Novel idea for affordable housing

Boston Condos for Sale and Apartments for Rent

Novel idea for affordable housing

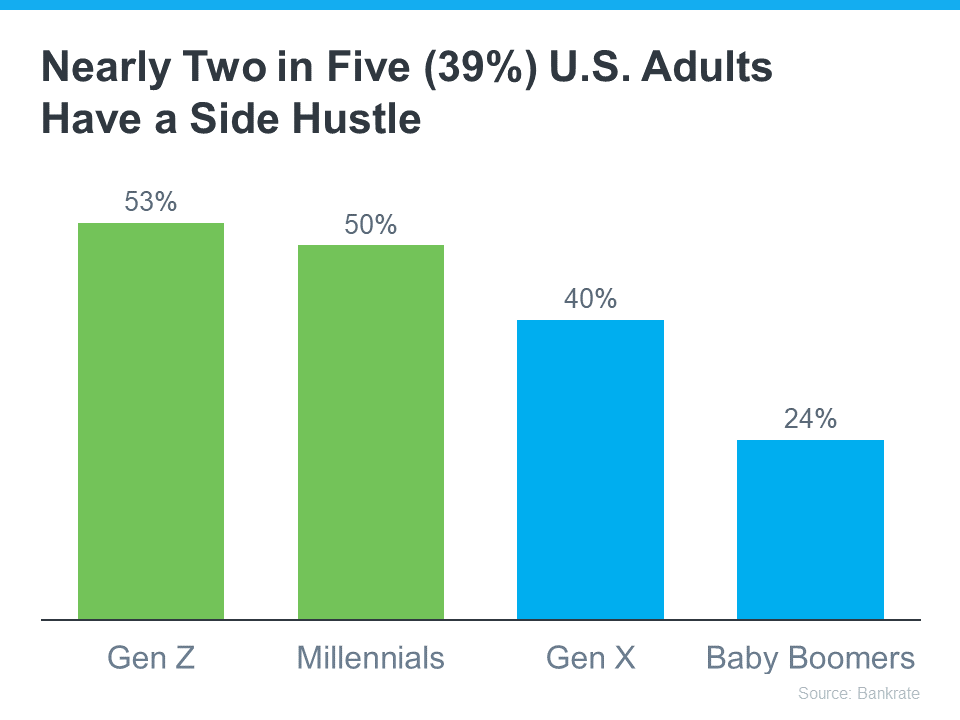

Does the rising cost of just about everything these days make your dream of buying a Boston condo for sale feel less within reach? According to Bankrate, many people are seeking additional income through side hustles, possibly to cope with those increasing expenses and save for a home. This trend is particularly popular with younger individuals who may be dealing with student loan debt (see graph below):

Here are two strategies that can not only make buying a Boston condo for sale more affordable in the short term, but turn it into a lucrative side hustle that can pay off down the road.

Transforming the Challenge of a Fixer-Upper into an Opportunity

One thing you could do to help you break into homeownership is consider purchasing a fixer-upper. That’s a home that may be a bit less appealing and as a result has lingered on the market longer than normal. According to a recent article from U.S. News:

“The current state of the housing market may have you expanding your options to try to find a home that you can afford. A fixer-upper that needs some updating and a little love can feel like a welcome alternative to move-in ready houses that go off the market before you can even take a tour.”

By opting for a home that requires some work, you may see two big benefits. For starters, you may find it’s easier to find a home because you’re not looking for that perfect option. Plus, it may also help you enter the housing market at a lower price point. This strategy provides a more affordable way to become a homeowner while also offering the potential for future profits.

Yes, the home may need a little elbow grease, but investing time and effort into gradually enhancing your house not only makes it a home but also increases its future market value. So, while you enjoy the satisfaction of turning a house into a home, you’re also building equity that can be unlocked when it’s time to sell.

