Boston condos: Show me the Money

Boston Real Estate for Sale

Boston condos: Show me the Money

Are you dreaming of buying your own Boston condo and wondering about how you’ll save for a down payment? You’re not alone. Some people think about tapping into their 401(k) savings to make it happen. But before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert. Here’s why.

The Numbers May Make It Tempting

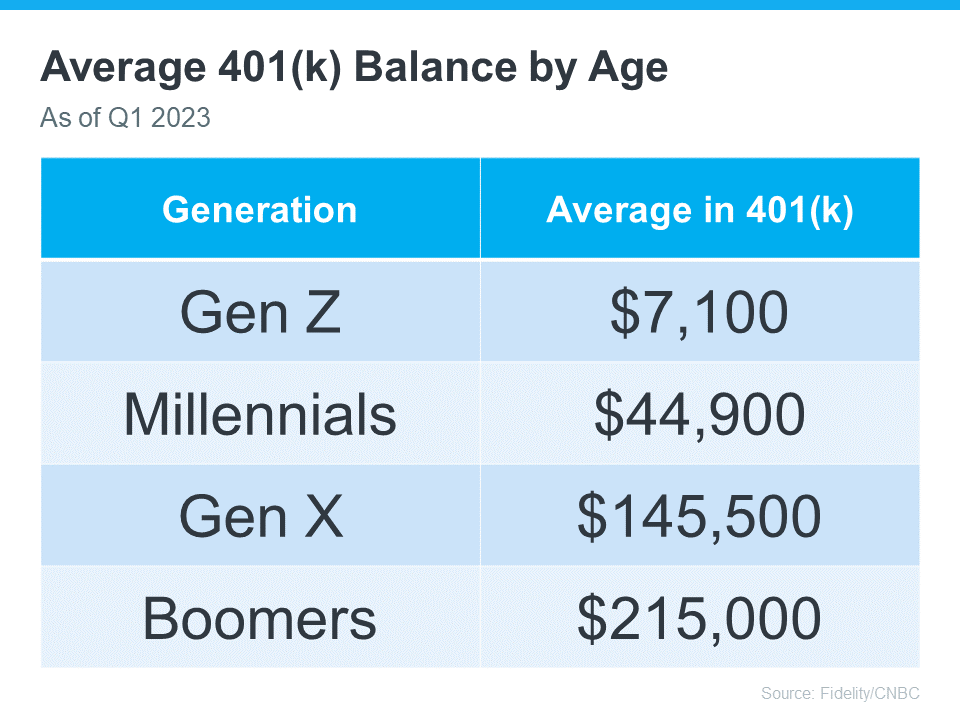

The data shows many Americans have saved a considerable amount for retirement (see chart below):

It can be really tempting when you have a lot of money saved up in your 401(k) and you see your dream home on the horizon. But remember, dipping into your retirement savings for a home could cost you a penalty and affect your finances later on. That’s why it’s important to explore all your options when it comes to saving for a down payment and buying a home. As Experian says:

“It’s possible to use funds from your 401(k) to buy a house, but whether you should depends on several factors, including taxes and penalties, how much you’ve already saved and your unique financial circumstances.”

Alternative Ways To Buy a Home

Using your 401(k) is one way to finance a home, but it’s not the only option. Before you decide, consider a couple of other methods, courtesy of Experian:

- FHA Loan: FHA loans allow qualified buyers to put down as little as 3.5% of the home’s price, depending on their credit scores.

- Down Payment Assistance Programs: There are many national and local programs that can help first-time and repeat homebuyers come up with the necessary down payment.

Above All Else, Have a Plan

No matter what route you take to purchase a home, be sure to talk with a financial expert before you do anything. Working with a team of experts to develop a concrete plan prior to starting your journey to homeownership is the key to success. Kelly Palmer, Founder of The Wealthy Parent, says:

“I have seen parents pausing contributions to their retirement plans in favor of affording a larger home often with the hope they can refinance in the future… As long as there is a tangible plan in place to get back to saving for their retirement goals, I encourage families to consider all their options.”

Boston Condos for Sale and the Bottom Line

If you’re still thinking about using your 401(k)-retirement savings for a home down payment, consider all your options and work with a financial professional before you make any decisions.

__________________________________________________________________________________________

NEW YORK, July 29 (Reuters) – Beset by COVID-19 and its fallout, local landlords are offloading their properties to cash-rich institutional investors, and America’s real-estate market may never be the same.

