Boston Condos for Sale 2021

Loading...

My Semi-logic Reason Why Boston Condo Prices Won’t Drop

There have been a lot of shifts in the housing market recently. Mortgage rates rose dramatically last year, impacting many people’s ability to buy a Boston condos for sale. And after several years of rapid price appreciation, national home prices finally peaked last summer. These changes led to a rise in headlines saying prices would end up crashing.

Even though we’re no longer seeing the buyer frenzy that drove Boston condo values up during the pandemic, prices have been relatively flat at the national level. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), doesn’t expect that to change:

“[H]ome prices will be steady in most parts of the country with a minor change in the national median home price.”

You might think sellers would have to lower prices to attract buyers in today’s market, and that’s part of why some may have been waiting for prices to come crashing down. But there’s another factor at play – low inventory. And according to Yun, that’s limiting just how low prices will go:

“We simply don’t have enough inventory. Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely.”

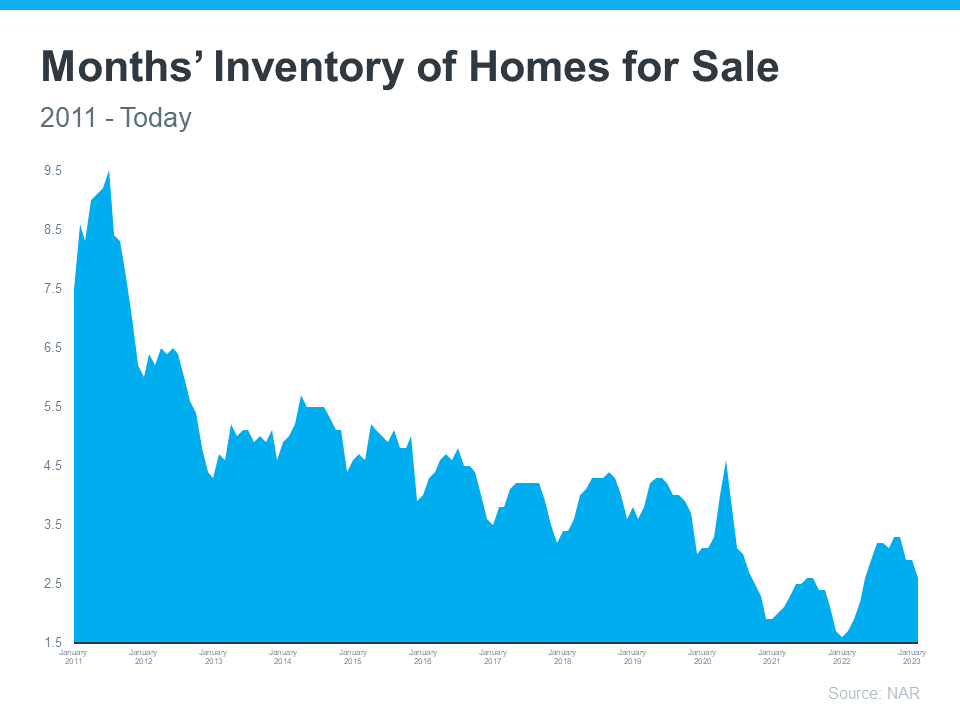

As you can see in the graph below, we’ve been at or near record-low inventory levels for a few years now.

That lack of available homes on the market is putting upward pressure on prices. Bankrate puts it like this:

“This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equation simply won’t allow a price crash in the near future.”

If more homes don’t come to the market, a lack of supply will keep prices from crashing, and, according to industry expert Rick Sharga, inventory isn’t likely to rise significantly this year:

“I believe that we’re likely to see low inventory continue to vex the housing market throughout 2023.”

Sellers are under no pressure to move since they have plenty of equity right now. That equity acts as a cushion for homeowners, lowering the chances of distressed sales like foreclosures and short sales. And with many homeowners locked into low mortgage rates, that equity cushion isn’t going anywhere soon.

With so few homes available for sale today, it’s important to work with a trusted real estate agent who understands your local area and can navigate the current market volatility.

Boston Condo Prices and a Bottom Line

A lot of people expected prices would crash this year thanks to low buyer demand, but that isn’t happening. Why? There aren’t enough homes for sale. If you’re thinking about moving this spring, let’s connect.

