Real Estate Interest Rates in 2025

Boston Condos for Sale and Apartments for Rent

Real Estate Interest Rates in 2025

As of April 25, 2025, mortgage rates have seen a small decrease, with the average 30-year fixed mortgage rate currently at 6.81%

**********************************************

As of late April, the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances, $806,500 or less, increased to 6.81% from 6.61%, with points decreasing to 0.62 from 0.63, including the origination fee, for loans with a 20% down payment.

Updated: Boston Real Estate Blog April 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Real Estate Interest Rates in 2025

As of February 20, 2025 – 6.87%!

Real Estate Interest Rates in 2025

Real Estate Interest Rates in 2025

- 30-year fixed: 6.65%

- 20-year fixed: 6.41%

- 15-year fixed: 5.96%

- 5/1 ARM: 6.90%

Today’s Mortgage Rates Rise Slightly: January 22, 2025 Trends

Today’s mortgage rates . According to Zillow, both the 30-year and 15-year fixed interest rates sit at 6.67% and 5.95%, respectively.

______________________________

Key Takeaways 1/21/25

- Current Rates Overview: 30-year fixed at 7.11%, 15-year fixed at 6.41%, 5/1 ARM at 6.87%.

- Recent Trends: Most mortgage rates have experienced a slight increase, reflecting broader economic conditions.

- Refinance Consideration: The 30-year refinance rate is at 7.10%.

- Market Influences: Economic factors such as the Federal Reserve’s decisions, inflation, and geopolitical events are affecting mortgage rates.

Overview of Today’s Mortgage Rates

As of January 21, 2025, mortgage rates have shown a steady increase, indicating a trend that many are closely watching. The current average rates from Bankrate reveal that different types of mortgages have experienced fluctuations. Here’s a detailed breakdown of last week’s rates compared to the current figures:

January 2025

The average 30-year conforming loan rate was 7.15%

Mortgage rates fell last week after a brutal few months of rising rates. The question now is whether rates can keep going lower, or if last week was just a pause in the mortgage rate storm before the spring home-buying season gets into full swing.

After the most recent jobs report, the 10-year yield exceeded my peak level forecast for 2025. Although mortgage rates did not rise above 7.25% like last year, yields surpassed my expectations for this early in the year.

Last week, the CPI data came in slightly below the forecast for Core CPI despite the higher headline month-to-month print. Retail sales figures missed expectations, although the control purchases portion performed well. Jobless claims increased slightly, but housing starts and industrial production data showed positive results. The Philly Fed index had a historic rise that no one took seriously.

So why did yields and mortgage rates fall last week?

First, the 10-year yield and mortgage rates were at elevated levels before the week started. This means we would need economic data to really outperform to push both rates and the 10-year yield much higher from the peak forecast level of 4.70% on the 10-year yield and 7.25% on mortgage rates. So when the CPI inflation report didn’t show much stronger core inflation data, bond yields fell right away.

Also, Fed President Waller talked about more rate cuts, spurring rates to fall. Some Fed members are getting slightly nervous about rates rising so Waller was trying to talk the market down. I discussed that in last week’s HousingWire Daily podcast.

Mortgage rates will remain elevated while the economy runs hot. Rates continued to rise this week after the December jobs report exceeded expectations;

Mortgage rates continued their ascent this week after Friday’s jobs report showed that employers added more positions than expected in December, which is likely to cement a pause on interest rate cuts by the Federal Reserve later this month.

HousingWire’s Mortgage Rates Center showed that the average 30-year conforming loan rate was 7.15% on Tuesday, up 6 basis points (bps) from a week ago. This is also the highest rate since June 2024. The 15-year conforming loan rate averaged 7.34% on Tuesday — up an astonishing 23 bps in the past week.

It’s an ominous start to 2025 after many housing market experts predicted that mortgage rates would drop by a full percentage point or more by the end of the year. According to Michael Merritt, senior vice president of customer care and default mortgage servicing at BOK Financial, many of the estimates for lower rates were based on the Fed’s publicized plan to cut rates at the end of 2024.

__________________________________________________________

Real Estate Interest Rates in 2025

According to FreddieMac Mortgage interest rates are at 6.91%, which is high. We started 2024 at about 6.5% which was also high. While some real estate companies and agents advocate buying now and refinancing later, I believe it is better to wait until rates go down before buying unless you are paying cash.

Refinancing is expensive partly because mortgage interest is front-loaded which means we pay the most interest on the first payments. Refinancing means starting over and paying more interest and less principal. Also, a job loss or change in your finances may make refinancing impossible.

When people don’t buy it slows the economy and rates go down. Do you really want to pay all of that interest to the bank each month?

When will rates go down? I am not making any predictions. I’ll just say that they will go down when they go down. I think 5% or lower is the sweet spot for home buyers.

______________________________________________________

June 1, 2024

The interest rate on a 30-year fixed-rate mortgage is 7.000% as of May 31, which is 0.125 percentage points lower than yesterday. Additionally, the interest rate on a 15-year fixed-rate mortgage is 6.375%, which is unchanged from yesterday.

