Boston Condos for sale Sale and Rent

Boston Real Estate for Sale: Mortgage rates likely to rise soon

But not yet.

The Fed did what they said they were going to do and raised their fed funds rate target by another 0.75%.

What happened to mortgage rates? They went down!

Read the story here.

Yes the -0.01% isn’t much, but didn’t every casual observer think mortgage rates were going to rise again? That we were heading for 6% or 7% or 8%?

Everyone is going to get used to mortgage rates in the 5s, and by springtime this will all settle down and we’ll get back to a relatively normal market again.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Updated: Boston Real Estate Blog 2022

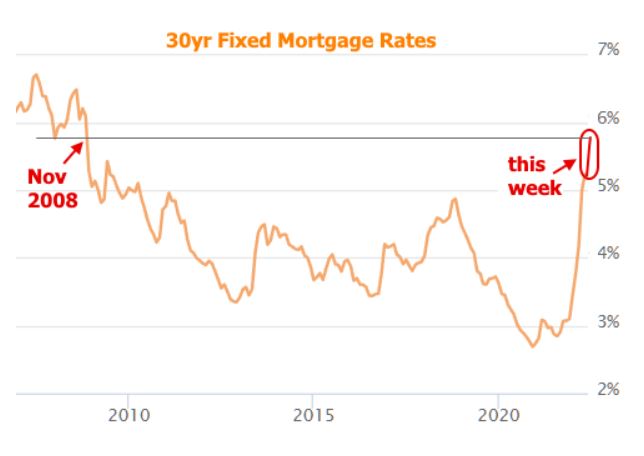

Mortgage Rates Heading for 6%

I picked a great day to start the mortgage-rate tracker in the right-hand column! >>>>

Mortgage rates haven’t been in the 6% range since 2008:

How many agents have operated in a 6% environment? It will be less than half of the active agents today. To check, their license number would have to be around 01850000 or lower (real estate license numbers in California are sequential).

Wondering how to cope? Here are my tips:

- Sellers – Offer to Pay Points. Even if the buyer won’t use your lender, offer to pay 1%-2% of the loan amount to buydown their interest rate. If their lender keeps the money instead of giving a lower rate, well then, heck, at least you tried. But the buyers should appreciate the effort, and two points should reduce the rate by at least 1/4%.

- Sellers – Carry the Financing. If the seller carries all or part of the financing at a reasonable rate, it will help the buyers. Plus, sellers only pay capital-gains taxes on the money you receive, so you’ll get a break there. The big bonus will be if the buyer stops paying – you’ll get your house back too!

- Buyers – Get a Short-Term Mortgage. We call them ARMs, or adjustable-rate mortgages which sounds scary after the neg-am debacle last time. But they offer a fixed-rate for the initial term – just get a seven-year or ten-year loan and refinance once we go into recession and the Feb has to back off again (because they owe $30 trillion themselves, it will probably happen sooner than later).

While the impact on the buyers’ monthly payments is real, it’s the market psychology that will make it worse. Buyers will be expecting lower prices, so instead, consider one of my tips above as an alternative.

Boston Condos 2022

Loading...

Boston Real Estate for Sale: Mortgage rates likely to rise soon (2021 Video)

The government will soon scale back stimulus programs that have kept mortgage rates low. Buying a Boston condo for sale is likely to get more expensive. Watch the most recent 2021 mortgage rate video below.