On average how much do Boston condo fees increase each year?

Boston Condos for Sale and Apartments for Rent

On average how much do Boston condo fees increase each year?

Boston Condo Fees: How Much Have Boston Condo Fees Increased?

As you slide your key into the lock of your glossy new Boston condo, you may be greeted by not only the rich aroma of your freshly painted walls but also a growing fear about how much the condo fees, also known as Homeowner Association (HOA) fees might dent your wallet. Amid the city twilight and charming aesthetic that resonates with every brick, are these rising costs casting a long shadow over your sweet dwelling dream? Dive in as we take an in-depth look at the sharp increase in Boston condo fees. Buckle up, condo owners and potential buyers, it’s time to navigate these choppy financial waters!

According to our research, Boston condo fees (HOA fees) have risen by an average of 3.2% per year in recent years. However, this can vary depending on the location and quality of the building. It is always important to carefully review condo fee details before purchasing a condominium or investing in real estate.

Boston Condo Fees: An Overview of the Increase

If you’re on the lookout for a condo in Boston, you may have noticed an increase in condo (HOA) fees. Several Boston neighborhoods have seen a steady rise in condo fees over the past few years. According to industry experts, this trend is expected to continue into the foreseeable future.

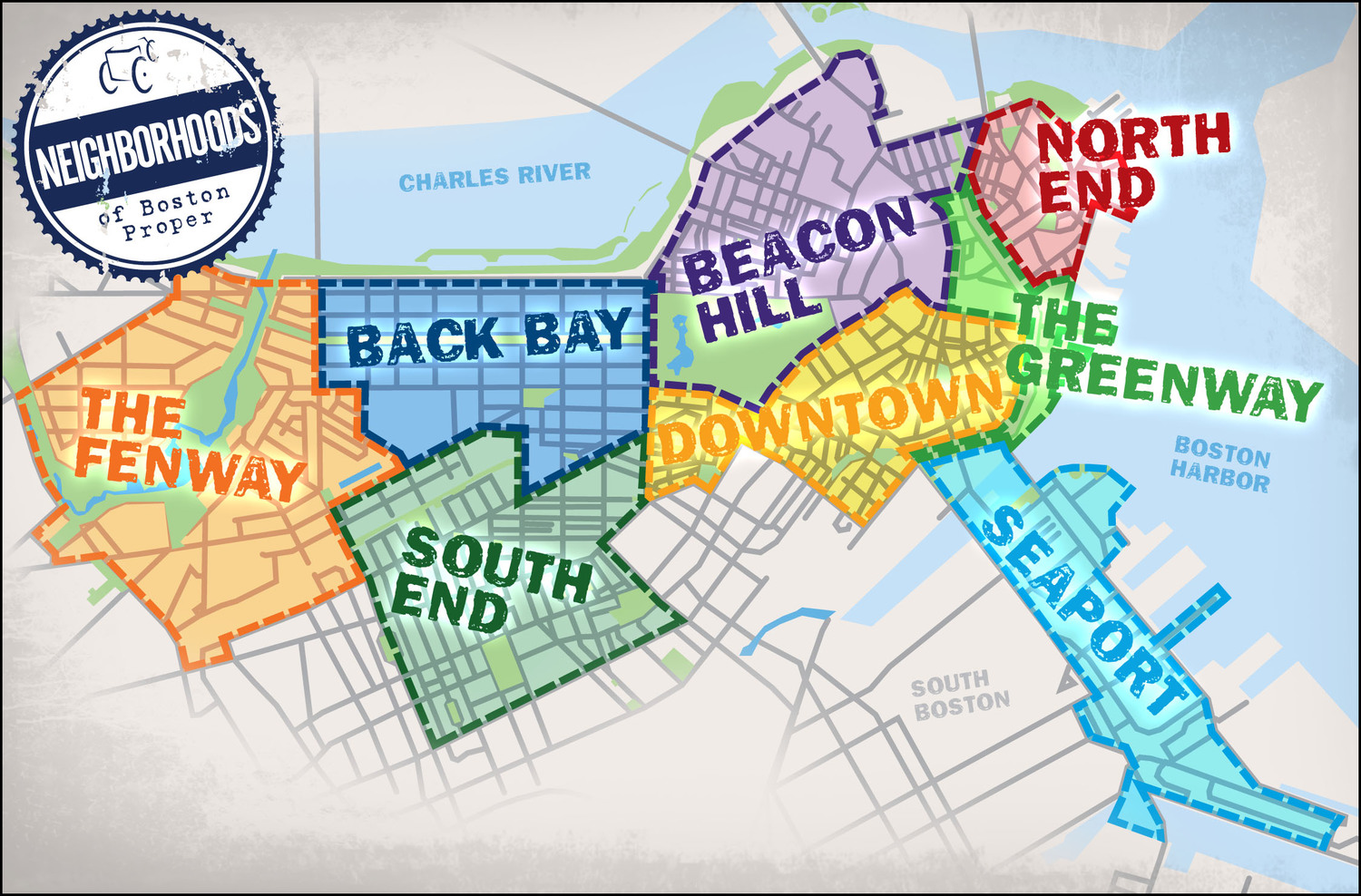

Boston neighborhood condo fee analysis

For instance, Beacon Hill residents saw their condominium fees increase by 6% from 2018 to 2019 alone. In comparison, South End and Back Bay residents saw an increase of roughly 2-3%. However, even that percentage of increase can add up significantly over time.

One major factor contributing to this trend is the increasing cost of living in Boston. Boston has consistently ranked among the most expensive cities in the United States because of its high rent cost, strict building codes, high taxes and overall expenses. As it becomes more expensive to live in Boston, the costs associated with maintaining condos also go up.

Some argue that this spike in condo fees is due to greed on the part of property management companies and condo boards. However, while it’s true that some Boston condo boards and management companies may prioritize profits over residents’ needs, it’s important to recognize that rising costs within Boston are generally outside of their control. Factors such as health care costs for employees and stricter building codes all drive up maintenance prices.

It’s similar to how gas prices fluctuate based on supply and demand. You can’t blame gas station owners entirely for increased prices — they simply have to keep up with market trends. In much the same way, property management companies must keep up with maintenance costs that are dictated by various market forces specific to Boston’s unique demands.

So now that we understand why HOA fees are on the rise let’s take a closer look at how this affects different types of housing units in the city.

- According to a 2019 study by Trulia, Boston was listed among the cities with the highest condo fees in the country, with an average monthly fee of $347.

