Existing home sales data

Boston Condos for Sale and Apartments for Rent

Existing home sales data

NAR: Existing-home sales rise in February; market ‘flashing encouraging signs’

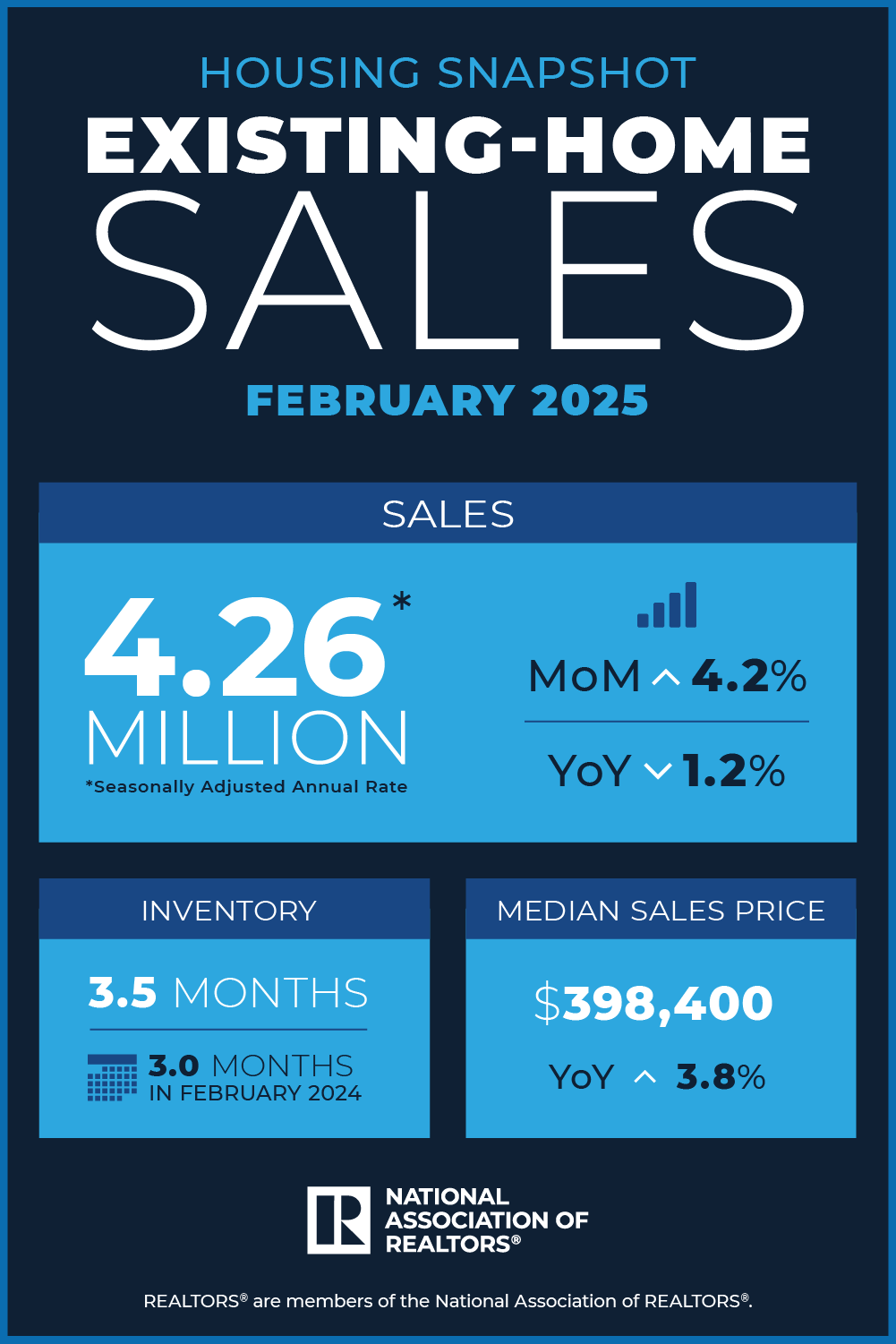

Existing-home sales rose in February, as buyers slowly returned to the market to take advantage of more inventory and variety and despite elevated interest rates, the National Association of REALTORS® (NAR) said.

Specifically, sales rose 4.2% from January to a seasonally adjusted annual rate of 4.26 million. Year over year, sales were down 1.2% from 4.33 million in February 2024.

Updated: Boston Condo Blog 2025

Existing home sales data

July numbers are old news, but they don’t get published until August. It is important to remember that it is usually at least 30 days from the offer to closing. Home sales were down in July month over month nationwide.

Housing data still leans in favor of sellers, REALTORS® Confidence Index shows

It’s still a strong sellers’ housing market, but optimism about increased buyer and seller traffic remains muted, the REALTORS® Confidence Index shows.

The index from the National Association of REALTORS® (NAR) said days on the market are down, nearly one-third of homes are selling above list price, and sellers on average are receiving 2.9 offers for their homes.

The June index said 29% of homes sold for above list price, which is in the same range as 30% the previous month and 33% in June 2023.