May 31, 2024

Today’s mortgage interest rates are rising for the first time this week. Here are the latest rates for popular home loans:

- 30-year fixed: 7.59%

- 15-year-fixed: 6.85%

- 30-year fixed jumbo: 7.56%

May 30, 2024

| Loan Term | Rate | Change |

|---|---|---|

| 30-Year Mortgage Rate | 7.61% | +0.17 |

| 15-Year Fixed Rate | 6.88% | +0.15 |

| 30-Year Jumbo Mortgage Rate | 7.56% | +0.13 |

May 26, 2024

Average 30-year mortgage rates have been hovering in the mid-to-upper 6% range for several weeks now, according to Zillow data. Rates dropped below 7% earlier this month in response to the latest Consumer Price Index report, which showed that inflation slowed in April.

As inflation continues to decelerate, mortgage rates should go down. But they may take longer to drop than initially expected. The Mortgage Bankers Association recently predicted that 30-year rates will end the year around 6.5% and that they won’t drop into the 5% range until late 2025.

May 23, 2024

Average 30-year mortgage rates continue to hover in the mid-to-high 6% range, according to Zillow data. Rates have been relatively steady after dropping earlier this month.

May 22, 2024

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances of $766,550 or less decreased to 7.01%, with points decreasing to 0.60 from 0.63, including the origination fee, for loans with a 20% down payment.

May 21, 2024

Today’s national mortgage interest rate trends … For today, Tuesday, May 21, 2024, the current average interest rate for a 30-year fixed mortgage is 7.02%.

May 18, 2024

| Product | Interest Rate | APR |

|---|---|---|

| 30 Year Fixed | 6.756% | 6.837% |

May 16, 2024

Today’s mortgage rates in Boston, MA are 6.875% for a 30-year fixed, 6.260% for a 15-year fixed, and 7.756% for a 5-year adjustable-rate mortgage (ARM).

May 15, 2024

For today, Wednesday, May 15, 2024, the current average 30-year fixed mortgage interest rate is 7.17%, falling 8 basis points since the same time last week.

May 14, 2024

Today’s average 30-year fixed-mortgage rate is 7.21 percent, down 12 basis points from a week ago.

Real Estate Interest Rates in 2024

NAR Chief Economist Lawrence Yun optimistic about real estate industry this year

The chief economist for the National Association of REALTORS® (NAR) expects interest rates to drop and home sales to pick up during the rest of the year and into 2025.

Lawrence Yun shared his outlook this week during NAR’s REALTORS® Legislative Meetings in Washington, D.C. He projected existing home sales to increase to 4.46 million nationwide, a 9% increase from 4.09 million in 2023. He also predicted existing home sales to jump to more than 5 million in 2025 and show gains in eight of the next 10 years.

Yun pointed to April employment data, which showed 6 million more jobs than pre-COVID highs. Those job numbers, he said, are boosting home prices.

“More jobs mean more home sales and higher housing demand,” said Yun. “You need a strong local economy for a strong housing market.”

Yun compared the current market to 1995, noting that the U.S. has 70 million more people and 40 million more payroll jobs than the mid-1990s, but home sales continue to lag at their lowest levels since 1995.

“How is it that home sales can be this low when we’ve got so many people living in this country?” asked Yun. “High mortgage rates and lack of inventory were a shock. Over the next 10 years, probably eight of those 10 years will improve for home sales.”

He reminded Realtors that referrals will be essential as market gridlock loosens.

“The referral business is key,” he said. “Your past clients are super happy in terms of their wealth gains. Seven percent mortgage rates are high compared to a couple of years ago, but you have to buy a home in order to build wealth. Have Americans lost the dream of homeownership? I don’t think so.”

Yun still expects interest rate cuts, even though the Federal Reserve has yet to take that step. The full cuts that were expected for 2024 could be delayed, in part, to 2025, he said.

“The Federal Reserve has delayed rate cuts,” Yun said. “I would have thought that, by now, rates would be lower and rate cuts would have begun. Whatever rate cut the Federal Reserve does not do this year will simply get pushed back to 2025. They’re calling for a September rate cut, but we’ll see.”

**************************************

Real Estate Interest Rates in 2024

Today, the average rate on a 30-year mortgage is 7.73%, compared to last week when it was 7.62%.

The annual percentage rate (APR) on a 30-year, fixed-rate mortgage is 7.75%. The APR was 7.65% last week. APR is the all-in cost of your loan.

With today’s interest rate of 7.73%, a 30-year fixed mortgage of $100,000 costs approximately $715 per month in principal and interest (taxes and fees not included), the Forbes Advisor mortgage calculator shows. Borrowers will pay about $157,486 in total interest over the life of the loan.

_________________

Average 30-year mortgage rates increased to 7.17% this week, according to Freddie Mac. This is the highest rates have been since November 2023.

April Mortgage rates for 30 yr, – 7.24%

Mortgage rates rose for the third straight week last week, hitting the highest level since November. As a result, mortgage application demand dropped 2.7% compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased to 7.24% from 7.13%, with points increasing to 0.66 from 0.65 (including the origination fee) for loans with a 20% down payment.