- A research study by Massachusetts Association of Realtors found that from 2018 to 2022, condo fees in Boston rose on average approximately 3.5% per year.

- In a 2021 survey conducted by Zillow, it was reported that condos in Boston’s most high-end neighborhoods had seen their condo fees increase by as much as 7% compared to the previous year.

- Prospective condo buyers in Boston should be aware of the increasing trend of condominium fees, which are expected to continue rising due to the high cost of living and maintenance expenses in the city. While some blame property management companies and condo boards for being greedy, these fees are generally beyond their control, as they must keep up with market forces specific to Boston’s demands. Homebuyers should carefully consider and budget for these fees as they may add up significantly over time.

Boston High-rise Luxury Units vs. Standard

While all condominiums in Boston are subject to condo (HOA) fees, luxury units typically command higher fees than standard ones. This is because luxury buildings come with additional amenities that require a lot of maintenance, such as swimming pools and fitness centers. If you’re considering purchasing or renting a luxury condo, it’s important to keep in mind that your HOA fee will likely be higher than those in standard condos.

For instance, in neighborhoods such as the Seaport, buyers can expect to pay an extra $0.50-$1 per square foot for luxury one-bedroom units compared to those in standard condos. While this might not sound like a lot at first glance, the difference adds up over time.

Of course, some might argue that these high fees aren’t justified. After all, when you’re paying more for your unit already, why should you have to pay even more? However, it’s vital to understand that the expenses associated with upscale condos are significantly higher than those of less luxurious buildings.

Take for example, the 22 Liberty building situated on Fan Pier Boulevard. The complex has several amenities, including a doorman service and valet parking both of which require additional personnel costs and regulatory compliance costs which drive up property operating costs and raises HOA FEES by a significant margin.

Now that we’ve examined the factors driving increased condo fees in Boston and how they affect different types of housing units let’s explore which neighborhoods are most affected by these changes.

Boston high rise luxury condos

Neighborhoods with Highest Increases

Boston’s condo market has seen an increase in condo fees across different neighborhoods. The trend is not only influenced by the property type but also location. In general, urban areas and upscale neighborhoods usually have higher condo fees since they provide residents with luxurious amenities and facilities. Let’s take a closer look at some of the neighborhoods in Boston with the highest increases.

Back Bay, located in downtown Boston, has witnessed an average increase of 8.6% per year for condo fees. Despite this, it still remains as one of Boston’s most expensive and fashionable apartment locations, offering an amazing lifestyle to residents.