Median days on the market was 22, down from 24 the previous month. Another sign of a robust sellers’ market was that 20% of buyers were willing to waive inspections and 24% agreed to waive an appraisal contingency.

The monthly NAR survey of a random sampling of its members showed just 13% of respondents expect a year-over-year increase in buyer traffic in the next three months, down from 20% one month ago and from 15% one year ago.

The numbers were slightly better on the seller side, with 17% of respondents expecting a year-over-year increase in seller traffic in the next three months, down from 21% last month but up from 12% one year ago.

Existing-home sales post biggest gain in a year

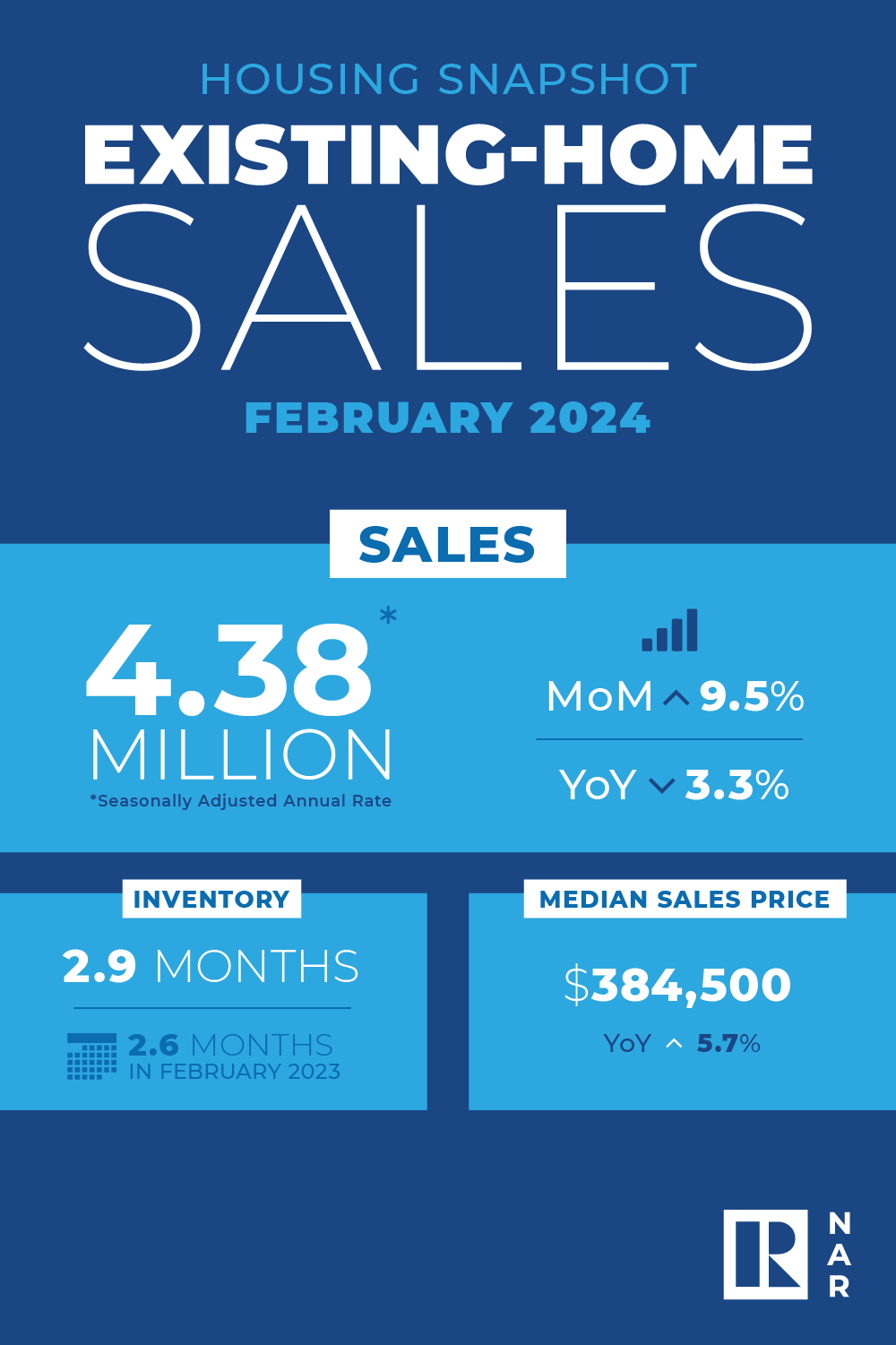

Existing-home sales jumped in February, posting their largest monthly increase since February 2023, the National Association of REALTORS® (NAR) said.

Specifically, sales rose 9.5% from January to a seasonally adjusted annual rate of 4.38 million. Year-over-year, sales were down 3.3% from 4.53 million in February 2023. The median existing-home price for all housing types in January was $384,500, up 5.7% from $363,600 a year before.

“Additional housing supply is helping to satisfy market demand,” NAR Chief Economist Lawrence Yun said in a press release. “Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices.”

The 30-year fixed-rate mortgage averaged 6.74% as of March 14, down from 6.88% a week before but up from 6.60% a year earlier, according to Freddie Mac.

