Millennials gain a foothold in the Boston real estate for sale market

Boston Real Estate

The millennials are bouncing back. The group surpassed baby boomers to make up the largest share of homebuyers between June 2022 and 2023. The National Association of REALTORS® (NAR) revealed this notable shift in its latest Home Buyers and Sellers Generational Trends report.

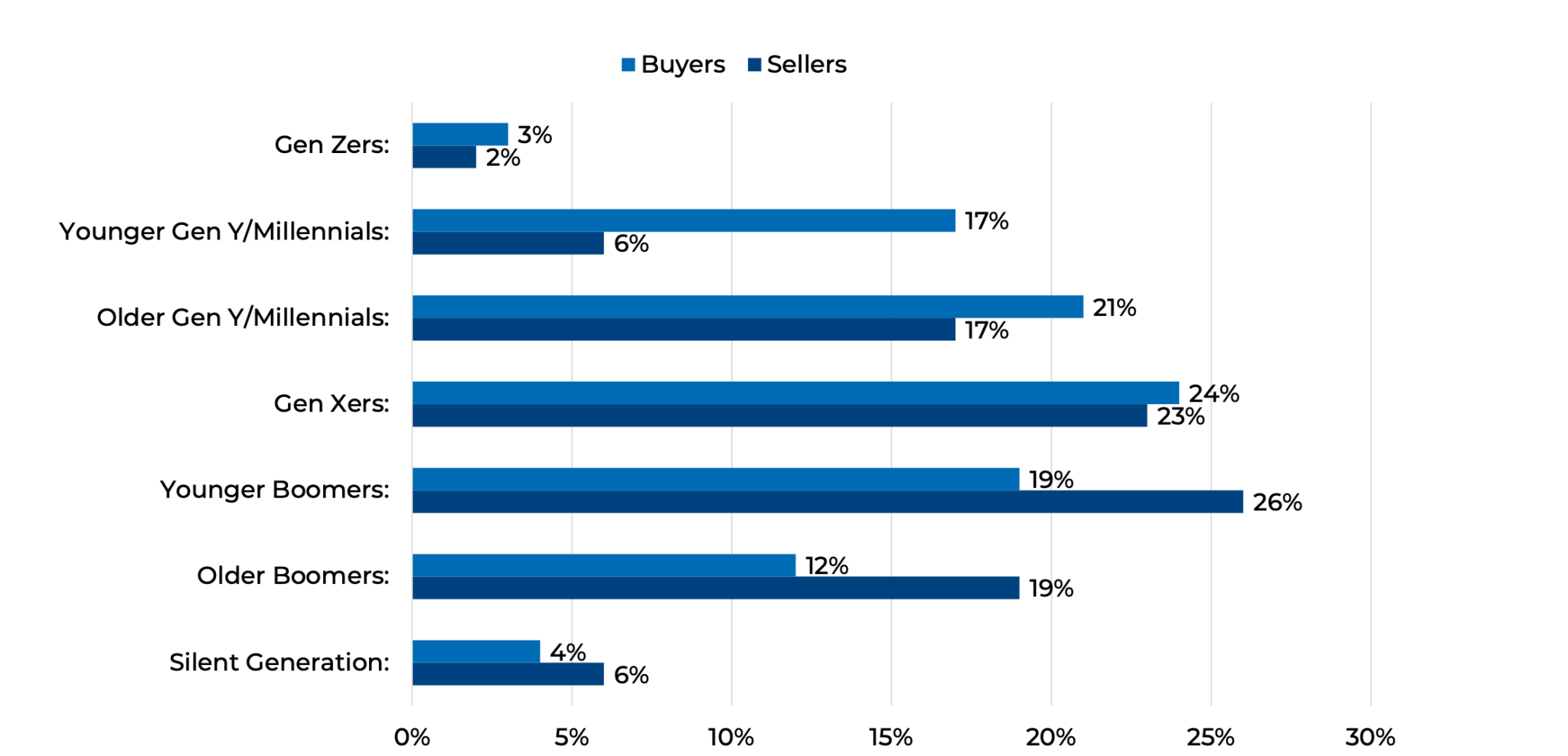

Share of homebuyers and homesellers by generation

Based on surveys with thousands of representative homebuyers from that period, the report provides a detailed picture of the most recent purchasing class. In last year’s version, baby boomers out-bought millennials for the first time in eight years. Now, however, millennials have reclaimed their No. 1 spot, accounting for 38% of the 4.7 million home sales across the U.S., while baby boomers accounted for 31%. Boomers were followed by Gen X (24%), the Silent Generation (4%) and Gen Z (3%).

