Real Estate: Housing Predictions

Boston Condos for Sale and Apartments for Rent

Real Estate: Housing Predictions

Zillow 2025 Forecast

Rates are in the spotlight again as 2025 approaches. That short-lived dip to two-year lows prompted renewed optimism for home buyers and bumped sales volume, then the rebound in October brought a reminder of unpredictability. Rates are likely to remain volatile throughout next year, say Zillow economists.

Read on for more about rates and four more predictions for 2025.

Housing market activity will pick up, home value growth will cool

“Buying a home in 2024 was surprisingly competitive given how high the affordability hurdle became,” says Zillow Chief Economist Skylar Olsen. “More inventory should shake loose in 2025, giving buyers a bit more room to breathe.”

Expect to see more sales and only a modest 2.6% increase in home value growth in 2025, as the market slowly becomes unstuck. This is mainly because we expect more sellers to list next year. A steadier market could make for simpler pricing conversations with those seller clients.

Some markets are expected to outperform this forecast, such as Hartford, Connecticut (4.2% home value growth), Providence, Rhode Island (3.9% growth), and Miami (3.8% growth).

But markets like New Orleans (-3.8%) and San Francisco (-2.3%) are expected to see declines, while Austin is predicted to have minimal growth (0.4%).

Mortgage rates will remain volatile

Borrowing costs should ease in 2025, but as we saw in 2024, mortgage rates rarely do what’s expected of them. What’s more certain is that buyers should expect plenty of ups and downs throughout the year. Also expect sprints of refinancing — which can present conversation opportunities of their own — during the rate dips.

Buyer’s markets will spread to the Southwest

As of November 2024, a total of 25 major metro areas, mostly in the South and Southeast, were considered buyers markets, according to Zillow’s Market Heat Index. Zillow predicts buyers markets will spread to the Southwest in 2025 as inventory continues to come unstuck in relatively affordable markets.

These buyers markets should see the greatest number of movers, while sellers will feel the heat of competition. But if mortgage rates fall more than expected, it dims the prospect that buyers markets will spread west. A significant mortgage rate dip would bring more buyers back to the market, again tilting negotiating power in favor of sellers.

More Americans will embrace small-home living

The pandemic-era need for more space is coming to an end. In 2025, buyers will increasingly embrace smaller homes as a more sustainable and affordable way to live.

The word “cozy” is appearing in more listings — 35% more in 2024 compared to 2023 — reflecting design trends that have shifted away from spacious open floor plans, toward more contained spaces that save both builders and buyers money.

Get more predictions, data, and economic news at zillow.com/research.

https://www.zillow.com/agent-resources/blog/market-report-predictions-2025/

Real Estate: Housing Predictions

Updated: Boston Real Estate Blog Fall 2023

__________________________________________________________________________________________________________________________________________________

Doug Bauer, Tri Pointe Homes CEO, joins ‘Squawk on the Street’ to discuss how investors should view today’s housing market, whether headwinds for homebuilders are beginning to weaken and how high mortgage rates need to be for housing demand to fall.

Overall, the housing market looks good for the long-term.

Boston Condos for Sale & Boston Apartments for Rent

Real Estate: Housing Predictions

Key Points

- Supply constraints and labor shortages could hinder the supply of homes in 2022.

- However, inflation, rising interest rates, and expensive Boston condo for sale prices may cool demand.

Boston’s condominium supply and demand are one of the greatest drivers of real estate values in a given market. A balanced market means a healthy supply of both Boston condo buyers and Boston condo sellers achieving slow but steady home price growth over time. But when that balance gets out of whack, it can drive prices down or sky-high, like we’re seeing today.

Nationally 2021 was an extremely tough year for housing supply, as buyers far outpaced sellers in most markets. As we look toward the coming year, many are wondering where housing supply and demand will go in 2022. Here’s what to expect.

IMAGE SOURCE: GETTY IMAGES.

Boston Condo Demand May Slow Some

Low-interest rates have been a big driving force in creating new demand for Boston condos for sale in 2021. The Federal Reserve has stated it plans to increase rates marginally in 2022, but the move won’t happen until mid-to-late 2022. An increase in interest rates and today’s already record-high housing market means fewer people will be able to afford these home prices, and demand will likely cool a bit. But slowing demand doesn’t necessarily mean things will be back to normal in 2022.

Boston Condos Supply Constraints Will Likely Continue

According to Realtor.com’s latest housing trends report, active listings are down 21.9% year over year, meaning there were 179,000 fewer homes for sale in October 2021 compared to the year prior. And it seems supply issues will likely continue.

Supply chain issues will present new challenges for the housing market in 2022 and definitely won’t help alleviate the current shortage of homes. According to the National Association of Home Builders (NAHB), October 2021 already saw a 0.7% decline in housing starts or the equivalent of 152,000 homes authorized to be constructed but unable to be built due to supply chain issues.