Total housing inventory at the end of February stood at 1.07 million units, up 5.9% from January and 10.3% from the year-ago level of 970,000. Unsold inventory stood at a 2.9-month supply at the current sales pace, down from 3 months in January but up from 2.6 months in February 2023.

Properties typically remained on the market for 38 days in January, up from 36 days in January and 34 days in February 2023.

By property type, single-family home sales in January surged 10.3% month over month to an annual rate of 3.97 million. The median existing single-family home price was $388,700, up 5.6% on a year-over-year basis.

Existing condominium and co-op sales were up 2.5% compared to January, at an annual rate of 410,000. The median existing condo price was $344,000, up 6.7% from February 2023.

______________________

December new-home sales jump 8%

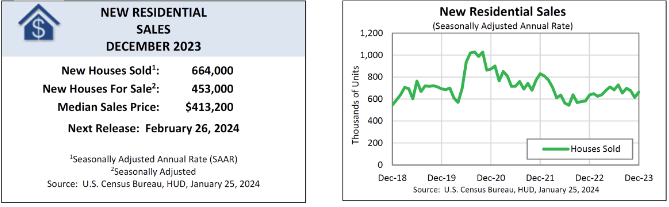

Sales of new single-family homes surged 8% between November and December, climbing to an annual rate of 664,000, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

Sales were up 4.4% compared to 636,000 a year earlier.

The median price of a new home sold during the month fell to $413,200 from $426,000 in November. Year over year, the median price was down from $479,500 in December 2022.

“Sales of new single-family houses in December 2023 blew past consensus expectations of 649,000,” First American Deputy Chief Economist Odeta Kushi said in a press release. “Mortgage rates fell in December to the lowest level since June 2023, boosting both demand and builder confidence. Mortgage rates have since moved lower in January, fueling further optimism.”

By region, the pace of new-home sales was up 32% month over month in the Northeast, 10.6% in the South, 9.2% in the Midwest and down 3.4% in the West.

Months’ supply of new homes for sale fell 6.8% to 8.2 months from 8.6 months in November; on a year-over-year basis, inventory was down 3.5% from an 8.5-month supply in December 2022.