Applications for a mortgage to purchase a home fell 1% for the week and were 15% lower than the same week one year ago. As home prices rise along with interest rates, potential buyers’ purchasing power are suffering a double whammy.

__________

Inflation needs to cool further before mortgage rates can drop. Average 30-year mortgage rates are hovering around 7% this week, the highest they’ve been in five months, according to Zillow data.

Data showing that the economy is still running hot has driven mortgage rates higher. This includes the latest Consumer Price Index report, which showed that prices rose 3.5% year over year in March. This is a slight uptick from the previous month’s reading, and higher than what many economists expected.

Because inflation has been somewhat sticky so far this year, we’ll likely need to wait longer for the Federal Reserve to start cutting rates.

*********

The 7% mortgage rate is back, MBA says

The 7 percent mortgage rate is back with a vengeance, sending homeowners and prospective buyers scurrying from the market.

The average contract interest rate for a 30-year rate with jumbo loan balances increased 16 basis points to 7.16 percent. The average contract interest rate for a 15-year fixed-rate mortgage jumped from 6.53 percent to 6.61 percent.

The contract rate last week on the average 30-year fixed-rate mortgage with conforming loan balances ($766,550 or less) rose by 19 basis points to 7.06 percent, according to the Mortgage Bankers Association. The rate for the week ending on Feb. 16 was the first to exceed 7 percent this year.

In terms of activity, the rate jump — which MBA chief economist Mike Fratantoni attributed to last week’s inflation report and the fading hopes of interest rate cuts in the near future — dampened the market. Mortgage loan applications dropped 10.6 percent from the previous week on a seasonally adjusted basis.

What is the current federal interest rate on a 30 year mortgage? 7.06%

January 2024 Boston condo for sale mortgage interest rates are 7.50%

November Boston condo for sale mortgage interest rates 7.94%

_______________________________________________________________________

For today, Tuesday, October 24, 2023, the current average interest rate for the benchmark 30-year fixed mortgage is 7.98%, rising 6 basis points over the last week.

Updated: Boston condo for sale website 2023

_______________________________________________________________________________________________

Boston condo mortgage rates continue to rise, in the month of October close to 8% at (7.8%).