Fenway Kenmore, home of Fenway Park Stadium, has seen condo fee increases of around 7.5% per year. This neighborhood’s location makes it a popular spot for college students which can contribute to increased maintenance and management costs.

South End has become an attraction for young professionals due to its contemporary bars and restaurants, art galleries, and townhomes. It has seen an annual average increase in condo fees of about 9%. However, the community still values its cultural significance within the city.

East Boston condo investors should expect to pay larger than normal HOA fees every month as they’ve seen periodic rates rise to around 7%. Nonetheless, buying into East Boston’s seemingly affordable real estate market is worth it considering developers are putting up top-of-the-line residential buildings making it a desired place for many home buyers.

For instance, if you’re currently living in Back Bay and purchased a luxury condominium unit worth $1 million five years ago when monthly HOA fees were above $500, you’d be paying around $750 by now after averaging out at 8% annually over five years.

With these examples in mind, let’s dive deeper into the factors contributing to these changes.

Factors Contributing to Boston Condo Fee Changes

The condo market in Boston has seen an increase in condo (HOA) fees due to different factors that come into play. These are typically affected by economic conditions, the cost of management and maintenance, age of the building or development, and location.

Economics can play an unpredictable role. If there’s a high demand for condos with owner-friendly policies then condo fees may hike. On the other hand, if owners are taking advantage of the current buyer’s market and leaving properties vacant for extended periods or offering unattractive leasing periods it may cause HOA fees to rise too cover for shared maintenance cost.

Another factor with long term effects is the age of the property. Just like cars, older properties require more maintenance as costly fixes arise leading to increased HOA fees. Picture owning a car for 10 years; you constantly need to do more service and repair work compared to when it was new and shiny off the lot.

Lastly, location plays a heavy psychological effect towards what people perceive as reasonable cost with amenities provided. The residents’ expectations should be met with corresponding facilities such as swimming pools and fitness centers which may raise HOA fees.

For instance, one could argue that having a high-end pool in a condominium complex isn’t necessarily important for those who do not enjoy swimming. However, someone else might say that providing a pool can make the unit more luxurious hence increasing its resale value.

Effect of Market Conditions

The real estate market in Boston has a direct impact on condo (HOA) fees for condominiums. When the market is strong, condo prices rise and developers build more luxury units with higher-end finishes. The cost of maintaining these units increases as well, therefore leading to increased HOA fees.

For example, during the recent housing boom in Boston, the cost of materials skyrocketed and construction companies were charging a premium just to be able to keep up with demand. As a result, developers had to charge more per square foot to cover their costs, which in turn drove up the price of condos and condo (HOA )fees.

On the other hand, during times of economic uncertainty or recession, there may be fewer homebuyers and less demand for new development projects. In this scenario, buildings may struggle to fill vacancies and management may have to increase HOA fees to compensate for lost revenue.

Another factor influencing market conditions is interest rates. When interest rates are low, it becomes more affordable for people to take out mortgages and purchase condos. This increases demand and causes the overall price of units and associated fees to rise.

To support this claim, it’s important to note that in early 2020 when interest rates were at historic lows before the COVID-19 pandemic struck, Boston saw an increasing number of homebuyers entering the market. Condo prices went up alongside demand putting upward pressure on HOA fees.

However, some experts argue that while market conditions do play a role in dictating fee changes for condos in Boston, there are other factors that contribute even more significantly.

They contend that location is key – areas like Back Bay or Beacon Hill will always command higher prices than those less desirable neighborhoods due to its sheer popularity among homebuyers. Additionally, upscale condos with extensive amenities (e.g., fitness centers, roof terraces, concierge services) will come with higher HOA fees than their cheaper counterparts.

Thus, while market conditions can change quickly and dramatically like we’ve seen following the pandemic, location and amenities are regarded as established determinants that homeowners should always factor into their equation.

Role of Management and Maintenance Costs

HOA fees play an essential role in covering management costs incurred by community associations responsible for maintaining the common facilities that benefit all residents of a development project. These expenses may include gardening or landscaping, roof repairs, pool maintenance, garbage disposal among other facility maintenance costs.

As opposed to market conditions which are subject to frequent changes contingent on external forces, the ongoing increase in maintenance and management costs has been one of the most significant drivers of increasing condo fees in Boston.

It’s worth noting that the rise in labor and supply costs is usually directly proportional to inflation rates. Since wages and prices increase each year due to inflation, it becomes costly for communities associations as they need to keep pace with this trend when maintaining their facilities.