___________________________-

Existing home sales data

Short supply of housing helps drive existing-home sales to 13-year low

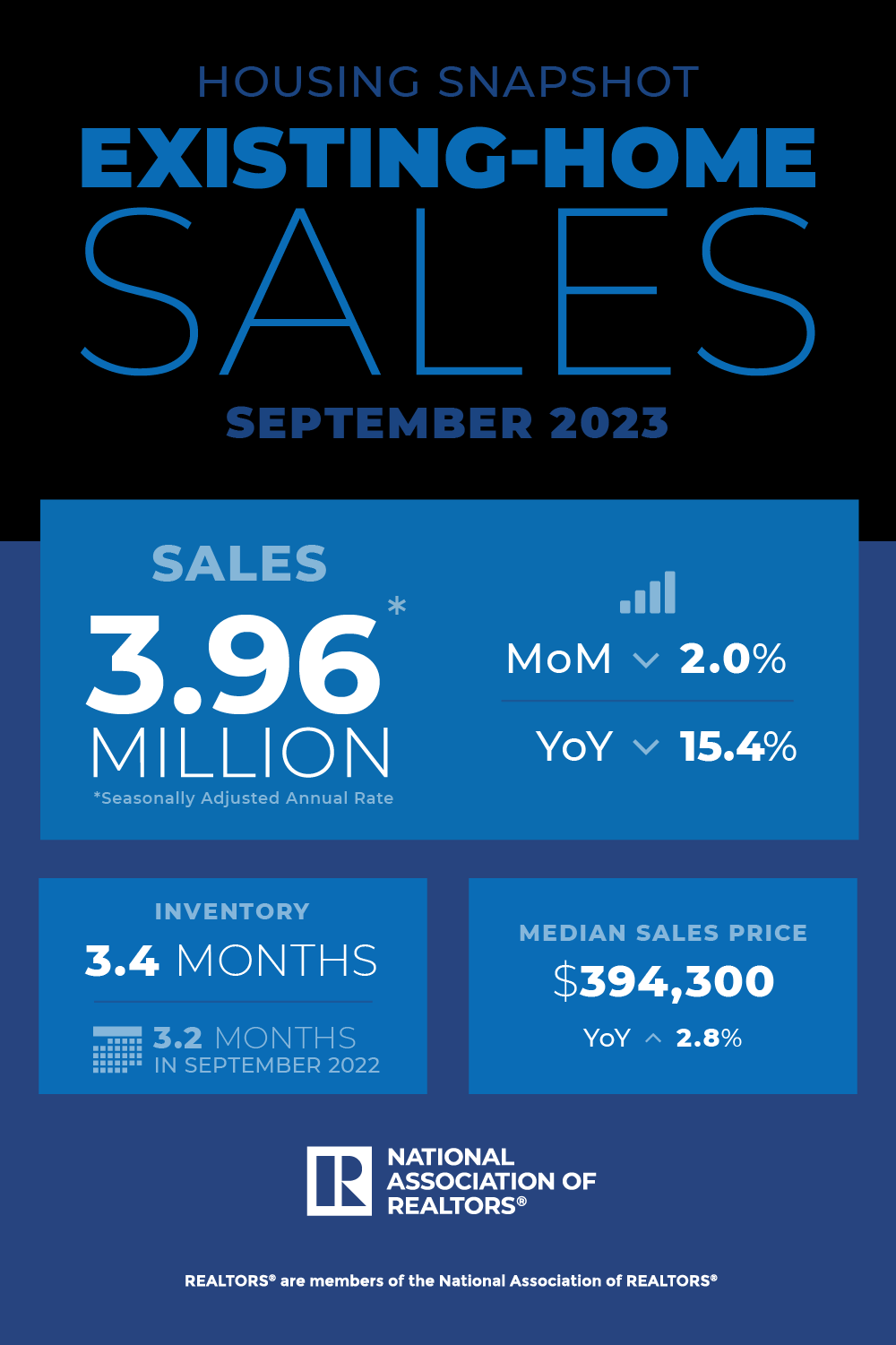

Existing-home sales fell to their lowest level since October 2010 in September, as high interest rates and limited supply throttled the pace of transactions.

Existing-home sales fell to their lowest level since October 2010 in September, as high interest rates and limited supply throttled the pace of transactions.

Specifically, existing-home sales slid 2% from August to a seasonally adjusted annual rate of 3.96 million. Year-over-year, sales were down 15.4% from 4.68 million in September 2022. The median existing-home price for all housing types in September was $394,300, up 2.8% from $383,500 in September 2022.

“As has been the case throughout this year, limited inventory and low housing affordability continue to hamper home sales,” NAR Chief Economist Lawrence Yun said in a press release. “The Federal Reserve simply cannot keep raising interest rates in light of softening inflation and weakening job gains.”

The 30-year fixed-rate mortgage averaged 7.58% as of Oct. 12, up from 7.49% a week before and 6.92% a year earlier, according to Freddie Mac.

The existing-home inventory rose 2.7% from August to 1.13 million, or the equivalent of 3.4 months’ supply, which was up from 3.3 months in August and 3.2 months a year earlier.

Properties typically remained on the market for 21 days in September, up from 20 days in August and 19 in September 2022. Sixty-nine percent of homes sold in September were on the market for less than a month.

By property type, single-family home sales in September slid 1.9% month over month to an annual rate of 3.53 million. The median existing single-family home price was $399,200, up 2.5% on a year-over-year basis.

Existing condominium and co-op sales slid 2.3% from August to an annual rate of 430,000 in September. The median existing condo price was $353,800, up 6.8% from September 2022.

Updated: Boston condo for sale website 2023

____________________________________________________________________________________________________________________

New-home sales surge in May

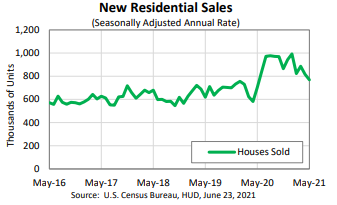

Specifically, sales jumped 12.2% month over month and 20% year over year to an annual rate of 763,000 homes, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development reported.

Meanwhile, the median price of a new home sold during the month rose to $416,300 from $402,400 in April. Year over year, the median price was down from $450,700 in May 2022.

“New-home sales, along with new-home construction, have accelerated in recent months despite high mortgage rates,” First American Economist Ksenia Potapov said. “While existing-home inventory, which has historically made up approximately 90% of total home inventory, is severely restricted, new homes offer an attractive alternative.”

By region, the pace of new-home sales was up across the country, with monthly increases of 17.6%, 17.4%, 11.3% and 4.1% in the Northeast, West, South and Midwest, respectively.

Months’ supply of new homes for sale fell 11.8% to 6.7 months from 7.6 months in April; on a year-over-year basis, inventory was down 19.3% from an 8.3-month supply in May 2022.

___________________________________________________________________________________________________________________________________________

March Boston Condo Sales Data

Home, Median sale prices set new records in February even as sales declined, according to a new Warren Group report.

The median sale price of both single-family homes and condos in Massachusetts trended higher last month, even as sales declined.

The statewide median single-family home price grew 6% to $498,369, up from $470,000 last year, marking a new all-time high for February. That’s a big jump from January when the median single-family home price only grew 0.8%.

The Warren Group’s February sales report found that Massachusetts single-family home sales fell 21.5% to 2,040 from 2,600 a year ago.

Cassidy Norton, The Warren Group associate publisher and media relations director, said despite the record-setting month for median single-family home prices, the 6% gain was much more moderate compared to what they’ve seen over the past couple of years.

“A lack of inventory, higher interest rates and economic uncertainties continue to be the biggest barriers to entry for prospective homebuyers,” Norton said. “Speaking of the economy, the most recent bank failures may shake consumer confidence in the coming months, which could yield even further declines in transactions not associated with a lack of inventory.”

Since January, 4,425 homes sold, down 27.8% from the first two months of 2022. During the same period, the year-to-date median single-family home price rose 2.9% to $499,000.

