Most Americans See Home Prices Stable or Rising

Boston Condos for Sale

Most Americans See Home Prices Stable or Rising

Peace be with you

Updated: Boston Real Estate Blog 2025

Most Americans See Home Prices Stable or Rising

In some cases, home prices are actually coming down. Will this trend spill into the Boston condo for sale market.

Most Americans See Home Prices Stable or Rising

If you’re following the news today, you may feel a bit unsure about what’s happening with home prices and fear whether or not the worst is yet to come. That’s because today’s headlines are painting an unnecessarily negative picture. If we take a year-over-year view, home prices did drop some, but that’s because we’re comparing to a ‘unicorn’ year when prices peaked well beyond the norm.

To avoid an unfair comparison to that previous peak, we need to look at monthly data. And that tells a very different and much more positive story. While local home price trends still vary by market, here’s what the national data tells us.

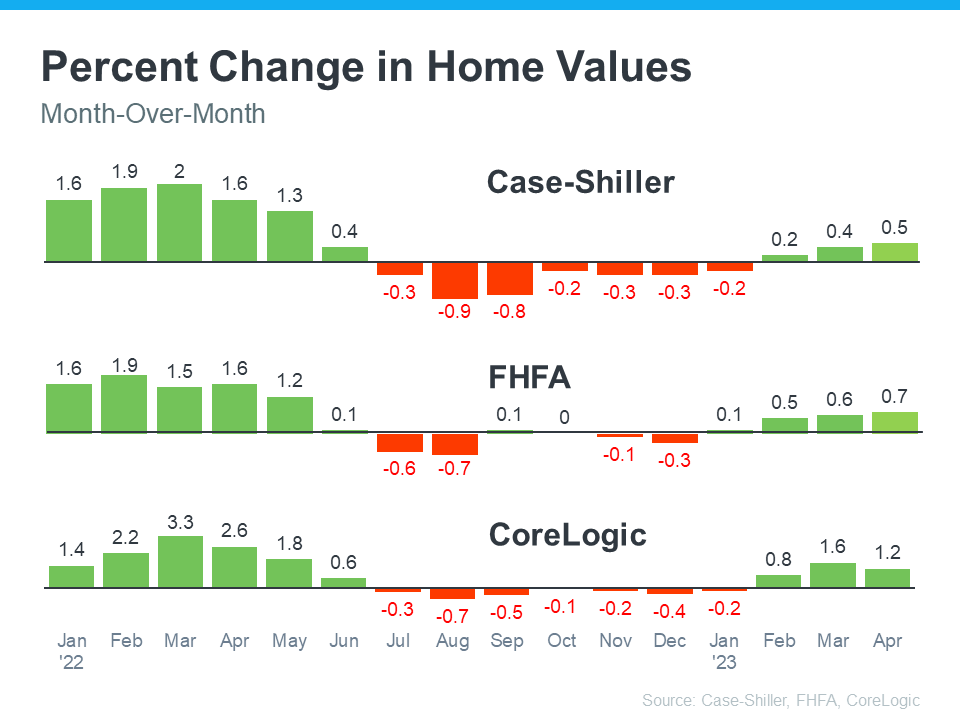

The graphs below use recent monthly reports from three sources to show the worst home price declines are already behind us, and prices are appreciating nationally.

Looking at this monthly view, we can see the past year in the housing market can be divided into two parts. In the first half of 2022, home prices were going up, and fast. However, starting in July, prices began to go down (shown in red in the graphs above). By around August or September, the trend started to stabilize. But, looking at the most recent data for early 2023, these graphs also show that prices are going up again.

The fact that all three reports show prices have been going up for three or more straight months is an encouraging sign for the housing market. The month-over-month data indicates a national shift is happening – home prices are rising again.

Craig J. Lazzara, Managing Director at S&P Dow Jones Indices, says this about home price trends:

“If I were trying to make a case that the decline in home prices that began in June 2022 had definitively ended in January 2023, April’s data would bolster my argument.”

Experts believe one of the reasons prices didn’t crash like some expected is because there aren’t enough available homes for the number of people who want to buy them. Even with today’s mortgage rates, there are more people looking to buy than there are homes available for sale.

Mark Fleming, Chief Economist at First American, explains how more demand than supply keeps upward pressure on prices:

“History has shown that higher rates may take the steam out of rising prices, but it doesn’t cause them to collapse entirely. This is especially true in today’s housing market, where the demand for homes continues to outpace supply, keeping the pressure on house prices.”

