Byline – John Ford Boston Beacon Hill Condo Broker 137 Charles St. Boston, MA 02114

Mortgage loan rates – going higher, no matter what?

Mortgage loan rates – going higher, no matter what?

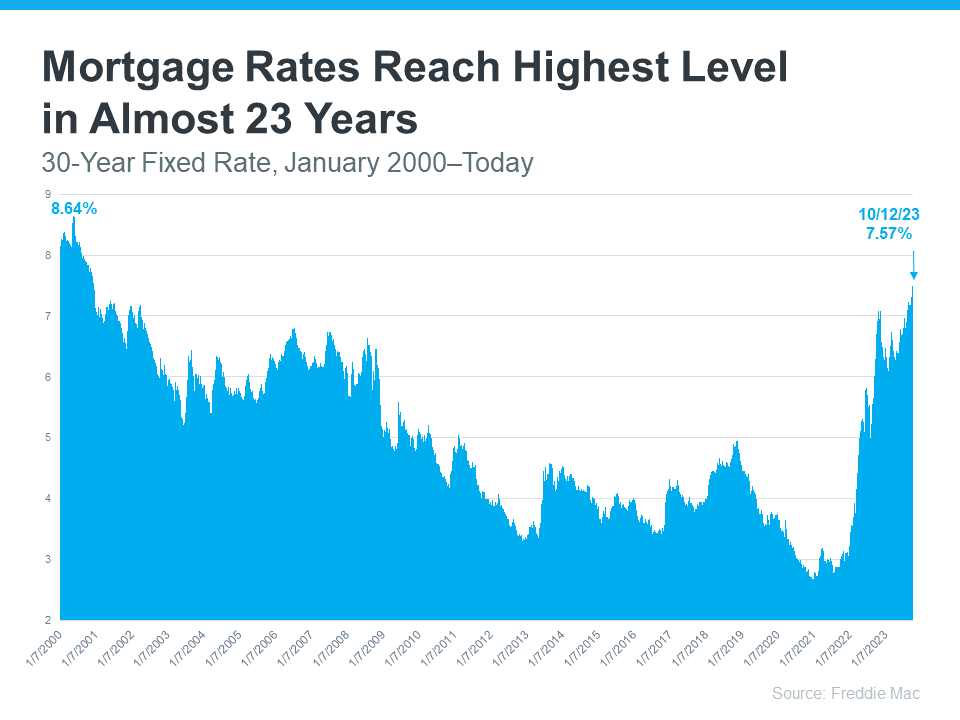

Boston condo for sale mortgage rates have been back on the rise recently and that’s getting a lot of attention from the press. If you’ve been following the headlines, you may have even seen rates recently reached their highest level in over two decades (see graph below):

That can feel like a little bit of a gut punch if you’re thinking about making a move to a Boston Beacon Hill condo. If you’re wondering whether or not you should delay your plans, here’s what you really need to know.

How Higher Mortgage Rates Impact You

There’s no denying Boston condo for sale mortgage rates are higher right now than they were in recent years. And, when rates are up, that affects overall Boston home affordability. It works like this. The higher the rate, the more expensive it is to borrow money when you buy a home. That’s because, as rates trend up, your monthly mortgage payment for your future home loan also increases.

Urban Institute explains how this is impacting buyers and sellers right now:

“When mortgage rates go up, monthly housing payments on new purchases also increase. For potential buyers, increased monthly payments can reduce the share of available affordable homes . . . Additionally, higher interest rates mean fewer homes on the market, as existing homeowners have an incentive to hold on to their home to keep their low interest rate.”

Basically, some people are deciding to put their plans on hold because of where mortgage rates are right now. But what you want to know is: is that a good strategy?

Where Will Mortgage Rates Go from Here?

If you’re eager for mortgage rates to drop, you’re not alone. A lot of people are waiting for that to happen. But here’s the thing. No one knows when it will. Even the experts can’t say with certainty what’s going to happen next.

Forecasts project rates will fall in the months ahead, but what the latest data says is that rates have been climbing lately. This disconnect shows just how tricky mortgage rates are to project.

The best advice for your move is this: don’t try to control what you can’t control. This includes trying to time the market or guess what the future holds for mortgage rates. As CBS News states:

“If you’re in the market for a new home, experts typically recommend focusing your search on the right home purchase — not the interest rate environment.”

Instead, work on building a team of skilled professionals, including a trusted lender and real estate agent, who can explain what’s happening in the market and what it means for you. If you need to move because you’re changing jobs, want to be closer to family, or are in the middle of another big life change, the right team can help you achieve your goal, even now.

Boston Condos for Sale and the Bottom Line

The best advice for your move is: don’t try to control what you can’t control – especially mortgage rates. Even the experts can’t say for certain where they’ll go from here. Instead, focus on building a team of trusted professionals who can keep you informed. When you’re ready to get the process started, let’s connect.

Updated: Boston condo for sale website 2023

__________________________________________________________________________________________

A fixed-rate mortgage can still be found at under 6%. That’s good news for buyers/borrowers.

Unfortunately, the days of low rates may be numbered.

As Holden Lewis puts it, “[I]n light of a tighter job market, the proper direction for bond yields is up, and that’s where they are heading. Mortgage rates will follow.”

The unemployment rate has dropped, nationwide, to 4.4 percent. That’s the best in five and a half years.

That would raise inflation fears at the Federal Reserve, on its own, but there’s more news:

Average hourly earnings in the private sector (seasonally adjusted) increased by almost 0.4 percent in one month, from $16.85 in September to $16.91 in October. That would be an annual rate of 4.3 percent. But there was an increase in average hours worked, so average weekly wages went up more than 0.6 percent, an annual rate of 7.8 percent.

7.8 percent??? no economist wants wages to rise that much in a year!

Wages go up when there aren’t enough workers looking for jobs.

The Fed wants low inflation. The only way to do that is to raise rates. Short-term rates.

Mortgage loans are long-term rates. They’ll go up, too.

More: Mortgage Matters – By Holden Lewis, Bankrate.com