Boston Condos for sale Sale

A younger journey into the Boston real estate market

There’s a common misconception that younger generations aren’t interested in homeownership. Many people point to the fact that millennials put off purchasing their first home as a reason for this belief.

Odeta Kushi, Deputy Chief Economist for First American, explains why millennials have put off certain milestones linked to homeownership. Those delays led to their homeownership rates trailing slightly behind older generations:

“Historically, millennials have delayed the critical lifestyle choices often linked to buying a first home, including getting married and having children, in order to further their education. This is clear in cross-generational comparisons of homeownership rates which show millennials lagging their generational predecessors.”

So, it’s partially true that some millennials have waited on homeownership to focus on other things in their lives – and that’s impacting certain housing market trends.

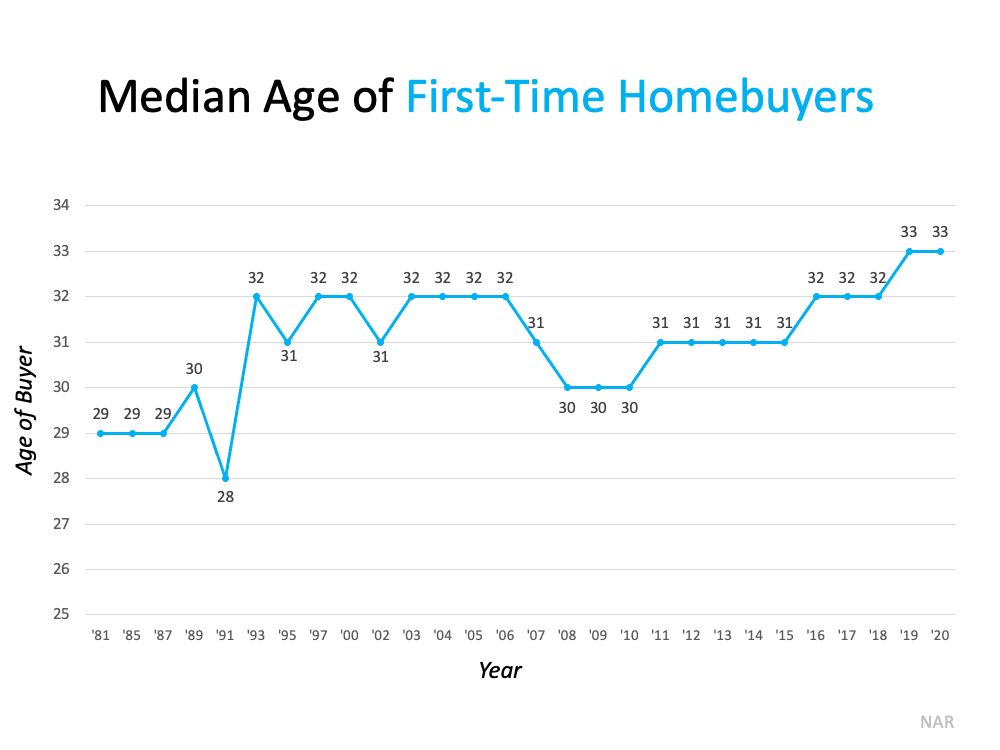

Data from the National Association of Realtors (NAR) indicates the average age of a first-time homebuyer is higher today than it’s been over the past 40 years. As the graph below shows, homebuyers today are purchasing their first home an average of 4 years later than people in the 1980s and early 1990s: But just because millennials are hitting certain milestones later in life doesn’t mean they’re not interested in becoming homeowners. The recent U.S. Census reveals a significant increase in homeownership rates for millennials and other young homebuyers.

