Boston Condos – Buy or Rent?

Boston Condos for Sale and Apartments for Rent

Boston Condos – Buy or Rent?

Thinking about buying a Boston Seaport condo for sale? While today’s mortgage rates might seem a bit intimidating, here are two solid reasons why, if you’re ready and able, it could still be a smart move to get your own place.

1. Home Values Typically Go Up Over Time

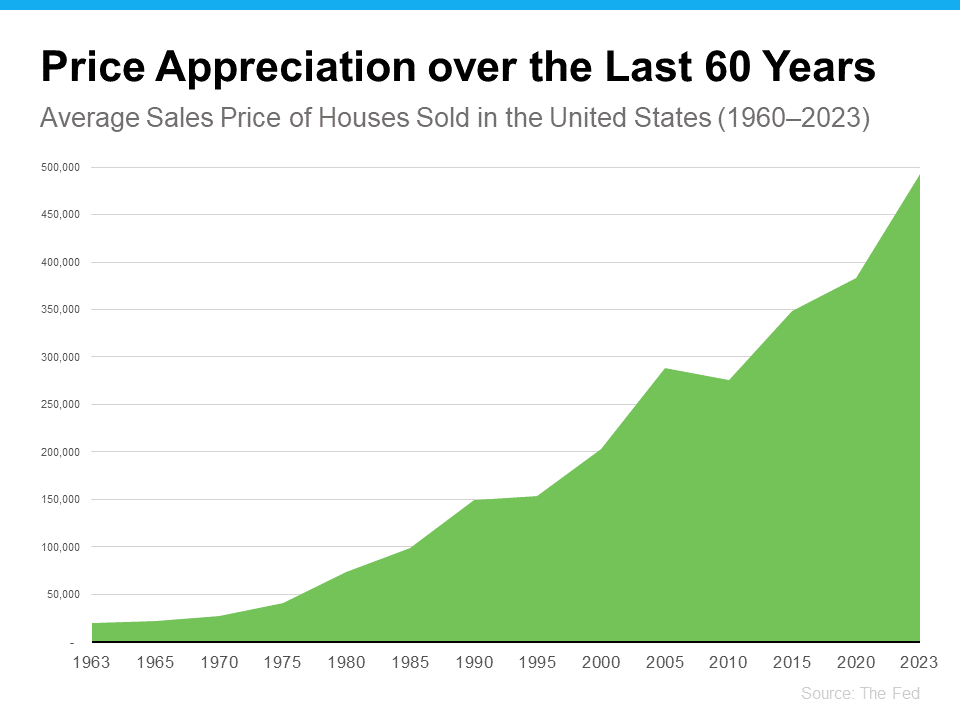

There’s been some confusion over the past year or so about which way home prices are headed. Make no mistake, nationally they’re still going up. In fact, over the long-term, home prices almost always go up (see graph below):

Using data from the Federal Reserve (the Fed), you can see the overall trend is home prices have climbed steadily for the past 60 years. There was an exception during the 2008 housing crash when prices didn’t follow the normal pattern, but generally, home values kept rising.

This is a big reason why buying a home can be better than renting. As prices go up and you pay down your mortgage, you build equity. Over time, this growing equity can really increase your net worth. The Urban Institute says:

“Homeownership is critical for wealth building and financial stability.”

