Confused about the Boston economy and real estate market? Its understandable.

Boston Condos for Sale & Boston Apartments

Confused about the Boston economy and real estate market? Its understandable.

The news for the last few weeks has been about Pres. Trump’s tariffs.

How will the tariff confusion impact the Boston condo market?

They say that history repeats itself. Let’s reflect on recent history, because it’s the only history that is relevant.

Flush with equity, how do Boston condo sellers react when faced with adverse uncertainty?

We have recent experience….Remember – Covid-19!

In the first couple of months after that drastic game-changing event began, the local real estate market froze up. Full paralysis.

But we moved on, many took advantage of the Covid crisis by locking in 3% interest rates.

And since then, Boston condo prices have risen.

Boston condo sales will likely slow as sellers and Boston condo buyers wonder what to do.

But risk and reward ride the same elevator!

Be Bold. Take Action!

We are used to the chaos, and are numb to it by now. There will be more chaos tomorrow, next week, and for the next 90 days. Might as well get on with those plans for your life!

Boston Condos for Sale & Boston Apartments

______________

As someone who’s thinking about buying or selling a home, you’re probably paying close attention to mortgage rates – and wondering what’s ahead.

One thing that can affect mortgage rates is the Federal Funds Rate, which influences how much it costs banks to borrow money from each other. While the Federal Reserve (the Fed) doesn’t directly control mortgage rates, they do control the Federal Funds Rate.

The relationship between the two is why people have been watching closely to see when the Fed might lower the Federal Funds Rate. Whenever they do, that’ll put downward pressure on mortgage rates. The Fed meets next week, and three of the most important metrics they’ll look at as they make their decision are:

- The Rate of Inflation

- How Many Jobs the Economy Is Adding

- The Unemployment Rate

Here’s the latest data on all three.

1. The Rate of Inflation

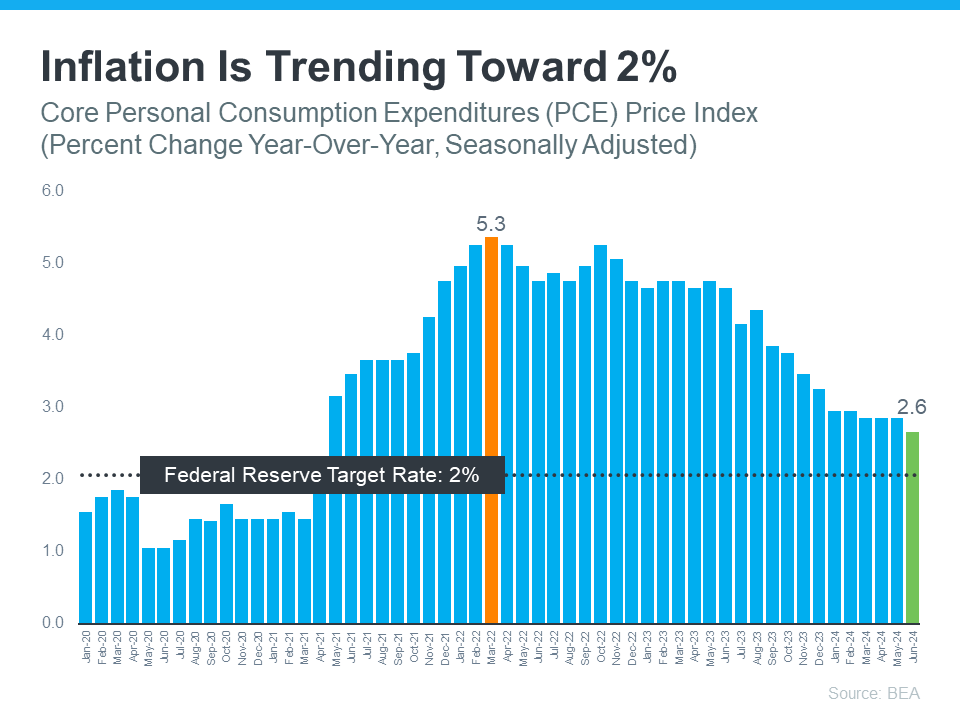

You’ve probably heard a lot about inflation over the past year or two – and you’ve likely felt it whenever you’ve gone to buy just about anything. That’s because high inflation means prices have been going up quickly.

