Looking to buy a Boston Seaport condo? Credit scores play a big part

Boston Real Estate Search

Looking to buy a Boston Seaport condo? Credit scores play a big part

Looking to buy a Boston Seaport condo? Credit scores play a big part

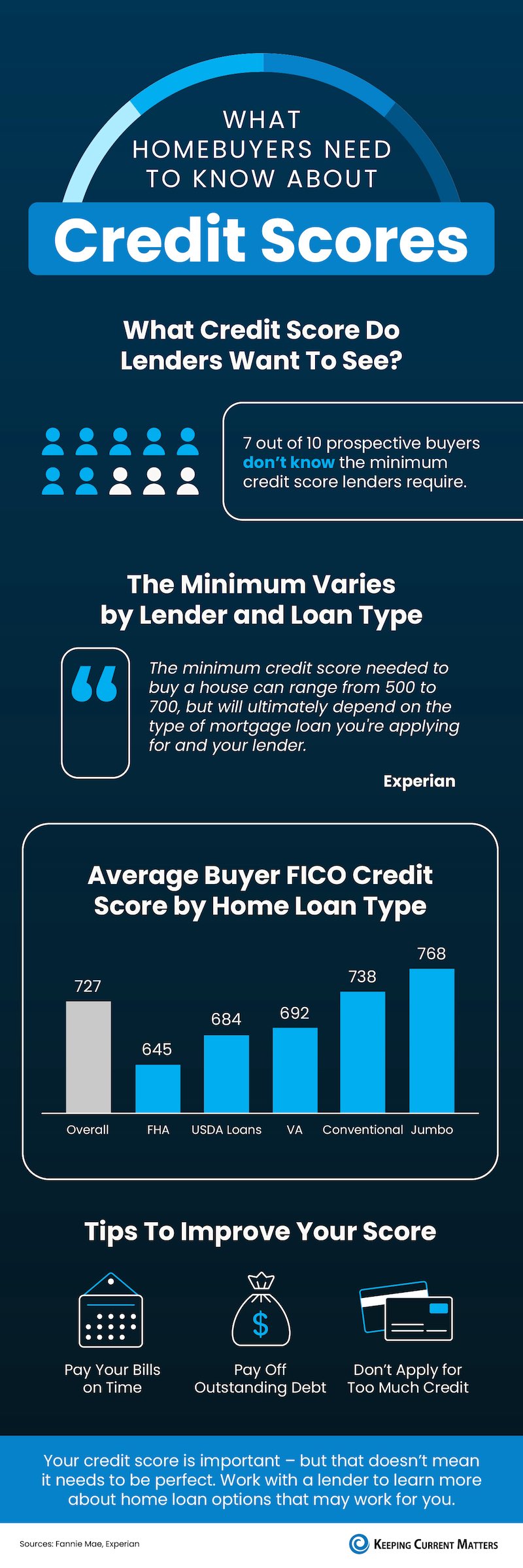

If you’re thinking about Seaport condo for sale, you should know your credit score’s a critical piece of the puzzle when it comes to qualifying for a home loan. Lenders review your credit to assess your ability to make payments on time, to pay back debts, and more. It’s also a factor that helps determine your mortgage rate. An article from Bankrate explains:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

This means your credit score may feel even more important to your homebuying plans right now since mortgage rates are a key factor in affordability, especially today. According to the Federal Reserve Bank of New York, the median credit score in the U.S. for those taking out a mortgage is 765. But, that doesn’t mean your credit score has to be perfect. An article from Business Insider explains generally how your FICO score range can make an impact:

“. . . you don’t need a perfect credit score to buy a house. . . . Aiming to get your credit score in the ‘Good’ range (670 to 739) would be a great start towards qualifying for a mortgage. But if you’re wanting to qualify for the lowest rates, try to get your score within the ‘Very Good’ range (740 to 799).”

Working with a trusted lender’s the best way to get more information on how your credit score could factor into your home loan and the mortgage rate you’re able to get. As FICO says:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders may use to determine your actual interest rates.”

If you’re looking for ways to improve your score, Experian highlights some things you may want to focus on:

- Your Payment History: Late payments can have a negative impact by dropping your score. Focus on making payments on time and paying any existing late charges quickly.

- Your Debt Amount (relative to your credit limits): When it comes to your available credit amount, the less you’re using, the better. Focus on keeping this number as low as possible.

- Credit Applications: If you’re looking to buy, don’t apply for other credit. When you apply for new credit, it could result in a hard inquiry on your credit that drops your score.