Before the pandemic, boyhood friends Michael Murano and Richard Tyson owned 96 rental units in their hometown of Rochester, New York. They offered accommodation to low-income tenants, many in the service industry, from rooming houses to single-family starter homes.

Today, they’re well on their way to liquidating the entire portfolio. Two-thirds of the units are already gone. The buyers? Large investors with all-cash offers.

“It broke my heart to sell 15 single-family homes to just one, out-of-state big corporate investor,” said Tyson, a 38-year-old U.S. Navy veteran.

“The last thing we need is to be exporting wealth out of this community, and limiting wealth creation here. But I knew we had to get the hell out of affordable housing – fast – because this was going to be a tidal wave coming at us.”

Many of America’s landlords have gone a year and a half without being paid by tenants, who’ve been protected by several state and local eviction moratoria as well as an umbrella federal ban enacted 11 months ago.

The owners have been waiting for $46 billion to help them survive without that income. The funds were approved by Congress months ago, but bureaucracy creaks; only $3 billion has reached them so far, according to U.S. Treasury Department data.

Now the eviction ban is about to end – on Saturday. Yet thousands of local landlords have already quit the business. And a growing number, like Tyson and Murano, are on their way out.

Taking their place: institutional investors, broadly defined in the industry as firms owning more than 1,000 units.

Boston Real Estate for Sale

These bigger players have bulk-bought properties during the pandemic, according to industry data and Reuters interviews with more than three dozen landlords, real estate brokers, landlord associations and property acquisition firms in major cities.

Such investors and their advocates say they provide long-term stability to the market at a time of upheaval, and are trying to fill the gap in rental properties needed by Americans as many small landlords are exiting in financial trouble.

Yet many housing campaigners say the growing presence of big investors in the market will inevitably mean higher rents and less affordable housing available to the types of tenants whose health and incomes have been hit hardest by the pandemic.

‘I’M EXTREMELY BITTER’

About 23% of small landlords, owning between one and three single-family homes, planned to sell at least one property due to difficulties caused by the eviction ban, according to a February survey of 1,000 such owners by the National Rental Home Council, a Washington D.C.-based trade advocacy group.

This could reshape the market in the United States, where local landlords provide the bulk of rental properties and affordable homes. They range from small “mom-and-pop” owners with a few units to medium players with dozens.

During the first half of 2021, $77 billion in institutional money has poured into the rental home market, according to residential brokerage Redfin.

This month, for example, Tricon Residential (TCN.TO) announced it would be spending $5 billion to buy an additional 18,000 homes together with a Texas pension fund and other large investors.

“There is an incredible demand and a shortage of supply for high-quality rental homes – in fact, we receive over 5,000 calls weekly to rent our homes, with only 250 homes available at any time,” said Kevin Baldridge, Tricon’s chief operating officer,

Housing promises lucrative returns, particularly in terms of rising home prices, at a time of low global yields, according to John Burns Real Estate Consulting. Institutional investors are reallocating money from fixed-income investments, it said.

“Every day, there is a new press release on an existing or new investor group raising billions to buy properties,” said Rick Palacios, Jr., John Burns’ director of research.

“The big buyers are happy to take these properties off local landlords’ hands.”

In Washington, D.C., affordable housing landlord Arthur Nalls tried for months to hang on after the pandemic began, paying off the mortgages on his two rental buildings with savings, then his credit cards and finally his retirement fund.

About a third of his 47 tenants stopped paying, the 66-year-old said. “My gas bills didn’t get a deduction, my utilities didn’t get a deduction, my property taxes were still due and I still had to make repairs.”

In January and June, Nalls sold his two properties to investors. “You can probably tell by the tone of voice,” he said, “I’m extremely bitter about the whole thing.”

‘COMMITTED CAPITAL’

The National Rental Home Council, which advocates for landlords of single-family homes, said large institutional investors still made up a very small percentage of owners but played an important role.

“What’s needed in today’s rental housing market is a source of committed capital to offset the very real and significant supply constraints,” said David Howard, its executive director.

That may be scant comfort to many of the tenants living in the 110 units of Devenscrest Village in Ayer, Massachusetts, which local realtors say is one of the last affordable residential complexes in the area.

Some are now facing displacement after the local owner of the property sold it to an investment firm this summer after an all-cash bidding war.