_______________________________________________________________________________________________

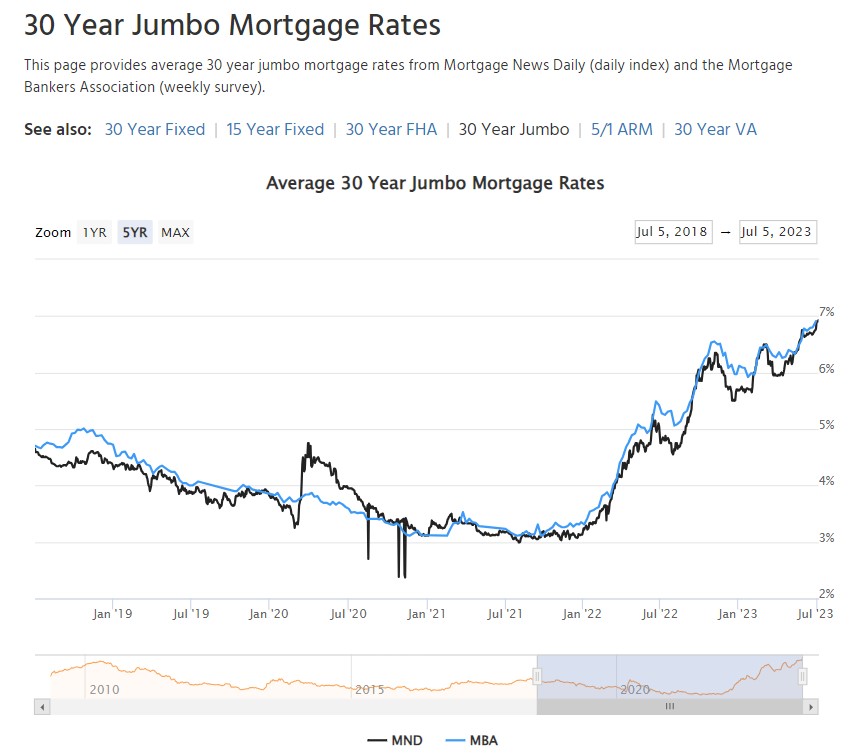

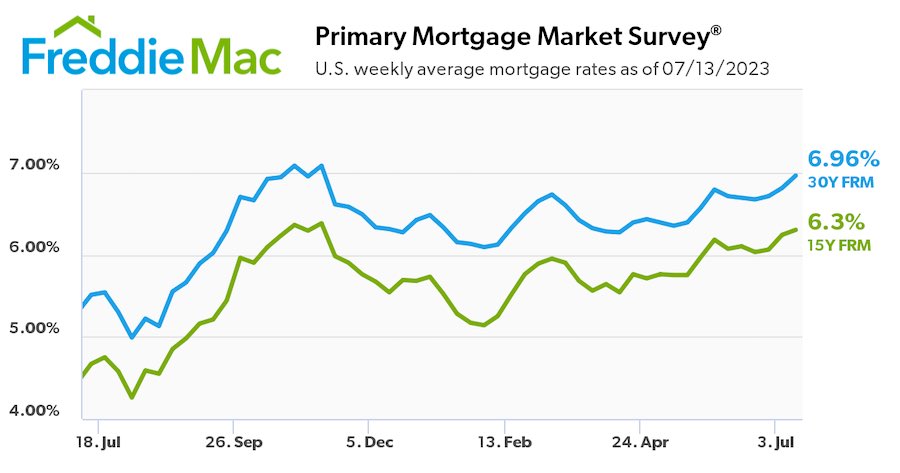

Mortgage interest rates went down and up again. Boston condo mortgage rates are fluctuating. The rates don’t seem to be slowing home sales down. probably because there are more Boston condo buyers than there are properties on the market. Home prices remain high and are still rising. Mortgage Rates at 6.96 percent.

Boston condo mortgage rates

______________________________________________________________________________________________________________________________________________________________

For a 30-year, fixed-rate mortgage, the average rate you’ll pay is 7.14%,

____________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________________________________________

Fed pauses interest rate hikes

The Federal Reserve on Wednesday halted its streak of 10 consecutive rate hikes since March 2022.

The pause is welcome news in the housing industry, which has seen mortgage rates roughly double since the start of last year, but the relief is unlikely to last.

After the unanimous vote to leave rates as is, Fed Chair Jerome Powell said more increases are likely later in the year to help bring down inflation.

“Tuesday’s CPI report suggests that inflation pressures persist, and the Fed will consider another hike next month,” CoreLogic Chief Economist Selma Hepp said. “The likelihood of another hike or two has also increased, given the lack of credit crunch the Fed was expecting from the banking sector. As a result, mortgage rates, while still on a gradual decline, are likely to remain higher through the remainder of the year.”

June Boston condo mortgage rates – 2023

| Product | Interest Rate | APR |

|---|---|---|

| 30-Year Fixed Rate | 7.08% | 7.10% |

| 20-Year Fixed Rate | 6.83% | 6.85% |

| 15-Year Fixed Rate | 6.40% | 6.43% |

| 10-Year Fixed Rate | 6.64% | 6.67% |

Spring Market

The popular 30-year fixed mortgage crossed over 7% this week as of May 24, 2023. Mortgage rates will continue torise until debt crisis is resolved. Stay tuned!

Updated: Boston Real Estate Blog May 2023

____________________________________________________________________________________________________________________________________________

Today’s Mortgage rate 6.93% – May 2023

_______________________________________________________________________________________________________________________________________________

The average 30-year fixed-rate mortgage rate stands at 6.6%, a sharp increase from a year ago, when it registered at 4.6%, a Bankrate analysis found.

_____________________________________________________________________________________________________________________________________

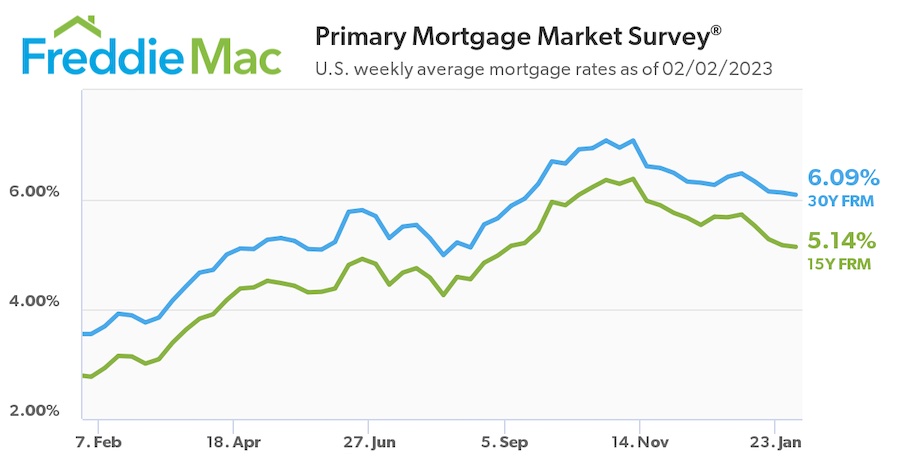

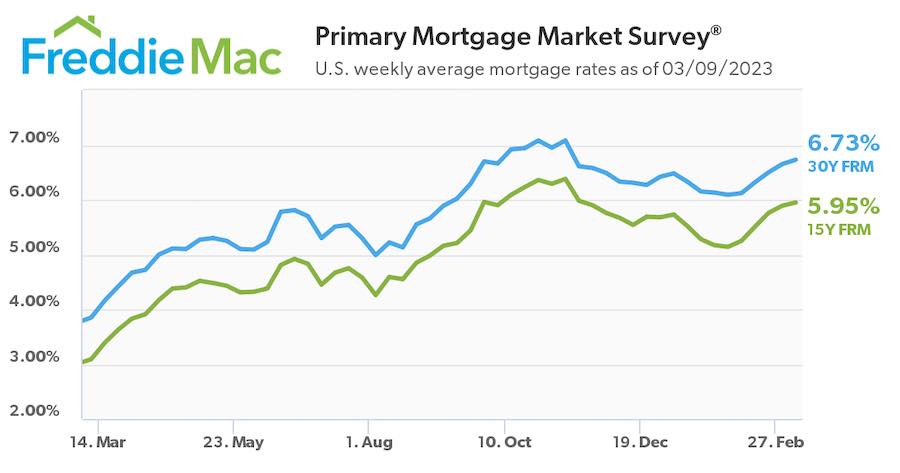

Higher rates are challenging for both homebuyers, who have to cope with steeper monthly payments, and sellers, who experience less demand and/or lower offers for their homes. After topping 7 percent last fall, mortgage rates dipped back down slightly, with the rate on a 30-year mortgage averaging 6.3 percent in early February. But that rate is inching back up, and stood at 6.66 percent as of March 22.