For the terms of this study, millennials included everyone aged 25 to 43, although the large group was also considered as two sub-groups, younger millennials (aged 25 to 33) and older millennials (aged 34 to 43). Younger millennials accounted for 17% of sales while older millennials accounted for 21%.

Age group breakdown

The millennial bump coincided with an overall rise in first-time buyers across generations, with 32% of recent buyers purchasing for the first time. That’s an increase of 6% year over year, and younger millennials led the surge. Seventy-five percent of younger millennial homebuyers purchased for the first time during the period of study, followed by 44% of older millennial homebuyers and 24% of Gen X homebuyers.

“Younger millennials [are] stepping into homeownership for the first time, and older millennials [are] transitioning to larger homes that suit their evolving needs,” NAR Deputy Chief Economist and Vice President of Research Jessica Lautz said in a press release.

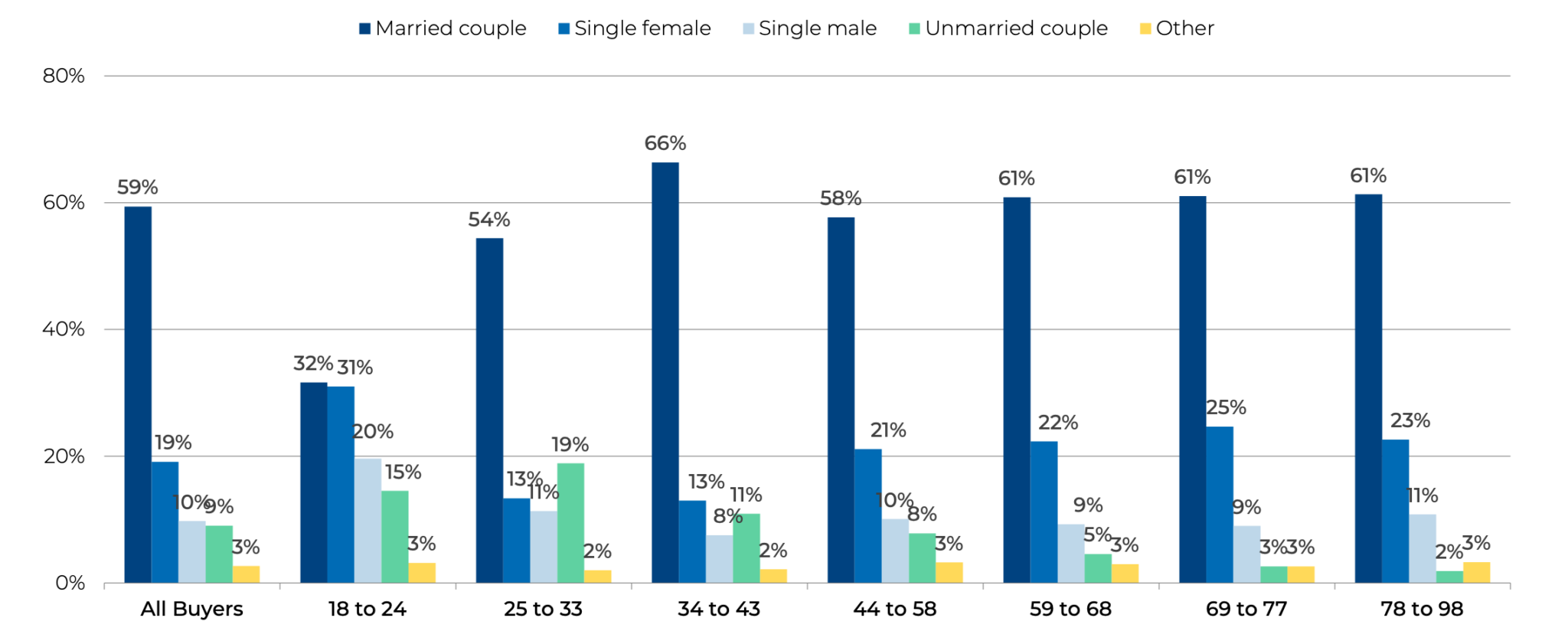

Older millennials had the highest income levels reported, with a median household income of $127,700 (followed closely by Gen X with $126,900). In turn, they also had the highest share of married couples purchasing, at 66%.

Meanwhile, younger millennials had the highest share of unmarried couples purchasing, at 19%. They were the most educated group, with 80% holding a bachelor’s degree or higher.

Single buyers were also common among Gen Z, the still-emerging demographic. NAR considered all buyers aged 18 to 24 as Gen Z and though they accounted for just 3% of all buyers, 31% of those purchasers were single females. That proportion is significantly higher than any other generation’s.

“Gen Z buyers are entering the housing market, and their demographics are emerging distinctly from other age groups,” Lautz said. “More than half are single buyers, outpacing all age groups of single men and single women.” She also pointed out that they are also most likely to identify as LGBTQ+.