Doug Duncan, Senior VP and Chief Economist at Fannie Mae, states home price growth is exceeding expectations thanks to that high demand:

“. . . housing prices continue to show stronger growth than what was previously expected . . . Housing’s performance is a testimony to the strength of demographic-related demand . . .”

Here’s How This Affects You

- Buyers: If you’ve been holding off on buying because you were worried the value of your home would go down, knowing home prices have bounced back should bring you some relief. It also gives you the opportunity to own something that usually becomes more valuable as time goes on.

- Sellers: If you’ve been waiting to sell your house because you were concerned about how changing home prices would affect its value, it might be a good idea to team up with a real estate agent to list your house. You don’t have to wait any longer because the latest data suggests things are turning in your favor.

Bottom Line

If you delayed your moving plans because you were concerned about home prices dropping, the latest data reveals the worst is already over, and prices are appreciating nationally. Let’s get in touch so you know what’s happening with home prices in our area.

___________________________________________________________________________________________________________________________________________________

Home-price growth slowed to 3% last month, and that’s not the only metric decelerating in today’s market. Inflation is also starting to slow which is helping bring down mortgage rates.

A new report from Redfin found the median home sale price fell 8.4% from its June all-time high, compared to home prices rising half a percent from the same period a year ago.

During the four-weeks ended Nov. 6, home-sale prices rose 3.2% on an annual basis, the smallest increase since July 2020.

These changes are reflected in the latest market activity, as early-stage homebuyer demand started leveling off and mortgage applications rose after a month and a half of declining.

Redfin deputy chief economist Taylor Marr says the recent report that the overall inflation rate is starting to back off makes it even more likely the Fed will slow rate increases.

“The inflation news is already helping to bring daily mortgage rates down,” she said. “However, Chair Powell has indicated that inflation would need to slow for several consecutive months before the Fed would lower its target for how high it raises rates next year.”

Marr added that still-high home prices are propping up inflation, but things are changing fast.

“The buyers who remain in this market are likely getting much better deals than the median asking or sale price reflects,” Marr said. “The typical home now sells for less than asking, price drops remain at a record high, and seller concessions are becoming increasingly common.”

For the week ended Nov. 6, pending home sales fell 34% from last year, marking the largest decline since January 2015.

Mortgage rates rose to 7.08% in the week ended Nov. 10, while mortgage applications rose 1% from the week before. Purchase applications were down 41% from last year.

Redfin found fewer Google searches for “homes for sale” during the week ended Nov. 10, down 28% from last year, but up a point from the week prior. Its Homebuyer Demand Index, which measures requests for tours and other services, was up 2.8% from the previous week, but down 34% from last year.

In the four weeks ended Nov. 6, active listings rose 10% from last year, while new listings were down 17% from last year.

The median asking price rose 7% from 2021 to $372,475, but was down 7% from a record high of $399,975 in May. Meanwhile, the median sale price increased 3% year over year to $359,250 – the slowest sale-price growth since the pandemic began.

Thirty-four percent of homes that went under contract had an offer within the first two weeks, showing little change from the previous four weeks but down 40% from last year. Twenty-eight percent of homes sold above list price, down from 43% last year and the lowest since July 2020.

The report also noted the monthly mortgage payment on a median asking-price home was $2,524 at the current 7.08% mortgage rate. That was up 50.7% from last year’s $1,687 when mortgage rates were 2.98% and up from a recent low of $2,203 in August.

__________________________________________________________________________________________________________________________

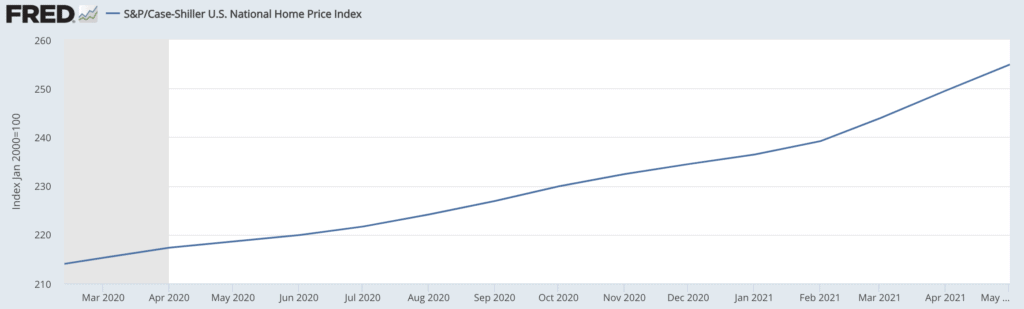

This week brings the latest round of S&P CoreLogic Case-Shiller Indices, which measure the average selling price of single-family homes nationwide. In short: Selling prices have not slowed down or flattened out this summer. Instead, prices continue to rise non-linearly in a rather spectacular fashion. The year-over-year national average rose 16.6% in May, expanding from a 14.8% year-over-year reading in April.

