Case & Shiller Sales Report

Boston Condos for Sale and Apartments for Rent

Case & Shiller Sales Report

_________________________________________________________________________________________________________________________________________________________

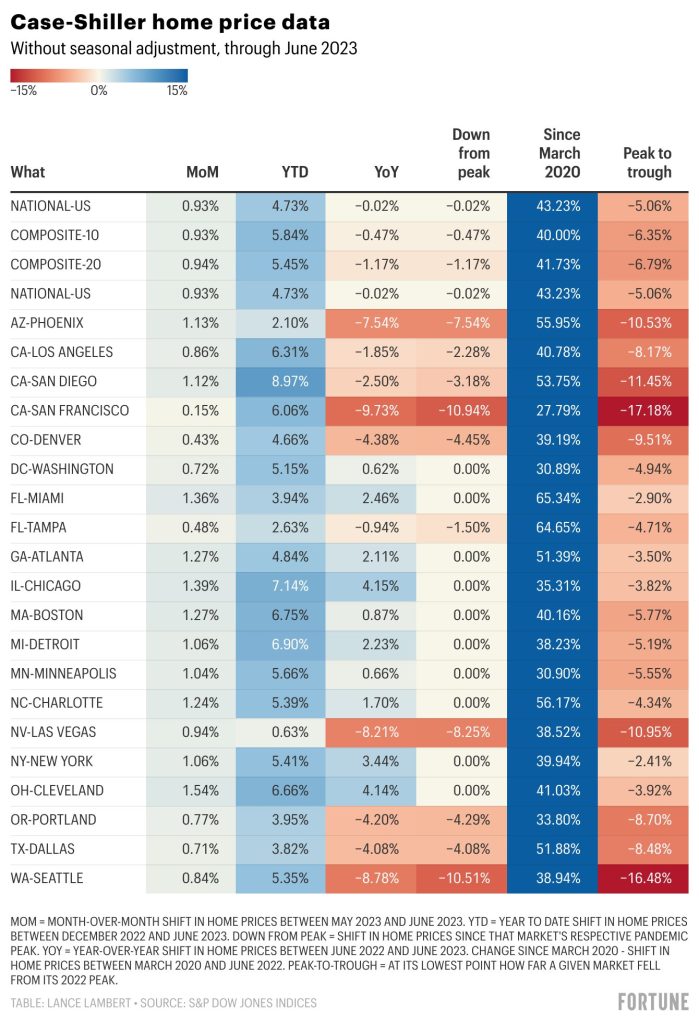

Though home prices are still increasing across the United States, the rate of growth is slowing, according to the latest S&P CoreLogic Case-Shiller Indices.

S&P Dow Jones Indices (S&P DJI) reported a national 18% year-over-year increase in June 2022, down from the 19.9% increase seen in May. It marks the third month in a row of slowed price growth.

The 10-City and 20-City Composites also reflected similar trends. Taking into account the metro areas of Boston, Chicago, Denver, Las Vegas, Los Angeles, Miami, New York City, San Diego, San Francisco and Washington, D.C., the 10-City Composite showed a 17.4% year-over-year price increase, down 1.7% from May. And for the 20-City Composite, June’s year-over-year price increase was 18.6%, down 1.9% from May.

Boston condo prices are up

In the Boston metro alone, prices were up 14.9% in June, year over year.

“As the macroeconomic environment continues to be challenging, home prices may well continue to decelerate,” says Craig J. Lazzara, S&P DJI managing director, said in an analysis accompanying the report. However, the analysis also emphasized the difference between price deceleration and price decline, stating that prices are still rising “at a robust clip.” Across composites, June’s growth rates remained at or above the 95th historical percentile.

However, as mortgage rates rise, concerns over a cooling market persist. In a statement following the release from S&P DJI, CoreLogic Deputy Chief Economist Selma Hepp noted that Western markets, including Seattle, Portland, Denver and California coastal cities, saw the greatest reduction in home prices growth during June.