Boston Condos for Sale and Apartments for Rent

Good News for Sellers in the real estate market

With fewer people putting their homes on the market, housing prices have hit a new high, according to a recent Redfin report.

Housing prices were higher than they’ve been since last summer

Redfin found housing prices were higher than they’ve been since last summer with a 17% year- over-year increase. In fact, nearly three in five homes were purchased within two weeks, an all-time high as half sold for more than asking price, according to the report.

Strong housing competition

And that’s not helping prospective homebuyers, who are still in hot competition to find a new home, as new listings fell 7% nationally.

Redfin chief economist Daryl Fairweather said with all the geopolitical and economic uncertainties, it’s no surprise than many homeowners are staying put.

“High prices and rising mortgage rates are a strong impediment even for homeowners who would ideally like to move to a better home,” he said. “First-time homebuyers, on the other hand, are still seeking the security of homeownership despite the chaos of this market.”

In the four weeks ended March 20, active listings fell 23% year over year to an all-time low of 469,000. The median asking price rose 15% from 2021 to $398,850. Meanwhile, the median sale price increased 17% year over year to $379,230, the largest increase since the four weeks ended Aug. 1, 2021. Additionally, prices were up 6% from four weeks prior.

Real estate going under agreement in one week

Forty-five percent of homes went under contract with an accepted offer within one week of being listed, up from 41% last year. Fifty-nine percent of homes went under contract with an accepted offer within two weeks of being listed, a 6% increase from the year prior.

Homes going above asking price

Additionally, 50% of homes sold above list price, up from 39% last year.

The report also noted an 8% week-over-week decrease in mortgage applications during the week ended March 18, and 30-year mortgage rates rose to 4.42%, the highest level since January 2019 and up from 4.16% from the week prior.

Boston Condo Search

Loading...

Good News for Sellers in the real estate market

Well, this Boston real estate blog post appears to conflict with my earlier blog post. In my defense, the earlier real estate blog post was that sales nationwide were down in Feb 2021. This blog post is specific to the Boston real estate market.

Boston home sales remain brisk in February as median prices hit new highs

Boston-area home sales rose for the sixth month in a row in February as the median selling prices for both homes and condominiums hit new highs — a sign an extremely active market is likely for spring.

“Buyer enthusiasm has been through the roof over the first two months of the year, with many eager to get a head start on the traditional spring selling season,” Greater Boston Association of Realtors President Dino Confalone said in a press release. “There’s a lot of pent-up demand from buyers who’ve been house-hunting for months, if not years, and their search has become a year-long effort.”

February saw the fourth-highest sales total for the month, with the sale of 598 single-family homes, an 8.3% increase from 552 homes sold in February 2020, according to GBAR data released this week. While sales were high in February, there was still a 32.3% drop from the record 883 homes sold in January.

Condo sales were robust, too, with the second most-active February on record, with 635 condos sold, a 5.1% increase from the 604 units sold in February 2020. Condo sales did decline 17.1% from a record high of 766 units sold in January, however.

Record-breaking prices accompanied the robust sales activity for condos and single-family homes in February.

The median sales price for single-family homes reached a February high at $648,750, a 5.7% increase from $614,000 a year earlier, while the median sales price for condos rose 3.1% year over year to an all-time high for the month at $597,000.

Inventory continues to be a factor as the number of buyers continued to outpace inventory, giving sellers the upper hand with top-dollar asking prices.

“On top of that, many buyers find themselves having to compete to outbid one another, and that’s helping to drive up prices further,” Confalone said in the release. “Right now, buyer demand is strongest in the suburban single-family home market, especially in communities outside of Rte. 128, and that’s where we’ve seen home values rise most sharply over the past year.”

The report found the inventory shortage was most pronounced with single-family home listings, which fell 42.8% from 1,701 in February 2020 to 974. New listings were down 24.5% from 1,297 in February 2020 to 979.

Active condominium listings rose 17.4% year over year to 1,994 from 1,968, while new condo listings increased 7.4% to 1,188, compared to 1,106 in February 2020.

The GBAR report also found pending sales rose in February for the ninth consecutive month. Single-family homes placed under agreement were up 3.1% from February 2020 and 38.4% from January. Pending condominium sales climbed 24.9% year over year and 29% month over month.

————————————————————————————————————————————————————————————–

An older real estate Blog post

There were fresh signs that home prices in much of the country are stabilizing and the housing market is on the mend.

Because baby boomers tend to own in the best locations (they got there first), may not be in a hurry to sell)

Boston real estate

Nearly a third (31%) of home sellers are “extremely anxious” about selling their homes in 2020. The percentage of sellers in each age group who feel this way are:

- 37% of millennials

- 35% of Gen Xers

- 20% of baby boomers

Another 46% of sellers are “somewhat anxious” about a home sale this year, while 6% have no anxiety at all.

While 32% of home sellers already have their home listed for sale, more than 6 in 10 sellers (62%) haven’t put their home on the market yet. Another 6% previously listed their home, but have since taken it off the market.

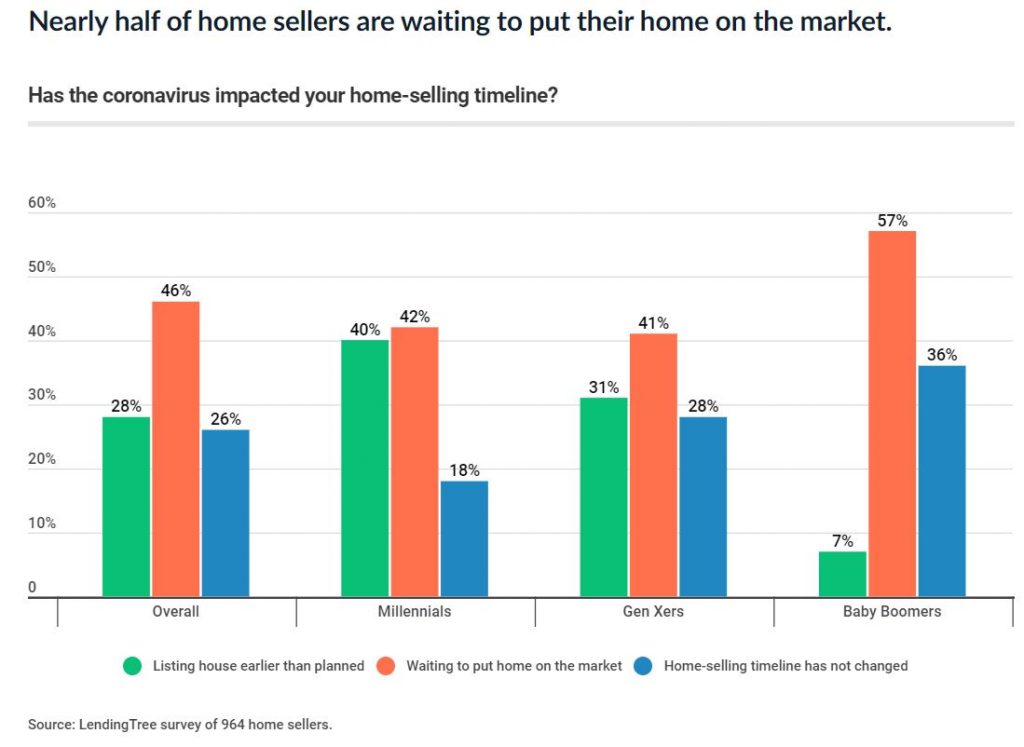

More baby boomers (57%) plan on waiting to put their home on the market, due to the COVID-19 pandemic, than Gen Xers (41%) and millennials (42%).

Boston Condo Search

Loading...