Housing Wealth and Personal Consumption

Boston Condos for Sale Search

Housing Wealth and Personal Consumption

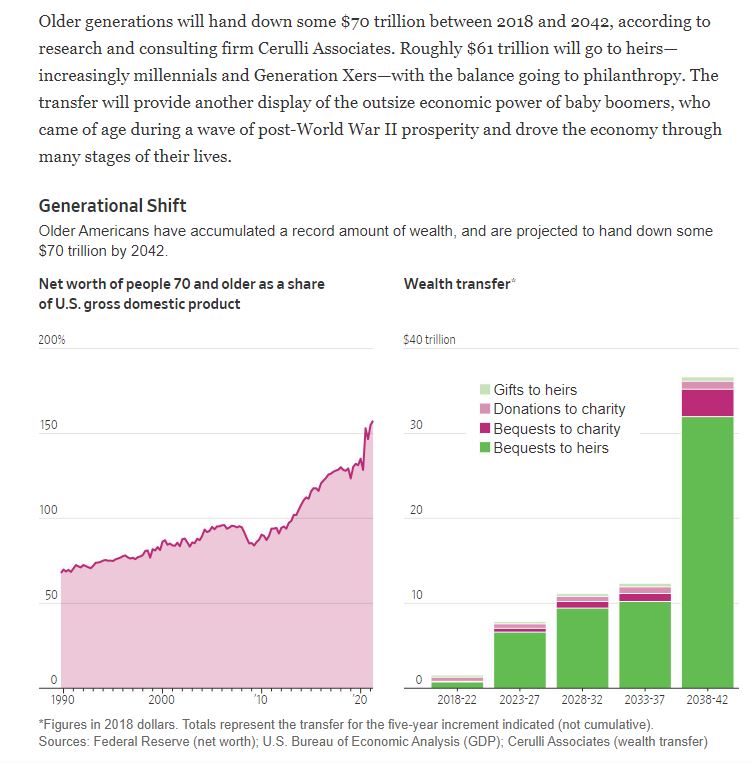

One of the main reasons that the real estate market could levitate at these price points is the monumental wealth transfer between baby boomers and their kids. A major tax advantage is closing out at the end of 2025, and those with a healthy portfolio will be letting it flow – another opinion on it here:

Over $82 TRILLION will transfer from older to younger generations in the US over the next twenty years…..that is over $4 trillion of stimulus per year, every year, for the next 20 years!

Over the next 10 years, 1.2 million people worth at least $5 million will transfer an estimated $31 trillion to their heirs and about two-thirds of that extraordinary amount of wealth – or $19.9 trillion – is forecast to be passed on by 2033 by about 155,000 individuals with a net worth of $30 million or more according to research firm Altrata. That is MULTIPLES of the amount of stimulus spent on ALL Americans during COVID that many attribute to spiking inflation…..concentrated in a much, much smaller group, mostly wealthier already.

Yes, luxury market pricing could grow well beyond our imagination.

What might this do to luxury real estate? It’s very possible that we’re about to enter an era of RUNAWAY Luxe-flation. The ability for markets to keep up the supply for this growing demand is almost certain to trigger massive price hikes. That $1,000 per night hotel room that is now $1,750 per night could easily go to $3,000. That $50 million Palm Beach mansion that now sells for $100 million could become a $250 million mansion. Yes, luxury and ultra luxury markets will see massive infusions of capital that may result in lowered buying power per dollar as prices soar.

If this capital infusion is not limited to luxury markets and spreads into other markets that simply cannot afford the higher prices, we may have a problem. Sadly, the pressures for less-wealthy people to squander their money on things that buy them perceived status keeps growing. If builders focus more on more profitable, more expensive properties, everyone else will suffer the consequences too.

Unless Congress acts, on Jan. 1, 2026, the estate, gift and generation-skipping transfer (GST) tax exemption amounts will be cut in half. A decrease in the exemption amount could result in significant additional transfer taxes for families with federally taxable estates. However, there is still ample opportunity for high-net-worth families to plan to utilize the current exemption amounts. This article will explore potential wealth transfer opportunities to capture and utilize the exemption amount before it may be lost.

