Downtown Boston real estate and home equity

Boston Condos for Sale and Rent

Downtown Boston real estate and home equity

Will we see home equity gains in 2025?

Downtown Boston real estate and home equity

Today’s Seaport condo owners are sitting on significant equity, even as home price appreciation has eased recently. If you’re a homeowner, your net worth got a boost over the past few years thanks to rising home prices. Here’s what it means for you, even as the market moderates.

Boston Condo Equity Has Grown in Recent Years

Because of the imbalance between how many homes were for sale and the number of homebuyers in the market over the past few years, home prices appreciated substantially.

And while price appreciation has slowed this year, that doesn’t mean you’ve lost all the equity in your home. In fact, the latest Homeowner Equity Insights report from CoreLogic finds the average homeowner’s equity has grown by $34,300 over the past year alone.

And if you’ve been in your home longer than that, chances are you have even more equity than you realize.

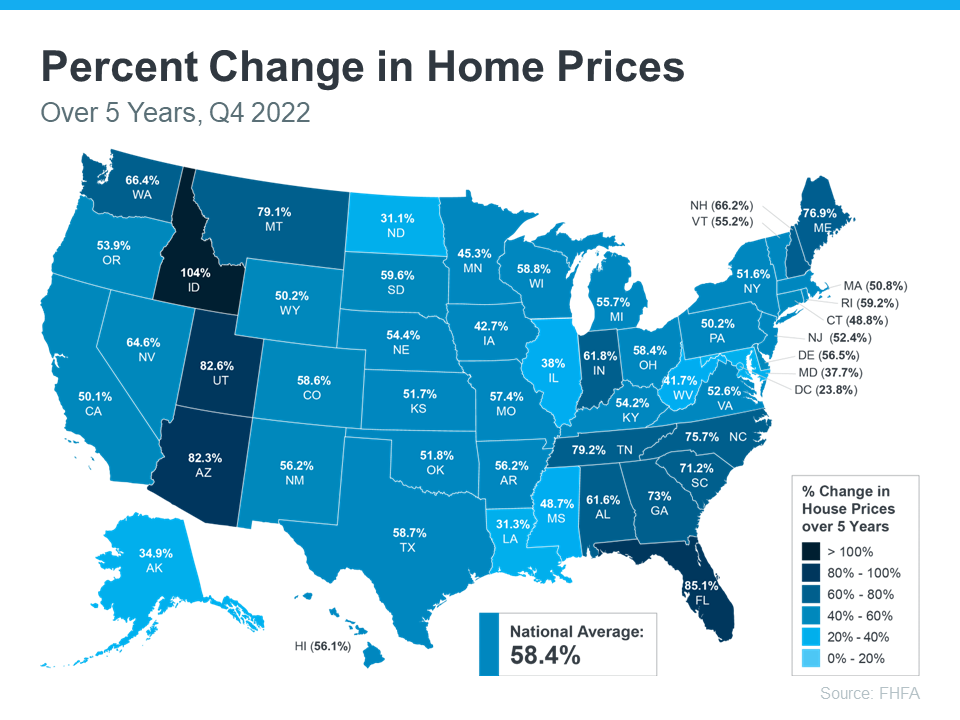

While that’s the national number, if you want to know what happened in your area, look at the map below from the Federal Housing Finance Agency (FHFA). It shows on average how much home prices have risen over the past five years, which has been a major driver behind equity growth.

Why This Is So Important Right Now

While equity helps increase your overall net worth, it can also help you achieve other goals, like buying your next home. When you sell your current house, the equity you’ve built up comes back to you in the sale, and it may be just what you need to cover a large portion – if not all – of the down payment on your next home.

So, if you’ve been holding off on selling, it may be time to find out how much equity you have and how it can help fuel your next move.

Homeownership is a long game, and if you’re planning to make a move, the equity you’ve gained over time can make a big impact. To find out just how much equity you have in your current home and how you can use it to fuel your next purchase, let’s connect.

___________________________________________________________________________________________

Homeownership is still a crucial part of the American dream. For those people who own a home (and those looking to buy one), it’s clear that being a homeowner has considerable benefits both emotionally and financially. In addition to long-term stability, buying a home is one of the best ways to increase your net worth. This boost to your wealth comes in the form of equity.

Equity is the difference between what you owe on the home and its market value based on factors like price appreciation.

The best thing about equity is that it often grows without you even realizing it, especially in a sellers’ market like we’re in now. In today’s real estate market, the combination of low housing supply and high buyer demand is driving home values up. This is giving homeowners a significant equity boost.

According to the latest data from CoreLogic, the amount of equity homeowners have has continued to grow as home values appreciate. Here are some key takeaways from the Homeowner Equity Insights Report:

- The average homeowner gained $51,500 in equity over the past year

- There was a 29.3% increase in national homeowner equity year over year

Boston condo owners

To give you an idea of what that looks like in your area, the map below shows the average equity gains by state.

What does all of that mean for you as a Boston condo owner?

If you’re already a homeowner, you likely have more equity in your house than you realize. The numbers in the map above reflect year-over-year growth. If you’ve been in your home for longer than a year, you’ll likely have even more equity than that. That equity can take you places. You can use the equity you’ve gained to fuel your next move, achieve other life goals, and more.

On the other hand, if you haven’t purchased a home yet, understanding equity can help you realize why homeownership is a worthwhile goal. Homeowners across the nation gained an average of over $50,000 in equity this year. Don’t miss out on this chance to grow your net worth.

Boston condos and the Bottom Line

If you want to learn more, let’s connect. A trusted advisor can help you understand where home prices are today, how they contribute to a homeowner’s net worth, and the impact equity can have when you own a home.

Boston Condos for Sale and Rent

________________________________________________________________________________________________________________________________________________________________________________________________________

Many of the questions currently surrounding the downtown Boston real estate industry focus on Boston condo prices and where they are heading. The most recent Home Price Expectation Survey (HPES) helps target these projected answers.

Here are the results from the Q2 2019 Survey:

- Home values will appreciate by 4.1% in 2019

- The average annual appreciation will be 3.2% over the next 5 years

- The cumulative appreciation will be 16.8% by 2023

- Even experts representing the most “bearish” quartile of the survey project a cumulative appreciation of over 6.7% by 2023

What does this mean for you?

A substantial portion of family wealth comes from home equity. As the value of a family’s home (an asset) increases, so does their equity.

Boston downtown real estate

Using the projections from the HPES, here is a look at the potential equity a family could earn over the next five years if they purchased a $250,000 home in January of 2019:Based on gains in home equity, their family wealth could increase by $42,000 over that five-year period.

Bottom Line

If you don’t yet own a Boston downtown condo, now may be the time to purchase. Owning or moving up to your dream home could allow you to ride the increase in equity of a growing asset.

Today’s newest Boston condos for sale

Sorry we are experiencing system issues. Please try again.