Good news for Boston condo mortgage rates

Boston Condos for Sale and Apartments for Rent

Good news for Boston condo mortgage rates

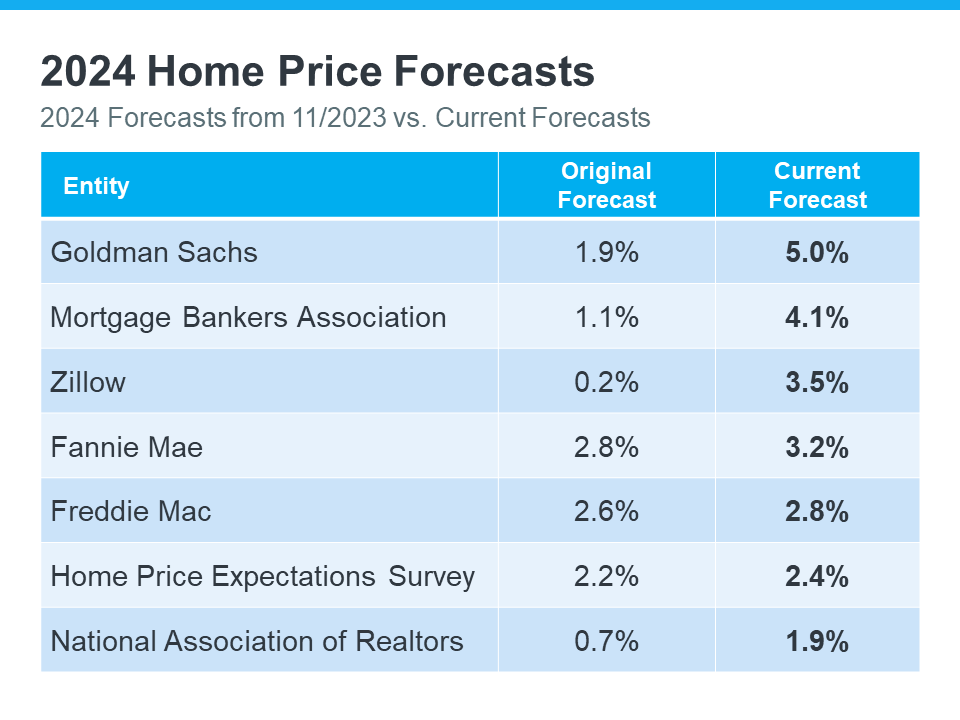

Good news Boston condo mortgage interest rates are making the news again. They have gone down to just over 6% for a 30-year mortgage. Experts believe that lower rates result in more Boston condo sales. That isn’t the case because we still have that old supply and demand problem. Expect home prices to increase as the demand is stronger than the supply.

Don’t get me wrong. I strongly favor lower interest rates. I just wish there were more Boston condos for sale for the middle class so that people could buy them.