For instance, if a building was built 10 years ago and allocated $500k toward its reserves for capital replacement of essential building systems over the next 20 years but didn’t account for rising labor and supply costs over time, it is bound to encounter difficulty when executing those projects in the future. This means that the building association will have two options: either pay higher HOA fees or execute fewer capital improvement projects which would lead to poor upkeep of key systems & amenities.

Multifamily buildings inclusive of condos are also sensitive to outside liabilities from weather disasters or personal injury lawsuits related to accidents in the common areas such as slips-and-fall accidents in hallways. Since community associations must take active measures such as improving paths, outdoor emergency planning procedures, changing insurance policies etc., these result in ever-increasing association dues.

For some homeowners who manage their condos as rentals, occupant turnover could also contribute to increased HOA fees as this often demands extensive wear and tear on the property.

As a general rule, homeowners should recognize that the cost of regular upkeep is less expensive than waiting until everything breaks down. The underlying rationale is that it’s cheaper to repair maintenance issues proactively or replace things when they are still working compared to fixing items when they break down altogether which can be very costly and take more time.

Impact on Homeowners and Renters

The constant increase of HOA fees has a direct impact on both homeowners and renters. For homeowners, it can mean an increased burden on monthly expenses, potentially leading to financial strain. For renters, it affects the affordability of Boston’s rental housing market, which is already high.

Imagine suddenly having an extra $200 – $400 attributed to your monthly expenses without notice? This scenario is not far from reality for some Boston residents. Such an increase in condo fees can be a considerable amount for those on a fixed budget or already struggling to make ends meet.

Furthermore, rising HOA fees can affect the resale value of properties. Higher fees tend to lower the value of the property as potential buyers may look to avoid the extra expenditures associated with such properties.

It is also important to note that as HOA fees rise, additional responsibilities and expectations come with them. Homeowners expect that their fees will translate into better quality living spaces and amenities, further increasing pressure on property management companies and boards.

For instance, many residents of The South End neighborhood have seen dramatic increases in their condo fees over recent years. One resident reported that her fee increased by nearly 50% within three years, causing the loss of financial stability and more significant repayments.

As a result, low-income homeowners who are unable to keep up with these rising costs are often forced to give up their homes altogether. With this surge in housing prices across America’s urban centers, it’s essential that policymakers take a critical look at market trends and outline ways to prevent worsening economic inequality.

While some homeowner associations argue that these fee hikes are necessary due to the general wear and tear of buildings and various improvements needed in common areas, others speculate that board members quickly approve fee increases without much justification or study.

Some may argue that HOA fees can be beneficial as they provide a steady source of income, ensuring the maintenance of essential amenities. Nonetheless, for HOAs to increase their fees unreasonably without taking into account the economic impact on residents is insensitive and dangerous.

Navigating the Future of Condo Fees in Boston

The steady increase of condo fees in Boston has led to concerns regarding how much worse this trend might become. While it’s uncertain what future developments will bring, there are several ways policymakers can address the issue and ensure that these trends don’t negatively affect homeownership and rental affordability.

One potential solution is to encourage greater representation from renters on condo boards. Presently, many condo boards in the city are dominated by landlords or homeowners who may have little understanding of those who rent their units. Renters, on the other hand, live with the reality of rising housing prices regularly and could bring perspectives valuable to these discussions.

Another option is for policymakers to promote greater transparency between buildings and their residents regarding fees. This includes information about fee breakdowns and any upcoming changes that may occur. By keeping residents informed and encouraging open lines of communication between property management companies, board members, and homeowners, transparency can help mitigate resentment.

Similarly, municipal governments should explicitly outline how they intend to keep housing affordable alongside increasing HOA fees. This would entail looking at measures like rent control or zoning guidelines that prefer mixed-income communities over building luxury towers catering exclusively to high-end renters.

Allowing housing authorities some measure of oversight over HOA boards could also hold them accountable if they raise fees too drastically.

Despite these measures being just a few ways forward amid increased pressure on housing affordability in Boston, proactive policymaking across government levels remains critical. The rise in HOA fees presents a daunting challenge—without swift and effective action—the consequences could be felt for generations to come.

However, some may argue that the market should remain entirely laissez-faire, and it’s up to individuals to decide what they can afford. While this sentiment may reflect a free-market ideology, the reality is much more nuanced. Not everyone has the means to pay skyrocketing housing prices, and steps should be taken to address these challenges head-on.