Boston Condos for Sale and Apartments for Rent

Boston Apartment Market – Investors are Skeptical

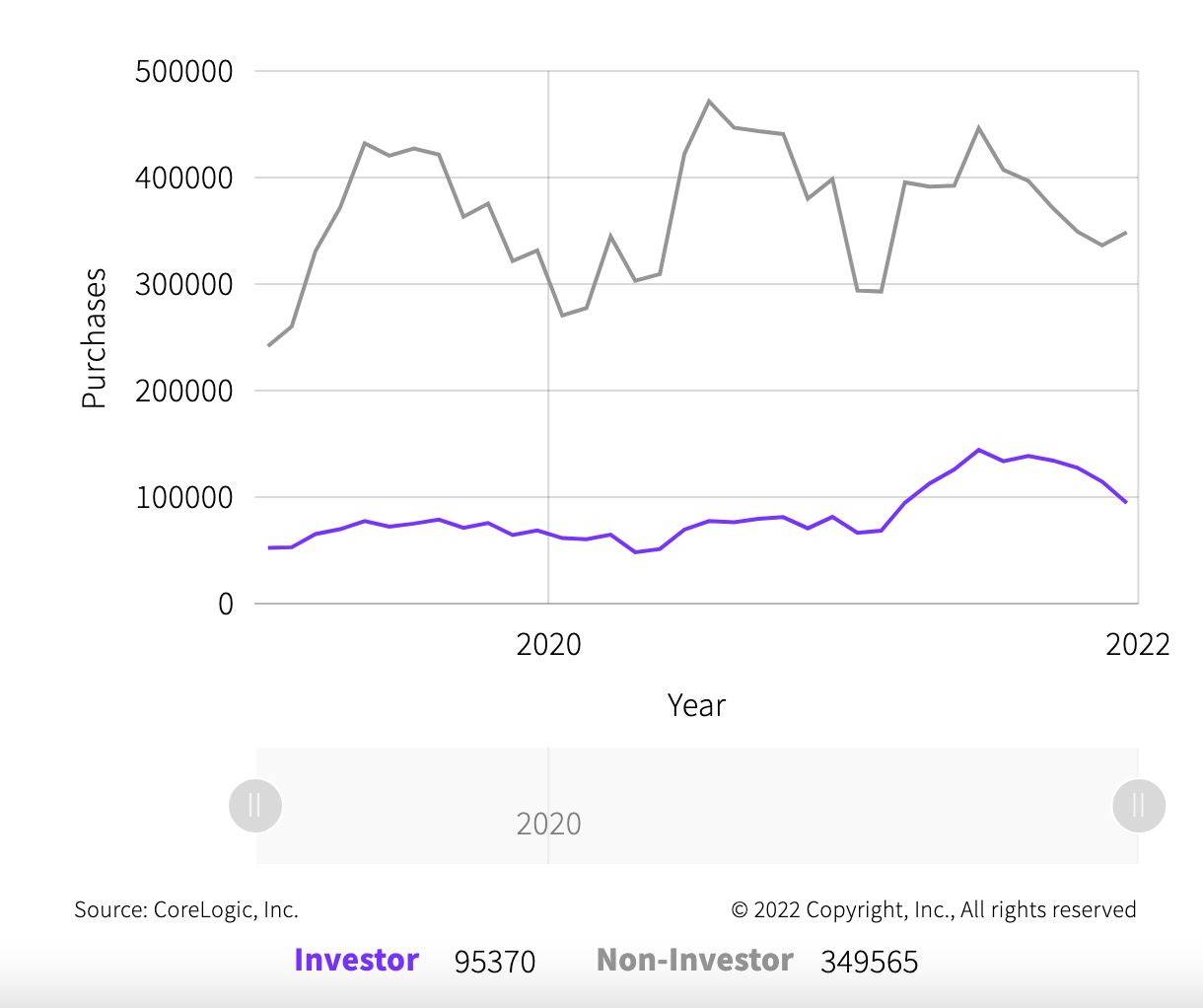

Investor activity showed early signs of slowing during Q4 of 2021, down from the historic highs seen in the second and third quarter, CoreLogic’s latest analysis reveals.

After rising significantly throughout 2021, the share of investor-backed home purchases came to a head in October, reaching 26.9% of total home sales — the highest monthly percentage ever reported by CoreLogic. November, though, marked the first decrease since July as the share of investor acquisitions fell to 25.5%. In December investor purchases fell even further, representing 20.4% of total sales.

Large investors, who retain 100 or more properties, decreased their activity the most. Of all investor purchases made in December 2021, just 20% were made by large investors — a 6% decrease from September — while small and medium-sized investors actually increased their activity during the period.

The stall in large investors also indicates that the recent surge of investments in single-family homes came from landlords, as opposed to house flippers. Only 13.8% of the homes purchased by investors in June 2021 were resold by December: a 0.8% drop from June 2020 and a 1.3% drop from June 2019. However, the report notes, since investors were purchasing at a high rate in the second half of last year, flipping rates could still increase.

Considering all the data, CoreLogic suggests that investor purchases will likely revert to pre-2021 levels. Based on the trend line, seen below, they may also tick back up in January, when owner-occupied transactions are slowest.

Monthly home purchases by investors and non-investors, Jan. 2019 – Dec. 2021

via CoreLogic

Click Here to view: Google Ford Realty Inc Reviews