The managing director and global head of index investment strategy at S&P Dow Jones Indices, Craig J. Lazzara, had this to say: “A month ago, I described April’s performance as ‘truly extraordinary,’ and this month I find myself running out of superlatives … the 16.6% gain is the highest reading in more than 30 years of S&P CoreLogic Case-Shiller data.”

In April there were five metros that recorded their all-time highest reading. In May, five more cities—Charlotte, Cleveland, Dallas, Denver, and Seattle—recorded all-time high prints.

But frankly, there’s no region of the country being left behind anymore: Year-over-year price gains in all 20 metros were in the top quartile of historical performance. In 17 out of 20 metros, price gains were in the top decile of all-time readings.

The West Coast had the three splashiest numbers, with San Diego, Seattle, and Phoenix all coming in with more than 23% increases in average selling prices over the past year.

What is Case-Shiller?

As a quick primer, the U.S. National Home Price NSA Index measures the 20 largest metro areas in the U.S. and is computed with a three-month moving average. More specifically, the Case-Shiller measures the 20 largest metropolitan statistical areas, or MSAs. Urban areas and the surrounding suburban counties are grouped into one MSA.

The moving average part is key to our discussion here: Everything we see in newly-released figures is already backward-looking by quite a bit—not only for the two-month lag itself (for example, May prints come out at the end of July)—but also factoring in the moving average of the past few months.

It’s important to have this context when looking at a metric that is rising non-linearly. Here is a chart of the Case-Shiller over the past 14 months:

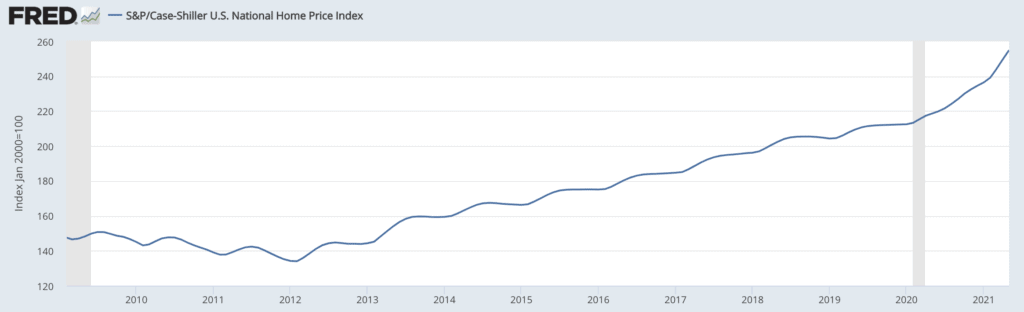

And here’s the vantage point if we widen the aperture to the 12 years following the Great Recession of 2007-2009:

Key takeaways

The steady rise that was maintained through 2020 was great and sustainable. Interest rates were historically low, and personal incomes were rising along with jobs growth. The supply of homes available for sale remained a bit too low, given that Millennials were starting to hit their prime home-buying years. They became the single largest demographic of real estate purchasers by the end of the 2010s.

But this curling up of the tail in the past year is not sustainable—that’s an objective mathematical certainty. The average selling prices of homes is rising faster than any of the pillar metrics can keep up with. Wages aren’t rising non-linearly. Interest rates have been skirting along a floor level for a couple years now, and can’t really slide any lower (especially given that inflation is running at its fastest pace in over a decade).

In short, affordability metrics are moving in the wrong direction: south. We could read the tea leaves back in May, when we noted the sticker shock that was hitting the faces of prospective homebuyers.

Estimates vary between lenders and different investment sectors, but a fair consensus is that median home-buying power rose by about 8% in the past year, thanks to rises in incomes and slightly lower mortgage rates. But that pales in comparison to a 16%-plus rise in average selling prices.

Here’s where to point fingers

There are some important factors pushing up prices that are hopefully one-offs and will soon dissipate. The pandemic has been the biggest of these. COVID-19 initially sent city-dwellers scampering for a way out of the city and into the suburbs. Their white-collar employers largely promoted this swing as the Zoom economy got into full swing.