Meanwhile, the median condominium sale price increased 4.5% to $460,000. Yet, condo sales posted another decline last month, falling 25.5% from last year to 1,018.

“Condo trends were in lockstep with single-family homes in February,” Norton said. “Inventory is down, there aren’t enough new listings to keep up with demand, and the median condo price continues to climb – just at a more modest pace.”

So far this year, 2,196 condos sold across the state, down 26.8% from 2022, with a median sale price that’s up 6.8% to $469,950.

February 2023 Boston condo sales data

Number of Boston condo sales – 163 sales, down 31.8% vs, February 2022.

Median Boston condo sales price – $690,000, up 1.5% vs, February 2022

Boston condo inventory – 818 condos for sale, up 9% vs, February 2022

Boston condos average days-on-market 65, up 32% vs, February 2022

Boston condo for sale list price $708.00, up 0.42% vs February 2022.

______________________________________________________________________________________________________________________________________

Existing home sales data

September 2022 sale numbers may come as surprise to many observers.

Number of Boston condo sales for September 2022

Number of Boston condos for sale – 271

DOWN 47.9% vs Sept 2021

———————————————————————————————————————————————————————————-

Median Boston condo for sale price – $690,000

DOWN 6.4% vs Sept 2021

————————————————————————————————————————————————————————————–

Boston condo median sale price per sq. ft.-$775

DOWN 2.9% vs Sept 2021

————————————————————————————————————————————————————————————–

Boston condo for sale inventory -1,319

DOWN 16.5% vs Sept 2021

————————————————————————————————————————————————————————————–

Boston condo sales days on market – 39

DOWN 20.4% vs Sept 2021

The fourth quarter of 2021 held a glimmer of good news for homebuyers: growth in home prices slowed. The bad news: affordability worsened overall amid rising prices and mortgage rates.

Of the 183 markets measured by the National Association of Realtors’ quarterly report, 67 saw a double-digit increase in median sales prices for existing single-family homes in the fourth quarter. The figure stands slightly below the 78 percent of markets seeing the same increase in the third quarter.

The median single-family sales

The median single-family sales price across the country rose 14.6 percent year-over-year to $361,700 in the fourth quarter, a slight tick down from the 15.9 percent annual rise in the third quarter.

“Homebuyers in the last quarter saw little relief as home prices continued to climb, albeit not as fast as earlier in the year,” said Lawrence Yun, NAR’s chief economist. “The increasing prices are indicative of a seller’s market, with an abundance of eager buyers and very limited supply.”

Boston condos and increasing mortgage rates.

Making matters worse for homebuyers is increasing mortgage rates. In 2020’s fourth quarter, the average monthly mortgage payment considering a 20 percent down payment was $1,039, based on an average mortgage rate of 2.81 percent. In 2021, the average payment was $1,240, based on a mortgage rate of 3.13 percent.ADVERTISEMENT

The share of families’ income spent on mortgage payments jumped from 14.7 percent to 16.9 percent year-over-year. The problem is only likely to grow, as Freddie Mac announced on Thursday the average mortgage rate hit 3.69 percent, its highest level since January 2020.

Boston condos for sale and the bottom line

“A number of families, especially would-be first-time buyers, are increasingly being forced out of the market, and this is why supply is critical to expanding homeownership opportunity,” Yun added.

Still, Yun professed optimism for buyers in the coming year.

“The good news is that home prices should begin to normalize later in 2022 as more homes come on the market,” Yun said

The largest annual gains in home prices hit Punta Gorda, Florida, where prices rose 28.7 percent, followed closely by Ocala, Florida, with a 28.2 percent gain. Other significant markets seeing major year-over-year sales price gains include Austin-Round Rock, Texas (25.8 percent), Phoenix-Mesa-Scottsdale, Arizona (25.7 percent) and Las Vegas-Henderson-Paradise, Nevada (24.7 percent).Contact Holden Walter-Warner

_____________________________________________________________________________________________________________________________

After almost two years of double-digit increases, many experts thought home price appreciation would decelerate or happen at a slower pace in the last quarter of 2021. However, the latest Home Price Insights Report from CoreLogic indicates while prices may have plateaued, appreciation has definitely not slowed. The following graph shows year-over-year appreciation throughout 2021. December data has not yet been released.

As the graph shows, appreciation has remained steady at around 18% over the last five months.

In addition, the latest S&P Case-Shiller Price Index and the FHFA Price Index show a slight deceleration from the same time last year – it’s just not at the level that was expected. However, they also both indicate there’s continued strong price growth throughout the country. FHFA reports all nine regions of the country still experienced double-digit appreciation. The Case-Shiller 20-City Index reveals all 20 metros had a double-digit appreciation.

Why Haven’t We Seen the Deeper Deceleration Many Expected?

Experts had projected the supply of housing inventory would increase in the last half of 2021 and buyer demand would decrease, as it historically does later in the year. Since all pricing is subject to supply and demand, it seemed that appreciation would wane under those conditions.

Boston condos for sale buyer demand, however, did not slow as much as expected, and the number of listings available for sale dropped instead of improved. The graph below uses data from realtor.com to show the number of available listings for sale each month, including the decline in listings at the end of the year.

