“John, is this a good time to buy a Boston downtown condo?” Let me try to answer that question

Boston Real Estate for Sale

“John, is this a good time to buy a Boston downtown condo?” Let me try to answer that question

After months of sitting on the sidelines, many homebuyers who were priced out by high mortgage rates and affordability challenges finally have an opportunity to make their move. With rates trending down, today’s market is a sweet spot for buyers—and it’s one that may not last long.

So, if you’ve put your own move on the back burner, here’s why maybe you shouldn’t delay your plans any longer.

As you weigh your options and decide if you should buy now or wait, ask yourself this: What do you think everyone else is going to do?

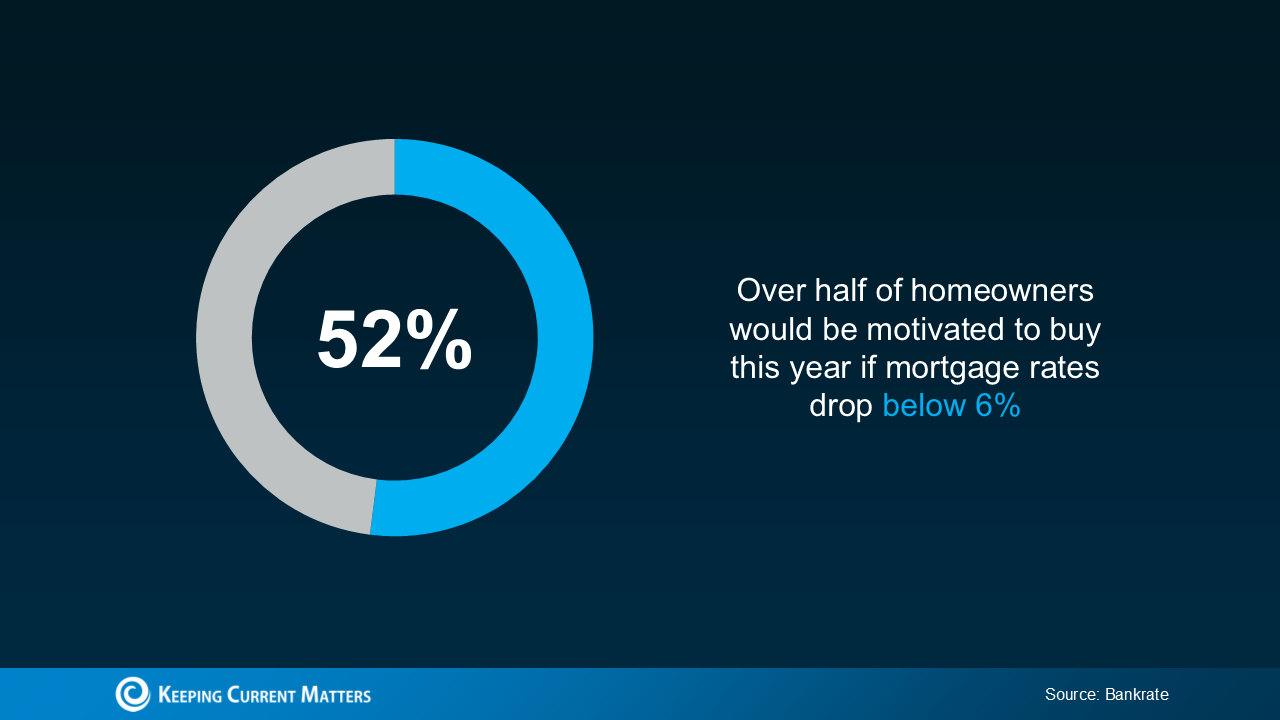

The truth is, if mortgage rates continue to ease, as experts project, more buyers will jump back into the market. A survey from Bankrate shows over half of homeowners would be motivated to buy this year if rates drop below 6% (see graph below):

With rates already in the low 6% range, we’re not terribly far off from hitting that threshold. The bottom line is, that when they drop into the 5s, the number of buyers in the market is going to go up – and that means more competition for you.