When you’re ready to start the homebuying process, a lender will be able to assess which range your score falls in and tell you more about the specifics for each loan type.

Boston Condos and the Bottom Line

With affordability challenges today, prioritizing ways you can have a positive impact on your credit score could help you get a better mortgage rate. If you want to learn more, let’s connect.

____________________________________________________________________________________________________

Looking to buy a Boston Seaport condo? Credit scores play a big part

Not only do you need at least a minimum credit score to qualify for a mortgage, but the interest rate that you will pay is also determined in a large part by how high your credit score is. For most mortgages, the minimum credit score needed to buy a house is 620. There are a few lenders that will allow you to qualify for an FHA loan with a score below 600 but these are very few and far between. A higher score significantly improves your chances of approval. Borrowers with a score under 650 only make up a small number of homebuyers who ultimately close the purchase of a home. Every way you look at it, the higher you can raise your credit score, the better off you’ll be before locking in a mortgage.

For example, a $350,000 30-year mortgage at 6.3% will have a $2,166 monthly payment (without property taxes and insurance). That same $350,000 loan at 5.5% will have a $1,987 monthly payment. The monthly difference of $179 might not seem like much at first glance but it can make a substantial difference. From a lender’s debt-to-income perspective, that amount doubles because your monthly debt goes up by $179 and your monthly spendable income goes down by the same amount. From your personal financial perspective, it means you have $2,148 less to spend each year.

Different lenders have slightly different criteria for assigning interest rates to credit scores. Generally, the range looks something like this:

800 or higher – Excellent

740-799 – Very good

670-739 – Good

580-669 – Fair

579 or lower – Poor

An example of interest rates for different scores would be something like a score between 660 to 679 being given an interest rate of 5.36%. A score between 620 to 639 is given an interest rate of 6.34%. If your score is on the cusp of these general ranges, it is worth the effort to shop around for a lender that has a breakpoint that gives you a better interest rate.

Tips to Improve From a Good Credit Score to a Great Credit Score

If your score is already in the 700s, you’re in decent shape — but you may be wondering how to take your score from good to great. There are different credit scores used by lenders but by far the most common is the FICO score which operates on a scale from 300 to 850. Trying for a perfect score is almost impossible and probably not worth the effort. However, striving for a score in the high 780s to 800+ can be worth your time.

These tips assume you’ve already done what is needed to bring your score up to at least 690 or 700 — meaning you don’t have a bankruptcy, you’ve cleaned up any errors on your credit report, etc.

Tip #1. Always pay on time. Always. With an already decent score, this is the most influential factor to improve it even more. On your credit report, late payments are known as “delinquencies.” They stay on your report for 7 years but the older these are, the less they count towards your current score. Most have little impact after 2 years. Remember everything on your credit report is automated so being even a day late will make the payment delinquent. This can be a good reason to use automated payments if you aren’t always prompt about paying your bills on time. Having a checking account that automatically draws from your savings account when needed can also be a good idea.

Tip #2. Don’t close old accounts. These can show a longer history of you being a responsible borrower. Having the balance available also helps your credit utilization ratio (see below). In most cases, having older (including unused) accounts on your report will boost your score.

Tip #3. Pay attention to your credit ratio. This is the difference between your credit limit and the current balance you owe. The general rule of thumb with the credit ratio is to stay below 30% utilization. That means that if your limit is $10,000, your balance should be around $3,000. You can improve this by either wisely increasing the limit or more wisely, decreasing the amount that you owe.

Tip #4. Continue monitoring your credit score for errors. You’d be surprised how many and how frequently errors are reported on people’s credit reports. At a minimum, pull your free annual report from each major reporting agency. If you have to pay for an up-to-date copy shortly before applying for a mortgage, it can be worth the small fee. Do this about three months before applying for a mortgage because it takes time to have errors removed.

Tip #5. Establish a good mix of credit types. This is a good indication to lenders that you are among the most responsible borrowers. All types of credit are not the same when calculating your credit score. Different common types of credit include unsecured credit cards, secured car loans, and personal loans. Store credit cards are at the low end of the spectrum and needing a co-signer is even less desirable. But… you do need to have credit to improve your credit score. If you have paid off all your debt, good for you. However, you might want to consider opening a credit account to keep your score current. This could be taking out a low-interest loan that you know you can pay on time, every time. Maybe instead of paying all cash for a car, make a big down payment and take on a small loan. Or a credit card that you can make a small charge on each month and keep the ratio of the amount borrowed to the limit at close to 30%.

