Slowing Boston condo market

Boston Condos for Sale and Apartments for Rent

Slowing Boston condo market

It’s a bit sluggish around downtown Boston and it will probably stay that way for the foreseeable future – and likely for months to come. Prices and rates are high, and the inventory keeps growing, which gives buyers hope that either the perfect Boston condo for sale will come along and/or prices might go down.

It’s Boston real estate stagflation, also known as the Boston condo broker’s nightmare!

Updated: Boston Real Estate Blog 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Slowing Boston condo market

Do you think the Boston condo for sale market’s high interest rates combined with still high property prices is posing an affordability issue for Boston condo buyers? If so, could this eventually force something in the market to break?

As you are aware 2024 will be a presidential election year. In my experience, the Boston condos market traditionally slows down when we have a presidential election year.

Last thought of the morning, presently, the national economy is robust, but how long can it last, especially if we have one more interest rate hike which may economist think is a 50/50 chance.

Updated: Boston Real Estate Blog

________________________________________________________________________________________________________________________________

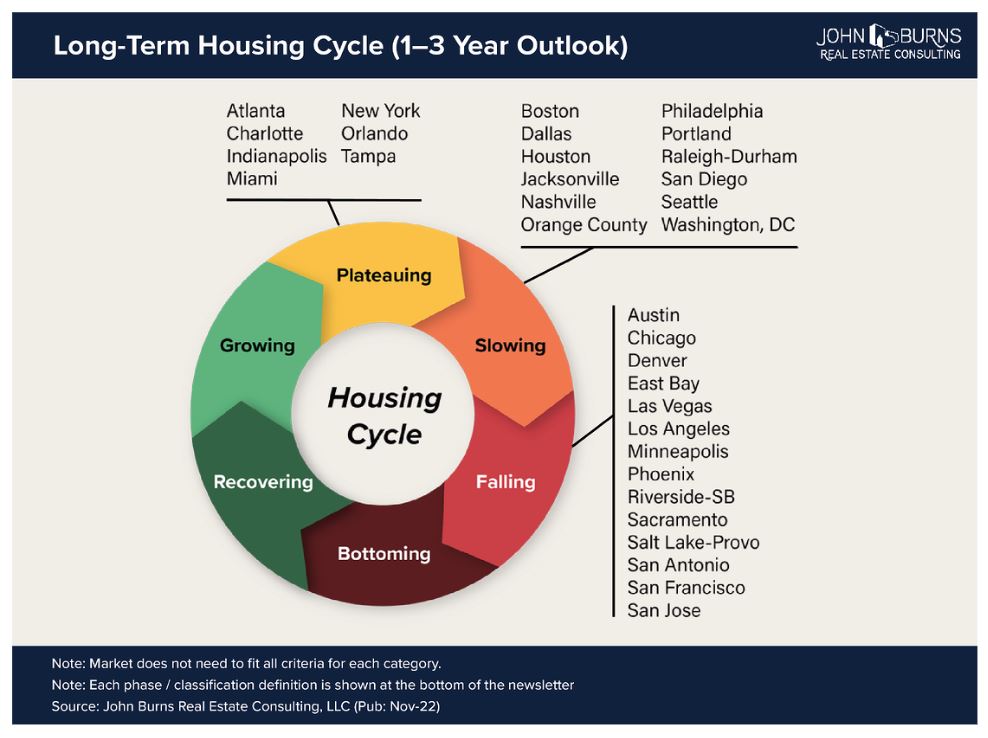

The well respected John Burns Real Estate Consulting firm, predicts that the Boston condo for sale market will experience a slowdown in the net 1-3 years.

The staff at John Burns Real Estate Consulting have been on the forefront of market tracking for years now. They have staff that travels around the country to gather data from builders in particular, and have built a tremendous network.

I don’t mind being labeled as ‘slowing’ because…..well, I guess it beats a falling market!

Their definition of Slowing real estate market:

Markets in the Slowing phase face alarming affordability levels, decelerating (or even declining) home price appreciation, and rapidly slowing sales—making capital investments less attractive. Several of these slowing markets were among the first to recover from the initial COVID panic in April 2020.

Affordability housing issues

In-migration and job growth, fueled by the proliferation of work-from-home policies, set these markets apart as higher wage workers relocated due to the relative affordability—most notably in downtown Boston.

Current employment

Current employment is well above prior peak levels in all of these markets. While strong job growth from high-wage sectors has buoyed these markets, it has also been the primary driver of their now strained affordability, with a significant number of locals now completely priced out of ownership.

YOY home price growth

YOY home price growth is decelerating rapidly, and construction volumes are pulling back from very high levels. Their business focus is tilted towards builders and new homes, but their analyses about the general market conditions are applicable to the resale market too.https://www.realestateconsulting.com/the-light-current-housing-cycle-landscape/Each area will have several variables that makes it unique, but we are a society that wants to label everything with one word. I have one word for you – auction. If an auction company took over real estate, we wouldn’t need opinions, analyses, or realtors! But than again, I’d be out of a job. Lets keep the status quo for now.

Updated: Boston Real Estate Blog