******************************

Good news for Boston condo mortgage rates

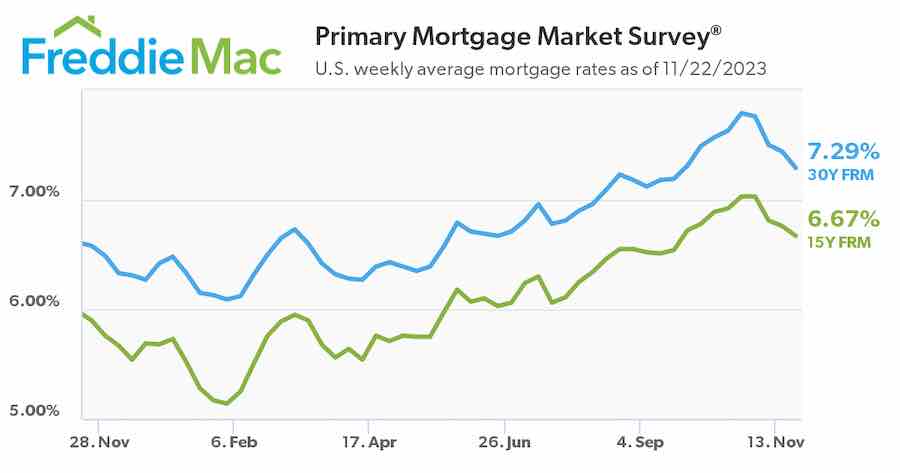

There’s a lot of confusion in the Boston condo for sale market about what’s happening with day-to-day movement in mortgage rates right now, but here’s what you really need to know: compared to the near 8% peak last fall, mortgage rates have trended down overall.

And if you’re looking to buy or sell a home, this is a big deal. While they’re going to continue to bounce around a bit based on various economic drivers (like inflation and reactions to the consumer price index, or CPI), don’t let the short-term volatility distract you. The experts agree the overarching downward trend should continue this year.

While we won’t see the record-low rates homebuyers got during the pandemic, some experts think we should see rates dip below 6% later this year. As Dean Baker, Senior Economist, Center for Economic Research, says:

“They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.”

And Baker isn’t the only one saying this is a possibility. The latest Fannie Mae projections also indicate we may see a rate below 6% by the end of this year (see the green box in the chart below):

The chart shows mortgage rate projections for 2024 from Fannie Mae. It includes the one that came out in December, and compares it to the updated 2024 forecast they released just one month later. And if you look closely, you’ll notice the projections are on the way down.

It’s normal for experts to re-forecast as they watch current market trends and the broader economy, but what this shows is experts are feeling confident rates should continue to decline, if inflation cools.

Boston Condos for Sale | Ford Realty Inc

What This Means for You

But remember, no one can say for sure what will happen (and by when) – and short-term volatility is to be expected. So, don’t let small fluctuations scare you. Focus on the bigger picture.

If you’ve found a home you love in today’s market – especially where finding a home that meets your budget and your needs can be a challenge – it’s probably not a good idea to try to time the market and wait until rates drop below 6%.

With rates already lower than they were last fall, you have an opportunity in front of you right now. That’s because even a small quarter point dip in rates gives your purchasing power a boost.

Boston Condos for Sale Bottom Line

If you wanted to move last year but were holding off hoping rates would fall, now may be the time to act. Let’s connect to get the ball rolling.

Where is Ford Realty Located?

Ford Realty is located in 137 Charles Street in Beacon Hill

Ford Realty – Condo for Sale Office

Updated: Boston Real Estate Blog 2024

Ford Realty Inc 2024 Google Reviews

Click here to view Ford Realty Google Reviews

Beacon Hill Condos for Sale

Updated: Boston Real Estate Blog 2024

Condo Broker 137 Charles St. Boston, MA 02114

Visit our office at 137 Charles Street, Beacon Hill MA 02114

Sorry we are experiencing system issues. Please try again.

Contact us directly and we can save you money on the broker fee.

We can be reached cell/text 24/7 at 617-595-3712

Sorry we are experiencing system issues. Please try again.

