Boston condos for sale and hedge against inflation

Boston Condos for Sale and Apartments for Rent

Boston condos for sale and hedge against inflation

It feels like everything is getting more expensive these days. That’s because inflation has remained higher than normal for longer than expected – and that’s impacting the costs of goods, services, and more. And with rising costs all around you, you’re probably questioning: is now really the right time to buy a home?

Here’s the good news. Owning a home is actually one of the best ways to protect yourself from the rising costs that come with inflation.

A Fixed Mortgage Protects You from Rising Housing Costs

One of the key benefits of homeownership is that when you buy a Beacon Hill condo for sale with a fixed-rate mortgage, your biggest monthly expense — your mortgage payment — stabilizes. Sure, your payment could rise slightly as your homeowner’s insurance and property taxes shift. But no matter what happens with inflation, your principal and interest payments won’t change.

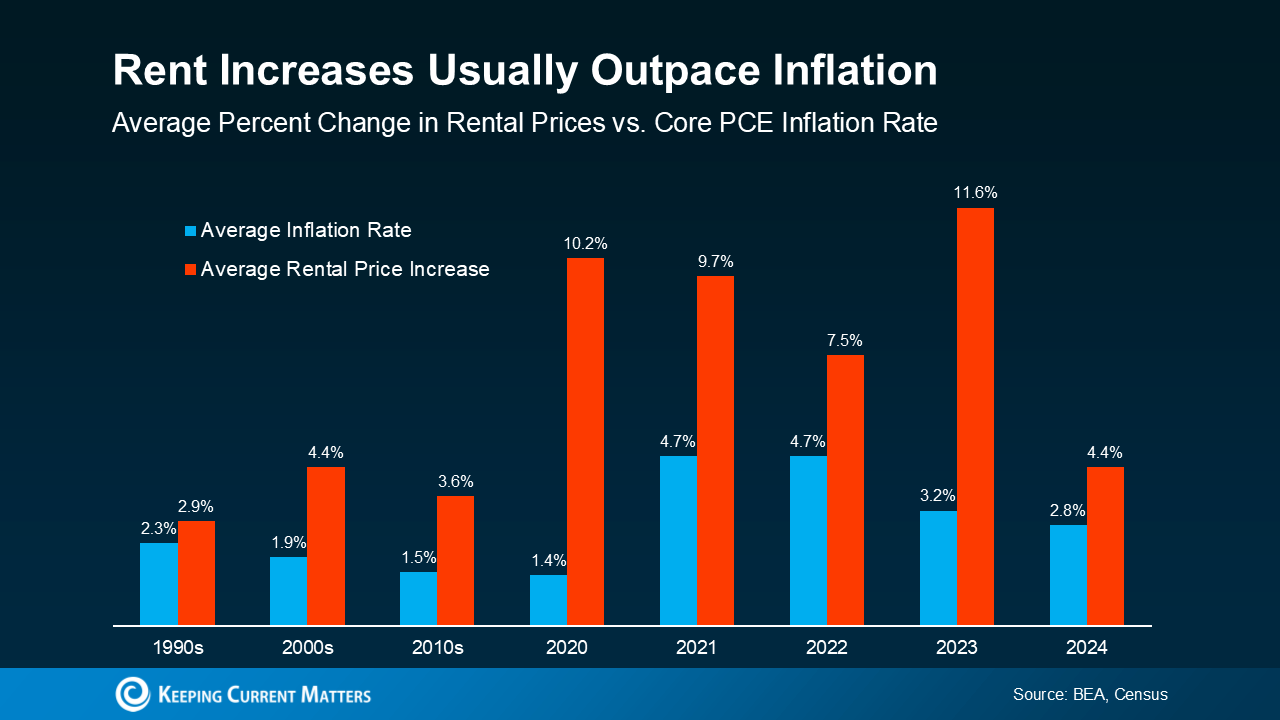

That’s not the case if you rent. Rent tends to rise over time, and it usually goes up even faster than the rate of inflation. Just look at the data from the Bureau of Economic Analysis (BEA) and the Census Bureau (see graph below):

So, while renters face higher costs year after year, homeowners with a fixed mortgage rate lock in their monthly payments, making it easier to budget no matter what happens with inflation.