Three tenants told Reuters that residents there were told by the firm in July that it plans to make renovations that could raise rents from $900 for a two or three-bedroom apartment to as much as $2,100. They said residents in about 40 units, all on month-to-month leases, had received notices to vacate by Sept. 30.

The firm now managing the property, Devenscrest Management, said it was revitalizing a long-neglected neighborhood, and investing millions of dollars in repairs and renovations.

In an emailed statement, Devenscrest added the revamp could not be safely conducted with homes occupied. It said 37 tenants had been given more than 75 days to relocate, which it said was over double the amount of time required by law.

“We recognize that relocating one’s home can be difficult. As we have stated to all residents with whom we have spoken, we will work with those residents who require additional time to find a new home,” it said.

The company said the $900 rent figure was misleading when taking into account the cost of heating uninsulated units, adding that a recent inspection found an original heating system from the mid-1940s. It said that once the units were upgraded they would be offered at the market rates at that time.

The building’s former owner is Larry Tocci, a local landlord who the residents said charged below-market prices. In the past eight years, he’s never had a vacancy.

He said a rapid escalation of property prices in the area had made the prospect of a sale too tempting to refuse.

But, Tocci added, he’s now worried about the tenants with whom he was on a first-name basis.

“I’ve been running the place for 41 years, and I really tried to take care of my tenants. There are a lot of good people in there just trying to get by,” he said. “I know I’ve sold and it’s no longer my responsibility – but after 41 years, I do feel somewhat responsible.”

‘LEFT HOLDING THE BAG’

The increasing interest of institutional investors has already helped push up both rents and home prices during the pandemic, according to John Burns, though other factors like lack of inventory and low interest rates have also been drivers.

Rents are up 7% nationally from a year ago, according to housing tracker Zillow. Average home prices rose 16.6% in the year ending May, according to the CoreLogic Chase-Shiller index, the highest annual growth since it started in 1987.

Even before COVID-19 struck, America was plagued by a lack of affordable homes, defined by the government as one that a household can rent for 30% or less of their income. A quarter of American renters pay more than half their incomes on rent, the Harvard Joint Center for Housing Studies says.

Now, in the aftermath of the pandemic eviction bans, an estimated 6.5 million tenants owed $27.5 billion in back rent and utilities as of the middle of July, according to Mark Zandi, chief economist at Moody’s Analytics.

Robert Pinnegar, chief executive of the National Apartment Association, a landlord trade group, said the economics of small owners meant they were already operating on thin profit margins of around 10% before the pandemic upended life.

“Eviction moratoria have not only left renters strapped with insurmountable debt but have left small owners to unfairly hold the bag,” he added.

Boston Real Estate for Sale

______________________________________________________________________________________________________________________________________________________________________________________________

Most Boston condo buyers use some kind of financing to buy a home. Over the last 15 years or so the home buying process has changed because

Boston Condo Loan Process

The process of getting a loan to buy a home hasn’t changed much and most of it is shrouded in mystery. Homebuyers fill out forms like crazy and send information to the lender.

Once a buyer has a contract to purchase a home the process goes into a kind of black hole. The property is appraised and the process goes to “underwriting”. Sometimes we get to talk to the underwriter but most of the time we don’t get to and they always seem to be on vacation the week of the closing.

When I work with downtown Boston real estate buyers or sellers I have no control over the mortgage process and a big part of my process is to constantly ask for updates. It seems like it all works out most of the time.

During the great recession and housing market crash financing “fell through” a lot more often than it does these days.

Often when something does go wrong it is people like me who become the “face” of the purchase and end up absorbing the blows and explaining what went wrong even though we do not have any control over the process.

Working with a loan officer who doesn’t return phone calls or give updates can turn a positive home buying or selling experience into a hellish one.

I am looking forward to the day when consumers will start to benefit from today’s technology when they want to borrow money. A day when the process is transparent and the consumer is in charge. There is plenty of room for better customer service in mortgage and finance.

Downtown Boston Real Estate and the Bottom Line

Chose your lender wisely. Get recommendations from real estate agents and friends, relatives, neighbors and co-workers who have recently purchased homes.

Boston Condos for Sale

Back to Boston condos for sale homepage

Contact me to find out more about this property or to set up an appointment to see it.

SEARCH FOR CONDOS FOR SALE AND RENTALS

For more information please contact one of our on-call agents at 617-595-3712.