More Foreclosures Coming

Boston Condos for Sale and Apartments for Rent

More Foreclosures Coming

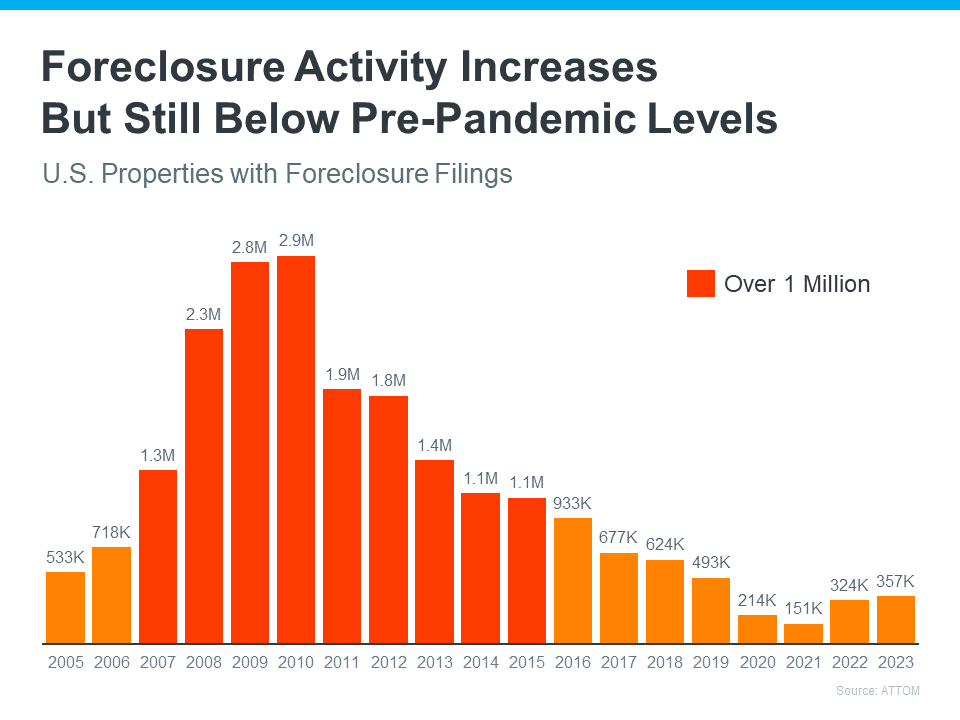

U.S. foreclosures are the highest since the pandemic’s start

by Liz Hughes 2022

January foreclosure filings were the highest since the start of the pandemic, according to a new report.

ATTOM found 23,204 U.S. properties had foreclosure filings last month rising 29% from December and up 139% from a year ago.

Rick Sharga, executive vice president of RealtyTrac said January’s increased level of foreclosure activity wasn’t a surprise as it tends to slow down in November and December before picking up after the start of the new year.

“This year, the increases were probably a little more dramatic than usual since foreclosure restrictions placed on mortgage servicers by the CFPB expired at the end of December,” he said in a press release.

In January lenders repossessed 4,784 properties through the completed foreclosure process, an increase of 57% from December and up 235% from last year. January was the seventh consecutive month of increases.

Six states had at least 100 or more foreclosures with the greatest monthly increase. They included Michigan which was up 622%, Georgia up 163%, Texas with a 98% increase, Tennessee up 50% and Alabama with a 44% increase.

Additionally, five major metros with populations of more than 200,000 had the greatest number of increases. They included Detroit with 1,013, Chicago with 210, New York City at 129, Miami with 113 and Philadelphia with 107.

Nationally, one in every 5,922 homes had a foreclosure filing in January. The highest foreclosure rates in January were in New Jersey (one in every 2,336 housing units), Illinois (one in every 2,740), Nevada (one in every 3,119), Michigan (one in every 3,127) and Ohio which had one in every 3,251.

In areas with populations of at least 200,000, the highest foreclosure rates were in Detroit (one in every 1,547), Atlantic City (one in every 1,564), Cleveland, Ohio, (one in every 1,659), Columbia, South Carolina, (one in every 1,921) and Trenton, New Jersey, (one in every 2,299).

Despite the large increases, Sharga said it’s important to keep these numbers in context.

“Foreclosure completions are still far below normal levels — less than half as many as in January of 2020 before the pandemic was declared, and about 60% lower than the number of foreclosure completions in 2019,” he said. “We’re likely to continue seeing large year-over-year percentage increases for the rest of this year, but it’s also likely that foreclosure activity will remain below historically normal levels until the end of 2022.”

In January foreclosure starts rose in 33 states including the District of Columbia. Lenders began the foreclosure process on 11,854 properties nationally last month, an increase of 29% from December and up 126% from a year prior.

Boston Condos for Sale

More Foreclosures Coming

While the expiration of the federal moratorium on foreclosure filings continues to impact homeowners struggling with the economic effects of the pandemic, the pace of filings has slowed from the initial shock that followed the end of the moratorium on July 31.

According to real estate data provider ATTOM Data Solutions, foreclosure filings, which include default notices, scheduled auctions or bank repossessions, rose 5% in October on a monthly basis and 76% from October 2020, to 20,587 filings.

“As expected, now that the moratorium has been over for three months, foreclosure activity continues to increase,” said Rick Sharga, executive vice president at RealtyTrac, an ATTOM company. “But it’s increasing at a slower rate, and it appears that most of the activity is primarily on vacant and abandoned properties, or loans that were in foreclosure prior to the pandemic.”

Among the 220 U.S. metropolitan statistical areas tracked by ATTOM, Miami and Chicago had some of the highest foreclosure rates, alongside Trenton, N.J., St. Louis and Cleveland. At the state level, Illinois, Florida, New Jersey, Nevada and Ohio had the highest foreclosure rates.

The start of the foreclosure process picked up speed in October nationwide, with a 5% month-over-month increase and a 115% surge from October 2020. New York, Miami, Los Angeles, Houston and Atlanta led the way among major metro areas by foreclosure starts.

“Most foreclosure activity for the next few months is likely to be foreclosure starts, since virtually nothing entered the foreclosure process during the past year,” Sharga said in the release. “The ratio of foreclosure starts to foreclosure completions will normalize over time as we get back to normal levels of activity.”

Foreclosure completions rose 13% month over month and 17% year over year, ATTOM said. Major urban areas with the highest foreclosure completions were St. Louis, Chicago, Baltimore, Philadelphia and New York.

![]()

_____________________________________________________________________

_

Boston Condos for Sale

_______________________________________________________________________________________________________________________________________________________________________________________

Colleen M. Sullivan reports in this week’s Banker & Tradesman that almost 70 percent of Bay State homeowners who purchased a home between 2003 and 2007 with some kind of second loan are now underwater.

That translates to about 71,000 homeowners throughout the state who owe more on their homes than they are currently worth. I wonder, how many of those 71,000 homes will go into foreclosure?

File Under: Danger ahead.