The Fed has stated its goal is to get the rate of inflation back down to 2%. Right now, it’s still higher than that, but moving in the right direction (see graph below):

2. How Many Jobs the Economy Is Adding

2. How Many Jobs the Economy Is Adding

The Fed is also watching how many new jobs are created each month. They want to see job growth slow down consistently before taking any action on the Federal Funds Rate. If fewer jobs are created, it means the economy is still strong but cooling a bit – which is their goal. That appears to be exactly what’s happening now. Inman says:

“. . . the Bureau of Labor Statistics reported that employers added fewer jobs in April and May than previously thought and that hiring by private companies was sluggish in June.”

So, while employers are still adding jobs, they’re not adding as many as before. That’s an indicator the economy is slowing down after being overheated for quite some time. This is an encouraging trend for the Fed to see.

3. The Unemployment Rate

The unemployment rate is the percentage of people who want to work but can’t find jobs. So, a low rate means a lot of Americans are employed. That’s a good thing for many people.

But it can also lead to higher inflation because more people working means more spending – which drives up prices. Right now, the unemployment rate is low, but it’s been rising slowly over the past few months (see graph below):

What Does This Mean Moving Forward?

While mortgage rates are going to continue to be volatile in the days and months ahead, these are signs the economy is headed in the direction the Fed wants to see. But even with that, it’s unlikely they’ll cut the Federal Funds Rate when they meet next week. Jerome Powell, Chair of the Federal Reserve, recently said:

“We want to be more confident that inflation is moving sustainably down toward 2% before we start the process of reducing or loosening policy.”

Basically, we’re seeing the first signs now, but they need more data and more time to feel confident that this is a consistent trend. Assuming that direction continues, according to the CME FedWatch Tool, experts say there’s a projected 96.1% chance the Fed will lower the Federal Funds Rate at their September meeting.

Remember, the Fed doesn’t directly set mortgage rates. It’s just that whenever they decide to cut the Federal Funds Rate, mortgage rates should respond.

Of course, the timing of when the Fed takes action could change because of new economic reports, world events, and other factors. That’s why it’s usually not a good idea to try to time the market.

Boston Condos and the Bottom Line

Recent economic data may signal that hope is on the horizon for mortgage rates. Count on a local real estate agent you can trust to keep you up to date on the latest trends and what they mean for you.

Confused about the Boston economy and real estate market? Its understandable.

If you’re thinking of buying or selling a Boston condo, one of the biggest questions you have right now is probably: what’s happening with Boston condo for sale prices? And it’s no surprise you don’t have the clarity you need on that topic. Part of the issue is how headlines are talking about prices.

They’re basing their negative news by comparing current stats to the last few years. But you can’t compare this year to the ‘unicorn’ years (when home prices reached record highs that were unsustainable). And as prices begin to normalize now, they’re talking about it like it’s a bad thing and making people fear what’s next. But the worst home price declines are already behind us. What we’re starting to see now is the return to more normal home price appreciation.

To help make home price trends easier to understand, let’s focus on what’s typical for the market and omit the last few years since they were anomalies.

Let’s start by talking about seasonality in real estate. In the housing market, there are predictable ebbs and flows that happen each year. Spring is the peak homebuying season when the market is most active. That activity is typically still strong in the summer but begins to wane as the cooler months approach. Home prices follow along with seasonality because prices appreciate most when something is in high demand.