With rates already in the low 6% range, we’re not terribly far off from hitting that threshold. The bottom line is, that when they drop into the 5s, the number of buyers in the market is going to go up – and that means more competition for you.

That increased demand will likely push home prices up, which could potentially take away from some of the benefits you’d gain from a slightly lower interest rate. As Nadia Evangelou, Senior Economist and Director of Real Estate Research at the National Association of Realtors (NAR), explains:

“The downside of increased demand is that it puts upward pressure on home prices as multiple buyers compete for a limited number of homes. In markets with ongoing housing shortages, this price increase can offset some of the affordability gains from lower mortgage rates.”

So, while waiting to buy may seem like a smart move, it could backfire if rising prices outpace your savings from slightly lower rates.

What This Means for You

Right now, you’ve got the chance to get ahead of all of that. Today’s market is a buyer sweet spot. Why? Because a lot of other buyers are waiting – which means not as many people are actively looking for homes. That means less competition for you.

At the same time, affordability has already improved quite a bit. Recent easing in mortgage rates has made homeownership more accessible. As Mike Simonsen, Founder of Altos Research, says:

“Mortgage payments on the typical-price home are 7% lower than last year and are 13% lower than the peak in May 2024.”

And while the supply of homes for sale is still low, it’s also higher than it’s been in years. According to Ralph McLaughlin, Senior Economist at Realtor.com:

“The number of homes actively for sale continues to be elevated compared with last year, growing by 35.8%, a 10th straight month of growth, and now sits at the highest since May 2020.”

This means you now have more options to choose from than you’ve had in quite a while.

With fewer buyers in the market, improving affordability, and more homes to choose from, you have the chance to find the right one before the competition heats up.

Why Waiting Could Cost You

If you’re waiting for the perfect time to buy, it’s important to understand that timing the market is nearly impossible. The longer you wait, the higher the risk that market conditions will shift—and not necessarily in your favor. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“It’s one of those things where you should be careful what you wish for. A further drop in mortgage rates could bring a surge of demand that makes it tougher to actually buy a house.”

Boston Condos and the Bottom Line

Don’t wait until you have to deal with more competition and higher prices – you already have the chance to buy a home while we’re in the sweet spot today. Connect with an agent to make sure you’re taking advantage of it.

Love thy neighbor

Byline – John Ford Beacon Hill Condo Broker

Boston Apartments for Rent Updated Every 15 Min for 2024 Apartment

All Beacon Hill Apartments with Reduced Fees for 2024

Some of our apartments have reduced Boston real estate fees

Sorry we are experiencing system issues. Please try again.

_______________________________

“John, is this a good time to buy a Boston downtown condo?” Let me try to answer that question

Boston Condos for Sale and Apartments for Rent

If you’re thinking about buying a home, you want to know the decision will be a good one. And for many, that means thinking about what home prices are projected to do in the coming years and how that could impact your investment.

This year, we aren’t seeing home prices fall dramatically. As the year goes on, however, some markets may go up in value while others may lose value. That’s why it’s helpful to keep the long-term view in mind. Experts project a return to a steadier rate of price appreciation in the years that follow.

