Are buyers waiting for lower interest rates?

Boston Condos for Sale and Apartment Rentals

Federal Reserve Chair Jerome Powell said Wednesday the central bank won’t begin cutting its key interest rate “until it has gained greater confidence that inflation is moving sustainably toward” its 2% goal, noting the move will likely occur “at some point this year.”

His comments, in prepared remarks he’s scheduled to deliver before the House Financial Services Committee at 10 a.m., echo those he made at the Fed’s last meeting in late January.

Powell didn’t give a timetable for rate cuts but could provide more details in response to questions from lawmakers.

What is the current inflation rate in 2024?

In January, inflation overall rose 0.3% while a core measure that excludes volatile food and energy items increased 0.4%, both substantially higher than the recent trend, according to the personal consumption expenditures index, the Fed’s preferred gauge.

But those readings still pushed down annual inflation to 2.4% and the core yearly measure to 2.8%. PCE inflation peaked at a 40-year high of 7% in June 2022.

__________________

Are buyers waiting for lower interest rates? Yes, and they might be coming.

- The Fed could slash rates more than expected in 2024, Wells Fargo strategist Erik Nelson said.

- That’s because the job market is likely weaker than it looks on the surface.

- Weakening job growth could be the negative catalyst that pushes the Fed to ease monetary policy.

Steep rate cuts from the Federal Reserve could be coming later this year thanks to weakening in the job market, which likely isn’t as robust as some of the latest data has made it out to be, according to Wells Fargo strategist Erik Nelson.

Updated: Boston Condos for Sale Blog 2024

John Ford Boston Beacon Hill Condo Broker 137 Charles St. Boston, MA 02114

_____________________________________________________________

Boston Condos for Sale and Apartments for Rent

Are buyers waiting for lower interest rates? When you read about the Boston condo for sale market, you’ll probably come across some information about inflation or recent decisions made by the Federal Reserve (the Fed). But how do those two things impact you and your homebuying plans? Here’s what you need to know.

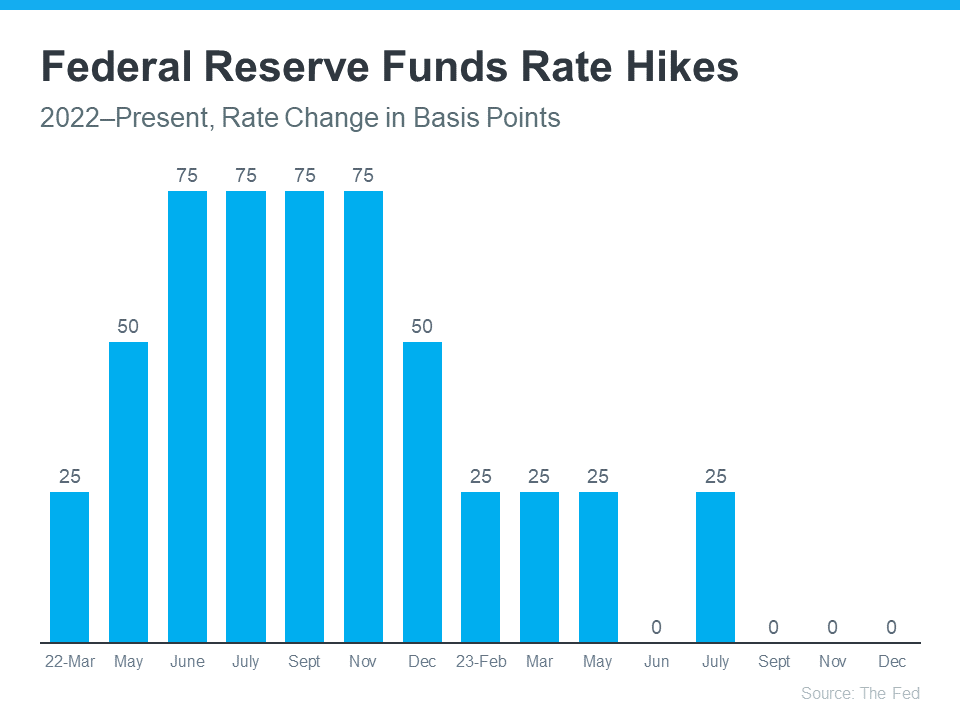

The Federal Funds Rate Hikes Have Stalled

One of the Fed’s primary goals is to lower inflation. In order to do that, they started raising the Federal Funds Rate to slow down the economy. Even though this doesn’t directly dictate what happens with mortgage rates, it does have an impact.

Recently inflation has started to cool, a signal those increases worked and are bringing inflation back down. As a result, the Fed’s hikes have gotten smaller and less frequent. In fact, there haven’t been any increases since July (see graph below):

And not only has the Fed decided not to raise the Federal Funds Rate the last three times the committee met, they’ve signaled there may actually be rate cuts coming in 2024. According to the New York Times (NYT):

“Federal Reserve officials left interest rates unchanged in their final policy decision of 2023 and forecast that they will cut borrowing costs three times in the coming year, a sign that the central bank is shifting toward the next phase in its fight against rapid inflation.”

This indicates the Fed thinks the economy and inflation are improving. Why does that matter to you and your plans to buy a home? It could end up leading to lower mortgage rates and improved affordability.

