End of the Month Boston Real Estate Mortgage Rates

Boston Real Estate

End of the Month Boston Real Estate Mortgage Rates

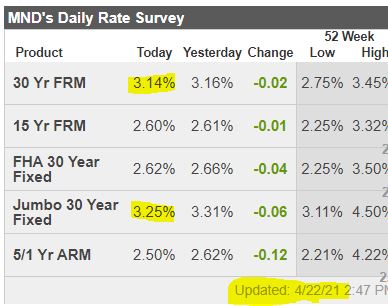

“Mortgage rates showed little movement again this week, hovering around 6.8 percent,” said Sam Khater, Freddie Mac’s Chief Economist. “Since the start of 2024, the 30-year fixed-rate mortgage has not reached seven percent but has not dropped below 6.6 percent either. While incoming economic signals indicate lower rates of inflation, we do not expect rates will decrease meaningfully in the near-term. On the plus side, inventory is improving somewhat, which should help temper home price growth.”

News Facts

- The 30-year FRM averaged 6.82 percent as of April 4, 2024, up from last week when it averaged 6.79 percent. A year ago at this time, the 30-year FRM averaged 6.28 percent.

- The 15-year FRM averaged 6.06 percent, down from last week when it averaged 6.11 percent. A year ago at this time, the 15-year FRM averaged 5.64 percent.

End of the Month Boston Real Estate Mortgage Rates

Updated: Boston condo for sale website 2023

End of the Month Boston Real Estate Mortgage Rates

The traditional spread between the 10-year Treasury Yield and the 30-yr fixed mortgage rate has been 1.75%. Today it is 2.7%, which sure makes it look like the next Fed increase is already priced in. This week, we will see if mortgage rates will moderate and stay in the fives after the Fed bumps again!

When 10yr Treasury yields are dropping, mortgage rates are typically following, even if the proportion can vary. Mortgages definitely don’t benefit as much when it comes to overseas developments, but the sense of a big picture reversal is the same in either case. By Friday afternoon, the average mortgage rate was just a hair lower than those seen in early July. You’d have to go back another month to see anything lower.

Any conversation about big drops in rates requires an asterisk right now. Rate quotes can vary greatly depending on the scenario and the lender, but they’re not necessarily as different as they may seem. The reason is the role of “upfront costs” in the current market. Historically, it tends to make more financial sense to avoid paying additional upfront costs (aka “points”) in exchange for a lower rate. Many borrowers may still agree.

Nonetheless, points are packing a bigger punch than normal due to trading levels in the bond market, and that is having an impact on many loan quotes. For example, there are some scenarios where a single discount point can drop the rate by more than half a percent. Historically, that point would only be worth 0.25%.

There’s no universal recommendation here. If you find yourself comparing one mortgage quote to another, just make sure you’re taking the upfront costs into consideration.

https://www.mortgagenewsdaily.com/markets/mortgage-rates-07222022

____________________________________________________________________________________________________________________

End of the Month Boston Real Estate Mortgage Rates

Boston Condos for Sale and Apartments for Rent

Boston real estate

Boston real estate mortgage rates have settled down nicely, and are back in the high-2s for those Boston real estate buyers who don’t mind paying a half-point or so (those quoted above are with zero points paid).

Not sure that it matters. Not sure that anything matters anymore.

I read one real estate news article that asked a real estate broker to discuss the market conditions.

Specifically, what do you tell buyers?

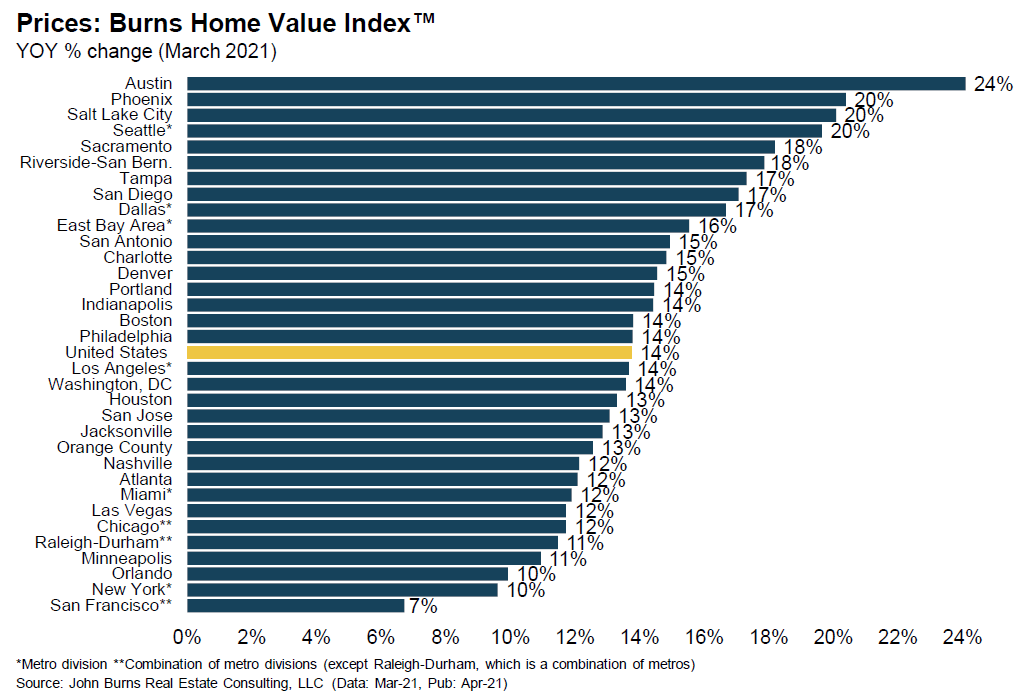

Thankfully, the market is so hot that we have more sales to rely on. Even with the prices going up, at least there are a few recent sales nearby that help to substantiate the trend.

Is adding 1% per month to pricing enough to keep up with the actual? 1.5%?

Or how about 2.0% per month in the quality mid-range markets, both local and national?

Boston real estate

Boston Real Estate

Ford Realty Inc., Boston Real Estate for Sale

Click to View Google Review

Updated: Boston Real Estate 2024