Here are three reasons why the number of active listings didn’t increase as expected:

1. There hasn’t been a surge of foreclosures as the forbearance program comes to an end.

2. New construction slowed considerably because of supply chain challenges.

3. Many believed more sellers would put their houses on the market once the concerns about the pandemic began to ease. However, those concerns have not yet disappeared. A recent article published by com explains:

“Before the omicron variant of COVID-19 appeared on the scene, the 2021 housing market was rebounding healthily from previous waves of the pandemic and turned downright bullish as the end of the year approached. . . . And then the new omicron strain hit in November, followed by a December dip in new listings. Was this sudden drop due to omicron, or just the typical holiday season lull?”

No one knows for sure, but it does seem possible.

Boston condos for sale and the Botton Line

Home price appreciation might slow (or decelerate) in 2022. However, based on supply and demand, you shouldn’t expect the deceleration to be swift or deep.

____________________________________________________________________________________

Boston Condos for Sale

Loading...

The median price of homes in the U.S. rose to an all-time high during the week ended Dec. 19, up 15% from the prior-year period to $360,500, according to a new Redfin report. Meanwhile housing inventory continues to drop and has hit another all-time low.

Redfin chief economist Daryl Fairweather said that as available home-sale inventory continues to hit new lows each week, those in the market for new homes can’t help but feel that the “well is running dry.”

“Fewer homes are selling because of a lack of supply, while demand remains strong,” he said in a press release. “That’s why home prices continue to climb higher and higher. But once mortgage rates increase in 2022, I expect the rate of price growth to slow down significantly.”

During the four weeks ended Dec. 19, asking prices rose 14% from the year before and 29% from 2019 to $347,475, while pending home sales rose 0.1% year over year and 49% from 2019.

New listings were down 9% from last year, but up 11% from 2019, marking the largest two-year increase since September.

Redfin said 42% of all homes went under contract with an accepted offer within the first two weeks of being listed, up from 36% a year before and 25% at the same time in 2019.

Additionally, the report noted a 3% week-over-week decrease in mortgage applications during the week ended Dec. 17. Thirty-year mortgage rates inched up to 3.12% for the week ended Dec. 16

Existing home sales data

The pandemic and work-from-home orders have changed where, when and why people buy homes. As a result, housing prices hit the highest median of all time in 2021, as the number of homes for sale fell to an all-time low and the demand for second homes surged, according to a new Redfin report.

“The ongoing pandemic, including its seismic effect on the U.S. economy and the way Americans live and work, has made 2021’s housing market anything but typical,” said Daryl Fairweather, chief economist for Redfin. “Remote work, low mortgage rates, a shortage of building materials and wealth inequality that has allowed an influx of affluent Americans to buy vacation homes, to name just a few factors, have come together to create a historic year for real estate. Buyers paid more for homes, bought sooner than they planned and searched outside their hometowns. This year’s frenzied housing market has been one for the books — but it may become more balanced in 2022.”

Redfin compiled a list of 10 housing records set in the past year:

1. The typical U.S. home sold for nearly $400,000

The national median price for homes hit $386,000 in June, up 24.4% from last year. According to the report, the average sale price may hit another all-time high before the end of the year.

2. Home supply dropped to its lowest level in history

There were 1.38 billion homes for sale in June on a seasonally adjusted basis, down 23% year over year.

3. The typical home sold in just 15 days

An average of 15 days on the market is the lowest in history, down 39 days from June 2020.

4. Over 60% of homes went off-market in two weeks

An average of 61.4% of homes that went under contract in March had an accepted offer within two weeks of hitting the market, an all-time high.

5. More than half of homes sold above listing price

Of homes sold in June, 56.5% sold for above listing price, a record high and up 29.6% from a year earlier.

6. Mortgage rates dropped to 2.65%

The average 30-year fixed mortgage rate hit 2.65% the week ended Jan. 7, the lowest of all time.

7. Investors purchased nearly 1 in 5 of all homes sold in the U.S.

Real estate investors bought 18.2% of homes purchased in the country during the third quarter of 2021, up 11.2% from a year earlier.

8. Demand for second homes nearly doubled from before the pandemic

Second-home demand increased 91% from pre-pandemic levels in January, marking record growth.

9. Nearly one-third of Americans looked to move to a different metro area

In another side effect of the surge in remote work, 31.5% of Redfin users looked to move to a different metro area in the first quarter of 2021, an all-time high and up from 26% from a year earlier.

10. The typical luxury home sold for 25% more than last year

The median sale price of U.S. luxury homes jumped 25.8% year over year to $1,025,000 in the second quarter, marking record price growth.

Boston Condos for Sale

Loading...

__________________________________________________________________________________________________________________

October 2021 brought 6.34 million in sales, a median sales price of $353,900, and 2.4 months of inventory. The median sales price is up 13.1% year over year, and inventory is down 12% from October 2020.