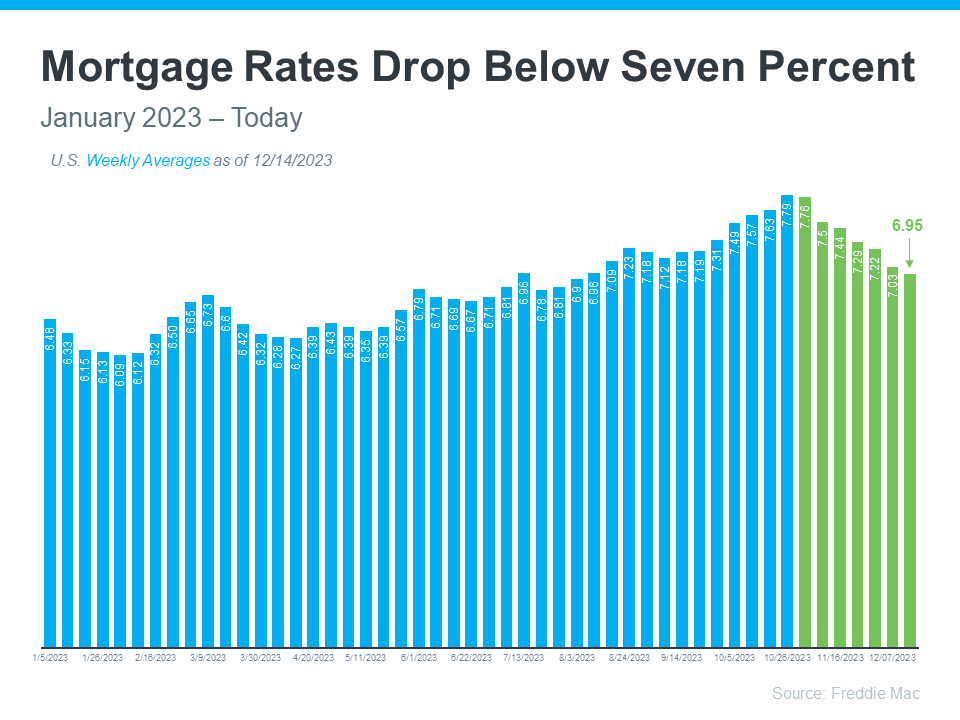

Mortgage Rates Are Coming Down

Mortgage rates are influenced by a wide variety of factors, and inflation and the Fed’s actions (or as has been the case recently, inaction) play a big role. Now that the Fed has paused the increases, it looks more likely mortgage rates will continue their downward trend (see graph below):

Although mortgage rates may remain volatile, their recent trend combined with expert forecasts indicate they could continue to go down in 2024. That would improve affordability for buyers and make it easier for sellers to move since they won’t feel as locked-in to their current, low mortgage rate.

Although mortgage rates may remain volatile, their recent trend combined with expert forecasts indicate they could continue to go down in 2024. That would improve affordability for buyers and make it easier for sellers to move since they won’t feel as locked-in to their current, low mortgage rate.

Boston Condos for Sale and the Bottom Line

The Fed’s decisions have an indirect impact on mortgage rates. By not raising the Federal Funds Rate, mortgage rates are likely to continue declining. Let’s connect so you have expert advice about changes in the housing market and how they affect you.

Ford Realty – Boston Real Estate Google Reviews 2020 -2024

Where is Ford Realty Located?

Ford Realty is located in 137 Charles Street in Beacon Hill

_______________________________________________________________

It’s funny how the press works. Someone comes up with a new story arc, suddenly you read about in every newspaper, suddenly everyone’s talking about it, then it disappears.

This week, it was, “Are buyers holding off buying because they think interest rates will drop, further?”

From the Globe:

… [E]ven though rates on home loans are approaching historic lows, many prospective borrowers are apparently holding off, on the assumption that in just a few weeks they will be able to get even better deals.

Borrowers are tempted by a proposal floated by the US Treasury to move rates to 4.5 percent for 30-year, fixed-rate mortgages.

And other efforts are afoot that could further drop rates. The Federal Reserve Bank recently initiated a mortgage-buying program to lower rates. Upping the ante, the nation’s top mortgage regulator, James Lockhart, told a business group earlier this week that the government’s ongoing efforts could result in rates dropping “well below 4 percent.”

I’m skeptical that there are a lot of people waiting for lower rates. I think what people want mostly is stability, which means three or more months of no more “bad news”. Only when there is confidence on the part of potential homebuyers will they return to the market.

If I was a buyer, would I wait to buy based on potential drops in the interest rates? I don’t think so. Rates are at “historic” lows, already. Most people would be happy with a sub-6% interest rate on their 30-year mortgage loan.

Most people buy based on what their monthly payment is going to be. Yes, it could be “cheaper”, but if a homeowner can afford $2,000 a month in mortgage loan payments, then would they really wait if the payments might (might) go down to $1,800?

What potential buyers can’t stomach is a potential 10% drop in home value, within one year.

Ford Realty Beacon Hill – Condo for Sale Office

Boston condos for sale – Ford Realty Inc

Updated: Boston Condos for Sale Blog 2024

John Ford Boston Beacon Hill Condo Broker 137 Charles St. Boston, MA 02114