So, while renters face higher costs year after year, homeowners with a fixed mortgage rate lock in their monthly payments, making it easier to budget no matter what happens with inflation.

Boston Condo Prices Typically Rise Faster Than Inflation

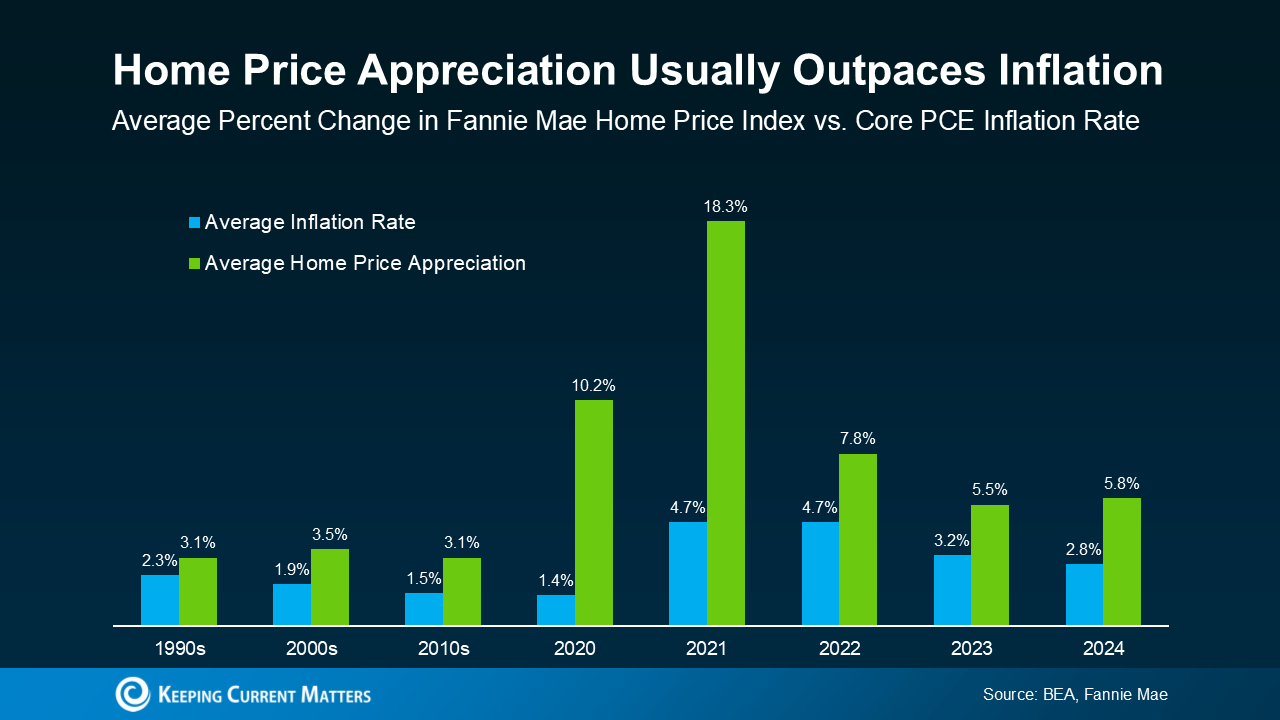

Another big reason homeownership is a great hedge against inflation is that home values tend to appreciate over time — often at a higher rate than inflation, according to data from the BEA and Fannie Mae (see graph below):

That makes real estate one of the strongest long-term investments during times of rising prices. While inflation can chip away at the value of cash savings, real estate typically holds or grows in value, allowing you to build wealth.

That makes real estate one of the strongest long-term investments during times of rising prices. While inflation can chip away at the value of cash savings, real estate typically holds or grows in value, allowing you to build wealth.

On the other hand, renting offers no protection against inflation. In fact, it does the opposite — when inflation drives up costs, landlords often pass those increases onto tenants through higher rents.

That means as a renter, you’re continually paying more without gaining any financial benefit. But as a homeowner, rising prices work in your favor by increasing the value of your home and growing your equity over time.

And with experts forecasting continued home price growth, that means you’re making an investment that usually grows in value and should outperform inflation in the years ahead.

In short, a fixed-rate mortgage protects your budget, and home price appreciation grows your net worth. That’s why homeownership is a strong hedge against inflation.