Renting Out a Portion of Your Home To Make It More Affordable

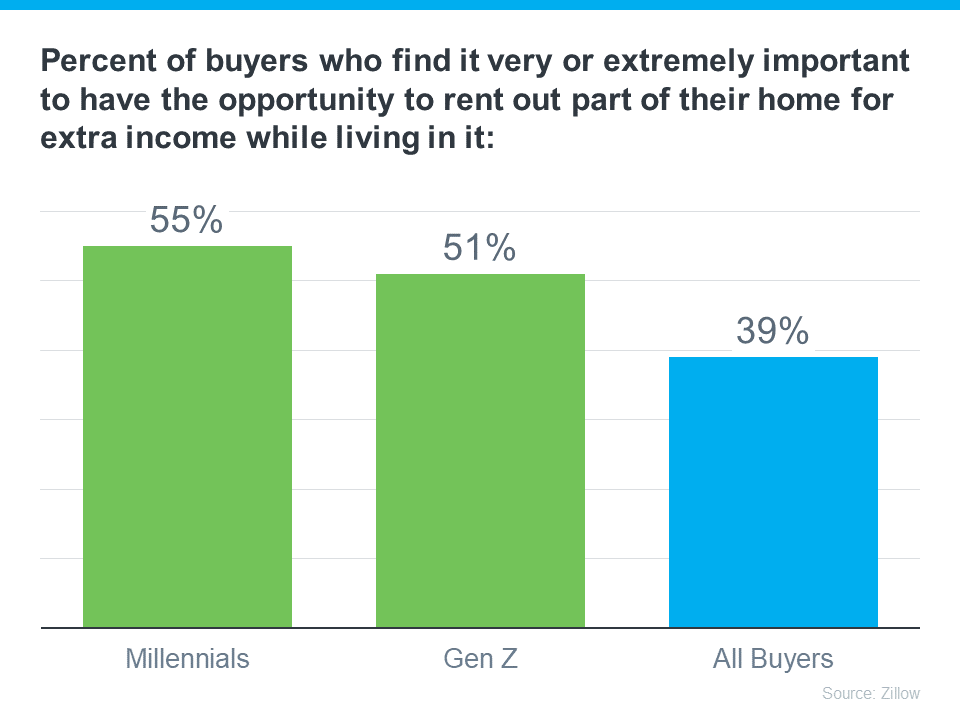

Another savvy strategy is to purchase a home with the upfront intention of renting out a portion of it. According to a recent press release from Zillow, renting out a part of their home is already very important for most young homebuyers (see graph below):

This approach serves a strong purpose. As Manny Garcia, Senior Population Scientist at Zillow, says:

“For those first-time buyers navigating the ‘side hustle culture,’ where a regular 9-to-5 might not quite cut it for homeownership dreams, rental income can step in to help . . .”

Basically, it can help you afford your monthly mortgage payments. So if you’re open to it, renting out a portion of your home not only helps with affordability, but it also positions you as an investor and turns your home into a source of income.

Boston Condos for Sale and the Bottom Line

In the face of today’s affordability challenges, both of these strategies offer more attainable paths to homeownership, especially for younger buyers. If you want to discuss these options and see how they might play out for you in our local market, let’s connect.

Ford Realty Beacon Hill – Condo for Sale Office

Updated: Boston Condos for Sale Blog 2023

Byline – John Ford Boston Beacon Hill Condo Broker 137 Charles St. Boston, MA 02114

![]()

__________________________________________________________________________________________________________________________________________________________

The right and wrong ways to make housing more affordable

by Melvin A. Vieira, Jr.

Many of us remember that stunning statistic: according to the Federal Reserve Bank of Boston, the average net worth of a white household in the Greater Boston area is nearly a quarter of a million dollars, but it is just eight dollars for Black households. Eight dollars. That rate is higher for Hispanic households, though it is still a fraction of the wealth that white households possess.

Addressing this inequity is personal to me. Having worked in the Boston area for decades, I have seen first-hand how difficult it is for members of traditionally underserved communities, namely Black and Hispanic residents, to purchase their own homes. Without homes of their own, people struggle to build multi-generational wealth. As a result, racial and economic inequities persist and grow unchecked.

One of the greatest ways we can combat this inequity is by ensuring that traditionally underserved communities have access to safe, reliable, affordable housing. Doing so will allow them to develop multi-generational wealth, bolstering their own communities and the entire Greater Boston area with it.

As 2022 President of the Greater Boston Association of Realtors®, I understand what steps must be taken — and what must be avoided — to increase the presence of safe, reliable, affordable housing in the region, and build toward the future for so many by creating generational wealth.

