Beacon Hill condos equity

Boston Condos for Sale and Apartment Rentals

Beacon Hill condos equity

Many homeowners looking to sell their Boston condo feel like they’re stuck between a rock and a hard place right now. Today’s mortgage ratesI. Maybe you’re in the same boat.

But what if there was a way to offset these higher borrowing costs? There is. And the money you need probably already exists in your current home in the form of equity. Which can help you buy a larger Beacon Hill condo for sale

What Is Beacon Hill Condo Equity?

Think of equity as a simple math equation. Freddie Mac explains:

“. . . your home’s equity is the difference between how much your home is worth and how much you owe on your mortgage.”

Your equity grows as you pay down your loan over time and as home prices climb. And thanks to the rapid home price appreciation we saw in recent years, you probably have a whole lot more of it than you realize.

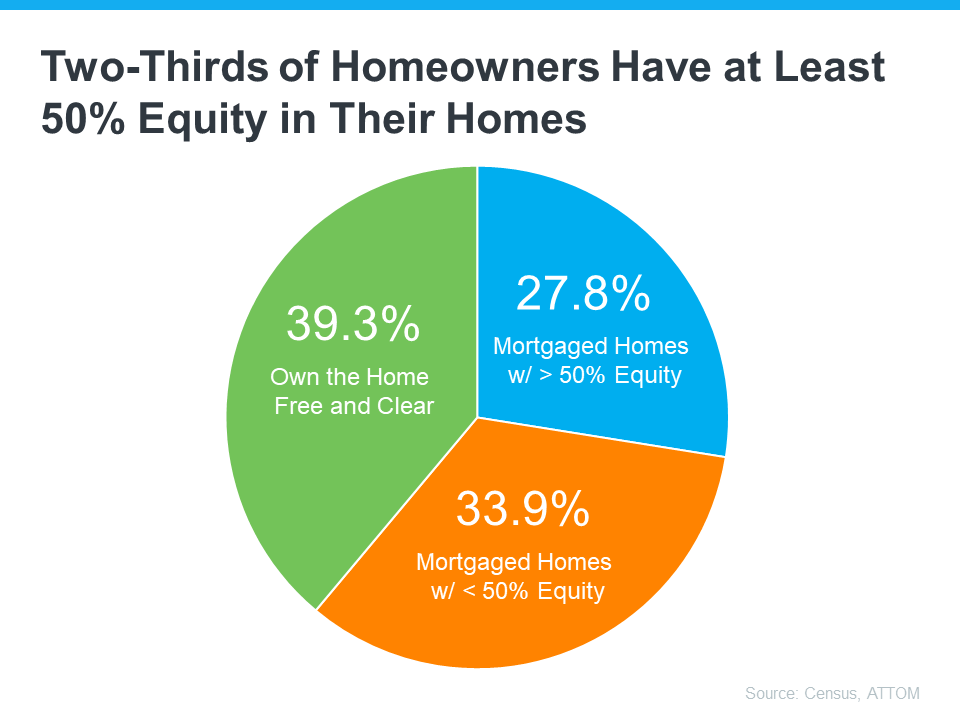

The latest from the Census and ATTOM shows more than two out of three homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity (shown in blue in the chart below):

That means the majority of homeowners have a game-changing amount of equity right now.

How Your Equity Can Help Fuel Your Move

After you sell your house, that equity can help you move without worrying as much about today’s mortgage rates. As Danielle Hale, Chief Economist for Realtor.com says:

“A consideration today’s homeowners should review is what their home equity picture looks like. With the typical home listing price up 40% from just five years ago, many home sellers are sitting on a healthy equity cushion. This means they are likely to walk away from a home sale with proceeds that they can use to offset the amount of borrowing needed for their next home purchase.”

To give you some examples, here are a few ways you can use equity to buy your next home:

- Be an all-cash buyer: If you’ve been living in your current home for a long time, you might have enough equity to buy your next home without having to take out a loan. If that’s the case, you won’t need to borrow any money or worry about mortgage rates.

- Make a larger down payment: Your equity could also be used toward your next down payment. It might even be enough to let you put a larger amount down, so you won’t have to borrow as much at today’s rates.

The First Step: Determine How Much Equity You Have in Your Home

Want to find out how much equity you have? To do that, you’ll need two things:

- The current mortgage balance on your home

- The current value of your home

You can probably find the mortgage balance on your monthly mortgage statement. To understand the current market value of your house, you can pay hundreds of dollars for an appraisal, or you can contact a local real estate agent who will be able to present to you, at no charge, a professional equity assessment report (PEAR).

Once you’ve connected with a trusted local agent and run the numbers, you’re one step closer to making a move you may not have thought was realistic – all thanks to your equity.

Beacon Hill Condo Equity and the Bottom Line

If you want to find out how much equity you have and talk more about how it can make your next move possible, let’s connect.

