Are we heading towards a Boston condo slowdown? Perhaps not

Boston Real Estate Search

Are we heading towards a Boston condo slowdown? Perhaps not

In 2024, we had more drama than usual. The Big Three:

- Hotly-contested election.

- Commission debacle.

- Mortgage rates that were supposed to come down, but didn’t.

Any one of those could have derailed the Boston condo for sale market, but instead we survived just fine:

Are we heading towards a Boston condo slowdown? Perhaps not

People might think that 8% mortgage rates will kill the Boston condo for sale market, but they are one more thing that can be fixed with money.

Two popular strategies to lower the mortgage rate:

30-year fixed rate buydown: Paying one point, or 1% of the loan amount will lower the rate by 1/4%. It would take a few points paid to make a significant difference, and the home seller can contribute too. On a $2,000,000 purchase with 25% down and a loan amount of $1,500,000, the monthly payment is $11,006 at the 8% rate. But the payment can be permanently reduced to $9,358 per month by paying six points, for a savings of $1,648 per month! Hopefully the seller will contribute some or all of the fee.

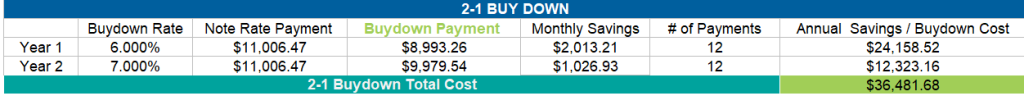

2-1 temporary rate buydown: Paying 2.4 points will lower the mortgage rate by 2% in the first year, and then by 1% in the second year. With the same $1,500,000 loan, here’s how the 2-1 buydown looks:

Boston condos for sale and the bottom line

In both of those examples, you have a fixed-rate 30-year mortgage. If you are more of a gambler and don’t want to pay any points

The other alternative is to get the 3/1 ARM that has a fixed rate of 6.25% for three years, and then the rate adjusts annually for the remaining 27 years.

Updated: Boston condo for sale website 2023

____________________________________________________________________________________________________

Glenn Kelman, president and CEO of Redfin, joins Fast Money to discuss the state of the housing market and whether things have slowed down.

Boston Condos for Sale

Ford Realty Inc., Boston Real Estate for Sale

Click to View Google Review

Updated: Boston Real Estate 2020-2023

____________________________________________________________________________________________________

As shelter-in-place orders were implemented earlier this year, many questioned what the shutdown would mean to the real estate market. Specifically, there was concern about home values. After years of rising home prices, would 2020 be the year this appreciation trend would come to a screeching halt? Even worse, would home values begin to depreciate?

Original forecasts modeled this uncertainty, and they ranged anywhere from home values gaining 3% (Zelman & Associates) to home values depreciating by more than 6% (CoreLogic).

However, as the year unfolded, it became clear that there would be a little negative impact on the housing market. As Mark Fleming, Chief Economist at First American recently revealed:

“The only major industry to display immunity to the economic impacts of the coronavirus is the housing market.”

Have prices continued to appreciate so far this year?

Last week, the Federal Housing Finance Agency (FHFA) released its latest Home Price Index. The report showed home prices actually rose 6.5% from the same time last year. FHFA also noted that price appreciation accelerated to record levels over the summer months:

“Between May & July 2020, national prices increased by over 2%, which represents the largest two-month price increase observed since the start of the index in 1991.”

What are the experts forecasting for home prices going forward?

Below is a graph of home price projections for the next year. Since the market has changed dramatically over the last few months, this graph shows forecasts that have been published since September 1st.

Downtown Boston Real Estate and the Bottom Line

The numbers show that home values have weathered the storm of the pandemic. Let’s connect if you want to know what your home is currently worth and how that may enable you to make a move this year.

Boston Real Estate Search

Charles River Park condos for sale