Boston Housing Recovery

Boston Real Estate for Sale Search

Loading...

Boston Housing Recovery

Peace be with you

Scroll down for our Beacon Hill condo for sale listings.

Visit our office at 137 Charles Street Rear, Beacon Hill MA 02114

The property listing data and information, or the Images, set forth herein were provided to MLS Property Information Network, Inc. from third-party sources, including sellers, lessors, landlords, and public records, and were compiled by MLS Property Information Network, Inc. The property listing data and information, and the Images, are for the personal, noncommercial use of consumers having a good faith interest in purchasing, leasing, or renting listed properties of the type displayed to them and may not be used for any purpose other than to identify prospective properties which such consumers may have a good faith interest in purchasing, leasing or renting. MLS Property Information Network, Inc. and its subscribers disclaim any and all representations and warranties as to the accuracy of the property listing data and information, or as to the accuracy of any of the Images, set forth herein.

![]()

![]()

Updated: Boston Real Estate Blog 2025

A housing recovery may come by 2024

The following is from a JP Morgan analysis

These recent, positive indicators are a little surprising, given the 30-year mortgage rate remains at levels (6% to 7%) that many would have thought too high to promote any stability.

Today’s improvement seems to be due in large part to the fact there are nationally too few single-family homes relative to population pressures. The good news is, these drivers may continue to act as guardrails for the U.S. housing market:

- Demand—More than 30% of young people aged 18 to 34 are still living at home with their parents, according to the U.S. Census Bureau. Meanwhile, millennials (aged 27–42 in 2023) form the largest generation group in the United States at approximately 72 million. The effort of all these young adults to own homes creates a source of demand that is likely going to be a theme for years into the future.

- Supply—Meanwhile, there’s a shortage of housing stock. Since the bursting of the 2008 housing bubble, new home development in the United States has lagged demand. We estimate that today, this gap totals approximately 2-2.5 million too few housing units. And the recent spike in mortgage rates is, counterintuitively, exacerbating this shortage, as homeowners who refinanced when rates dipped are now disincentivized to move and take a new mortgage at a higher rate (2020 had the largest number of refinances on record; 2021 had the third highest, trailing only 2003).3

We think these drivers will not only cushion how low prices will go over the next year, but can also help shorten the lag between the transaction trough, when sales activity bottoms out, and when prices follow to their nadir.4

Right now, aggregate home prices are down about 4-5% from the national peak in 2022. We believe aggregate home prices will decline, on average, about 10% from peak to trough when the pandemic’s full fallout is complete.

In other words, we expect the decline to be smaller and come sooner than the crash the U.S. housing market experienced after the 2008 Financial Crisis, when single-family home values depreciated by about 30% from peak to trough. That nadir came a full two-and-a-half years after buying activity bottomed out in late 2008.

Also, unlike the 2008 crisis that depressed home prices fairly uniformly across the country, the amount of volatility an individual city is experiencing depends largely on each locale’s unique market dynamics.

Cities are on very different paths back to normal

Last fall, as the housing market was cooling, we said that national statistics, while informative, would fail to tell the whole story. We expected cities to experience widely differing drops in home prices based in large part on how overheated their particular housing markets were at the start of 2022, before interest rates rose.

Subsequent home price drops have been dispersed, and in the general direction we anticipated.

Proven right: Our 2022 expectation that cities would see widely divergent home price drops

______________________________________________________________________________________________

One of the biggest surprises of 2020 is the resilience of the Boston residential real estate market. Lawrence Yun, Chief Economist of the National Association of Realtors (NAR), is now forecasting that more homes will sell this year than last year. He’s also predicting home sales to increase by 8-12% next year. There’s strong evidence that he will be right.

ShowingTime, a leading showing software and market stat service provider for the residential real estate industry, just reported on their latest the ShowingTime Showing Index:

“Home buyer traffic jumped again in July, recording a 60.7 percent year-over-year increase in nationwide showing activity.”

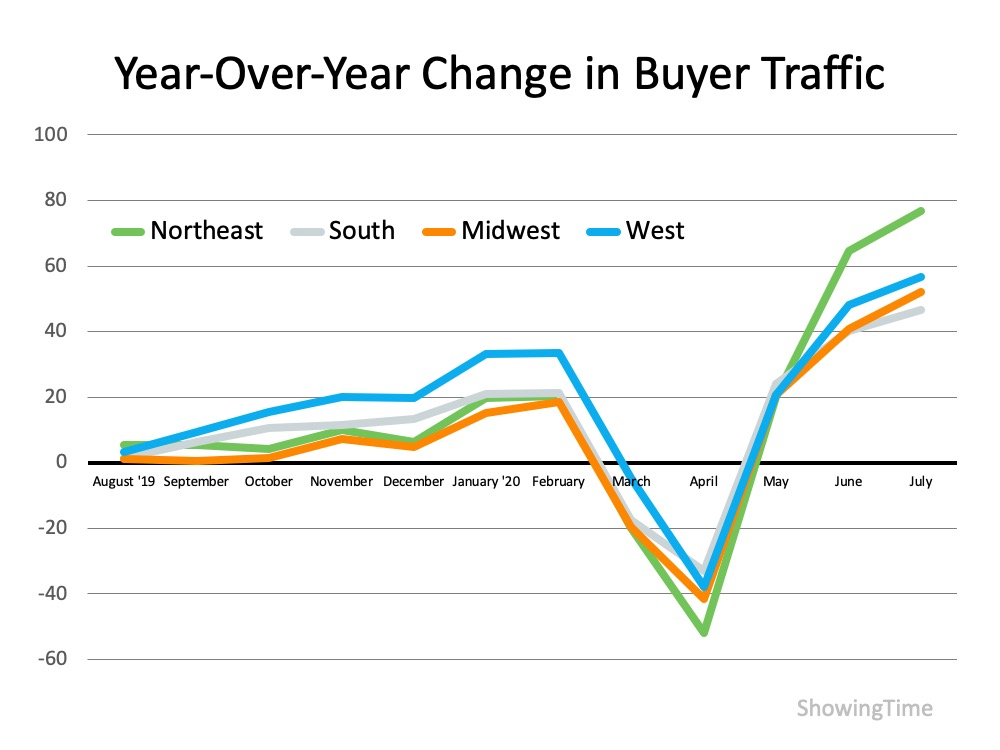

That means there are 60% more buyers setting appointments to see homes than there were at this same time last year. The number of potential purchasers was also up dramatically in every region of the country:

The Northeast was up 76.6%

The West was up 56.7%

The Midwest was up 52.1%

The South was up 46.7%

The Housing Market Is Showing a ‘V’ Type Recovery

ShowingTime also indicates the real estate market has already come back from the downturn earlier this year that was caused by shelter-in-place orders. Here are the year-over-year numbers for each region on a monthly basis (See graph below):

We’re way ahead of where we were at this time last year. This data validates the thoughts of Frank Martell, President and CEO of CoreLogic, who recently noted:

“On an aggregated level, the housing economy remains rock solid despite the shock and awe of the pandemic.”

Boston Real Estate and the Bottom Line

If you’re thinking about selling your Boston downtown condo, this may be a great time to get the best price and the most favorable terms.

Boston Real Estate for Sale Search

Loading...