Investors are no longer gobbling up real estate

Boston Condos for Sale and Apartments for Rent

Investors are no longer gobbling up real estate

Are you trying to buy a Boston Fenway condo but you feel like you’re up against deep-pocketed Wall Street investors snatching up everything in sight? Many people believe mega investors are driving up prices and buying up all the homes for sale, and that’s making it hard for regular buyers like you to compete.

But here’s the truth. Investor purchases are actually on the decline, and the big players aren’t nearly as active as you might think. Let’s dive into the facts and put this myth to rest.

Most Real Estate Investors Are Small, Not Mega Investors

A common misconception is that massive institutional investors are dominating the market. In reality, that’s not the case. The Mortgage Reports explains:

“On average, small investors account for around 18% of the market, while mega investors represent only about 1%.”

Most real estate investors are mom-and-pop investors who own just a few properties — not large corporations buying up entire neighborhoods. They’re people like your neighbors who have another home they’re renting out or a vacation getaway.

Investor Home Purchases Are Dropping

But what about the big investors you hear about in the news? Lately, those institutional investors – the ones that make headlines – have pulled back and aren’t buying as many homes.

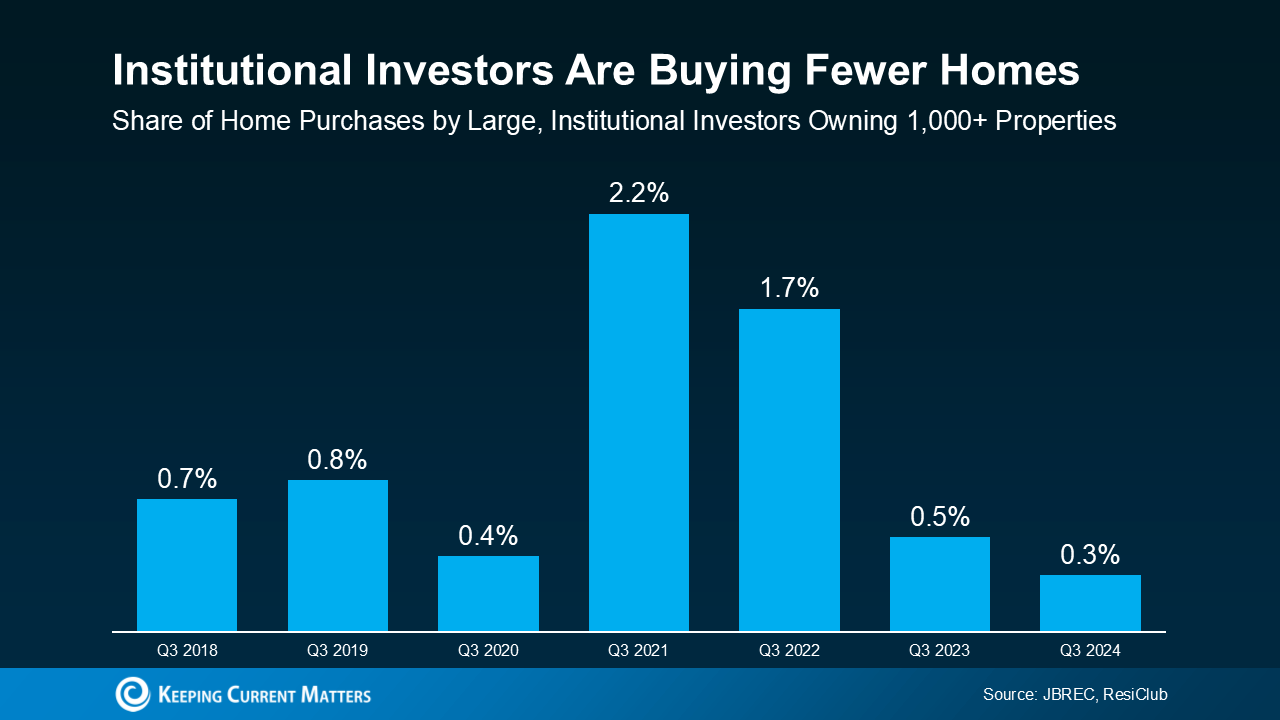

According to John Burns Research and Consulting (JBREC), at their all-time peak in Q2 2022, institutional investors (those owning 1,000+ single-family homes) only made up 2.4% of home sales. And that number has only come down since then. By Q3 2024, that number had fallen to just 0.3% (see graph below):

That’s a major shift, and it means far fewer investors are competing in the market now than just a few years ago.

That’s a major shift, and it means far fewer investors are competing in the market now than just a few years ago.

Investors are clearly more reluctant to buy in today’s market, but why? The answer is largely because higher mortgage rates and home prices have made it less attractive for them.

The idea that Wall Street investors are buying up all the homes and making it impossible for you to compete is a myth. While some investors are still in the market, they’re not nearly as active as they were in past years.

Boston Condos and the Bottom Line

Big institutional investors aren’t buying up all the homes – if anything they’re buying less than they have been. Connect with a local real estate agent to talk about what’s happening in your local market. There could be more opportunities than you think.

Have faith and you’ll be able to complete your Boston Fenway condo goals.

Peace be with you

___________________________________________________________________________________________-

Investors are no longer gobbling up real estate

__________________________________________________________________________________________

Happy Spring!

Peace be with you

Investors took a hard pivot away from home purchases in the third quarter, as rising borrowing costs appeared to reverse the sector’s record activity in a matter of months.

Real Estate Investors Purchases Dropped 30.2%

Investor home purchases dropped 30.2 percent year-over-year last quarter, according to Redfin data. Outside of the onset of the pandemic, it was the biggest decline in investor home purchases since the Great Recession.

Investor purchases dropped 26.1 percent from the second quarter, outpacing overall home sales decline of 17.4 percent in the same period.

The grip investors have held on the housing market is declining, too.

After peaking at 20.2 percent in the first quarter, the share of home purchases made by investors was 17.5 percent in the third quarter. That’s down from the previous quarter and the previous year, but still slightly up from pre-pandemic levels.

Slowing growth across home prices and apartment rents have added to investors’ hesitance,

“It’s unlikely that investors will return to the market in a big way anytime soon,” Redfin senior economist Sheharyar Bokhari said.

Cooling Real Estate Market

Investors may have slowed down purchases, but there are some glimmers of possibility in the cooling market. Homebuilders stuck with excess inventory are reportedly offering deep discounts to investors willing to buy in bulk, slashing up to 20 percent off retail value.

Major players are also trying to jump into the single-family rental market. JPMorgan Chase is teaming up with Haven Realty Capital to acquire $1 billion in single-family rentals.

Pandemic Boomtowns Saw the Biggest Declines

Redfin’s report said “pandemic boomtowns” lost the biggest share of investor home purchases. Phoenix saw the biggest year-over-year drop — down nearly 50 percent — and Miami marked a 37.7 percent decrease from the previous year. New York and Newark were among the five markets to see increases in investor purchases.

Overall, investors purchased $42.4 billion worth of homes in the third quarter, down 30.5 percent from the previous quarter and 26.3 percent year-over-year.The typical home investors bought cost roughly $452,000, an increase of 6.4 percent year-over-year but a 4.3 percent decline from the second quarter.

Happy Spring!

Peace be with you