Real Estate Interest Rates in 2023

6.50%

With the spring housing market just around the corner, homebuyers are getting more for their money as their mortgage payments are stretching further than they have in recent months, according to a new report from Zillow.

Last October, a $3,000 mortgage afforded a buyer a $560,000 home, down from an $865,000 home in January 2022. That double-digit jump in mortgage prices made a huge impact on what homes were actually within reach for buyers. Zillow found that today, a $3,000 mortgage payment buys you a home that’s 140 square feet smaller than one you could have purchased last year.

Now, as mortgage rates are falling from their 7% peak, buyers are finding they can get more home for their money. According to Zillow, “the typical home value associated with a $3,000 mortgage payment is up about $60,000 since October, and home size has recovered by 84 square feet.”

In January, a Boston home with a median $3,000 monthly mortgage payment had a median square footage of 1,754, a 486 square-foot change year over year. Since October, with the change in mortgage rates, that square footage increased by 163.

“Mortgage rates have a huge impact on the types of homes buyers are able to afford,” said Anushna Prakash, economic data analyst at Zillow. “Rates that doubled over the past year carved an extra bedroom or office space off of homes at the national level, though the sting has lessened in recent weeks. Buyers in more affordable hot markets are still getting solid bang for their buck, despite losing a lot of purchasing power.”

Zillow noted that the annual decline is more noticeable in some markets like Hartford which had the largest drop losing 1,200 square feet last year, while both Indianapolis and Cleveland lost more than 1,000 square feet. As expected, homes in less-expensive markets had more of a drop as higher costs had more buyers competing for those properties. However, Zillow also noted in the more expensive markets, a monthly $3,000 mortgage payment always bought you less space.

________________________________________________________________________________________________

I am not in favor of putting any kind of a spin on Boston condo interest rates. Sure they went down a little and we saw an uptick in mortgage applications but the rates make Boston condos for sale less affordable.

People who bought Boston homes when the rates were at rock bottom are not going to be selling anytime soon.

It is especially important right now to buy the right condominium and not the overpriced condo.

___________________________________________________________________________________________________

December Mortgage Rates

Last Check 6.51%

October mortgage rates

Last check 6.81%

On last check rates were at 7.22%

November mortgage rates

On last check it was 7.20%. Please remember rates change daily.

If the assessments from key experts prove out, September rates will probably remain in the same territory they are now, swinging up and down slightly.

“The economy will slow faster than inflation, so more yo-yo action should be expected in September,” Bankrate chief financial analyst Greg McBride says. “The average 30-year fixed will be between 5.6 percent and 6.0 percent, with the average 15-year fixed rate in the 4.75 percent to 5.0 percent neighborhood.”