_____________________________________________________________________________________________________________

The following is the most recent sales data release for September 2021

Boston Condo Sales

Up in September by 35.2% versus September 2020

Median Boston condo sales price

$725,000 Up 11.3% versus September 2020

Boston Condo Inventory

1,573 Boston condos for sale. Down 26.2% versus September 2020

Boston Condo Days-on-Market

95 days to put a Boston condo under the agreement. UP 13.7% versus September 2020

Boston Condo Median Sales Price Per. Sq. Ft.

$794.00 per sq fr. Up 17.9% versus September 2020

Boston Condos for sale Sale

____________________________________________________________________________________________________________________________

Boston Condos for sale Sale

Existing home sales data

The rate of home price growth climbed to a new extreme in August, according to CoreLogic.

Annual appreciation surged by 18.1% in August, setting a new record since tracking began in 1976. It more than tripled the year-ago rate of 5.9% and shattered the “downshifted” 0.2% growth forecast from August 2020. It also marks the sixth straight month in which the Home Price Index made double-digit year-over-year gains, besting July’s 17.5% and June’s 16.6%.

_____________________________________________________________________________________________________________________________

Boston Condos for sale Sale

Existing home sales data

August home sales fell for the first time in 12 months as median sales prices of both single-family homes and condominiums declined or stayed flat last month, according to the Greater Boston Association of Realtors August Housing Market Report.

The drop in home sales comes one month after July’s report saw both home and condo sales on the rise as home values continued to be at or near record highs.

According to the report, the slower sales pace is not uncommon in August, and property values last month did grow 8% from last year while inventory is still tight after months of unprecedented demand.

In August, single-family homes sales fell 2.4% year over year with the selling of 1,552 homes compared to the 1,590 homes sold in August of 2020. Home sales volume also decreased 8.4% from July. Last month was the 10th most active August on record for home sales, according to the report.

Condominium sales grew from last August, up 13.4%, with 1,299 condos selling last month compared to 1,146 a year prior, while sales activity slowed from July dropping 10.2%. August was the fifth-highest August on record for condo sales.

“It feels like we’ve been in a non-stop sprint for much of the past year, but the market is now getting a chance to catch its breath,” GBAR President Dino Confalone said in a press release. “There’s been a bit of softening in demand over the past 8-10 weeks as some buyers have opted to take a break from the market due to affordability issues or to pursue summertime activities. Others have grown frustrated by the lack of inventory and chosen to renew leases or stay in their current home, and collectively that’s taken some of the air out of the market.”

Despite the softening of sales, prices continued to rise in August, just not as dramatically as they had in recent months, according to the report. The median selling price of a single-family home increased 8.4% from a year earlier rising to $780,000 from $719,500, the smallest price gain in the past six months. In the condo market, the median selling price rose 7.8% from a year earlier to $639,000 from $592,500, the smallest price increase in four months.

As has been the case throughout the year, supply and demand imbalances will continue to lead to more appreciation of home values, according to Confalone, who says it remains a seller’s market as “most properties are still selling at or above the asking price when priced right.”

Boston home sales, prices on the rise as the market pace slows

Home and condo sales were on the rise again last month, marking July as the 11th month in a row of improved sales. Despite the increase, the pace of growth was the slowest in four months, according to a recent report from the Greater Boston Association of Realtors, which also found the median selling price-appreciation rate easing as home values continue at or near record highs.

Single-family home sales grew 6.7% over last year, with the sale of 1,678 homes, compared to 1,572 homes sold in July of 2020, making it the sixth-most active July on record for Greater Boston home sales.

On a month-over-month basis, however, sales volume was down 10% from the 1,865 homes sold in June.

Condominium sales set a new record for July, up 25% to 1,423 from 1,138 condos sold a year before. Similar to the monthly decline in single-family home sales in July, condo sales fell 12% from 1,617 condos sold in June

Boston Condos for sale Sale

_______________________________________________________________________________________________________________________________________________________________________________________________________________________________

GBAR President Dino Confalone said that after months of unprecedented demand, the association is seeing a more “relaxed pace to the market” this summer.

“Since Memorial Day, activity hasn’t been quite as strong as it was this spring, with some buyers pulling back to reassess the market and others opting to focus on vacation travel, family events and other summer activities,” he said in a release. “There’s also been a steady stream of new listings coming onto the market since June 1, and that’s giving buyers more options and time to look for a home.”.

Demand may be softening, but according to the report, sales prices continued to climb, just not as aggressively.

The median price of a single-family home rose for the 21st month in a row in July, posting a 12.1% gain from last year’s $700,000., The increase was the smallest price gain in six months. In the condo market, the median selling price increased 8.2% from a year earlier rising to $640,000 from $591,250, the smallest price increase for condos in four months. Median selling prices in July declined 10% from June’s record high of $812,000 for a single-family home, but condo median prices remained unchanged.

Multiple offers are also down, as well as the number of bidding wars, according to the report, relieving some of the pressure on prices.

Confalone says it remains a seller’s market, but it’s starting to show more price adjustments, and inventory is sitting on the market longer.

Supply and demand issues continued, with active single-family home listings down 28% year over year and condo listings falling 19.8%. Month over month, single-family home listings improved 2% while condo listings saw a 5.6% decline.