The adult composition of homebuyer households

However, when it comes to selling homes, baby boomers remain in the lead. Boomers made up 45% of total sellers; younger boomers (aged 59 to 68) made up 26% while older boomers (aged 69 to 77) made up 12%. Both millennials and Gen X accounted for 23%, trailed by the Silent Generation, at 6%, and Gen Z, at 2%.

“Baby boomers continue to dominate the home-selling market as they make pivotal decisions regarding their retirement living situations, whether it’s right-sizing or moving closer to loved ones,” Lautz said.

Younger baby boomers were also the most likely to reside in their home for more than 16 years before moving. Their median tenure was 20 years. “Benefiting from longer periods of homeownership compared to other generations, boomers approach these transactions with substantial equity, enabling strategic housing trades,” Lautz concluded.

In all, 82% of total buyers across generations felt their home purchase was a good financial investment, with younger millennials feeling most strongly, at 86%. The desire to simply own a home was their most common reason for buying, as opposed to boomers and the Silent Generation, who reported moving to be closer to family and friends at higher rates.

Additionally, the majority of homebuyers, 89%, worked with a real estate agent, although the internet was the most common way that shoppers found their eventual home. All age groups but the Silent Generation reported using the internet, rather than an agent, to make that discovery although millennials used the internet at higher rates.

Still, across all generations, buyers were generally satisfied with their agent’s work. Seventy-five percent of buyers said they would definitely use their agent again or recommend them to others. Similarly, 73% of sellers were likely to reuse or refer their agent.

Millennials gain a foothold in the Boston real estate for sale market

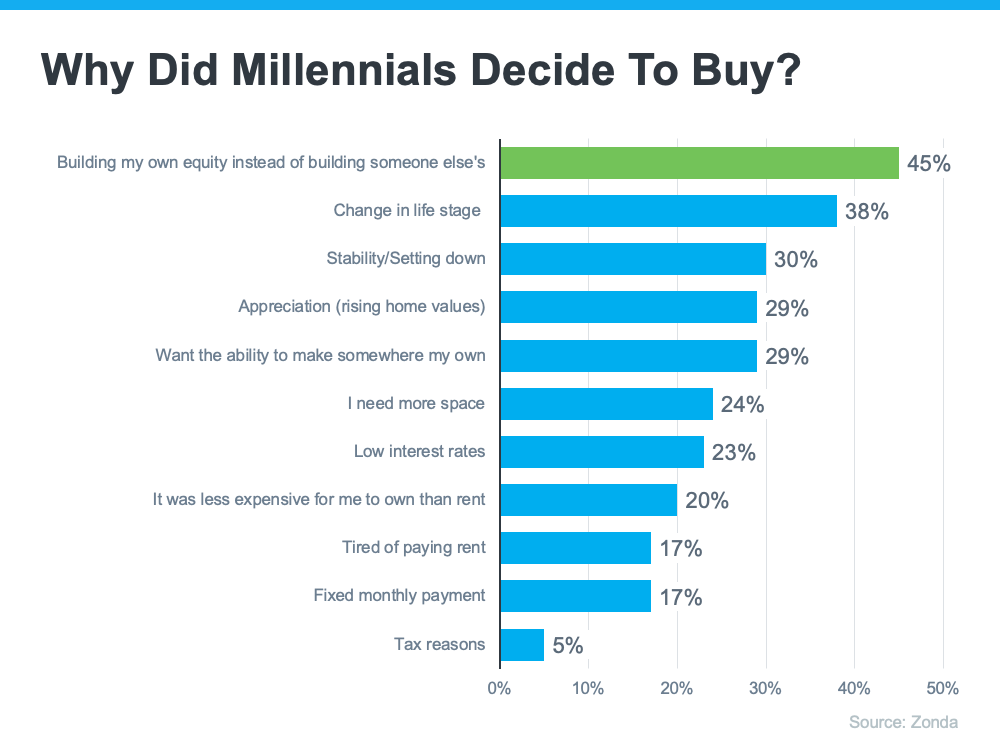

In the United States, there are over 72 million millennials. If you’re part of that generation and have thought about buying a home, you aren’t alone. According to Zonda, 98% of millennials want to become a homeowner at some point if they aren’t already. But why? There are plenty of reasons you may choose to become a homeowner. Here’s why other millennials have made that decision (see graph below):

This graph shows why millennials are buying homes according to Zonda’s 6th annual millennial survey. The top reasons include building equity, a change in life stage, wanting stability, rising home values, and wanting to make somewhere truly their own. Here’s a look at each in more detail.