Boston Condos for Sale and the Bottom Line

Inflation can make everyday expenses unpredictable, but owning a home gives you stability. Unlike rent, your monthly mortgage payment stays pretty much the same over time. Plus, the value of your home is likely to increase after you buy.

Boston condos for sale and hedge against inflation

Federal Reserve could have handled inflation less painfully, experts say

Chair of the Federal Reserve of the United States Jerome Powell (Photo Illustration by Steven Dilakian for The Real Deal with Getty)

The conventional wisdom is that the Federal Reserve had to jack up interest rates and keep them elevated — causing immense pain to real estate investors — to bring inflation under control.

But what if the conventional wisdom is wrong? What if the Fed could have raised rates less, reduced them sooner, and employed more targeted measures to fight inflation?

Some experts are making that case. If they’re right, the Fed owes real estate an apology.

No industry relies on debt more. Its critics sometimes say, “No one is forcing anyone to borrow money,” but that is naive. Real estate players who use debt can grow faster and outcompete those who don’t, so for most, it’s not really a choice.

Could borrowers have hedged against the Fed’s rate hikes? Some bought rate caps, which are like an insurance policy against rate increases, but the caps are expiring while rates remain at their highest point since the mid 2000s.

Could they have locked in long-term loans? A typical commercial real estate loan is interest-only and matures in five years. Many are floating-rate because they are cheaper, at least at the outset. Now there’s a steady drumbeat of loans coming due on properties that don’t generate enough revenue to pay today’s much higher interest rates.

Blaming property investors for exposing themselves to what have been unprecedented rate hikes is like blaming fishermen for living on the coast when a tsunami hits. The Fed knew that people would drown when, beginning in March 2022, it raised the federal funds rate by 525 basis points in less than 18 months. And it should have known it would freeze the housing market, too. Brokers and agents certainly did.

Given that the Fed had lowered the rate to zero to offset the anticipated economic effects of the pandemic, the increases were, percentage-wise, its fastest and steepest ever — more severe even than those championed by Paul Volcker four decades ago. Only five times in its history has the Fed raised rates by 75 basis points at once — once in 2004 and four times in its recent blitz.

Boston condos for sale and hedge against inflation

Updated: Boston Real Estate Blog 2025

Condo Broker 137 Charles St. Boston, MA 02114

Visit our office at 137 Charles Street, Beacon Hill MA 02114

Where is Ford Realty Located?

Ford Realty is located in 137 Charles Street in Beacon Hill

![]()

Click Here to view: Google Ford Realty Inc Reviews

Some Highlights

- Wondering if it makes sense to buy a home today even when inflation is high? When other costs go up due to inflation, buying a home helps you keep your monthly housing expense steady.

- Rents typically increase with inflation. Maybe that’s why, according to a recent survey, 65.1% of landlords say they plan to raise the rent of at least one of their properties within the next 12 months.

- Especially when inflation is up, having a stable housing payment can be helpful. Let’s connect so you can learn more and start your journey to owning a home today.

______________________________________________________________________________________________

If you’re following along with the news today, you’ve heard about rising inflation. Today, inflation is at a 40-year high. According to the National Association of Home Builders (NAHB):

“Consumer prices accelerated again in May as shelter, energy and food prices continued to surge at the fastest pace in decades. This marked the third straight month for inflation above an 8% rate and was the largest year-over-year gain since December 1981.”

With inflation rising, you’re likely feeling it impact your day-to-day life as prices go up for gas, groceries, and more. These climbing consumer costs can put a pinch on your wallet and make you re-evaluate any big purchases you have planned to ensure they’re still worthwhile.

If you’ve been thinking about purchasing a Boston condo for sale this year, you’re probably wondering if you should continue down that path or if it makes more sense to wait. While the answer depends on your situation, here’s how homeownership can help you combat the rising costs that come with inflation.

Owning a Boston Condo Helps You Stabilize Your Monthly Expenses

Investopedia explains that during a period of high inflation, prices rise across the board. That’s true for things like food, entertainment, and other goods and services, even housing. Both Boston apartment rental prices and Boston condo for sale prices are on the rise. So, as a buyer, how can you protect yourself from increasing costs? The answer lies in homeownership.

