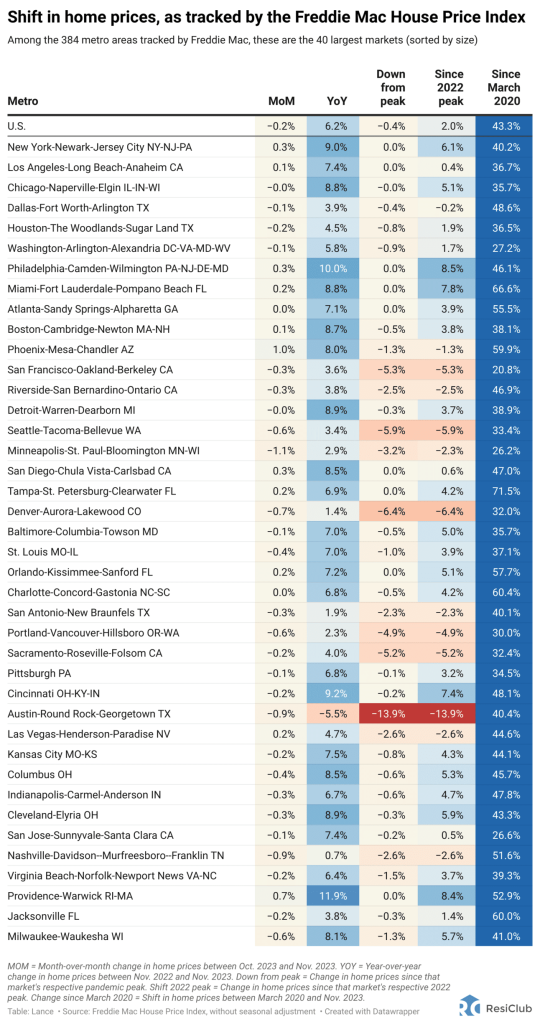

Boston did about as well as any of the higher-end markets last year with a +8.5% year-over-year pricing gain, in spite of some of the ivory-tower doubters! I think we will see a positive pricing trend for Boston condos for sale in 2024 too.

My concern today, is the overly positive job numbers and how that will impact the Fed and interest rates going into the 1st Q of 2024.

Boston condos for sale – Ford Realty Inc

Boston condos for sale – Ford Realty Inc

Updated: Boston Condos for Sale Blog 2024

John Ford Boston Beacon Hill Condo Broker 137 Charles Street Boston, MA. 02114

Back Bay Condos for Sale

Sorry we are experiencing system issues. Please try again.

Click Here > Boston Back Bay Apartments for Rent

Ford Realty Beacon Hill – Condo for Sale Office

Boston condos for sale – Ford Realty Inc

Updated: Boston Condos for Sale Blog 2024

John Ford Boston Beacon Hill Condo Broker 137 Charles Street Boston, MA. 02114

Where is Ford Realty Located?

Ford Realty is located in 137 Charles Street in Beacon Hill

____________________________________________________________________________________________________________________________________________________

State of the national housing market 2024

The biggest challenge the housing market’s facing is how few homes there are for sale. Mark Fleming, Chief Economist at First American, explains the root causes of today’s low supply:

“Two dynamics are keeping existing-home inventory historically low – rate-locked existing homeowners and the fear of not finding something to buy.”

Let’s break down these two big issues in today’s housing market.

Rate-Locked Homeowners

According to the Federal Housing Finance Agency (FHFA), the average interest rate for current homeowners with mortgages is less than 4% (see graph below):

But today, the typical mortgage rate offered to buyers is over 6%. As a result, many homeowners are opting to stay put instead of moving to another home with a higher borrowing cost. This is a situation known as being rate locked.

When so many homeowners are rate locked and reluctant to sell, it’s a challenge for a housing market that needs more inventory. However, experts project mortgage rates will gradually fall this year, and that could mean more people will be willing to move as that happens.

The Fear of Not Finding Something To Buy

The other factor holding back potential sellers is the fear of not finding another home to buy if they move. Worrying about where they’ll go has left many on the sidelines as they wait for more homes to come to the market. That’s why, if you’re on the fence about selling, it’s important to consider all your options. That includes newly built homes, especially right now when builders are offering concessions like mortgage rate buydowns.