_____________________________________________________________________________________________

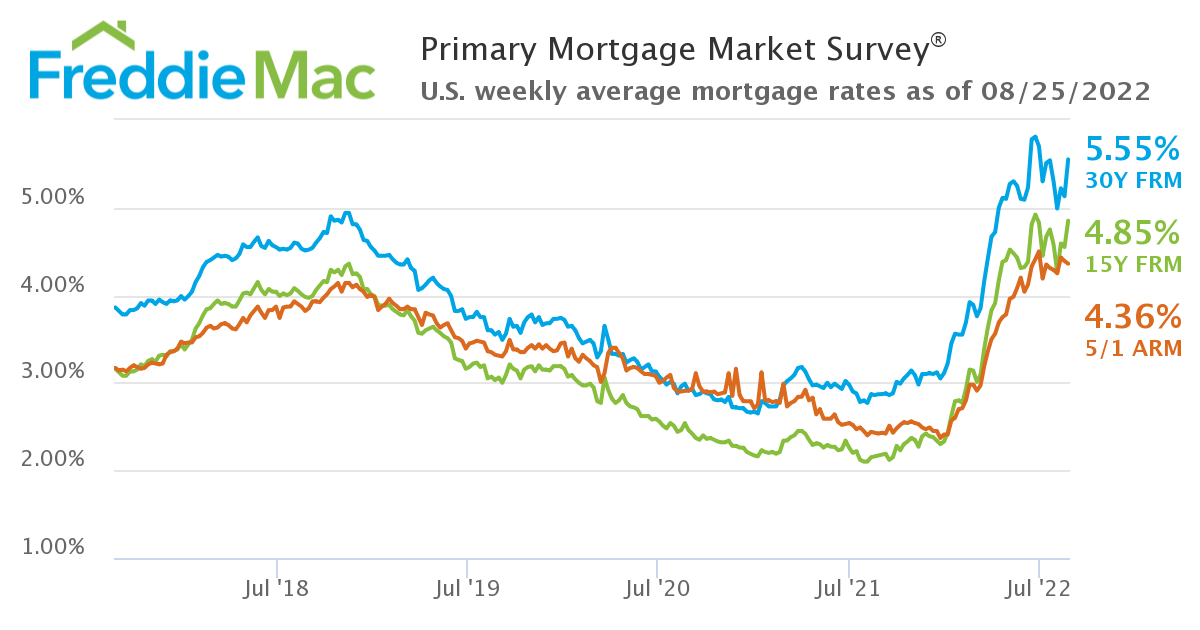

Here’s my take on the current Boston condo mortgage interest rates.

The bottom line is it’s not good news for both Boston condo buyers and sellers.

I see so signals from the Fed that interest rates will go down anytime soon. But please keep in mind, by historic standards the current interest rates are low. Federal Reserve chair Jerome Powell told us on Friday that the Federal Reserve will fight inflation and there will be some pain. Mortgage rates went up last week but are slightly lower than they were in June. Boston condo for sale prices are still rising the rates may slow that down a bit.

It won’t be the wealthy who feel that pain it will be the poor. Powell didn’t say that but we all know that it is true.

As for the rates in the chart they are averages and they are the rates that borrowers with good credit ratings get.

___________________________________________________________________________________________________________________________

Real Estate Interest Rates in 2023

In the last few weeks, the average 30-year fixed mortgage rate from Freddie Mac inched up to 5%. While that news may have you questioning the timing of your Boston condo search, the truth is, timing has never been more important. Even though you may be tempted to put your plans on buying a Boston condo on hold in hopes that rates will fall, waiting will only cost you more. Mortgage rates are forecast to continue rising in the year ahead.

If you’re thinking of buying a home, here are a few things to keep in mind so you can succeed even as mortgage rates rise.

How Rising Mortgage Rates Impact You buying a Boston condo

Mortgage rates play a significant role in your home search. As rates go up, they impact how much you’ll pay in your monthly mortgage payment, which directly affects how much you can comfortably afford. Here’s an example of how even a quarter-point increase can have a big impact on your monthly payment (see chart below):

With mortgage rates on the rise, you’ve likely seen your Boston condo purchasing power impacted already. Instead of delaying your plans, today’s rates should motivate you to purchase now before rates increase more. Use that motivation to energize your search and plan your next steps accordingly.

The best way to prepare is to work with a trusted real estate advisor now. An agent can connect you with a trusted lender, help you adjust your search based on your budget, and make sure you’re ready to act quickly when it’s time to make an offer.

Boston Condos for Sale and the Bottom Line

Serious Boston condo buyers should approach rising rates as a motivating factor to buy sooner, not a reason to wait. Waiting will cost you more in the long run. Let’s connect today so you can better understand your budget and be prepared to buy your home even before rates climb higher.

___________________________________________________________________________________________________________________________

Real Estate Interest Rates in 2024

How will the rise in interest rates impact the Boston condo for sale market?

Ford Realty Inc

Real Estate Interest Rates in 2023. We will see an increase in mortgage interest rates in 2023?

