Downtown Boston Real Estate Search for 2022

Updated: Boston Real Estate Blog 2022

Boston condos for sale: Is housing still affordable?

It’s impossible to research the subject of buying a home without coming across a headline declaring that the fall in home affordability is a crisis. However, when we add context to the most recent affordability statistics, we soon realize that, though homes are less affordable than they have been over the last few years, they are more affordable than they historically have been.

Black Knight, a premier provider of data and analytics for the mortgage industry, just released their latest Monthly Mortgage Monitor which includes a new analysis of the affordability situation. Here’s what the report reveals:

“The monthly payment required to purchase the average priced home with a 20% down 30-year fixed rate mortgage increased by nearly 20% (+$210) over the first nine months of 2021, . . . It now requires 21.6% of the median household income to make the monthly mortgage payment on the average home purchase, the least affordable housing has been since 30-year rates rose to nearly 5% back in late 2018.”

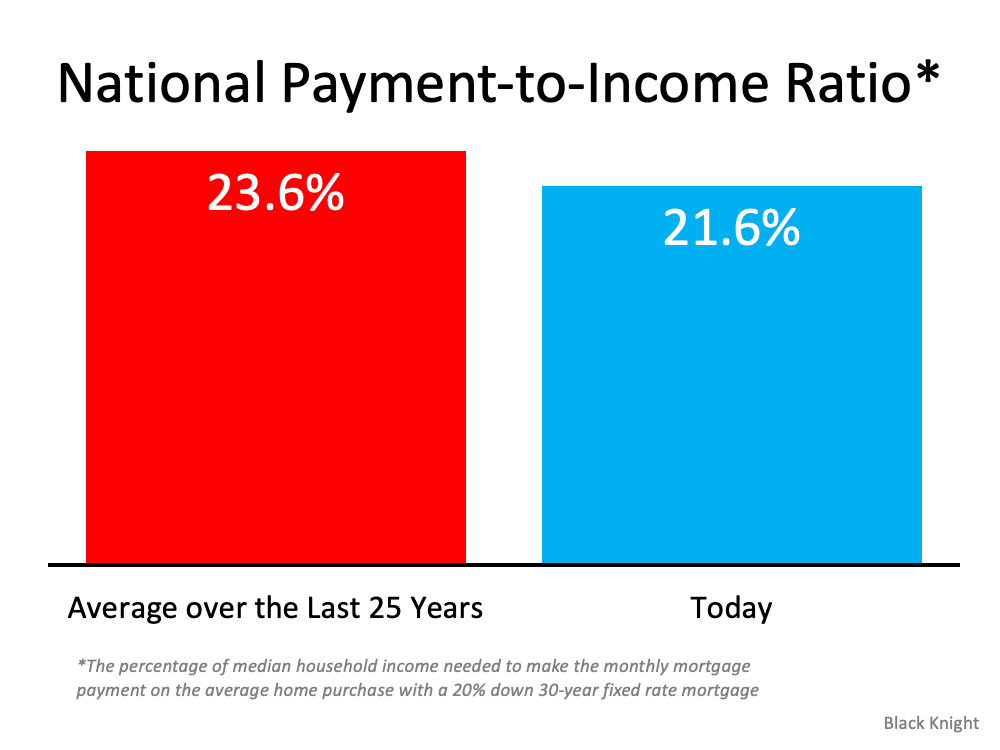

Basically, the report shows that homes are less affordable today than at any other time in the last three years. However, in a previous report earlier this year, Black Knight calculated that the percentage of the median household income to make the monthly mortgage payment on the average home purchase over the last 25 years was 23.6% (see graph below): Today’s payment-to-income ratio is more affordable than the average over the last 25 years. Given that context, we can see that American households still have the same ability to be homeowners as their parents did 20 years ago.

Today’s payment-to-income ratio is more affordable than the average over the last 25 years. Given that context, we can see that American households still have the same ability to be homeowners as their parents did 20 years ago.

This confirms the recent analysis of ATTOM Data resources where Todd Teta, Chief Product and Technology Officer, explains:

“The typical median-priced home around the U.S. remains affordable to workers earning an average wage, despite prices that keep going through the roof. Super-low interests and rising pay continue to be the main reasons why.”

Boston Condos and the Bottom Line

It’s true that it’s less affordable to buy a home today than it has been the last few years. However, it’s more affordable to buy today than the average over the last 25 years. In other words, homes are less affordable, but they’re not unaffordable. That’s an important distinction.

Click Here to view: Google Ford Realty Inc Reviews

Click to View Google Reviews

Updated: Boston Real Estate Blog 2022

_______________________________________________________________________________________________

Downtown Boston Real Estate Search for 2022

Boston condos for sale: Is housing still affordable?

There are many headlines about how housing affordability is declining. The headlines are correct: it’s less affordable to purchase a home today than it was a year ago. However, it’s important to give this trend context. Is it less expensive to buy a house today than it was in 2005? What about 1995? What happens if we go all the way back to 1985? Or even 1975?