Boston Condos for Sale

Existing homes sales rise only 1.4%. lower than expected of 2.2%

Boston Condos for Sale

________________________________________________________________________________________________________________________

Existing home sales data

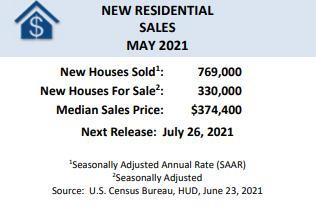

New-home sales slid 5.9% on a seasonally adjusted, monthly basis to 769,000 in May, while the median sales price rose to $374,400 from $365,300 in April, the U.S. Census Bureau and the Department of Housing and Urban Development reported.

Annually, new-home sales were up 9.2%.

The seasonally adjusted estimate of new houses for sale at the end of May was 330,000, representing a supply of 5.1 months at the current sales rate.

By region, the number of new homes sold in the Northeast soared by 33.3% to 52,000 on an adjusted basis, while they were flat in the Midwest at 95,000, up by 6.7% in the West at 190,000 and down by 14.5% in the South to 432,000.

“Right now, we view the shortage of housing inventory as the primary limiting factor for home sales as we start looking forward into the second half of the year,” Keller Williams chief economist Ruben Gonzalez said in an email. “These restrictive conditions in the existing home market should continue to drive new construction, as well as strong demand driven by the continued economic recovery and sustained low interest rates.”

Boston Real Estate for Sale

________________________________________________________________________________________________________________________

From AP:

America’s housing market has grown so overheated as demand outpaces supply that prices keep hitting record highs — and roughly half of all U.S. houses are now selling above their list price.

Two years ago, before the pandemic struck, just a quarter of homes were selling above the sellers’ asking price, according to data from the real estate brokerage Redfin.

On Tuesday, new data further illuminated the red-hot nature of the housing market: Prices rose in March at the fastest pace in more than seven years. The S&P CoreLogic Case-Shiller 20-city home price index jumped 13.3% that month compared with a year earlier — the biggest such gain since December 2013. That price surge followed a 12% year-over-year jump in February.

And mortgage rates remain at historically low levels, with the average rate on a 30-year fixed mortgage around 3%. A year ago, the average was nearly 3.25%.

Investors, including individuals buying second houses and wealthy Wall Street firms, are also buying more homes, intensifying the competition. Investors bought 17% of homes in April, up from 10% a year earlier, according to the National Association of Realtors. The large millennial generation is also increasingly turning toward home-buying.

Daryl Fairweather, chief economist at Redfin, said that demand had been outstripping supply even before the pandemic as developers struggled to build enough new homes. Builders now say that shortages of workers and lumber are limiting their ability to build.

New home construction fell in April after reaching a 15-year high a month earlier.

“All told, there is little, if any, indication that home prices will slow their appreciation anytime soon,” said Matthew Speakman, an economist at real estate website Zillow.

The number of homes for sale fell 21% in April compared with a year earlier, to just 1.16 million, near a record low in figures that date to 1982, according to the National Association of Realtors. The plummeting supply has pushed buyers into a near-frenzy. Properties were on the market for just 17 days in April, and 88% of homes sold were on the market for less than a month, the NAR said.

The ensuing bidding wars raised the price of the typical, or median, house to $341,600 last month, the NAR said, a record high.

Glenn Kelman, CEO of Redfin, said Tuesday on Twitter that one desperate home buyer in Bethesda, Maryland, offered — perhaps partly tongue-in-cheek — to name her first-born child after the seller. (She still lost out to another buyer.)

Kelman also noted that there are now more real estate agents than there are homes listed for sale. According to the Labor Department, 1.7 million Americans were working in real estate in April.

Some of the year-over-year price gain likely reflects the slower sales and reduced demand a year ago at the onset of the pandemic. All 20 cities in the Case-Shiller index reported faster price increases in March than in February.

The largest increase was in Phoenix for the 22nd straight month; prices there rose 20% compared with a year ago. San Diego experienced the next-largest gain, at 19.1%, followed by Seattle, with 18.3%.

Fairweather, the Redfin economist, said the housing market may cool off in the coming months. With vaccinations spreading and COVID-19 waning, more sellers may be willing to list their homes.

Fairweather suggested that many Americans are likely to start spending more money on services, such as vacations, dining out and other entertainment, and focus less on new homes.

Indeed, the number of people signing contracts to buy homes dropped in May, and fewer people are applying for mortgages. Sales of newly-built homes dropped nearly 6% in April, likely because of spiraling prices.

“At a certain point,” Fairweather said, “buyers just back off, and you get more stable price growth. I think this is the peak, but it’s going to be hot for a long time. It’s more like a plateau.”

Record-low mortgage rates are likely to remain in place for the rest of the year and will be driving housing demand as state economies steadily reopen, but more listings and increased home construction will be needed to tame price growth.

Boston Real Estate for Sale

Click here back to Boston Real Estate Home Search

Ford Realty – Boston Real Estate Google Reviews 2020 & 2021

Click Here: Seaport Luxury high rise condos

Click here: Beacon Hill Apartment rentals