What Does This Mean for You?

These two issues are keeping the supply of homes for sale lower than pre-pandemic levels. But if you want to sell your house, today’s market is a sweet spot that can work to your advantage.

Be sure to work with a local real estate professional to explore the options you have right now, which could include leveraging your current home equity. According to ATTOM:

“. . . 48 percent of mortgaged residential properties in the United States were considered equity-rich in the fourth quarter, meaning that the combined estimated amount of loan balances secured by those properties was no more than 50 percent of their estimated market values.”

This could make a major difference when you move. Work with a local real estate expert to learn how putting your equity to work can keep the cost of your next home down.

Rate-locked homeowners and the fear of not finding something to buy are keeping housing inventory low across the country. But as mortgage rates start to come down this year and homeowners explore all their options, we should expect more homes to come to the market.

_____________________________________________________________________________________________

State of the national housing market 2024

Housing affordability nationwide is the worst it has ever been on record due to spiking home prices and interest rates, Bloomberg reports.

Housing Crisis

The crisis has reached areas of the country that once had the most affordable homes, the outlet reported citing data from the Federal Reserve Bank of Atlanta.

In September 2022, a median-income household would have had to spend a little over 46 percent of its income to afford a median-priced home. That’s a 14-point spike from September 2021, when a household had to spend about a third of its income to afford a home in its community. (The data measured affordability based on the ability of a median-income household to absorb the estimated annual costs associated with owning a median-priced home, including mortgage, estimated taxes and the cost of insurance.)

Income Levels Not Keeping up with Housing Prices

Furthermore, in all but one U.S. metro area with more than 500,000 people, a median-income household would have to spend more than 30 percent of its income to own a median-priced home.

Housing Expert Predictions

Experts are predicting a market correction, where home prices fall more in line with income levels, the outlet reported. But, at this point, inventory of unsold homes hasn’t increased to the point where housing prices will see.

Boston Real Estate Outlook

My thoughts, Boston seems to be having the same problem as the rest of the country. Affordability is having major impact especially with firs-time homebuyers.

State of the national housing market 2022

The Boston condo for sale market doesn’t always reflect national real estate trends, but they’re some similarities, especially when it comes to days-on-the-market.

Mortgage rates reached a 20-year high this month, causing another hit to the already volatile housing market, according to a new Redfin report.

How are rising mortgage rates impacting the housing market?

As mortgage rates creep toward 7%, pending home sales and new listings are declining more than they did over the summer, as the number of sellers dropping prices rose to its highest level on record, and the number of homes selling for over asking price dropped to its lowest since the start of the pandemic.

The second sharp rate increase this year, together with nerves about inflation and the direction of the economy, is dragging home-sale activity down further than it was over the summer and pushing homebuyer sentiment down near its all-time low.

Are home-buying applications down?

Yes, mortgage applications fell 2% week over week and were down 39% from last year.

Are home searches on Google down?

Yes, Google found fewer searches for “homes for sale” during the week ended Oct. 8, down 35% from last year putting it on par with March 2020.

______________________________________________________________________________________________________________________________________

State of the national housing market 2024

Existing-home sales went down for the fourth consecutive month, slumping by 3.4 percent in May from the previous month, the National Association of Realtors reported.

The tide isn’t turning anytime soon, with low inventory, high mortgage rates and higher prices limiting deals and sidelining some would-be buyers.

“Further sales declines should be expected in the upcoming months given housing affordability challenges from the sharp rise in mortgage rates this year,” said NAR chief economist Lawrence Yun in a statement.

The interest rate for 30-year, fixed-rate mortgages jumped to 5.23 percent in May, up from 4.98 percent in April, according to Freddie Mac. On Tuesday the average rate was 6 percent.

However, as sales slowed, housing prices continued to soar in May. The median price for existing homes rose 14.8 percent in May from a year earlier to a record $407,600. That’s no surprise: The median price has consistently hit record highs each month from the year before for nearly 10 years.

Yun suggested that the inventory levels needed to nearly double for the appreciation of home prices to slow down.

Across the country, there were 1.16 million units for sale or under contract at the end of May, up 12.6 percent from April and down 4.1 percent from May 2021, according to the NAR.