_________________________________________________________________________________________________________________________________

One of the major story lines over the last year is how well the residential real estate market performed. One key metric in the spotlight is home price appreciation. According to the latest indices, home prices are skyrocketing this year.

Here are the latest percentages showing the year-over-year increase in home price appreciation:

- The House Price Index (HPI) from the Federal Housing Finance Agency (FHFA): 18.8%

- The S. National Home Price Index from S&P Case-Shiller: 18.6%

- The Home Price Insights Report from CoreLogic: 18%

The dramatic increases are seen at every price point and in all regions of the country.

Increases Are Across Every Boston Condo Price Point

According to the latest Home Price Index from CoreLogic, each price range is seeing at least a 19% increase year-over-year:

Real Estate Increases Are Across Every Region in the Country

Every region in the country is experiencing at least a 14.9% increase in home price appreciation, according to the Federal Housing Finance Agency (FHFA):

Real Estate Increases Are Across Each of the Top 20 Metros in the Country

According to the U.S. National Home Price Index from S&P Case-Shiller, every major metro is seeing at least a 13.3% growth in prices (see graph below):

What About Real Estate Price Appreciation in 2022?

Prices are the result of the balance between supply and demand. The demand for single-family homes has been strong over the last 18 months. The supply of houses available for sale was near historic lows. However, there’s some good news on the supply side. Realtor.com reports:

“432,000 new listings hit the national housing market in August, an increase of 18,000 over last year.”

There will, however, still be a shortage of supply compared to demand in 2022. CoreLogic reveals:

“Given the widespread demand and considering the number of standalone homes built during the past decade, the single-family market is estimated to be undersupplied by 4.35 million units by 2022.”

Yet, most forecasts call for home price appreciation to moderate in 2022. The Home Price Expectation Survey, a survey of over 100 economists, investment strategists, and housing market analysts, calls for a 5.12% appreciation level next year. Here are the 2022 home appreciation forecasts from the four other major entities:

- The National Association of Realtors (NAR): 4.4%

- The Mortgage Bankers Association (MBA): 8.4%

- Fannie Mae: 5.1%

- Freddie Mac: 5.3%

Price appreciation is expected to slow in 2022 when compared to the record highs of 2021. However, it is still expected to be greater than the annual average of 4.1% over the last 25 years.

Boston Condos for Sale and the Bottom Line

If you owned a home over the past year, you’ve seen your household wealth grow substantially, and you’ll see another nice boost in 2022. If you’re thinking of buying, consider buying now as prices are forecast to continue increasing through at least next year.

_____________________________________________________________________________________________________________________________

Boston Real Estate for Sale

Loading...

Boston real estate

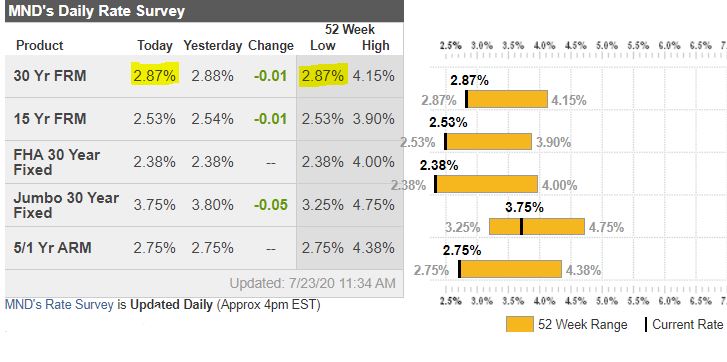

Today we should see another all-time-low record in mortgage rates!

What is the impact?

Let’s do the Boston Real Estate Math:

If we just go back to the 52-week high of 4.75%, you could borrow $808,000 and pay $4,215/mo.

If you shopped around to get a 3.0% jumbo rate today, you’d pay a point or so, but you could borrow $1,000,000 and have a payment of $4,216 per month.

Within a 12-month period, the borrowing power has gone up from $808,000 to $1,000,000 with no change in payment!

This is why sellers don’t mind pushing their list prices – they want to share in the benefit!

Boston Real Estate for Sale

Loading...

Click Here to view: Google Ford Realty Inc Reviews