Boston condos for sale: Big predictions I never thought of

Downtown Boston Real Estate

Loading...

Boston condos for sale: Big predictions I never thought of

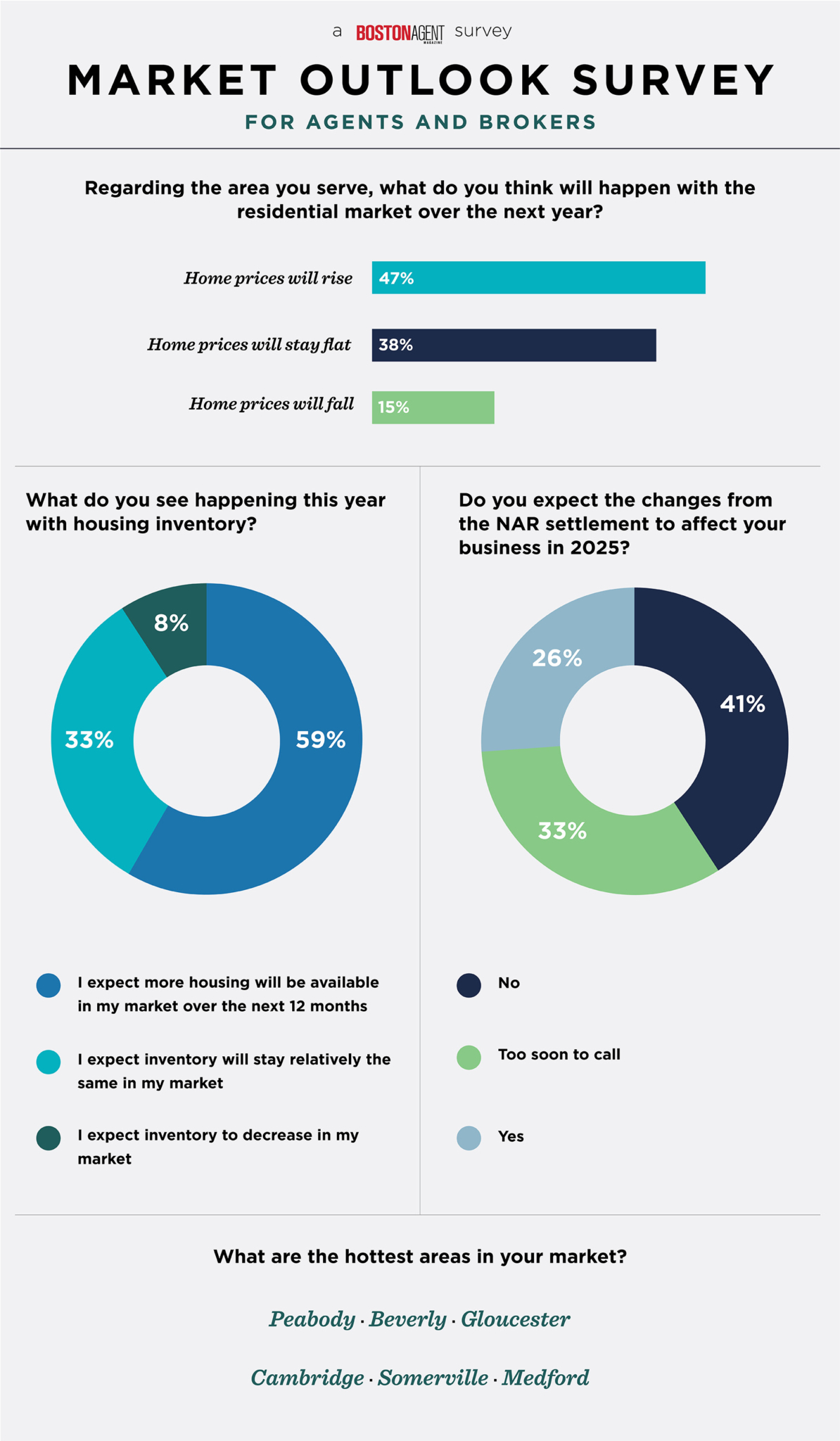

The chart below are Boston condo for sale predictions for 2025. The survey was conducted by local Boston condo brokers and agents.

___________________________________

Boston condos for sale: Big predictions I never thought of

We all collectively scratched our heads and asked “what just happened?” in 2020. Now in 2021, we’re looking ahead and trying to make predictions for the year. While we are still living in unpredictable times, there are a few things that we can be confident will come to pass in the months to come. I should have thought of these earlier.

The Economy Is Set To Soar. So will Boston condos for sale

Just about every economist is pointing to an economy set to explode in 2021. A Wall Street Journal article explained why, noting a few specific catalysts:

• The move online we’ve all experienced during the past five years set up businesses to not only weather the storm but, in many cases, flourish.

• There is tons of cash sloshing around. The Federal Reserve reports that Americans have collectively made $2 trillion in new savings deposits since the pandemic hit.

Combine this with pent-up demand from consumers who have been sidelined since last February and with the arrival of vaccines, and the economy looks like a rocket on the final countdown.

All taken together, this means we can expect apartment tenant applications to soar for several reasons. First, despite severe hardships to specific industries (hospitality, travel, restaurants), many Americans are doing pretty well. Plus, as working from home becomes the new normal, many workers are fleeing dense urban jungles for more enjoyable environments (think downtown Boston) and renting homes as they relocate.