_____________________________________________

Good news for Boston condo mortgage rates

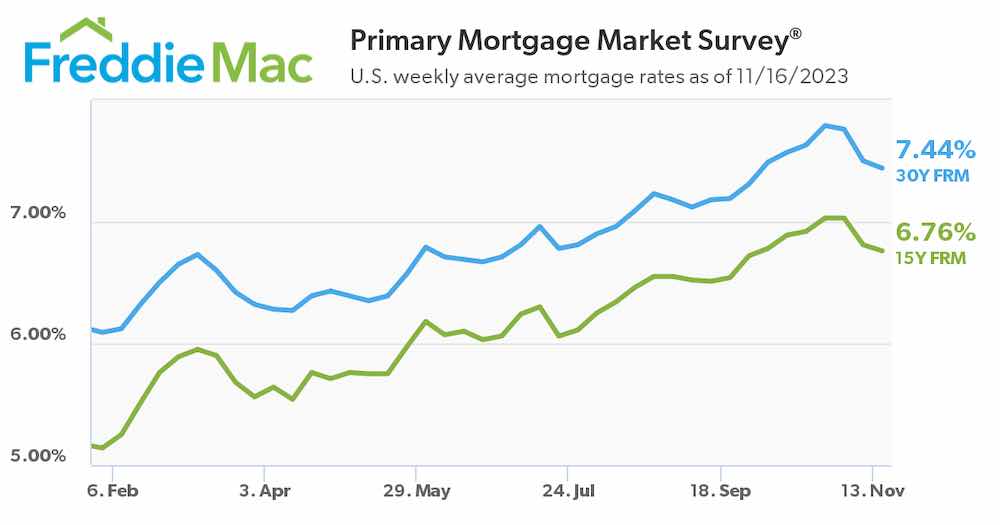

With another rate drop, the 30-year mortgage average has fallen to its lowest level since early August, plunging to 7.44%. Though many other loan averages moved down as well, several remained flat and refi averages included multiple increases.

_________________________________________________________

Good news for Boston condo mortgage rates

Mortgage rates over 7% but going in the right direction, thank God.

Yes, Boston condo mortgage interest rates are still ridiculously high but they are going in the right direction. When I purchased my first Boston condo for sale, I had to pay 8%, or 9% or more doesn’t mean 7.29% is a deal. Homes are proportionally more expensive today than they were in the 1980s. Houses have gone up by 310% since 1980. Wages have gone up about 17.5% since 1980.

If a lender or a real estate agent suggests that home buyers are dating the mortgage but marrying the house just walk away. It costs money to refinance and if housing prices level out or go down home buyers wishing to refinance may find themselves with no equity, or worse

___________________________________________________________________________________________________

Good news for Boston condo mortgage rates

_________________________________________________________________________

Good news for Boston condo mortgage rates

Mortgage rates held steady last week, leaving room for homebuyers and those looking to refinance to get in while the getting is relatively good.

Purchase and refinance applications both reached five-week highs last week after mortgage rates held steady from the previous week, according to a report from the Mortgage Bankers Association.

The seasonally adjusted purchase index increased 3 percent from the previous week as buyers tried taking advantage of the mortgage rate easing. Purchase applications were down modestly on an unadjusted basis from the previous week, but up 12 percent year-over-year.

The weeks mortgage rates have spent at 7.61 percent have marked a relative reprieve for buyers and refinancers after rates hovered around 8 percent earlier this fall.

That would be great news for buyers sidelined by high mortgage rates and a housing market grappling with high prices and low inventory.

COMPANIES AND PEOPLE

TAGS

____________________________________________________________________________________________

Good news for Boston condo mortgage rates

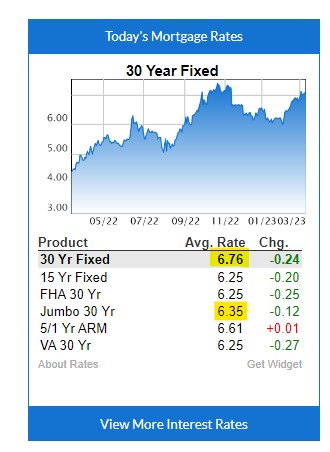

Mortgage rates improving 0.24% in one day is extremely unusual!

In a matter of 48 hours, Silicon Valley Bank has gone from being a company that we’ve never heard about or discussed to the highest profile bank failure since the Great Financial Crisis.

Such developments sound like they should be good for bonds and today was no exception. The news certainly overshadowed today’s jobs report although traders also looked willing to take that in stride (higher headline job creation offset by lower wage growth and higher unemployment).

The net effect was the largest rally in 4 months and one of the 5 biggest rallies of the past decade–at least for Treasuries.

https://www.mortgagenewsdaily.com/markets/mbs-recap-03102023