Building home equity –

Homeownership is a long-term investment that allows you to build wealth, increase your net worth, and become more financially stable. Beyond that, the alternative to owning a home is typically renting. With the way rents have risen so dramatically over time, it may make sense to build your own equity instead of the equity of the person you’re renting from.

A change in life stage –

As a millennial, you’re reaching your prime homebuying years. That means you may be at the point where you need more space or a different location.

Stability or settling down in a home –

This could mean establishing your career or just generally deciding more concretely what you want your life to look and feel like. As that idea becomes clearer, you may want to establish that lifestyle in a particular place and put down roots.

Rising home values –

By purchasing a home, you own an asset that traditionally increases in value over time. That can mean your home will have a higher resale value if you decide to move again.

Wanting to make somewhere “mine” –

Owning a home gives a sense of freedom because you can customize it however you want, make updates as you see fit, and be yourself in a place that’s solely your own.

Boston Condos Bottom Line

There are plenty of great reasons why millennials are buying homes today. If you’ve thought about becoming a homeowner and any of these reasons resonate with you too, let’s connect to explore your options.

_______________________________________________________________________________________________

Millennials gain a foothold in the Boston real estate for sale market

Millennials that were slow to make the transition from renting a Boston apartment to owning a Boston condo are now making up for lost time.

This demographic has become a powerful force in the home buying market. The 66 million Millennials in the U.S. now range in age between 24 and 42, which puts them firmly in that “sweet spot” for homebuyers. In fact, Millennials are expected to form 25 million new households by 2025.

Who are the fastest growing group of homebuyers?

Whether they are shopping for a first home, upgrade or relocation, Millennials are the fastest growing group of homebuyers. According to the National Association of REALTORS, Millennials represent 43 percent of all homebuyers.

What do Millennials expect in the home-buying process?

Millennials grew up in the Internet age, and they are accustomed to seamless, on-demand digital experiences. They use smartphones to order everything from a mocha latte to furniture, and increasingly, they are relying on mobile apps for a variety of important transactions, such as banking, financial planning and managing their healthcare. Millennials bring those same expectations with them when it comes to that home-buying and home-closing experience.

This generation also demands transparency into transactions and instant communication. Serving the Millennial customer requires delivering information and an overall experience that is fast, convenient and frictionless.

What do Millennials expect with Boston condo closings?

Flexibility: When it comes to Boston condo closing, flexibility is the key. Millennials prefer to be fully remote with a remote online notary (RON) from the comfort of their home – not in a lawyers conference room.

_______________________________________________________________________________________________

Millennials gain a foothold in the Boston real estate for sale market

As they come of peak age for first-time homeownership, millennials are gaining an increasing share of today’s Boston real estate market.

Since 2016, millennials have comprised the largest share of home-purchase mortgage applications, rising even higher in 2020, when they made up more than half of overall applications, according to a recent CoreLogic report.

Today, as the millennial generation approaches the peak age of first-time homeownership, their home purchases are soaring. Millennials’ share of home purchases grew an average of 2% to 4% per year between 2014 and 2019, rising from 33% to 47%. In 2020, that share grew to 54%, thanks to both natural growth and the pandemic’s impact, which included record-low mortgage rates and the flexibility of working remotely.

CoreLogic found the share of millennial first-time homebuyer mortgage applications to be even higher, at 79% in 2020, up 5% from 2019.

However, Apartment List’s 2021 Millennial Homeowners Report showed that although millennial homeownership rates rose sharply over the past five years, they continued to lag previous generations. At age 30, 42% of millennials owned homes, compared to 48% of Gen Xers and 51% of Baby Boomers.

Homebuyer demand from millennials is likely to continue, as those under 30 have yet to become homeowners, while older millennials are at the stage of purchasing their next homes. CoreLogic found the share of millennial repeat buyer home-purchase applications was 35% in 2020, just 4% percent lower than Gen X.

Affordability is one of the biggest roadblocks facing millennials, especially following the pandemic, the Apartment List report found.

More than three-quarters of those surveyed said they were waiting until they have the financial means or are married or committed to homeownership with a life partner before buying a home. Forty percent said the pandemic had a big effect on their plans, with 21% delaying a purchase due to partial or total income loss or a reduction of down-payment savings.

Record-low interest rates have made it easier to finance a home with a good down payment, but many millennial renters can’t afford that upfront cost. The majority of those surveyed by Apartment List doesn’t have a down payment saved, despite future homebuying plans. According to the report, only 15% saved more than $10,000, less than what’s needed to cover a 20% down payment on a median-priced condo.

There is declining optimism over the prospect of homeownership among millennial renters. In 2020, 18.2% of them said they planned to rent forever, up from 12.3% in 2019 and 10.7% in 2018, according to the report.