It’s hard to gauge how much of the work-from-home trend will have staying power once COVID-19 finally recedes as a national health concern. But certainly enough companies are still riding the remote work train as I type this to motivate a large demographic of people to seek homes in suburban and rural areas.

This is one half of the reason why the Midwest region has fastest sales pace of anywhere in the U.S. The other half of the reason: The Midwest has the lowest average selling price of any region in the country—and folks are begging for anything affordable, anywhere.

The ripple effect of higher prices

We’re already seeing one of the simple, yet major effects of home prices that are rising too fast: People stop wanting to pay them.

Many people have shrugged and continued to rent, semi-content to wait and see if prices will come down. This is a powerful psychological factor given that most of us remember not-too-long-ago when house prices went down… a lot.

The ingredients that caused the big crash back in 2007 through 2009 aren’t in place now, so it’s a very remote possibility that a similar outcome could unfold today. Today’s mortgages aren’t issued without income verification. Standards put in place by the government and the country’s biggest lenders make a pretty sturdy firewall against worst-case outcomes.

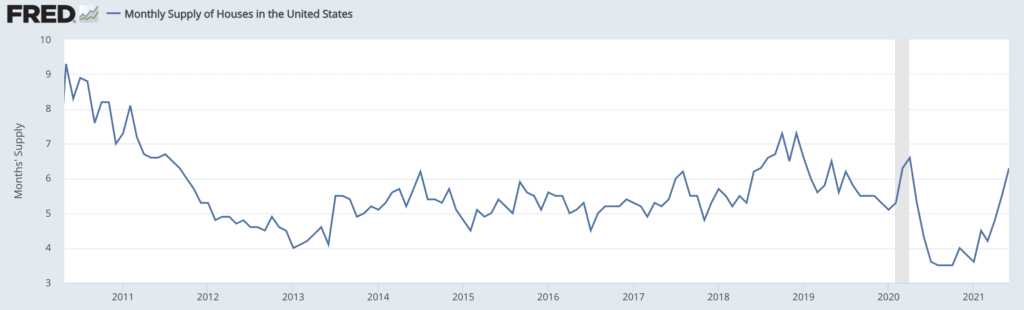

But sales can and might slow to a crawl, despite so many prospective buyers. We’re already seeing this in the new home sales information put out by the U.S. Department of Commerce. The report for June had the U.S. hitting a 14-month low in sales, its third straight month of declines. The 676,000 sales reported was a big miss from the expected number of 800,000. May’s initially reported figure was also revised down by 45,000 homes—another sign of deterioration between handshake stage and the signature stage.

The data is divided into four regions—and only the Midwest saw a net increase in sales during June. The East, South, and West (where prices are highest) all saw declines.

Some pressures easing

Those hoping to see an increase in new-home construction may see one glimmer of hope: Lumber prices fell by more than 50% over the past few months. In addition to supply shortages in molded fixtures, copper derivatives, and labor, lumber prices were a major crimp for homebuilders. Input costs rose even faster than home selling prices, leading to a big drop in building permits, which hit a nine-month low in June.

The lower input costs should quickly work their way into the construction markets and help keep the necessary flow of new properties humming. But despite improvement in the months’ supply of homes, it’s still not enough to meet the needs of Millennial buyers nor the flow of remote workers seeking larger homes away from cities.

This is why average selling prices keep hitting new records despite the solid uptick in available inventory.

It’s always good to keep an open mind when dealing with something unprecedented. There’s no modern precedent for COVID-19—certainly not in a digital economy—so we don’t know just how pervasive the “flee to the suburbs” trend will become. There’s also no precedent for all the stimulus and intervention we’ve had over the past couple of years, and the possible subsequent effects on inflation and mortgage rates.

But don’t be a chaser of an incremental property to add to your portfolio—not at these levels. Homes cannot and will not act like stocks, crypto, or any other asset class. All those other things can be purchased by someone with just a few hundred or thousand bucks to toss around. That is not the case with single-family properties.

Once price gains are double that of purchasing power gains, the party’s about over. Expect to see a plateau as the overall sales pace slows down mightily until inventories can keep up with the rampant demand. And that will take some time—12 to 18 months at minimum, given the extreme lag times in construction.

Boston Condos for Sale

________________________________________________________________________________________________________________________

I just viewed this link to a Gallop article that I found on Charles Cherney’s Twitter feed. The article states: “77% of Americans see housing values in their area stabilizing or moving higher during the year ahead.” This number is up 19 points from the 2008 survey. It also mentions that expectations for housing prices are best in the East.

File Under: Just thought you like to know.