Is it becoming a Boston condo buyers market?

Boston Condos for Sale and Apartments for Rent

Is it becoming a Boston condo buyers market?

I’m not sure but that, but Redfin thinks so.

There are more Boston condos for sale on the market right now than there have been in months – and that could be a game changer for you if you’re ready to buy a Boston Seaport condo. Let’s look at two reasons why.

You Have More Boston condos To Choose From

An article from Realtor.com helps explain just how much the number of homes for sale has gone up this year:

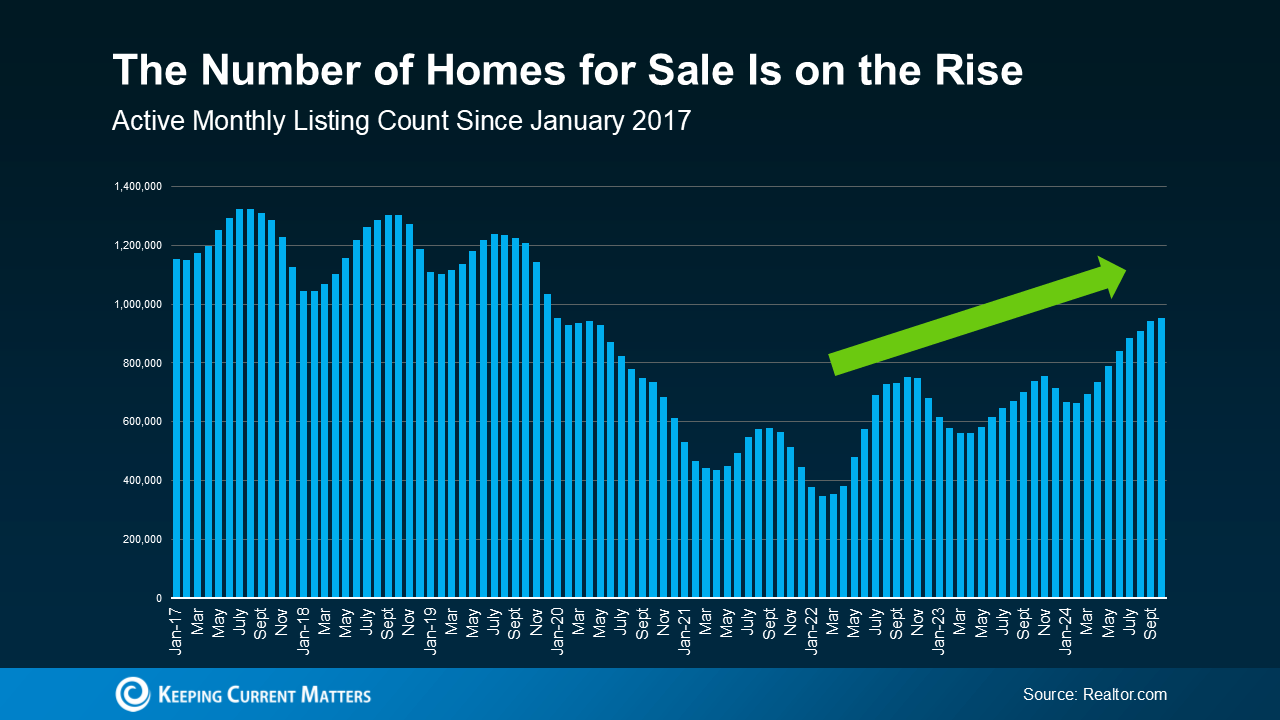

“There were 29.2% more homes actively for sale on a typical day in October compared with the same time in 2023, marking the twelfth consecutive month of annual inventory growth and the highest count since December 2019.”

And while the number of Boston condos for sale on the market still isn’t quite back to where it was in the years leading up to the pandemic, this is definitely an improvement (see graph below):

With more homes available for sale now, you have more options to choose from. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, explains:

With more homes available for sale now, you have more options to choose from. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, explains:

“Though still lower than pre-pandemic, burgeoning home supply means buyers have more options . . .”

That means you have a better chance of finding a house that meets your needs. It also means the Boston condominium buying process doesn’t have to feel quite as rushed, because more options on the market means you’ll likely face less competition from other buyers.