We have embraced the Residential Assistance for Families in Transition (RAFT) Homelessness Prevention Program. Pioneered by the state’s Department of Housing and Community Development, the RAFT program provides emergency financial assistance to those at imminent risk of homelessness. The program sets aside specific funding for more vulnerable groups, including elders, unaccompanied youths and people with disabilities. I am proud to say our members have volunteered to assist families in filling out the applications required for them to access these funds.

We have also provided financial support to the Massachusetts Affordable Housing Alliance’s (MAHA) STASH Program which assists first time generational home buyers afford home ownership. It’s a race conscious homeownership policy that has a track record of success. Programs like these are a critical first step to establishing generational wealth, as they allow individuals to keep their homes in times of crisis, provide stability, and offer the dream of homeownership. As a society we must further these programs, but Realtors® and property owners must also make individuals aware of it.

We must embrace the state’s new Housing Choice law. Passed just last year, this program provides cities and towns the tools critical to developing more safe, reliable, affordable housing. For instance, it lowers the voting threshold necessary to passing certain types of zoning ordinances and bylaws from a two-thirds supermajority to a simple majority.

The Initiative also mandates that specific cities and towns – known as MBTA Communities – develop multi-family housing units within walking distance of public transit stops. Policies like these emphasize why the Housing Choice Initiative is absolutely essential to developing more reliable, affordable housing in Massachusetts. It streamlines the wide-scale production of housing, making the prospect of owning a home in Massachusetts far more tenable than before.

Since its implementation, the Initiative has already led to the production of more than 50,000 multi-family housing units. While more are undoubtedly needed, this shows that, with time, the Housing Choice Initiative will bring opportunity to so many in Massachusetts that currently lack it.

While these are just a few steps we can take to empower traditionally underserved communities in the Greater Boston area, there are steps we must avoid taking. One such step is the re-implementation of rent control. It is easy to empathize with the views of rent control supporters: housing appears to be getting more and more expensive, especially for those who are neither white nor wealthy. Unquestionably, home ownership is out of reach for far too many.

Rent Control offers people in need false hope but is not the solution. While it could benefit a small group of people, rent control hurts many more and will undercut our economy. This is because there is little way to guarantee that those who most likely deserve rent controlled units actually receive them. Furthermore, rent control discourages landlords from conducting property upkeep and maintenance, as doing so becomes too expensive. Additionally, rent control discourages the building of new properties. As a result, housing supply becomes more limited, making existing properties more expensive. This in turn fuels gentrification, with long-time renters and owners leaving their neighborhoods because they can no longer afford to live there.

By taking the right steps and avoiding the wrong ones, we can increase the presence of safe, reliable, affordable housing in Massachusetts, and bolster multi-generational income for all. Yet in doing so, it is absolutely essential we take the right steps and avoid the wrong ones.

I know little about affordable housing.

Here’s an idea that seems to have merit.

It’s a co-operative complex in The Bronx (in New York City) called Co-op City, which has 15,372 units across 35 high-rises and 7 town-house clusters.

(The prices are ridiculously low, which has led to problems with on-going maintenance, etc., which you can learn about, by clicking through on links in the comments section.)

Homey, if You Don’t Mind a Building Boom (page two) – By David Sharfenberg, The New York Times

Prices range from $10,500, for a three-room one-bedroom, to $22,750, for a six-and-a-half-room three-bedroom. Whatever the resident’s initial investment, the co-op repays that amount when the resident leaves.

Carrying charges “which cover gas, electricity, heat, air-conditioning, security and maintenance” range from $522 to $1,131 a month, depending on the size of the apartment, said Steven Gold, director of residential sales and marketing for the RiverBay Corporation.

Applicants must undergo credit and criminal background checks and a home visit, and meet income restrictions. To get a five-room, two-bedroom apartment, for instance, a family of four must earn at least $38,280, at most $95,088.

The waiting list for two-bedroom apartments is six to nine months, so apparently people like the idea.

What do you think?

Back to Boston condos for sale homepage

Contact me to find out more about this property or to set up an appointment to see it.

SEARCH FOR BOSTON CONDOS FOR SALE

For more information please contact one of our on-call agents at 617-595-3712.