Home Price Appreciation in the Years Ahead

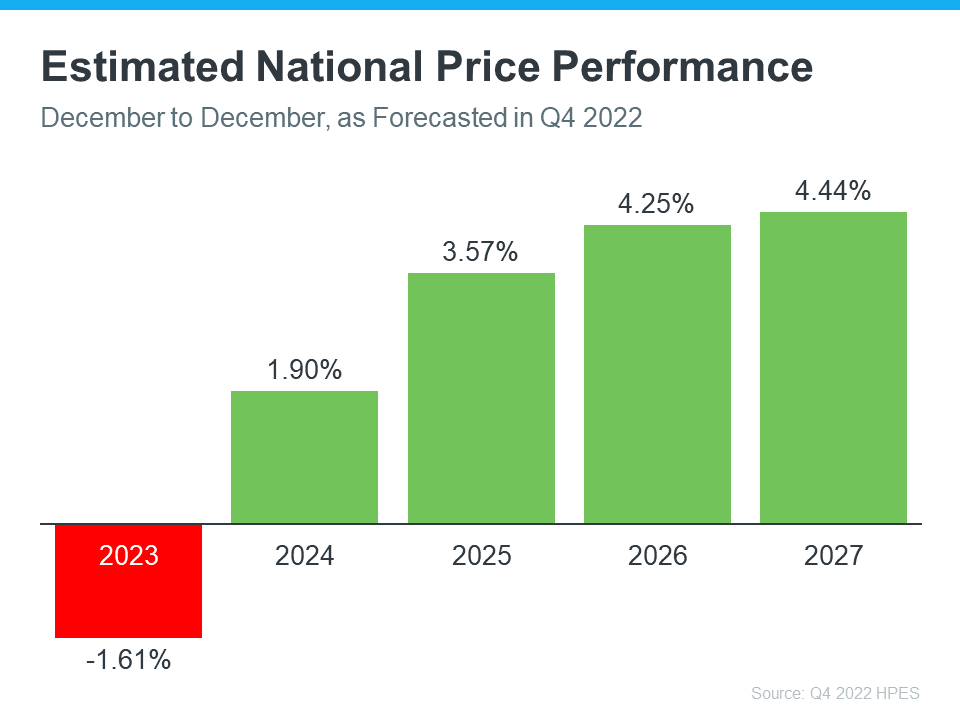

Over 100 economists, investment strategists, and housing market analysts were polled by Pulsenomics in their latest quarterly Home Price Expectation Survey (HPES). The report indicates what they believe will happen with home prices over the next five years. As the graph below shows, after mild depreciation this year, these experts forecast home prices will return to more normal levels of appreciation through 2027.

The big takeaway is experts aren’t forecasting a drastic fall in home prices nationally, even though some markets will see home price appreciation while others may depreciate. And when they look further out, they see steady price appreciation in the long run. That’s a great example of why homeownership wins over time.

What Does This Mean for You?

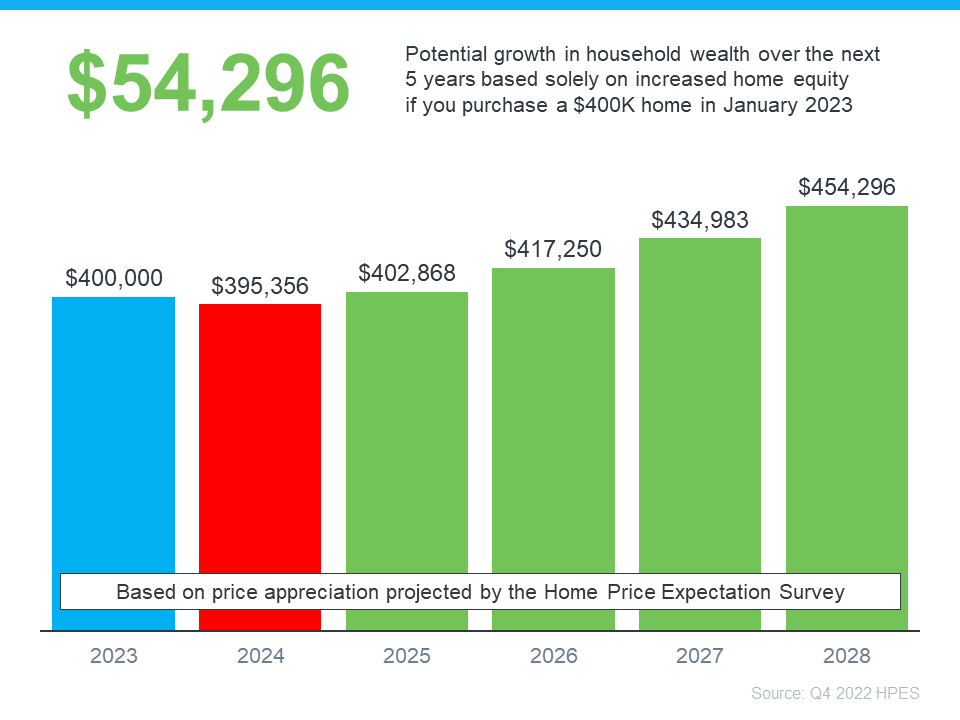

Once you buy a home, price appreciation raises your home’s value, and that grows your household wealth. Here’s how a typical home’s value could change over the next few years using the expert price appreciation projections from the survey mentioned above (see graph below):