Home Price Growth Is Slowing

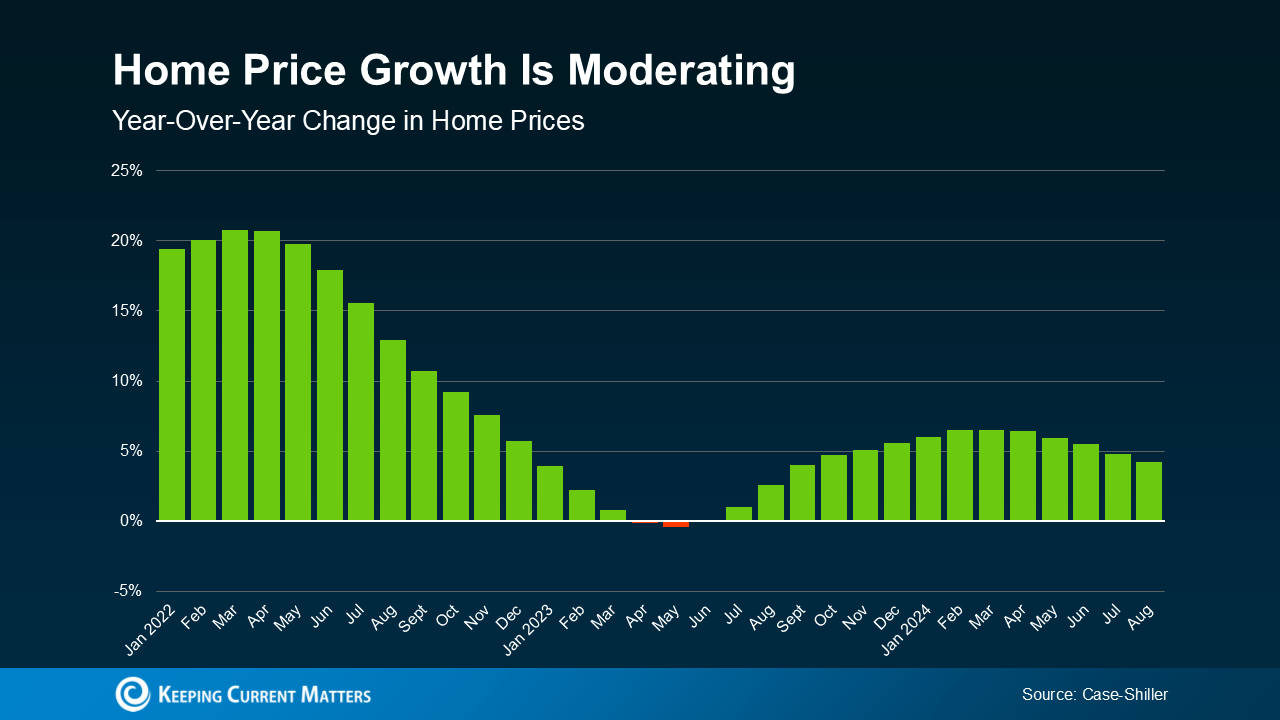

When there aren’t many homes for sale, buyers have to compete more fiercely for the ones that are available. That’s what happened a few years ago, and it’s what drove prices up so quickly.

But now, the increasing number of homes on the market is causing home price growth to slow down (see graph below):

In certain markets, the number of available homes has not only bounced back to normal, but has even surpassed pre-pandemic levels. In those areas, home price growth has slowed or stalled completely. As Lance Lambert, Co-Founder of ResiClub, explains:

In certain markets, the number of available homes has not only bounced back to normal, but has even surpassed pre-pandemic levels. In those areas, home price growth has slowed or stalled completely. As Lance Lambert, Co-Founder of ResiClub, explains:

“Generally speaking, housing markets where active inventory has returned to pre-pandemic 2019 levels have seen home price growth soften or even decline outright from their 2022 peak.”

Slower or stalled price growth could give you a better chance of finding something within your budget. As Dr. Anju Vajja, Deputy Director at the Federal Housing Finance Agency (FHFA), says:

“For the third consecutive month U.S. house prices showed little movement . . . relatively flat house prices may improve housing affordability.”

But remember, inventory levels and home prices are going to vary by market.

So, having a real estate agent who knows the local area can be a big advantage. They can help you understand the trends in your community, which can make a real difference in finding a home that fits your needs and budget.

Boston Condos and the Bottom Line

More housing options – and the slower home price growth they bring – can help you find and buy a home that works for your lifestyle and budget. So don’t hesitate to reach out to a local real estate agent if you want to talk about the growing number of choices you have right now.

May marks a turning point in the housing frenzy, homebuyers starting to regain control

Homebuyers are finally starting to regain some control.

May was a turning point in the pandemic housing frenzy, according to a new Redfin report, which saw home inventory climb to a new high and more sellers dropping their prices.

But that all comes at a great cost as record-high prices, along with the 5% mortgage rates continues to keep many buyers out of the market. Last month a record 57% of homes sold above list price, up from 51% a year earlier.

Redfin’s economics research lead Chen Zhao said the sudden surge in mortgage rates led to May’s sudden and significant housing market cooldown.

“However, mortgage rates are now stabilizing and homes remain in short supply, so while we do expect home-price growth rates to decline, we don’t expect prices to fall much at the national level,” Zhao said. “For homebuyers trying to determine the best timing this year, the main benefit of waiting is that there may be less competition as supply starts to build up.”

Redfin found fewer Google searches for “homes for sale” during the week ended May 21, down 10% from a year earlier. Its Homebuyer Demand Index, which measures requests for tours and other services, fell 9% year over year during the week ended May 29, the seventh consecutive decline in the index.

Additionally, mortgage applications fell 14% from last year as the 30-year mortgage fell slightly to 5.09% for the week ended June 2. With that, the monthly mortgage payment on a median asking price home fell slightly to $2,391 up 40% from $1,710 a year earlier, when mortgage rates were 2.99%.

In the four weeks ended May 29, active listings fell 10% year over year (the smallest decline since April 2020). The median asking price rose 17% from 2021 to $412,450. Meanwhile, the median sale price increased 16% year over year to a record $400,999.

Fifty-four percent of homes went under contract with an accepted offer within the first two weeks of being listed, up from 53% last year. Thirty-nine percent of homes went under contract with an accepted offer within one week, remaining flat from last year.

Homes on the market fell to a record-low 15 days, a drop from 19 days in 2021. And they continue to sell well above the asking price. A record 57% of homes sold above list price last month, up from 51% a year earlier.