Obviously, the price of a home has appreciated dramatically over the last 45 years. So have the prices of milk, bread, and just about every other consumable. Prices rise over time – we know it as inflation.

However, when we look at housing, price is just one component that makes up the monthly cost of the home. Another key factor is the mortgage rate at the time of purchase.

Let’s look back at the cost of a home over the last five decades and adjust it for inflation by converting that cost to 2021 dollars. Here’s the methodology for each data point of the table below:

- Mortgage Amount: Take the median sales price at the end of the second quarter of each year as reported by the Fed and assume that the buyer made a 10% down payment.

- Mortgage Rate: Look at the monthly 30-year fixed rate for June of that year as reported by Freddie Mac.

- P&I: Use a mortgage calculator to determine the monthly principal and interest on the loan.

- In 2021 Dollars: Use an inflation calculator to determine what each payment would be when adjusted for inflation. Green means the homes were less expensive than today. Red means they were more expensive.

As the chart shows, when adjusted for inflation, there were only two times in the last 45 years that it was less expensive to own a home than it is today.

As the chart shows, when adjusted for inflation, there were only two times in the last 45 years that it was less expensive to own a home than it is today.

- Last year: Prices saw strong appreciation over the last year and mortgage rates have remained relatively flat. Therefore, affordability weakened.

- 2010: Home values plummeted after the housing crash 15 years ago. One-third of all sales were distressed properties (foreclosures or short sales). They sold at major discounts and negatively impacted the value of surrounding homes – of course homes were more affordable then.

At every other point, even in 1975, it was more expensive to buy a home than it is today.

Boston Condos for Sale and the Bottom Line

If you want to buy a Boston condo, don’t let the headlines about affordability discourage you. You can’t get the deal your friend got last year, but you will get a better deal than your parents did 20 years ago and your grandparents did 40 years ago.

Ford Realty Inc., Boston Real Estate for Sale

Click to View Google Review

Updated: Boston Real Estate 2021

Downtown Boston Real Estate Search for 2021

_______________________________________________________________________________________________________________________________________________________________________________________________________

Boston condos for sale: Is housing still affordable?

ATTOM Data Solutions’ first-quarter 2021 U.S. Home Affordability Report found the median prices of single-family homes and condos to be more affordable today than historical averages in 52% of counties analyzed, down from 63% in the first three months of 2020.

The median home prices in 287 of the 552 counties the company analyzed were more affordable than past averages, down from 349 in the year-ago period. Nationwide, the expense of purchasing a median-priced home consumed 23.7% of the average wage in the first quarter of 2021, up from 22% in the first quarter of 2020 and 19.7% five years ago. This puts it in line with the 28% standard lenders prefer for homeowners to spend, according to the report.

Inventory continues to be tight, as homes are still selling well above asking price — factors the report found did not outweigh the benefits of increased wages and low mortgage rates.

“The past year certainly has been an odd one for the U.S. housing market. Home prices surged at a remarkable pace even as the virus pandemic damaged the U.S. economy, which dropped historical affordability levels,” ATTOM Chief Product Officer Todd Teta said in a press release. “But average workers untarnished by the pandemic were still able to afford the typical home because wages and rock-bottom interest rates worked to their favor in a big way.”

Teta added that uncertainties about the 2021 housing market depend on how well the U.S. economy recovers.

The report also found home-price appreciation outpaced average weekly wage growth in 86% of the counties analyzed. Boston’s Suffolk County was among the 14% of counties where wage growth outpaced home-price appreciation.

Lately, there have been many headlines circulating about whether or not there is an “affordability issue forming in the housing market.”

Downtown Boston Real Estate Search for 2021

——————————————————————————————————————————————————————————————————————————————————————————————————————————————–

Boston condos for sale: Is housing still affordable?

If you are considering selling your current Boston downtown condo and moving up to a Boston luxury condos of your dreams, but are unsure whether or not to believe what you’re seeing in the news, let’s look at the results of the latest Housing Affordability Report from the National Association of Realtors (NAR).

According to NAR:

“A value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that a family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

- The national index results for August came in at 141.2.

- This is up from 138.9 in July, but down 8.3% from last August’s value of 153.9.

One big factor in determining affordability each month is the interest rate available at the time of calculation. In August 2017, the 30-year fixed rate mortgage interest rate was 4.19%. This August, the rate rose to 4.78%!

With an index reading of 141.2, housing remains affordable in the U.S.

Regionally, affordability is up in three out of four regions. The Northeast had the biggest gain at 6.2%. The South had an increase of 2.4% followed by the West with a slight increase of 0.1%. The Midwest had the only dip in affordability at 4.8%.

Despite month-over-month changes, the most affordable region remains the Midwest, with an index value of 175.7. The West remains the least affordable region at 101.2. For comparison, the index was 146.7 in the South, and 151.2 in the Northeast.

Boston Real Estate and the Bottom Line

If you are thinking of selling your downtown Boston condo, let’s get together to discuss the affordability conditions in our marketplace.