Peace be with you

___________________________________________________________________

Beacon Hill condos equity

Nearly half of all homeowners in the U.S. have equity-rich properties, meaning they own at least 50% of their homes’ equity, according to ATTOM’s fourth-quarter 2022 U.S. Home Equity & Underwater Report.

Forty-eight percent of mortgaged homes were equity rich in the fourth quarter of last year, down from 48.5% in the third quarter but up from 41.9% a year earlier.

The report notes that while nationally, equity-rich levels are nearly double what they were a few years ago, “the drop-off in the last three months of 2022 reversed a string of 10 straight quarterly gains.” The number of equity-rich mortgage payers fell in 31 states from the third to the fourth quarter of 2022. That drop-off, according to ATTOM, marks the first signs of how falling home prices are affecting homeowners following a “decade-long market boom.”

ATTOM CEO Rob Barber says dents are starting to “surface in the armor” around the county’s housing market after 11 years of a “strong showing” for owners.

“Home values have been dropping since the middle of last year, which appears to be starting to cut into homeowner equity around the country,” Barber said. “That’s probably happening because values are sinking faster than owners are paying off their mortgages. How that shakes out over the next few months will depend on a lot of factors, including where interest rates go. But for now, it looks like the runup in wealth flowing from owning homes has stalled along with the market.”

ATTOM found the largest drops in equity-rich shares of mortgages in the fourth quarter were spread across the West. Idaho led the declines, with homeowner equity falling from 65.8% in the third quarter to 61.6% in the fourth; Arizona was down from 63.4% to 59.9%; Nevada fell from 55.8% to 52.3%; Washington from 61% to 58.5%; and Oregon from 55% to 53.2%.

Of the top 10 states with the biggest increases in the equity-rich share of mortgaged homes from the third to fourth quarters, five were in the South. The largest increases were seen in Montana, at 58% from the third quarter’s 51.5%, Kansas at 37% from 34%, Delaware at 35.9% from 34.2%, Mississippi at 33.2% from 31.5% and Arkansas at 38% from 36.6%.

Homes considered “seriously underwater” remained historically low throughout most of the country in the fourth quarter. The report found 2.9%, or one in 34 mortgages, were seriously underwater in the last quarter of 2022, meaning those homeowners owed at least 25% more than market value. That number was unchanged from the previous quarter, but still down from 3.1% in the fourth quarter of 2021.

Overall, the report found 94.1% of homeowners had some equity in the fourth quarter, a slight decrease from the third quarter’s 94.3% but up from 93.5% a year earlier and 88.8% in 2020.

_____________________________________________________________________________________________

![Why Growing Home Equity Is Great News if You Plan To Move [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/07/07152602/20220708-MEM.png)

Your equity in your Boston Beacon Hill condo is a powerful tool that can help you achieve your goals as a homeowner. And chances are, your equity grew substantially over the past year. According to the latest Equity Insights Report from CoreLogic, homeowners gained an average of $51,500 in equity over the past year.

If you’re looking for the best ways to use your growing equity in your Boston Beacon Hill condo, here are four options:

1. Use Your Boston Beacon Hill Equity To Buy a Home That Fits Your Needs

If you’re finding you no longer have the space you need, it might be time to move into a larger home. Or, it’s possible you have too much space and would like something smaller. No matter the situation, consider using your equity to power a move into a home that fits your changing lifestyle. Moving into a larger home can provide extra space for remote work or loved ones. Downsizing, on the other hand, may mean saving time and money by caring for a smaller home.

2. Move to the Location of Your Dreams

If the size of your Beacon Hill home isn’t a challenge but your current location is, it could be time to relocate to a new area. Maybe you enjoy vacationing in the mountains, at the beach, or another area, and you’re dreaming of living there year-round. Or perhaps the distance between you and your loved ones is greater than you’d like, and you want to close the gap. No matter what, your home equity can fuel your move to the location where you really want to live.

3. Start a New Business

If you’re not ready to move into a new home, you can use your equity to invest in a new business venture. As the U.S. Small Business Administration Office of Advocacy says:

“There is an estimate of 31.7 million small business owners in the United States, many of them started their business with the equity they had in their home.”

While it’s not recommended that homeowners use their equity for unnecessary spending, leveraging your equity to start a business that you’re passionate about can potentially grow your nest egg further.

4. Fund an Education

Whether you have a loved one preparing to head off to college or you’re planning to go back to school yourself, the thought of paying for higher education can be daunting. In either situation, using a portion of your growing equity can help with those costs, so you can make an investment in someone’s future.

Beacon Hill Condos and the Bottom Line

Your equity can help you achieve your goals. If you’re unsure how much equity you have in your home, let’s connect today so you can start planning your next move.

Boston Condos for Sale and Apartment Rentals

Ford Realty Inc., Boston Real Estate for Sale

Click to View Google Review

Updated: Boston Real Estate 2020 – 2024

________________________________________________________________________________________________________________________________________________

Rising Beacon Hill condo prices have been in the news a lot lately and much of the focus has been on whether home prices are accelerating too quickly, as well as how sustainable the growth in prices really is. One of the often-overlooked benefits of rising prices, however, is the impact that they have on a homeowner’s equity position.