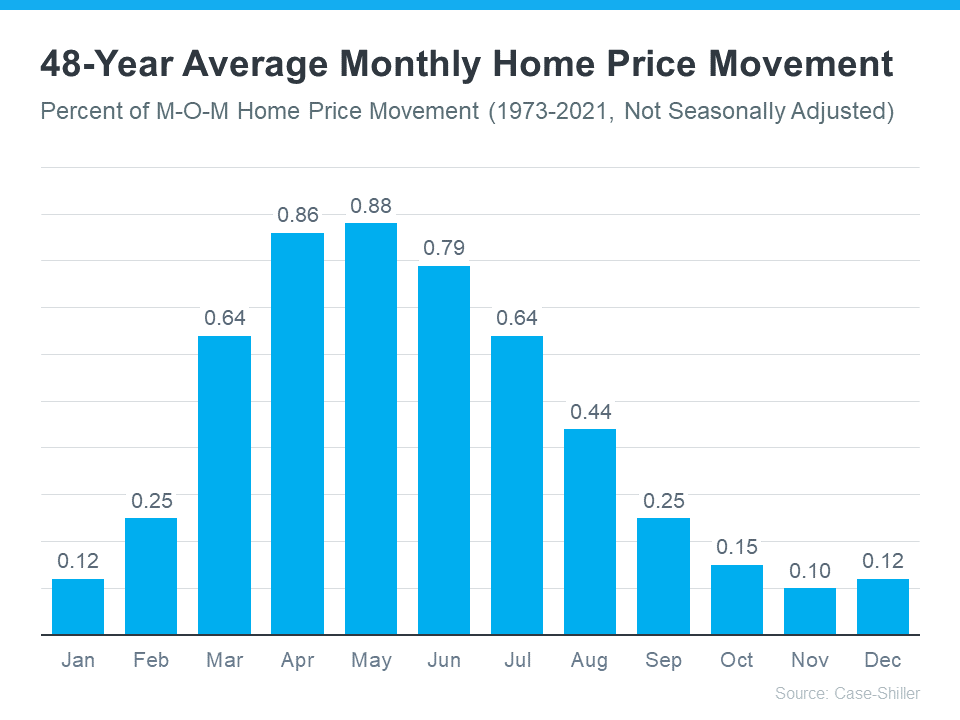

That’s why, before the abnormal years we just experienced, there was a reliable long-term home price trend. The graph below uses data from Case-Shiller to show typical monthly home price movement from 1973 through 2021 (not adjusted, so you can see the seasonality):

As the data from the last 48 years shows, at the beginning of the year, home prices grow, but not as much as they do entering the spring and summer markets. That’s because the market is less active in January and February since fewer people move in the cooler months. As the market transitions into the peak homebuying season in the spring, activity ramps up, and home prices go up a lot more in response. Then, as fall and winter approach, activity eases again. Price growth slows, but still typically appreciates.

Why This Is So Important to Understand

In the coming months, as the housing market moves further into a more predictable seasonal rhythm, you’re going to see even more headlines that either get what’s happening with home prices wrong or, at the very least, are misleading. Those headlines might use a number of price terms, like:

- Appreciation: when prices increase.

- Deceleration of appreciation: when prices continue to appreciate, but at a slower or more moderate pace.

- Depreciation: when prices decrease.

They’re going to mistake the slowing home price growth (deceleration of appreciation) that’s typical of market seasonality in the fall and winter and think prices are falling (depreciation). Don’t let those headlines confuse you or spark fear. Instead, remember it’s normal to see a deceleration of appreciation, slowing home price growth, as the months go by.

Boston Condos and the Bottom Line

If you have questions about what’s happening with home prices in our local area, let’s connect.

______________________________________________________________________________________________________________________________________________________________

As we continue to push through the health crisis that plagues this country, more and more conversations are turning to economic recovery and the future of the Boston real estate market. While we look for signs that we’ve reached a plateau in cases of COVID-19, the concern and fear of what will happen as businesses open up again is on all of our minds. This causes confusion about what an economic recovery will look like. With this in mind, it’s important to understand how economists are using three types of sciences to formulate their forecasts and to work toward clearer answers.

- Business Science – How has the economy rebounded from similar slowdowns in the past?

- Health Science – When will COVID-19 be under control? Will there be another flareup of the virus this fall?

- People Science – After businesses are fully operational, how long will it take American consumers to return to normal consumption patterns? (Ex: going to the movies, attending a sporting event, or flying).

Sam Khater, Chief Economist at Freddie Mac, says:

“Although the uncertainty of the crisis means forecasts of economic activity are more unclear than usual, we expect that most of the economic damage from the virus will be contained to the first half of the year. Going forward, we should see a recovery starting in the second half of 2020.”

Boston economy and real estate

This past week, the Bureau of Economic Analysis released the advanced estimate for Gross Domestic Product (GDP) for the first quarter of 2020. That estimate came in at -4.8%. It was a clear indicator showing how the U.S. economy slowed as businesses shut down and consumers retreated to their homes in fear of the health crisis and of contracting COVID-19. Experts agree that the second quarter of 2020 will be an even greater slowdown, a sign more businesses are feeling the effects of this health crisis. The same experts, however, project businesses will rebound, and a recovery will start to happen in the second half of this year.

Boston Real Estate and the Bottom Line

As time goes on, we’ll have more clarity around what the true economic recovery and Boston condo for sale market will look like, and we’ll have more information on the sciences that will affect it. As the nation’s economy comes back to life and businesses embrace new waves of innovation to serve their customers, the American spirit of grit, growth, and prosperity will be alive and well.

2. How Many Jobs the Economy Is Adding

2. How Many Jobs the Economy Is Adding