In the end, on-time payments and your credit ratio tend to have the most impact when you are trying to move your good credit score to great.

Updated: Boston Real Estate Blog 2024

![]()

Click Here to view: Google Ford Realty Inc Reviews

__________________________________________________________________________________________________________________________________

In today’s market, nearly every lender in the country is requiring a minimum credit score of 620 or higher. Unfortunately, this eliminates nearly one-third of potential homebuyers according to Zillow. The other two-thirds of buyers may qualify for a loan but will need a score above 740 to get the best rates. If your score falls between 620 and 740, there will most likely be an adjustment to your rate, or you could possibly miss out on credit that you would have otherwise received.

If you are below 620 or just below 740, here are a few things you can do to raise your score while looking for a Boston Seaport condo for sale:

Pay your bills on time-

Sounds simple, but one recent late payment can drop your score significantly.

Keep your debt ratios low-

If your credit limit on your credit card vs. your balance is too high, you can lose significant points. I have seen 30 points or more for a single credit card. Never have your credit cards maxed out when trying to buy a Boston Seaport condo

Opening up new credit-

If you open up a new credit card or buy a car, this can negatively impact your score as well. Generally speaking it is not a good idea to open anything when getting ready to buy a Boston condo for sale or during the process. There are some circumstances where one may have little to no credit where opening up a new credit card can be positive for your score. You would want to consult an expert in this case.

Don’t close your credit card accounts-

Generally speaking, it is not a good idea to close a credit card that you are no longer using. If you do so, you could potentially eliminate a positive piece of credit from your score which can significantly drop your score. Every credit report and situation is different, so make sure that you get professional help before making changes to your credit profile.

Boston Real Estate Blog Updated 2024

If you are in the market for a new house, you may be overlooking one key to your success: your credit score.

That three-digit number has a direct impact on your ability to get a mortgage and what interest rate you will pay.

To get that low rate though, you’ll have to have a good credit score.

“Even a quarter-point or half-point can make a really big difference over the long haul on a large loan amount,” said Ted Rossman, senior industry analyst at Bankrate and CreditCards.com.

Credit scores range between 300 and 850. A good score is between 670 and 739, very good is from 740 to 799, and 800 and up is considered excellent, according to FICO, a leading credit-scoring company.

If you don’t measure up, it doesn’t necessarily mean you are shut out of the market. There are several moves you can make to improve your score.

First, check your credit history

You are allowed one free credit report a year from the three main credit-scoring companies: Experian, Equifax and TransUnion. You can reach out to each directly or you can access them through annualcreditreport.com.

Not only should you know your score, but you should also make sure there are no mistakes or unintended skeletons in your closet, like a missed payment you forgot about.

Pulling your report before you apply for a mortgage or pre-approval, ideally a few months in advance, will give you time to correct any issues.

Pay bills on time

Late or missed payments can knock down your score.

The easiest way to avoid that is to set up automated payments for your bills, said Faron Daugs, founder and CEO of Harrison Wallace Financial Group.

Lower your credit utilization ratio

Even if you pay your credit card bills in full each month, you may still have a high utilization rate, Rossman pointed out.

For example, if you make $3,000 in purchases and have a $5,000 limit, you are using 60% of your available credit. Try to keep it below 30%, Rossman said. Those with the best credit scores keep it below 10%.

Making an extra payment in the middle of the billing cycle can help knock the balance down before the statement comes out.

Become an authorized user on someone’s credit card

If you have no credit, one of the best ways to start building it is becoming an authorized user on someone else’s card.

Don’t rock the boat

If you are looking to purchase a home, hold off on any other big-ticket items, like a car. Also, don’t open or close any credit cards until after the mortgage is approved, Rossman suggested.

Boston Seaport condos for sale

View Boston Seaport condos for sale

Related Links

Boston Seaport condos for sale $1,000,0000 – $1,200,000

Boston Seaport condos for sale under $2M

Sorry we are experiencing system issues. Please try again.

Sorry we are experiencing system issues. Please try again.

[fruitful_recent_posts posts=”4″ style=”bordered” cols=”4″ show_thumbs=”on” thumb_width=”255″ thumb_height=”240″ thumb_radius=”4″ show_date=”on” show_header=”on” show_excerpt=”on” excerpt_len=”30″ show_metadata=”off”]

Boston condos for sale for 2024

Charlestown condos for sale under $1M for 2024

Boston downtown condos for sale for 2024

Boston High rise condos for sale

Boston Midtown condos for sale 2024