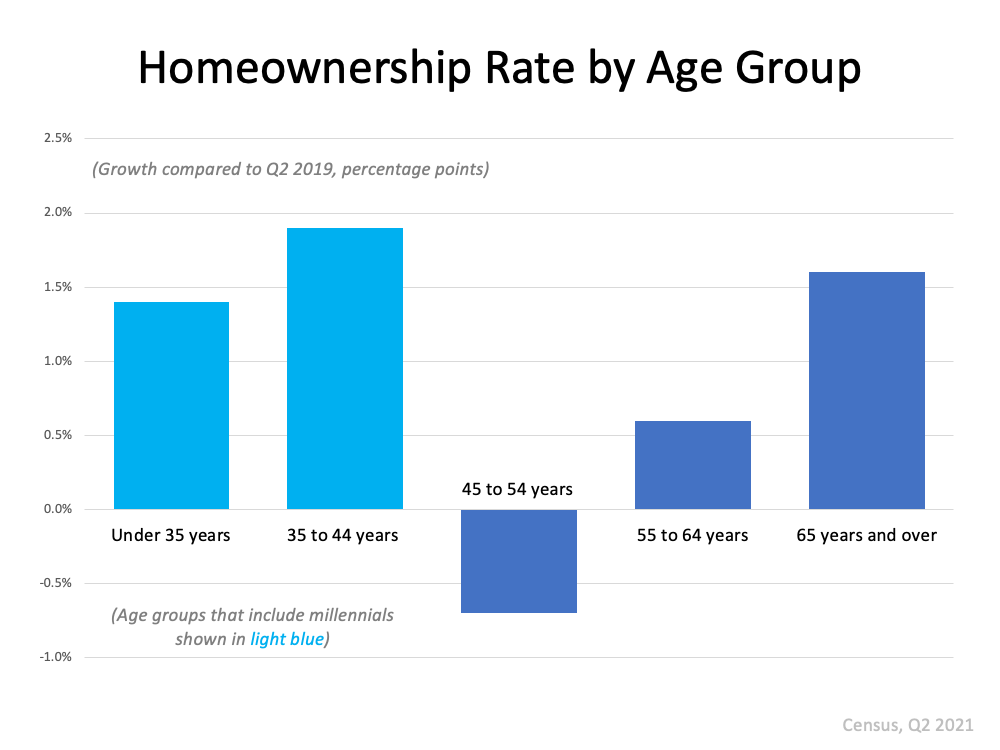

But just because millennials are hitting certain milestones later in life doesn’t mean they’re not interested in becoming homeowners. The recent U.S. Census reveals a significant increase in homeownership rates for millennials and other young homebuyers. As the graph above shows, millennials are entering the market in full force, and their share of the market is growing. Based on the data, the belief that younger generations don’t want to buy homes is a misconception. In fact, the recent Capital Market Outlook report from Merrill-Lynch further drives home this point, as it specifically mentions the effect millennials are having on demand:

As the graph above shows, millennials are entering the market in full force, and their share of the market is growing. Based on the data, the belief that younger generations don’t want to buy homes is a misconception. In fact, the recent Capital Market Outlook report from Merrill-Lynch further drives home this point, as it specifically mentions the effect millennials are having on demand:

“Demand is very strong because the biggest demographic cohort in history is moving through the household-formation and peak home-buying stages of its life cycle.”

Kushi is following the trend of millennial homeownership and puts it more simply, saying:

“. . . it’s clear that younger households (millennials!) are driving homeownership growth.”

As the largest generation, millennials’ impact on the market is growing as more and more people from that generation reach homebuying age – and Generation Z isn’t far behind, either. That means younger generations will likely continue to drive demand in the housing market for years to come.

Boston Condos and the Bottom Line

If you’re a member of a younger generation and interested in purchasing a home, you’re not alone. Many of your peers are on their path to homeownership, too. Let’s connect today and discuss what you can do to accomplish your homebuying goals.

Boston Condos for sale Sale

__________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Here’s a Boston condo buyers story which I think a lot of Millennial’s will be able to relate to:

I’m a pretty typical millennial. I dye my hair purple. I have a Harry Potter tattoo. I drive a Prius.

But in one way, I’m atypical for my generation: I just bought a Boston condo for sale

Just a year ago, data showed the median age of people buying houses was on the rise, and likely to continue going up.

In downtown Boston, though, things will be different. Rents are rising and scores of people are moving to the city. That’s driving rents up, which will encourage millennial’s like me to buy Boston condos for sale.

Many in my generation are burdened with student loan debt and even as Beacon Hill apartment rents rise, will be unable to afford to buy a downtown Boston condo. When you ask housing experts why millennial’s don’t buy homes, student loan debt is the most common reason they give.

A growing number of Boston millennial’s are working for the tech industry, however, which tends to pay well and could help mitigate the issue of debt.

I’m 24 years old, smack dab in the middle of the millennial generation, and today I’m signing final papers on my first Boston condo.

More millennial’s will join me. As my generation ages and rents continue to skyrocket, Boston’s already-crowded housing market is about to get seriously intense.

Yes, I was attracted by the historically low interest rates and the freedom of getting to tear down and paint my walls in my Boston condo

But the single biggest thing that convinced me it was the right time to buy was the jump in Beacon Hill apartment rent prices. The rent on my one-bedroom apartment in Beacon Hill went up nearly 5 percent in September, and that’s happening across the city.

Data from Seattle online real estate company Zillow (Nasdaq: Z) shows rents in Boston increased in the last year to a median price of $2,210 per month. For many millennial’s, that’s downright unaffordable.

I began my home search online, scouring Zillow and Redfin listings. Then I realized I had no idea what I was doing so I enlisted a knowledgeable Boston real estate agent to take me through the (many) twists and turns of buying a Boston condo

I’m not the only person of my age jumping into home ownership — the rate at which homes are flying off the Boston real estate market suggests that other millennial’s are getting in on the action.

The two biggest reasons people decide to buy homes are when they get married and have children, and millennials are just getting to the age when they hit those milestones.

But as the rents continue to rise, and our generation hits some big milestones, Boston millennial’s will buying Boston condos for sale in herds.

Click here: Back Bay luxury condos for sale and sales data

Click here: Beacon Hill luxury condos for sale and sales data

Click here: Midtown luxury condos for sale and sales data

Click here: Seaport luxury condos for sale and sales data