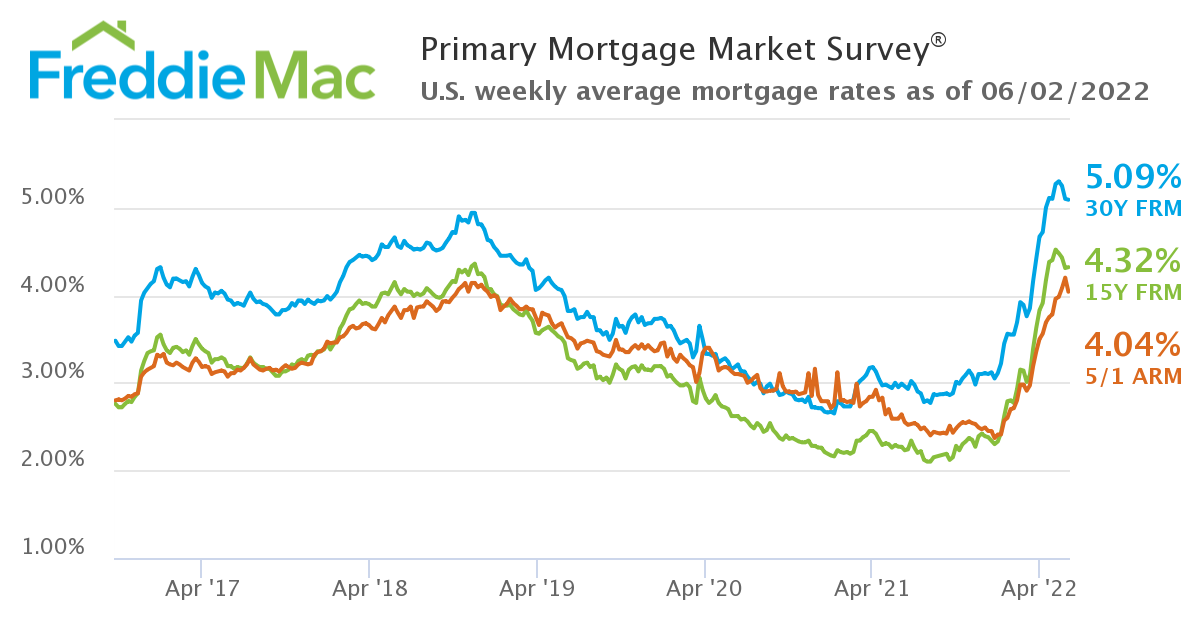

Last week, the average 30-year fixed mortgage rate from Freddie Mac jumped from 3.22% to 3.45%. That’s the highest point it’s been in almost two years. If you’re thinking about buying a Boston condo for sale, this news may have come as a bit of a shock. But the truth is, it wasn’t entirely unexpected. Experts have been calling for rates to rise in their 2022 projections, and the forecast is now becoming a reality. Here’s a look at the projections from Freddie Mac for this year:

- Q1 2022: 3.4%

- Q2 2022: 3.5%

- Q3 2022: 3.6%

- Q4 2022: 3.7%

As the numbers show, this jump in rates is in line with the expectations from Freddie Mac. And what they also indicate is that mortgage rates are projected to continue climbing throughout the year. But should you be worried about rising mortgage rates? What does that really mean for you?

Boston Condos for Sale and Monthly Payments

As rates increase even modestly, they impact your monthly Boston condo mortgage payment and overall affordability. If you’re looking to buy a home, rising mortgage rates should be an incentive to act sooner rather than later.

Good News for Boston Condo Buyers

The good news for Boston high-rise condo buyers is, even though rates are climbing, they’re still worth taking advantage of. Historical data shows that today’s rate, even at 3.45%, is still well below the average for each of the last five decades (see chart below):

That means you still have a great opportunity to buy a Boston Fenway condo now with a rate that’s better than what your loved ones may have paid in decades past. If you buy a Boston Back Bay condominium while rates are in the mid-3s, your monthly mortgage payment will be locked in at that rate for the life of your loan. As you can see from the chart above, a lot can change in that time frame. Buying now is a great way to protect yourself from rising costs and future rate increases while also securing your payment amount for the long term.

Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), says:

“Mortgage rates surged in the second week of the new year. The 30-year fixed mortgage rate rose to 3.45% from 3.22% the previous week. If inflation continues to grow at the current pace, rates will move up even faster in the following months.”

Boston condos for Sale and the Botom Line

Mortgage rates are increasing, and they’re forecast to be even higher by the end of 2022. If you’re planning to buy this year, acting soon may be your most affordable option. Let’s connect to start the homebuying process today.

Updated: Boston Real Estate Blog 2024

Boston Condos for Sale and Apartment Rentals

Real Estate Interest Rates in 2024

- The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.20% from 3.16%.

- Refinance demand fell 5% for the week and was 31% lower than the same week one year ago.

- Mortgage applications to purchase a home, which are less sensitive to weekly rate moves, rose 2% for the week but were 6% lower than the same week one year ago.

Rising mortgage interest rates continue to take their toll on demand, especially in the refinance market. Total mortgage application volume fell 2.8% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.20% from 3.16%, with points rising to 0.43 from 0.34 (including the origination fee) for loans with a 20% down payment.

As a result, refinance demand fell 5% for the week and was 31% lower than the same week one year ago. Refinance applications have dropped in seven of the past eight weeks. The refinance share of mortgage activity decreased to 62.9% of total applications from 63.5% the previous week.

“Activity has been particularly sensitive to rate movements, and last week’s decline was driven by a drop in conventional and FHA refinance applications, which offset an increase in VA refinance applications.” said Joel Kan, MBA’s associate vice president of economic and industry forecasting.

Mortgage applications to purchase a home, which are less sensitive to weekly rate moves, rose 2% for the week but were 6% lower than the same week one year ago. Buyers appear to be coming back to the market after a brief lull. Builders reported strong buyer traffic in a sentiment report out this week from the National Association of Home Builders.

“Purchase applications increased for both conventional and government loan segments, as housing demand continues to show resiliency at a time – late fall – when home buying activity typically slows. The second straight increase in purchase applications suggests that stronger sales activity may continue in the weeks to come,” said Kan.

Mortgage rates continued to move higher to start this week and are now at the highest level in more than three weeks. Rates were influenced Tuesday by a report on October’s retail sales, which rose by 1.7%, making it the strongest month in several years.

“In general, strong economic data puts upward pressure on rates. Economists were only expecting a 1.4% increase after last month’s 0.8% improvement,” said Matthew Graham, chief operating officer at Mortgage News Daily.