In this example, if you bought a $400,000 home at the beginning of this year and factor in the forecast from the HPES, you could accumulate over $54,000 in household wealth over the next five years. So, if you’re wondering if buying a home is a sound decision, keep in mind what a strong wealth-building tool it is long term.

Boston Condos for Sale and the Bottom Line

According to the experts, while we may see slight depreciation this year, home prices are expected to grow over the next five years. If you’re ready to become a homeowner, know that buying today can set you up for long-term success as home values (and your own net worth) are projected to grow. Let’s connect to begin the homebuying process today.

______________________________________________________________________________________________________________________________

This past year has been a low Boston condo inventory market. As result, downtown Boston condos are selling. And on the buyer side, while the inventory is down, the interest rates are historically low. It has been an ideal time to make a move on both sides. It still is the best time, however, we are beginning to see shifts that indicate a changing market…

This ideal market is not going to last forever. If you are not currently in your forever home and plan on making a move in the next couple of years, it would be a good idea to shift your timeline now. This way you can get the most out of your home sale or take advantage of these extremely low-interest rates.

We are beginning to see Boston condominium inventory rise along with the time on the market, so if you have the opportunity to make your move now, do it. Now is the time to take action!

Boston Condos for sale Sale and Rent

________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Question from Beacon Hill renter: Hello John, my parents have been pushing me to stop paying Beacon Hill apartment rent and buy a Boston condo or one in the suburbs. I’m 29 and single. I guess that I’m at the age when I should be looking at buying a home but I still like the freedom that renting gives me.

Financially, I can swing buying a home. My income is between $70k – $100k (with bonuses) and the last of my student loan will be paid off late this year. Is buying a home really the right thing for me to do?

Answer: Hello Beacon Hill Renter

You might not like my answer, but here it is: Only you can decide if now is the right time to buy a Boston condo. I’m sure that you know your parents have your best interests in mind. Here are my thoughts at your age buying now will build equity for the rest of your life. Owning a home will probably be your biggest asset when you approach retirement age but today that seems a long way off.

Something else you should consider is the stress that comes with buying a first downtown Boston condo. It’s a relatively complex process that requires considerable time to understand and look at a lot of options to make the best decision for your circumstances. Buying a first piece of real estate is a life event. It might not rate all of the ways up there with getting married or having children but it is probably in the top five for most people.

You could become a Boston real estate investor today and still rent an apartment that you’re not tied down to. Investing as a landlord at your age gives you plenty of flexibility while building equity at the same time. A big advantage of being a landlord is that your renters will pay your mortgage and other expenses. With that said, this is not the ideal time to try to rent out a Boston condo.

Buying Boston real estate and the Bottom Line

I tried in my answer to give you pros and cons in buying a Boston condo in this market. Let me conclude and simplify my answer with this, today is a good time to buy a Boston condo, I would hold off on the burbs at this time, the market is too hot.

Always remember this, the Boston real estate market consistently repeats the same cycle. It’s like other markets where you want to buy low and sell high. The cycle has high, middle, and low points. Beginning in 2012, prices have been screaming up. In 2021, the market seems to be coasting along in the middle of the cycle. But once the pandemic passes the prices are again going to be going up. To time the market is very tough I would look now as I feel interest rates are the lowest you’ll see in your lifetime. You could wait for the next low point but in the real estate cycle that seldom makes sense because from my 20 plus years in the Boston real estate market it’s very rare that prices go down so significantly, that’s worth trying to time the market. At the best, they just go stagnant. But trust me a year from now interest rates will be higher.

This is a very good time to buy a Boston condo for sale. The real question you should be asking is if you want to build equity or NOT build equity?