Buying a Boston condos for sale allows you to stabilize what’s typically your biggest monthly expense: your housing cost. When you have a fixed-rate mortgage on your home, you lock in your monthly payment for the duration of your loan, often 15 to 30 years. James Royal, Senior Wealth Management Reporter at Bankrate, says:

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same. That’s certainly not the case if you’re renting.”

So even if other prices increase, your housing payment will be a reliable amount that can help keep your budget in check. If you rent, you don’t have that same benefit, and you won’t be protected from rising housing costs.

Investing in Boston Condos for Sale Historically Outperforms Inflation

While it’s true rising Boston condo for sale prices and higher mortgage rates mean that buying a Boston condo today costs more than it did even a few months ago, you still have an opportunity to set yourself up for a long-term win. That’s because, in inflationary times, you want to be invested in an asset that outperforms inflation and typically holds or grows in value.

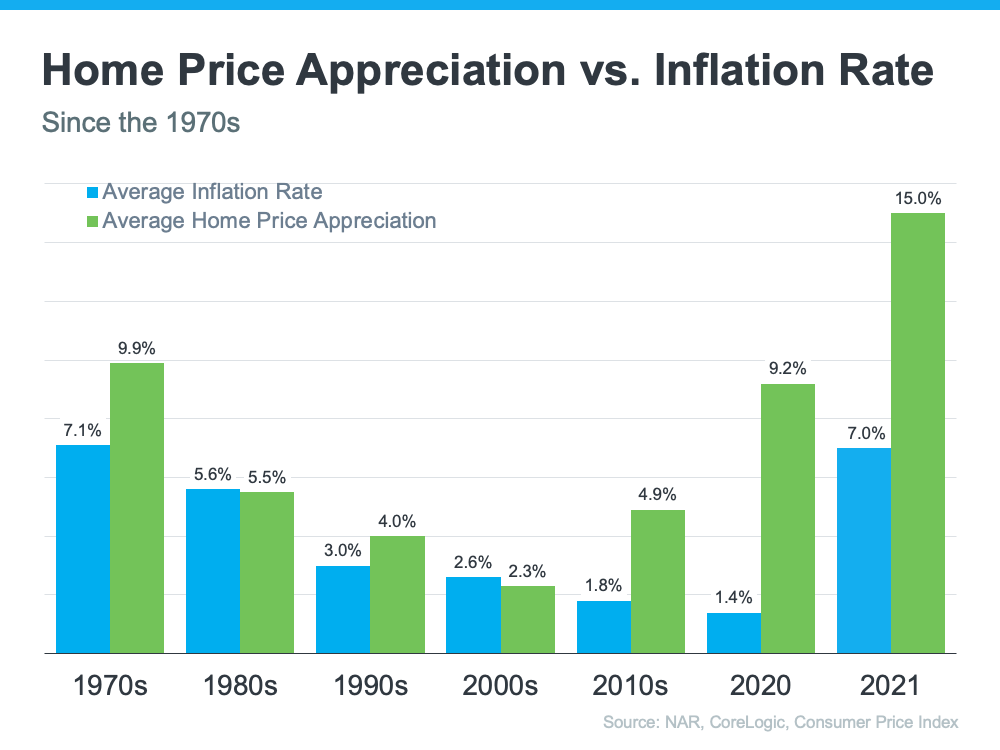

The graph below shows how the average home price appreciation outperformed the average inflation rate in most decades going all the way back to the seventies – making homeownership a historically strong hedge against inflation (see graph below):

So, what does that mean for you? Today, experts forecast home prices will only go up from here thanks to the ongoing imbalance of supply and demand. Once you buy a house, any home price appreciation that does occur will grow your equity and your net worth. And since homes are typically assets that grow in value, you have peace of mind that history shows your investment is a strong one.

It makes sense to buy today before Downtown Boston condo prices rise further.

Boston Condo and the Bottom Line

If you’ve been thinking about buying a Boston condo for sale this year, it makes sense to act soon, even with inflation rising. That way you can stabilize your monthly housing cost and invest in an asset that historically outperforms inflation. If you’re ready to get started, let’s connect so you have expert advice on your specific situation when you’re ready to buy a downtown Boston condo.

Updated: Boston Real Estate Blog 2022

Click Here to view: Google Ford Realty Inc Reviews