Boston Condos for Sale and Apartment Rentals

_________________________________________________________________________________________________________________________________

Real Estate Interest Rates in 2021

Boston Condos for sale Sale

____________________________________________________________________________________________________________________________

Boston Condos for sale Sale

Real Estate Interest Rates in 2024

Refinance applications fall to lowest level in three months as rates shoot up

Boston Condos for sale Sale

_____________________________________________________________________________________________________________________________

Boston Real Estate for Sale

Real Estate Interest Rates in 2021

I know I sound like an old person when I mention that when I bought my first house 9% was considered a good rate. Boston condos for sale were less expensive back then in the late 1980s and real wages were probably about the same.

Borrowers with the highest credit scores get the lowest interest rates.

A decade ago rates were about 2.5% higher than they are today and were considered very low.

Boston Condos for Sale

___________________________________________________________________________________________________________________________________________________________________________________________________

- Total mortgage application volume fell 0.9% last week from the previous week, according to the Mortgage Bankers Association.

- Mortgage rates were essentially flat during the week.

- Mortgage applications to purchase a home fell 3% for the week.

It was a mixed bag for mortgage demand last week, as higher rates did nothing for refinances and homebuyers faced more steep competition for a pitiful few homes for sale.

Total mortgage application volume fell 0.9% last week from the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index.

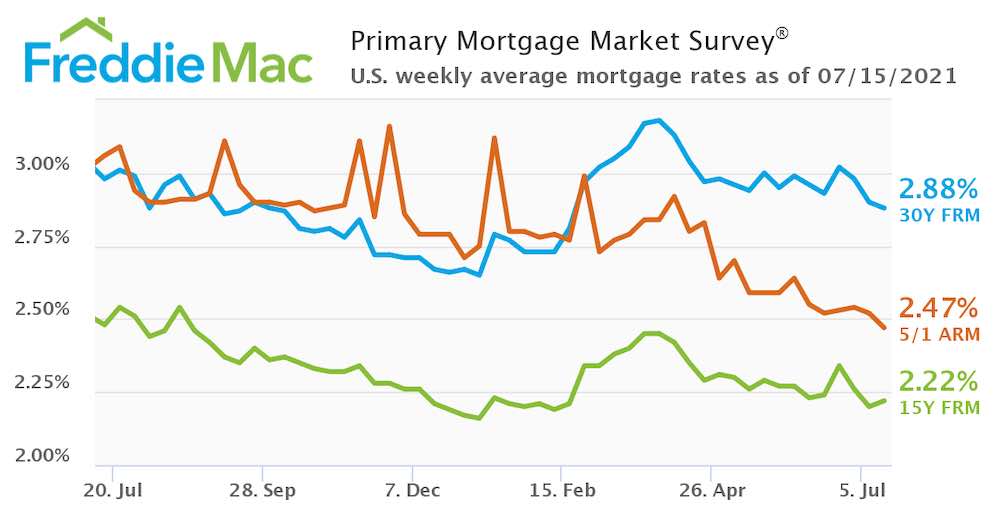

Boston Real Estate Interest Rates 3.18%

With no particular incentive to make a move, demand for mortgage refinances was essentially flat, rising 0.1% from the previous week. Application volume was 17% lower than the same week one year ago, even though rates were higher a year ago. That may be because so many borrowers have already refinanced at the record low rates seen last fall. The refinance share of mortgage activity increased to 61% of total applications from 60.6% the previous week

Boston Real Estate Mortgage Applications

Mortgage applications to purchase a home, which are less sensitive to weekly rate moves, fell 3% for the week. They were 24% higher than the same week one year ago, but that annual comparison is skewed. The housing market stalled in April and May of last year, when the pandemic started, and then rebounded dramatically in the summer.

“Both conventional and government purchase applications declined, but average loan sizes increased for each loan type,” noted Joel Kan, an MBA economist. “This is a sign that the competitive purchase market, driven by low housing inventory and high demand, is pushing prices higher and weighing down on activity.”

Higher prices and differing supply are also affecting the mix of activity, with much more growth in purchase loans with larger-than-average balances. Home sales on the high end of the market are soaring because there is far more available for sale. The housing shortage is most acute on the low end, where demand is strongest.

So far this week, mortgage rates have not moved much, but that is likely to change with new economic data coming out. Employment reports on Thursday and Friday could move interest rates in either direction.

Federal Reserve chair Jerome Powell takes questions from reporters after the U.S. central bank announced the decision to leave interest rates unchanged as the coronavirus economic recovery is underway.

Boston Real Estate News: FED not raising interest rates

The Federal Reserve restated its intent to keeping a lid on interest rates, saying the pandemic “continues to weigh on the economy, and risks to the economic outlook remain.”

Rates on 10-year Treasurys, a benchmark for mortgages, dropped after the Fed’s announcement, as investor demand for bonds sagged in reaction to the Fed’s dovish announcement.

The Federal Reserve Open Market Committee issued a statement today saying it intends to keep short-term rates, which the Fed has direct control over, near 0 percent until unemployment falls and inflation “is on track to moderately exceed 2 percent for some time.”

Although the Fed doesn’t have direct control over long-term rates, it can influence them by buying government bonds and mortgage-backed securities. The Fed said it will continue buying at least $80 billion in Treasury securities and $40 billion in mortgage-backed securities every month “until substantial further progress has been made” toward hitting its employment and inflation goals.

Boston Real Estate

Back to Boston condos for sale homepage