In 2017, the Tax Cuts and Jobs Act (TCJA) doubled the existing estate and gift tax exemption amounts from $5.6 million per person (or $11.18 million per married couple) to $11.18 million per person (or $22.36 million per married couple), indexed for inflation annually. In 2023, the estate and gift tax exemption amount is $12.92 million per person (or $25.84 million per married couple).

The TCJA is set to expire at the end of 2025. Let’s assume that the estate and gift tax exemption amount has increased to $14 million by this time (due to adjustments for inflation). In that case, if Congress does not act, the exemption amount would decrease to about $7 million per person or $14 million per married couple. This loss in exemption amount could increase overall transfer taxes for certain families by millions of dollars.

We’ve been in a similar position in prior years and have seen that congressional gridlock can make reaching an agreement on preserving or increasing the exemption extremely difficult. While it is uncertain what, if any, tax-related legislation will come out of Congress in 2024 and 2025, it may be wise to explore one’s options to use the current existing exemption well before 2026.

If you can afford to use a portion or all of your existing exemption amount before Jan. 1, 2026, the amount used now cannot later be taken away from you. It has also been confirmed that if you use more exemption during life than is available at death (due to the decrease), the IRS cannot impose estate tax on those “excess” gifts as part of the taxpayer’s taxable estate when they pass. (Please note that there are some minimal exceptions to this rule for certain types of gifts made within three years of death.)

In addition, it’s important to note that when using your exemption during your life, you use it from the “bottom up.” This means that if you have $12.92 million of exemption and you use $6 million by making a gift (leaving you with $6.92 million), if the exemption amount is then cut in half, the $6 million of exemption you have used is considered to come out of the remaining amount, not the amount that was taken away.

In the above example, if you make a $6 million gift and the exemption amount is cut in half from $14 million to $7 million, you will have only $1 million remaining for future gifts or to shield assets from taxes upon your death. Consequently, locking in the exemption amount that may be taken away requires large gifts close to or at the full exemption amount before the amount potentially drops.

Read the full article here:

https://www.kiplinger.com/retirement/estate-tax-law-changes-how-to-prepare

________________________________________________

Housing Wealth and Personal Consumption

Are you wondering if our local housing market could maintain current pricing – or even go higher? It’s possible, and if it happens, a major reason will be baby boomers pitching in to help their kids buy a home.

Compare the 2018-2022 era to what’s expected to happen over the next 20 years (chart above).

And then there’s this:

It’s hard to determine exactly how many Boston condo buyers are receiving help from their parents, in part because few are willing to discuss how they’re paying for a new home. But financial advisors say they’ve seen a wave of ultra-wealthy parents seeking advice on buying homes for their kids because of the increased gift and estate tax exemption.

The Tax Cuts and Jobs Act doubled the amount that Americans can pass on to heirs tax-free, to about $12 million for individuals and $24 million for couples in 2022. It will sunset at the end of 2025, when the exemption is scheduled to be cut in half.

It’s not just for the ultra-wealthy either. Every homeowner has picked up enough additional home equity lately that they might find a way to tap into it to help out their kids:

Unfortunately, the generational wealth transfer will do nothing to add to the supply of homes for sale – it will only create more demand of affluent buyers playing with money that’s been given to them.

The Fed will be forced to keep trying to control inflation, and Rob Dawg thinks mortgage rates will get as high as 7.25% (and they could go higher). It will cause an uncomfortable frenzy-transition period because the longer it takes, the more money will be inherited. Yikes!

How long will people wait and see?

Updated: Boston Real Estate Blog 2023

Click Here to view: Google Ford Realty Inc Reviews

Consumers react more to changes in their home values than changes in their investment portfolios according to a recent study.

Real estate economists at UCLA and the University of Southern California found that a 10% decline in housing wealth would result in a $105 billion, or 1.2% drop in personal expenditures.