Home equity is defined as the difference between the home’s fair market value and the outstanding balance of all liens (loans) on the property. While homeowners pay down their mortgages, the amount of equity they have in their homes climbs each time the value of their homes go up!

According to the latest Equity Report from ATTOM Data Solutions, “13.9 million U.S. properties in Q2 2019 were equity rich — where the combined estimated balance of loans secured by the property was 50 percent or less of the property’s estimated market value — representing 24.9% of all U.S. properties with a mortgage.”

This means that nearly a quarter of Americans who have a mortgage would be able to sell their homes and have a significant down payment toward their next home. Many who sell could also use their new-found equity to pay off high-interest credit cards or help children with tuition costs.

The map below shows the percentage of properties with a mortgage in each state that were equity rich in Q2 2019

Boston real estate

Bottom Line

If you are a Beacon Hill condo homeowner looking to take advantage of your home equity by moving up to your dream home, let’s get together to discuss your options!

Beacon Hill Condo Sales Data Updated in Real Time

Click the kink below for Beacon Hill condo sales charts:

Beacon Hill condo sales data based on real time – 30 day tracking

_______________________________________________________________________________________________________________________

Beacon Hill Condos – Open Houses

Sorry we are experiencing system issues. Please try again.

Beacon Hill Charity Donation

My new goal for the Fall of 2019 is to provide a percentage of our Beacon Hill Real Estate commission to fight Alzheimer’s

Select us to represent you either as a buyer or seller’s agent and we’ll give back a portion of the sales commission to find a cure for this awful disease.

- Having a recent love one suffer and died from this illness broke my heart. Please let us work together to find a cure.

- Ford Realty has been in business for over 20 years.

- Ford Realty Inc has several 2019 positive Google Reviews

- For more information email realtyford@yahoo.com. You can call or send us a text @ 617-595-3712.

- Thank you

Buying a Beacon Hill condo for sale

- Tips on buying a Beacon Hill condo

- Boston Beacon Hill condo buyers how to beat all cash offers

- 5 tips on buying a Beacon Hill condo for sale

- Benefits of buying a Beacon Hill condo

- Design tips for Beacon Hill condo buyers

- Boston Beacon Hill condos for sale 5 must know terms

- The difference between a Beacon Hill condos and a Beacon Hill loft

- Common mistakes when buying a Beacon Hill condo

- Buying a Beacon Hill condo with kids

- Is it time to ditch my Beacon Hill condo agent?

- Beacon Hill condos for sale: Do I need 20% down?

- 3 signs you’re going to buy a Boston Beacon Hill condo

- 6 principles to know when buying a Beacon Hill condo

- How to select a Boston Beacon Hill condo agent

- Boston Beacon Hill condos for sale downpayment

- Boston Beacon Hill condos finance

- Beacon Hill condos for sale what is negotiable

- Beacon Hill condos for sale: What it take to get a mortgage.

- Boston Beacon Hill condos for sale. Understand the condo association

- How much do Boston Beacon Hill condos cost?

- How to select a Beacon Hull broker

- Beacon Hill condos for sale: Clutter Free

- Beacon Hill condos for sale:Security Tips

- Beacon Hill condo renters are misinformed

- Boston Beacon Hill condos for sale: Design trends

- Boston Beacon Hill condos: Fixer up

- 8 Beacon Hill condo designs

- How to sell your Beacon Hill condo using social media

- Boston Beacon Hill condo sales volume

- Wage increases make Beacon Hill condos more affordable

- Boston Beacon Hill condos the importance of high owner occupancy

- Why you should buy a Beacon Hill condo off season

- What do these Boston Beacon Hill condo terms mean?

Click Here: Back to Boston Real Estate Home Search

Back to homepage: Boston condos for sale

Ford Realty – Boston Real Estate Google Reviews 2019

Boston condos for sale for 2021

Charlestown condos for sale under $1M for 2020

Boston downtown condos for sale for 2020

Boston High rise condos for sale

Boston Midtown condos for sale 2020

Boston North End condos for sale 2020

Contact me to find out more about this property or to set up an appointment to see it.

Beacon Hill apartments for rent $10K and under

Beacon Hill apartments for rent 10k and above

Boston condos for sale

Back Bay Boston condos for sale

Beacon Hill Boston condos for sale

Charlestown Boston condos for sale

Navy Yard Charlestown Boston condos

Dorchester Boston condos for sale

Fenway Boston condos for sale

Jamaica Plain Boston condos for sale

Leather District Boston condos for sale

Midtown/Downtown Boston condos for sale

Seaport District Boston condos for sale

South Boston condos for sale

South End Boston condos for sale

Waterfront condos for sale

North End condos for sale

West End condos for sale

East Boston condos for sale