2. Rent Keeps Rising in the Long Run

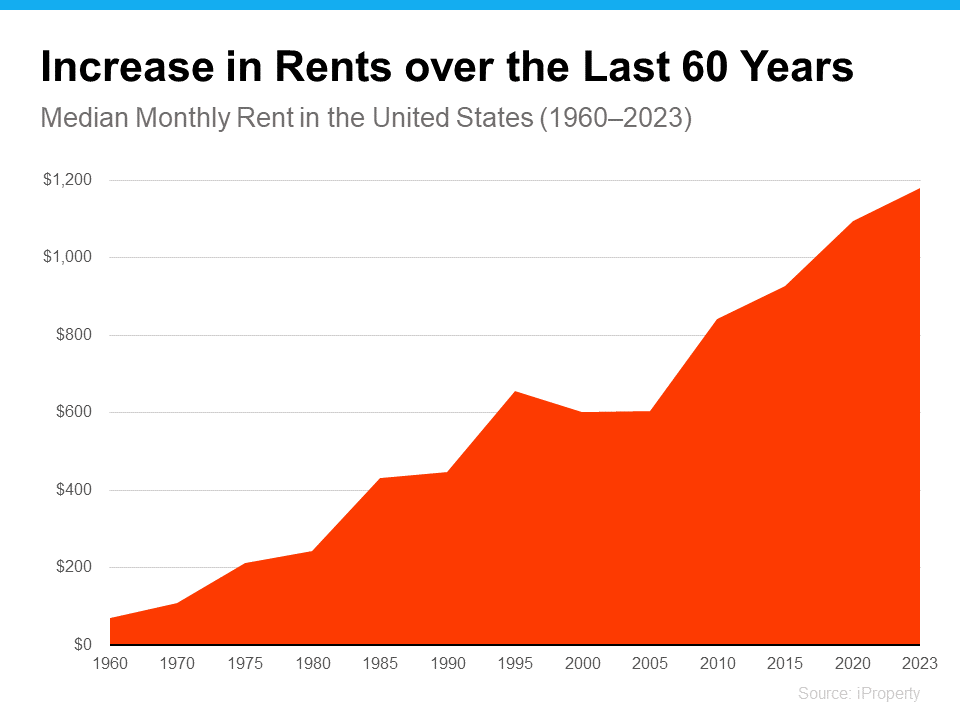

Here’s another reason you may want to think about buying a home instead of renting – rent just keeps going up over the years. Sure, it might be cheaper to rent right now in some areas, but every time you renew your lease or sign a new one, you’re likely to feel the squeeze of your rent getting higher. According to data from iProperty Management, rent has been going up pretty consistently for the last 60 years, too (see graph below):

So how do you escape the cycle of rising rents? Buying a home with a fixed-rate mortgage helps you stabilize your housing costs and say goodbye to those annoying rent increases. That kind of stability is a big deal.

Your housing payments are like an investment, and you’ve got a decision to make. Do you want to invest in yourself or keep paying your landlord?

When you own your home, you’re investing in your own future. And even when renting is cheaper, that money you pay every month is gone for good.

As Dr. Jessica Lautz, Deputy Chief Economist and VP of Research at the National Association of Realtors (NAR), says:

“If a homebuyer is financially stable, able to manage monthly mortgage costs and can handle the associated household maintenance expenses, then it makes sense to purchase a home.”

Boston Condos for Sale and the Bottom Line

If you’re tired of your rent going up and want to explore the many benefits of homeownership, let’s talk to explore your options.

____________________________________________________________________

Boston Condos – Buy or Rent?

Homeownership makes people happy.

This is not just a Boston real estate broker telling you this.

Study after study shows that homeownership positively affects a person’s life in more ways than financial security.

Below is a report from the NATIONAL ASSOCIATION OF REALTORS® research division, article, “Social Benefits of Homeownership and Stable Housing.

Rohe and Stegman found that low-income people who recently became homeowners reported

higher life satisfaction, higher self-esteem, and higher perceived control over their lives. 26

But the authors cautioned on the interpretation of the causation since residential stability was not controlled for. Similarly, Rossi and Weber concluded that homeowners report higher self-esteem and happiness than renters. 27 For example, homeowners are more likely to believe that they can do things as well as anyone else, and they report higher self-ratings on their physical health even after controlling for age and socioeconomic factors. In addition to being more satisfied with their own personal situation than renters, homeowners also enjoy better physical and psychological health. 28 Another study showed that renters who become homeowners not only experience a significant increase in housing satisfaction but also obtain a higher satisfaction even in the same home in which they resided as renters. 29

26 Rohe, W. and R. Stegman. 1994. “The Effects of Homeownership on Self Esteem, Perceived Control, and Life

Satisfaction of Low Income People,” Journal of the American Planning Association, 60(2), pp. 173-84.

