Boston Condos for Sale and Apartments for Rent

Before joining Compass you may want to read this

The following is an article I stumbled upon:

Compass Agents: You Are The Customer

As a newly public company, Compass faces a challenge to reach profitability. Its latest numbers reveal a noticeable drop in agent commission splits, a reminder that Compass’ path to profitability lies directly through — and may come at the expense of — its own agents.

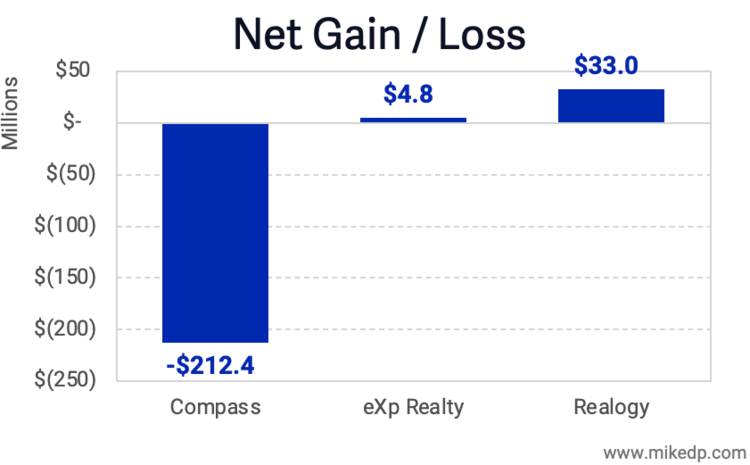

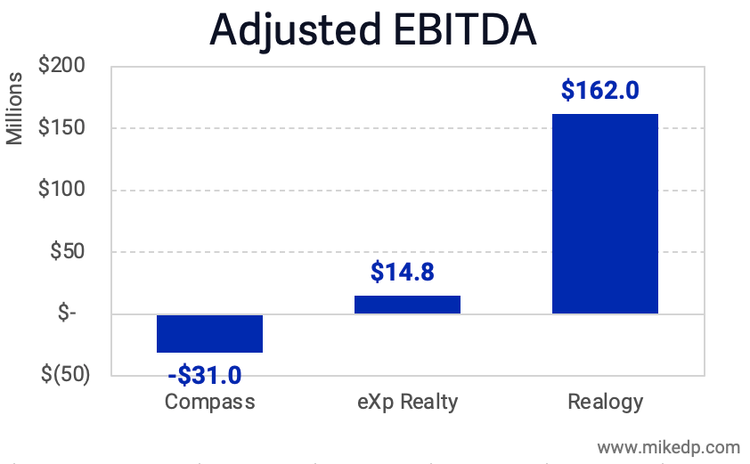

Compass incurred losses of $212 million in its first quarter as a public company, compared to the $270 million it lost in all of 2020. Meanwhile, Compass’ peers managed to turn a profit during some of their best quarters ever.

The $212 million loss includes a one-time expense of $149 million of stock based compensation. Looking at Adjusted EBITDA, where each company backs out various expenses to provide a more favorable accounting of the business, still reveals significant losses — compared to the healthy profits at eXp and Realogy.

The data reveals a brokerage continuing to lose money, especially compared to its peers, during a booming real estate market. But now that Compass is public, the spotlight is turning towards profitability and leading to an obvious source of additional profit: its agents.

The Agent is the Customer

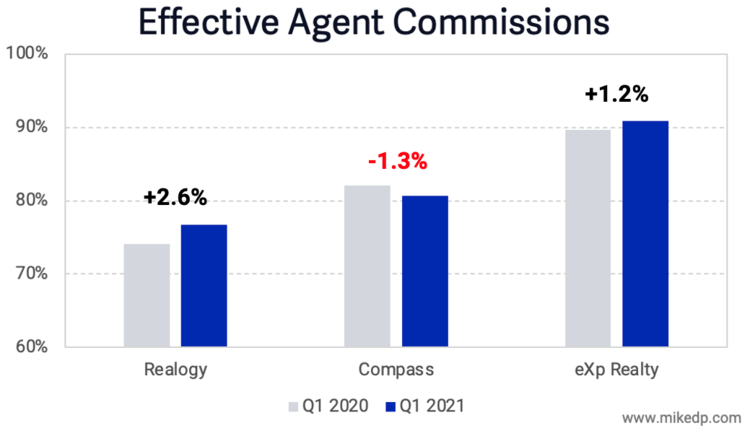

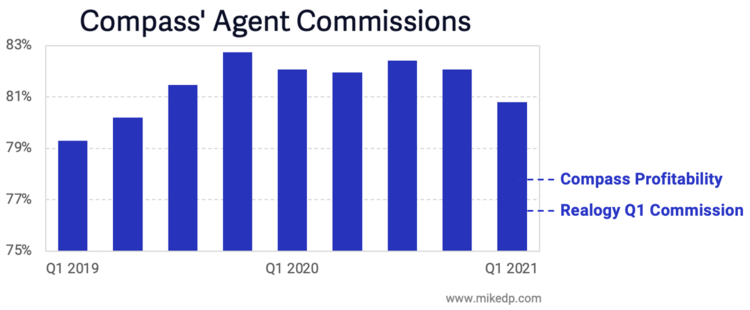

In the first quarter of 2021, Compass’ agents generated $1.1 billion in revenue and were paid $900 million in commissions (including stock). But the effective agent commission split of 80.8 percent is a noticeable drop from the past year. While its brokerage peers paid proportionally more money to their agents, Compass paid less.

In its public filings, Compass attributes this “favorable decrease” (their words, not mine) to “the change in mix of the commission arrangements we have with our agents” and “changes in geographic mix.” The agent economics are changing in Compass’ favor, and Compass is retaining more of the commission.

This dynamic is not unique to Compass, but it highlights the natural tension between brokerage and agent when less money being paid to agents is seen as “favorable” and “an improvement.”

For Compass, a reduction of its effective agent commission — through a combination of changes in commission arrangements, geographic mix, and increasing technology fees — of just 3 percent results in immediate profitability.

It’s highly unlikely that Compass will drop its agent commissions 3 percent and survive as a business. Agents would simply pack up and leave. But the gap isn’t too far and, combined with rising technology fees, represents the fastest path to sustained profitability.

Compass’ effective agent commission drop in Q1 2021 is the largest seen in two years. It may be an outlier or it may be the start of a trend, but it remains a key metric to watch going forward. And if you’re a real estate agent, this is a gentle reminder to never forget that you are the customer.

A note on data: When calculating Compass’ effective agent commission splits, I’ve included stock-based compensation. For Q1 2021, I’ve backed out the one-time acceleration of stock-based compensation expense of $41.7 million in connection with the IPO.

About the author: Mike DelPrete

Mike is a global real estate tech strategist, and a scholar-in-residence at the University of Colorado Boulder. He is internationally recognized as an expert and thought-leader in real estate tech. His evidence-based analysis is widely read by global leaders, and he is a sought-after strategy and new ventures consultant. His research and insights have featured in the New York Times, Wall Street Journal, Financial Times, and The Economist.

Click Here to view: Google Ford Realty Inc Reviews