Boston Condos for Sale and Apartments for Rent

Higher mortgage rates for borrowers

Last Friday was an interesting day for mortgage rates and the broader bond market. Rates began the day roughly in line with Thursday’s latest levels, but bonds lost ground throughout the morning. Multiple lenders adjusted rates higher before 1:30pm. After that, headlines made the rounds regarding the potential Russian invasion of Ukraine, which sent bond yields lower. By the end of the day, many lenders adjusted rates slightly lower.

The new week began with Russian Foreign Minister Lavrov making a series of comments that helped to moderate the more dire tone from Friday. Markets followed in lock step with rates rising to undo a majority of Friday’s improvement. This left the average mortgage lender roughly in line with Friday’s highs. That equates to 30yr fixed rates over 4.0% for most scenarios.

Russia/Ukraine headlines continued throughout the day. Although this did cause some volatility at times, markets progressively tuned out. Moreover, geopolitical risk is not destined to be the key market moving consideration unless things get appreciably worse. Even then, the primary narrative remains focused on inflation and the Fed’s evolving policy response.

Boston Condos for Sale and Rent

Higher mortgage rates for borrowers

- The average contract interest rate for 30-year fixed-rate mortgages increased to 3.10% from 3.03% in the past week.

- Applications to refinance a home loan decreased 1% last week from the previous week.

- The average loan size for a purchase application reached $410,000, its highest level since May.

Higher interest rates took some recent wind out of the sails in the mortgage market.

After gains the previous week, total mortgage application volume fell 1.1% last week from the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances of up to $548,250 increased to 3.10% from 3.03%. Points, including origination fee, rose to 0.34 from 0.30 for loans with a 20% down payment.

“Increased optimism about the strength of the economy pushed Treasury yields higher following last week’s FOMC meeting. Mortgage rates in response rose across all loan types, with the benchmark 30-year fixed rate reaching its highest level since early July 2021,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting.

Applications to refinance a home loan, which are highly sensitive to weekly rate movements, decreased 1% from the previous week and were essentially flat from a year ago. The increase in interest rates occurred late in the week and continued into this week, suggesting the negative effect on refinance demand will be more severe in next week’s report.

Mortgage applications to purchase a home fell 1% last week and were 12% lower than a year ago. The weakness in purchase demand is less about rising interest rates, which are still historically low, and more about sky-high home prices.

Prices nationally increased 19.7% year over year in July, up from an 18.7% annual increase in June, according to the latest S&P CoreLogic Case-Shiller Home Price Index. That’s another record increase.

Price gains are expected to soon start cooling slightly, simply because sales have dropped and more supply is coming on the market. Higher mortgage rates will also take some of the fuel out of rising prices, since potential buyers would face higher monthly payments.

_______________________________________________________________

Boston Condos for Sale

Higher mortgage rates for borrowers

Benchmark mortgage rates rose above the 3% mark once again, as bond markets responded to signs that the Federal Reserve could hike rates sooner than previously expected.

What is the 30-year fixed mortgage rate?

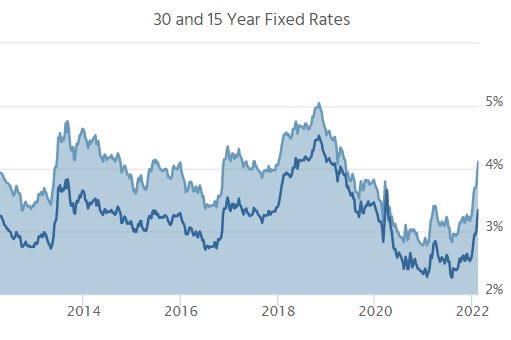

The 30-year fixed-rate mortgage averaged 3.02% for the week ending June 24, up nine basis points from the previous week, Freddie Mac FMCC, -4.62% undefined reported Thursday. It is the first time since late April that the benchmark rate has risen above 3%.

What is the 15-year fixed-rate mortgage rate?

The 15-year fixed-rate mortgage, meanwhile, rose 10 basis points to an average of 2.34%. The 5-year Treasury-indexed adjustable-rate mortgage averaged 2.53%, up one basis point from the previous week.

‘Markets once again appear to be in a holding pattern, waiting for the next bit of news that might push yields and rates in one direction or another, and they might not have to wait much longer.’

Boston Condos for Sale

Higher mortgage rates for borrowers

Record-low mortgage rates may now be a headline of the past.

The recent sharp rise in interest rates is now taking a toll on mortgage refinance demand, as the number of borrowers who could benefit shrinks.

Applications to refinance a home loan fell 5% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. They were also 43% lower compared with the same week one year ago. That is the first year-over-year drop since March 8, 2019. Last year at this time mortgage rates fell dramatically as fears of the coronavirus hit financial markets. That caused a large spike in refinance demand, hence this year’s comparison.

Now, several weeks of rising rates are dousing what was incredibly high demand for refinancing. That pulled total weekly mortgage application volume down 1.9% last week, according to the Mortgage Bankers Association’s seasonally adjusted index.

The average rate on the 15-year fixed rose for the first time in seven weeks, to 2.48%.

With higher rates now offering less potential savings, applications to refinance a home loan fell 5% for the week but were 87% higher than a year ago. That annual comparison had been more than 100% just last week