27 Rossi, P. and E. Weber. 1996. “The Social Benefits of Homeownership: Empirical Evidence from National

Surveys,” Housing Policy Debate, 7, pp. 1-15.

28 Rohe, Willam M., Shannon Van Zandt and George McCarthy 2001. The Social Benefits and Costs of

Homeownership: A Critical Assessment of the Research. Low-Income Homeownership Working Paper Series

LIHO-01.12, Joint Center for Housing Studies of Harvard University.

29 Luis Diaz-Serrano. Disentangling the housing satisfaction puzzle: Does homeownership really matter? Journal of

Economic Psychology. Amsterdam: Oct 2009. Vol. 30, Iss. 5; pg. 745

Buy a Boston Condo and Stay for Some Time

When you have all in order—positive debt-to-income ratio, consistent income for two years, and savings for a down payment—it might be tempting to start house hunting in earnest. But first, make sure you want to stay put for a while. If you buy and sell too soon, it can hurt you financially. Every year we put out this rent vs buy report in Portland and include a calculation of how long it takes before you’re financially better off owning than renting. This length of time ensures equity building and prevents the loss that comes from selling too soon.

This time last year, we reported a Bostonian was better off financially after three years and one month of owning a home than a renter.

Rent an Apartment Vs. Buy a Condo in Boston 2022

In 2022, a Bostonian is better off owning than renting financially, after three years and six months of homeownership. This rent vs. buy formula is determined by current mortgage rates (including other costs of ownership), average local home prices, and average local rental rates.

The time it takes to be better off with homeownership could increase a little this year as mortgage rates are predicted to rise in 2022 to 4%.

Last year the rate hit a crazy low of 2.65%, which helped the formula.

Also, interest rates are still low, but they’re expected to increase from the current 3.22% for a 30-year fixed-rate mortgage to 4% by end of 2022.

Boston Beacon Hill apartment rental rates were trending down for a few years (2019-2020) but have started to climb again in 2022.

Home Equity is the Answer to Financial Security

In the end, equity is the answer. Buying a Boston condo is still your best bet over renting a Boston Beacon Hill apartment in 2022. And timing is key. Whether you’re ready to buy now or whether you need a couple more years to get your finances in order, keep your sights set on owning a Boston condo. It is proven to increase financial security and well-being over time. Otherwise, your hard-earned money will line the pockets of your landlord, rather than your own. Home equity is like a personal savings account, historically the largest and best investment any of us can make in our lifetimes.

If you’re ready to buy now, or if you have questions about buying a home in the future, please call one of our Boston condo for sale agents today at 617-595-3712 or text/cell 617-595-3712

Click to View Google Reviews

Updated: Boston Real Estate Blog 2022

———————————————————————————————————————————–

Today’s Wall Street Journal has an interesting article entitled: “Renters Lose Edge on Homeowners” subtitle “Cost Gap returns to Historical Norms in Some Markets as Home Prices Drop.”

The article is about how the relative cost of owning versus renting is swinging back in favor of homeownership. So here’s my thought or question, does it make more economic sense to buy a Boston condo or to rent one. I’m asking this question in very broad terms, I understand many factors would be involved as it pertains to the buyer ect. But lets say it was you. Based on the example below which would make more economic sense for you, buy or rent?

Beacon Hill had two recent sales:

One was a studio at 9 Willow Street that sold for $157,000 and would rent for approx $1,400.00 per month.

The other was a two bedroom at 286 Cambridge Street that sold for $320,000 and would rent for $2,100.00 per month.

Which would make more financial sense for you to buy or to rent either one of those properties.