Boston Condos for Sale and Rent

Falling home prices in Boston – an historical perspective

Experts in the real estate industry use a number of terms when they talk about what’s happening with home prices. And some of those words sound a bit similar but mean very different things. To help clarify what’s happening with home prices and where experts say they’re going, here’s a look at a few terms you may hear:

- Appreciation is when home prices increase.

- Depreciation is when home prices decrease.

- Deceleration is when home prices continue to appreciate but at a slower pace.

Where Home Prices Have Been in Recent Years

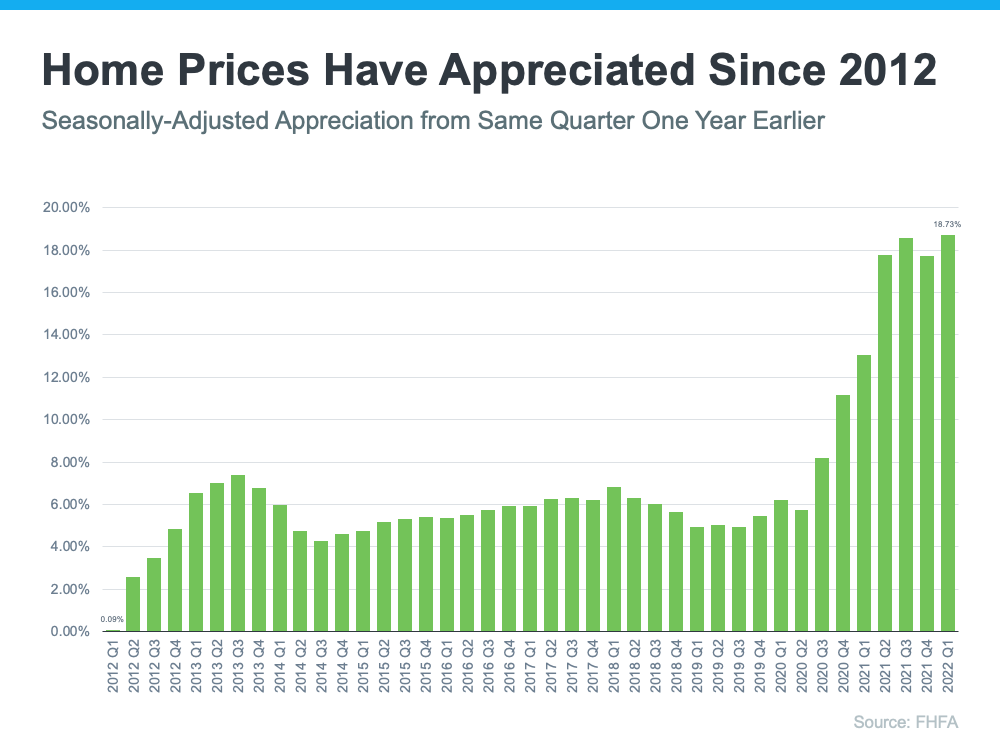

For starters, you’ve probably heard home prices have skyrocketed over the past two years, but homes were actually appreciating long before that. You might be surprised to learn that home prices have climbed for 122 consecutive months (see graph below):

As the graph shows, houses have gained value consistently over the past 10 consecutive years. But since 2020, the increase has been more dramatic as home price growth accelerated.

So why did home prices climb so much? It’s because there were more buyers than there were homes for sale. That imbalance put upward pressure on home prices because demand was high and supply was low.

Where Experts Say Home Prices Are Going

While this is helpful context, if you’re a buyer or seller in today’s market, you probably want to know what’s going to happen with home prices moving forward. Will they continue that same growth path or will home prices fall?

Experts are forecasting ongoing appreciation, just at a decelerated pace. In other words, prices will keep climbing, just not as fast as they have been. The graph below shows home price forecasts from seven industry leaders. None are calling for prices to fall (see graph below):

Mark Fleming, Chief Economist at First American, identifies a key reason why home prices won’t depreciate or drop:

“In today’s housing market, demand for homes continues to outpace supply, which is keeping the pressure on house prices, so don’t expect house prices to decline.”

And although housing supply is starting to tick up, it’s not enough to make home prices decline because there’s still a gap between the number of homes available for sale and the volume of buyers looking to make a purchase.

Terry Loebs, Founder of the research firm Pulsenomics, notes that most real estate experts and economists anticipate home prices will continue rising. As he puts it:

“With home values at record-high levels and a vast majority of experts projecting additional price increases this year and beyond, home prices and expectations remain buoyant.”

Boston condos for sale and the Bottom Line

Experts forecast price deceleration, not depreciation. That means home prices will continue to rise, just at a slower pace. Let’s connect so you can get the full picture of what’s happening with home prices in our local market and discuss your buying and selling goals.

Updated: Boston Real Estate Blog 2022

Click Here to view: Google Ford Realty Inc Reviews

Falling home prices in Boston – an historical perspective

Boston condos for sale

An interesting piece of information from a study on hedging the risk of lower real estate prices. It uses data from the last time real estate prices dropped, in the late 1980s.

The interesting part to me, however, is about the drop in prices, and about which cities were affected, the most. Not surprisingly (to me), the cities most affected were those most on the edge, cities with high unemployment, a high number of elderly, and low number of new residents, outside of major metropolitan areas.

But, my point isn’t that real estate prices went down in Massachusetts. It’s that, if you take these big cities out of the equation, the overall drop is much less. So, when people throw around the “real estate prices dropped in Massachusetts by 30% last time”, it’s true, but not necessarily relevant.

For example, prices in Brookline dropped a more modest 20%, with the greatest drop between 1990 and 1991 (remember the war and the recession?).

I think there were many reasons why the prices dropped. I don’t think those same reasons exist, today. I think if prices drop now, it’ll be for brand new reasons. That’s not very comforting, though, of course.

“This is exactly what happened in Massachusetts. Thirteen of the 64 areas experienced declines of more than 20% since peak, virtually wiping out all equity for first time buyers between 1987 and 1989. The worst three areas (Lowell -56%, Brockton