The pace of price appreciation ticked up everywhere in the U.S., with the largest increase in the South (for the ninth consecutive month), followed by the West, then the Midwest and Northeast.

Homes that sold were not on the market for long, as has been the case for a while. Properties that went into contract last month typically were on the market for 16 days, down from 17 days in April and 17 days in May 2021. Only 12 percent of homes sold in May were on the market for more than a month.

Demand for houses has exceeded supply since the start of the pandemic. Some Americans accelerated buying plans or sought to take advantage of remote work and low interest rates, while would-be sellers were able to change jobs without moving or refinanced before rates rose. But with remote work becoming the new normal, housing inventory could continue to get squeezed.

Updated: Boston Real Estate Blog 2022

_____________

State of the national housing market 2024

Just updated: A tight housing supply market is fueling the continuous rise in prices in the Boston condo for sale market in 2022. But it looks like changes are on the horizon.

State of the national housing market:

Click Here to view: Google Ford Realty Inc Reviews

_________________________________________________________________________________________

The Wall Street Journal runs some numbers to determine where there are signs of strength and weakness in the national housing market.

The paper analyzed data in 28 major metropolitan areas to determine “overall strength”, based on months of available supply of homes listed for sale, change in inventory since last year, average price change during that time, employment outlook over the next two years, and percentage of loans overdue.

The Boston metropolitan area?

Overall? We get a “moderate”.

Change in housing inventory, past 12 months? Down 10.9% (they include single family, condos, and townhouses in total)

Months supply: 6.7

Price change: -8.5%

Loan payments overdue: 3.6%

Employment outlook: Very weak

VERY WEAK??? Like I don’t have enough to worry about?

The loan payments overdue is an encouraging sign, though. We’ve got the sixth lowest overall, out of 28 MSAs. And, we’ve had the biggest drop in inventory out of all 28 areas.

For price changes, we’re right in the middle at #14, meaning we’re doing better than half because prices have dropped more (meaning, housing has become more affordable) or we’re doing worse than half because prices hae dropped more (meaning, owners are losing their shirts).

Source: Where Housing Is Headed – By James R Hagerty, The Wall Street Journal

Sorry we are experiencing system issues. Please try again.

Click Here: Back to Boston Real Estate Home Search

Buying a Boston Real Estate for sale

- Tips on buying a Boston real estate

- Boston real estate buyers how to beat all cash offers

- 5 tips on buying a Boston real estate for sale

- Benefits of buying a Boston real estate condo

- Design tips for Beacon Hill condo buyers

- Boston Beacon Hill condos for sale 5 must know terms

- The difference between a Beacon Hill condos and a Beacon Hill loft

- Common mistakes when buying a Beacon Hill condo

- Buying a Beacon Hill condo with kids

- Is it time to ditch my Beacon Hill condo agent?

- Beacon Hill condos for sale: Do I need 20% down?

- 3 signs you’re going to buy a Boston Beacon Hill condo

- 6 principles to know when buying a Beacon Hill condo

- How to select a Boston Beacon Hill condo agent

- Boston Beacon Hill condos for sale down-payment

- Boston Beacon Hill condos finance

- Beacon Hill condos for sale what is negotiable

- Beacon Hill condos for sale: What it take to get a mortgage.

- Boston Beacon Hill condos for sale. Understand the condo association

- How much do Boston Beacon Hill condos cost?

- How to select a Boston real estate broker

- Beacon Hill condos for sale: Clutter Free

- Beacon Hill condos for sale:Security Tips

- Beacon Hill condo renters are misinformed

- Boston Beacon Hill condos for sale: Design trends

- Boston Boston real estate: Fixer up

- 8 Beacon Hill condo designs

- How to sell your Midtown condo using social media

- Boston Boston real estate sales volume

- Wage increases make Boston real estate less or more affordable

- Boston Boston condos the importance of high owner occupancy

- Why you should buy a Boston real estate off season

- The definitions of Boston real estate terms and what they mean?

Back to Boston real estate for sale homepage

Contact me to find out more about this property or to set up an appointment to see it.

SEARCH FOR BOSTON CONDOS FOR SALE

For more information please contact one of our on-call agents at 617-595-3712.

Last Updated: 2024