That said, there is a dark side of the new normal that has the potential to confound unsuspecting landlords: damaged credit. We saw this in 2009 and 2001 as well. Maxed-out credit cards are not abnormal these days — nor are applicants who seem low on cash reserves or applicants with relatively new jobs. Late payments on credit histories are more common than ever.

We’re used to using these signals as indications an applicant might have trouble paying rent down the line. But the past year was anything but normal, and as we go forward, we may need to be more flexible than normal. Some of these apparently poor risks may actually be great potential tenants.

I think of the story of Amadeo Peter Giannini, the son of Italian immigrants who, in the aftermath of the 1906 San Francisco earthquake, set up a makeshift bank on a wharf and made loans to desperate locals on nothing but a handshake. His small bank — the Bank of Italy — flourished by capturing so many customers at such a fateful time. You may know it better today as the Bank of America.

Applicant Evaluations In The New Normal

As a landlord today, though, you should probably bank on more than a handshake. But what can you do in this post-pandemic world to balance the opportunities of a soaring economy with the risk of bad tenants?

• Learn to discount minor, pandemic-driven noise. Maxed-out credit cards, lower cash reserves, and new jobs are more common and less predictive than in normal times. Learn to look beyond these traditional measures.

• Pay attention to the big things. That said, some things are still instant disqualifiers. Foreclosures, evictions, bankruptcies, and failure to pay are all indications of a substandard applicant. These are the big things.

• Watch for fraudulently-altered financial documentation. A relatively new job is something you can overlook, but fraudulently-altered financial documentation, for example, a fake paystub from someone with no job, isn’t. Neither is a falsified bank statement.

I suspect all of us are eager for a prosperous 2021 after living with the Covid-19 pandemic throughout 2020. All signs are that this will turn out to be an excellent year. But remain careful — there are risks as well. Nonetheless, with proper precautions, 2021 can be a profitable year for property managers.

As we reach the final quarter of the year, few real estate experts are likely looking back on 2020 and boasting about their accurate forecasting abilities. Last year at this time, no one could have predicted the trends that came to define real estate markets in 2020.

Real Estate Sharing Lost Its Appeal

In response to strong demand from millennials, in recent years, shared amenities have expanded beyond on-site gyms and party rooms. As of early 2020, many new developments were offering buyers access to on-site co-working spaces and playrooms. Some luxury condo buildings were even throwing in amenities like common shared rooftop infinity pools.

Remote work has been trending since the late 1990s, but in 2020, it finally became the norm. While some employees will return to the office, there are early signs that for many workers, remote work is here to stay. The Boston Real estate market has already been affected on multiple levels.

As of late 2020, I’m seeing more people than ever before looking to size up in their current neighborhood as home offices are in increasingly high demand. Second, the suburbs and even small towns are becoming increasingly popular destinations as the need to live close to work is no longer a key factor in housing choice for the first time in decades. Third, as remote work persists, more people are realizing that there may be many reasons to take advantage of the lower cost of living in the suburbs.

The Sizing-Down Real Estate Trend Abruptly Ended

In December 2019, World Property Journal ran an article with the headline “Shrinking Homes, More Millennial Buyers Top 2 U.S. Housing Market Predictions for 2020.” Last December, there was every reason to make both of these predictions. With the pandemic, at least the sizing-down trend hit a huge hurdle.

Factors driving the sudden surge in demand for larger homes include remote work and remote schooling. Another factor has been the return to multigenerational living. Since the beginning of the pandemic, an exceptionally high percentage of younger millennials have returned to their parents’ homes. One August 2020 study found 39% of younger millennials have already returned home or plan to do so, and there are reports of married couples with children moving in with parents or inviting their parents to live in their homes to assist with child care. Both trends are creating a growing demand for larger homes.

Millennials Fled To The Boston Suburbs

Before the pandemic, walkability was critical, especially for millennials. A 2019 Zillow survey found that 60% of millennials said walkability was among the most important factors driving their neighborhood choice. Other studies have found that millennials were more likely to value proximity to amenities. Everything changed when the pandemic hit, work went remote and communal gatherings went out of style. As of late 2020, millennials appear to be leading an exodus to the suburbs.

On this account, however, it is important to note that even before the pandemic, many millennials were on their way or at least thinking about a future move to the suburbs. In fact, the pandemic may have just accelerated a trend already in motion. According to Zillow, pre-pandemic, 44% of younger millennial homebuyers were choosing to purchase in the suburbs, compared to 40% for older millennials.

Mortgage Rates Hit All-time Lows

In late 2019, Realtor.com was among the publications to predict that mortgage rates would start to rise slightly in 2020. The site predicted a bump up to 3.88% by the end of the year. In the end, mortgage rates didn’t increase but plummeted, even dipping to all-time lows. How long these rock bottom rates will remain is yet to be seen. If they remain low in 2021, opportunities could be ripe for buyers as steeper discounts on listed homes also become the norm.

What 2021 holds in store is yet to be seen, but one thing seems fairly certain. It may be difficult to exceed the levels of uncertainty and unpredictability that defined 2020 — a year that no real estate experts could have predicted.