Contractors and construction teams are also facing major labor shortages. More than 55% of home builders surveyed by NAHB reported a shortage of labor in 2021, while 90% of remodelers reported a shortage of subcontractors.

Input costs for home builders will also be put to the test in 2022 as the country faces record-high inflation rates, which push costs for materials and labor up. The U.S. Commerce Department has announced its plan to nearly double the tariff of Canadian lumber imported to the U.S. from 9% to 17.9%, which will have a major impact on lumber prices. Lumber prices have flattened back to pre-pandemic levels, but from late 2020 to 2021, prices went to record highs due to pandemic-related shortages and high demand. Continued higher lumber costs will likely result in more home start delays in 2022, further constricting supply.

All in, it seems housing supply and demand will remain pretty unbalanced until enough homes can be produced to meet the growing demand, which. according to various sources, will be millions of homes. According to compiled data from the NAHB, September 2021 saw 2.4 months’ supply of homes, which means a pretty aggressive seller’s market.

Boston Condos for Sale and the Bottom Line

Seeing levels return to pre-pandemic supply is unlikely in 2022, given the challenges within the supply chain, but hopefully, less demand for downtown Boston condos for sale will level off Boston condo for sale asking prices

Boston Condos for Sale & Boston Apartments for Rent

____________________________________________________________________________________________________________________________________

Boston Condos for Sale 2021

Loading...

Real Estate: Housing predictions

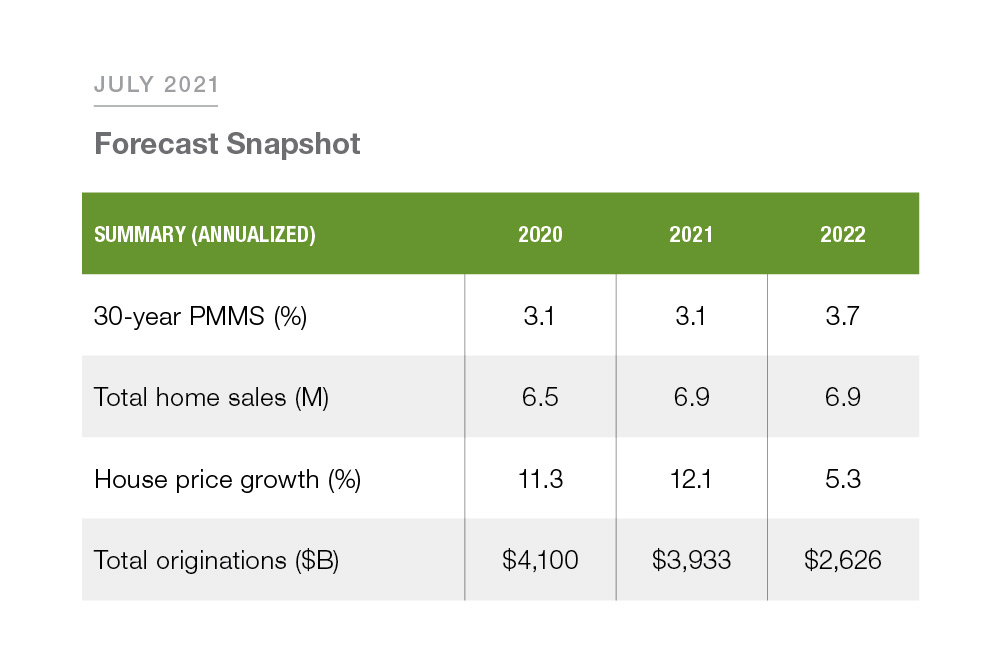

Real Estate: Housing predictions from Freddie Mac into 2022

High house price growth has been supported by increased demand due to low mortgage rates, disposable after-tax income that has risen during the current recession, and a major shortage of housing supply relative to our population. The increase in house price growth will be less transitory than the increase in consumer prices, as the U.S. housing market will continue to struggle with a shortage of available housing for many months to come. But, we do forecast house price growth to moderate in 2022, with full-year house price growth of 12.1% in 2021 followed by 5.3% in 2022.

The rapid run-up in house prices may be starting to exhaust potential homebuyers.

We’ve seen indications of softening demand in recent home purchase mortgage applications data. And, while sales metrics remain above pre-pandemic levels, the pace of sales has cooled since the first quarter of this year with home sales slowing for the past four consecutive months. That’s reflected in our home sales forecast, which has total home sales declining to 6.9 million in 2021 and 2022 after reaching a seasonally adjusted annual rate of 7.6 million and 7.2 million in the fourth quarter of 2020 and first quarter of 2021, respectively.

Boston Condos for Sale 2021

Loading...

![]()