No! We’re not going to have a Boston real estate crash.

Boston Condos for Sale and Apartments for Rent

No! We’re not going to have a Boston real estate crash.

Don’t expect the housing market to crash anytime soon

Lack of supply could keep prices high, despite high interest rates

Peace be with you

Peace be with you

Boston Beacon Hill Condos for Sale

Updated: Boston Real Estate Blog 2024

Condo Broker 137 Charles St. Boston, MA 02114

Visit our office at 137 Charles Street Rear, Beacon Hill MA 02114

Sorry we are experiencing system issues. Please try again.

Beacon Hill Condos for Sale

Te housing market may be hoping for a crash, but they shouldn’t be holding their breaths, according to economists.

“[There’s] just simply not enough supply,” National Association of Realtors chief economist Lawrence Yun told Insider. “So the economics of supply and demand, if there’s a shortage, prices simply cannot crash.”

The country is short between 2.3 million to 6.5 million housing units, according to Realtor.com.

Homebuyers have been stuck between elevated mortgage rates — though those have eased up in recent months — and high home prices. In March, home prices were up 6.5 percent year-over-year, according to the S&P CoreLogic Case-Shiller Home Price Index.

But while a market crash may bring down prices, that’s not all that would occur, so doom prognosticators should be careful what they wish for. When the market crashed 15 years ago, pushed in part by an oversupply of homes, the Great Recession quickly followed. People lost their jobs and livelihoods. Lower home prices meant squat for those who needed to focus on much more immediate issues.

Potential signs or symptoms of a housing crash include sudden drops in demand, inventory oversupply, increased mortgage rates, accelerated home production or a greater economic condition, such as a recession.

Boston Beacon Hill Condos for Sale

Updated: Boston Real Estate Blog 2024

Condo Broker 137 Charles St. Boston, MA 02114

Visit our office at 137 Charles Street, Beacon Hill MA 02114

Sorry we are experiencing system issues. Please try again.

Click Here to view: Google Ford Realty Inc Reviews

________________________-

No! We’re not going to have a Boston real estate crash.

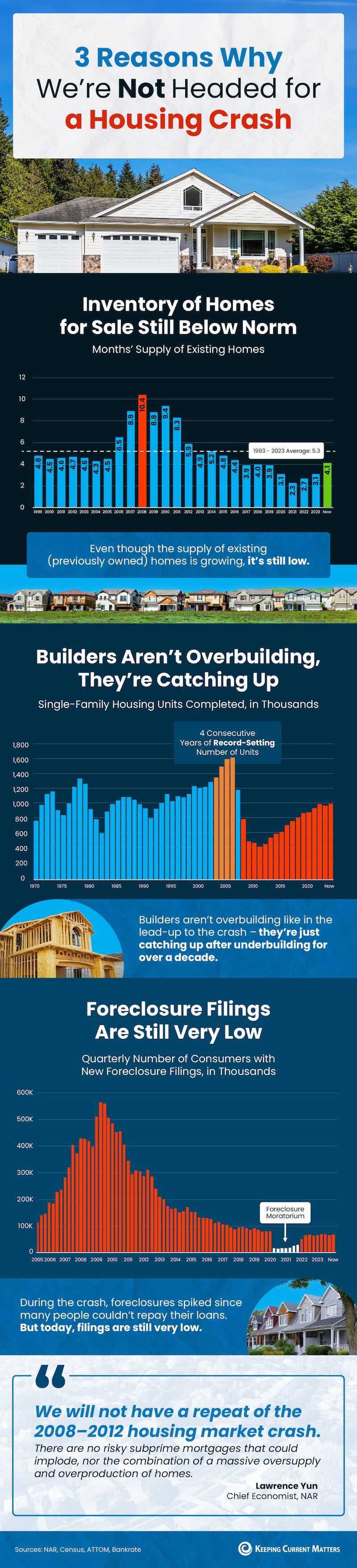

If you’re holding out hope that the Boston Seaport condo for sale market is going to crash and bring Boston condo for sale prices back down, here’s a look at what the data shows. And spoiler alert: that’s not in the cards. Instead, experts say condominium prices are going to keep going up.

Today’s market is very different than it was before the housing crash in 2008. Here’s why.

It’s Harder To Get a Loan Now – and That’s Actually a Good Thing

It was much easier to get a home loan during the lead-up to the 2008 housing crisis than it is today. Back then, banks had different lending standards, making it easy for just about anyone to qualify for a home loan or refinance an existing one.

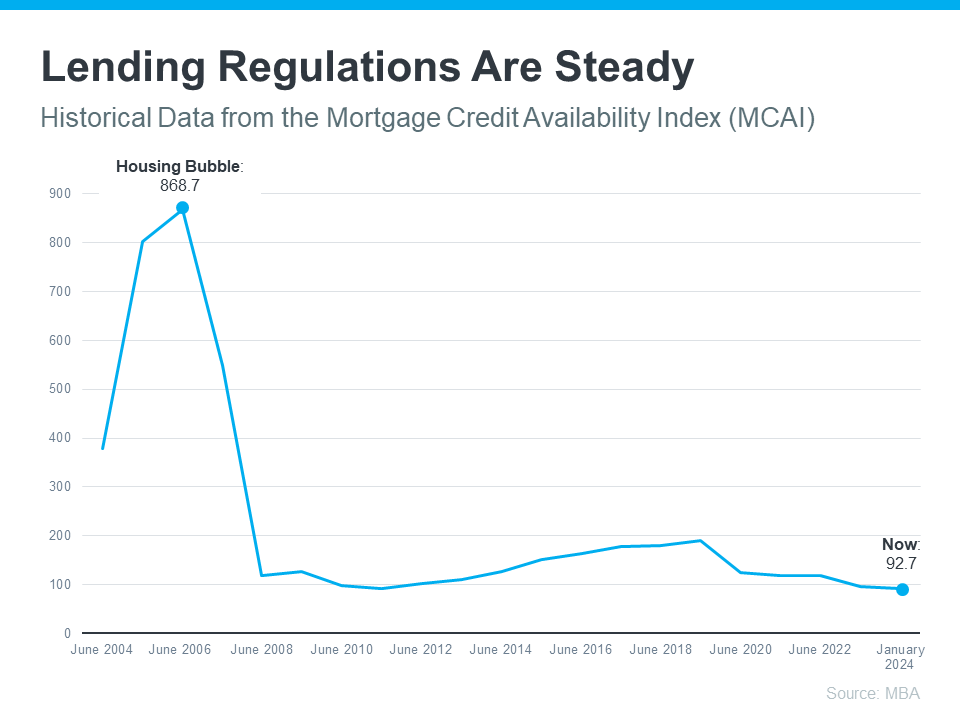

Things are different today. Homebuyers face increasingly higher standards from mortgage companies. The graph below uses data from the Mortgage Bankers Association (MBA) to show this difference. The lower the number, the harder it is to get a mortgage. The higher the number, the easier it is:

The peak in the graph shows that, back then, lending standards weren’t as strict as they are now. That means lending institutions took on much greater risk in both the person and the mortgage products offered around the crash. That led to mass defaults and a flood of foreclosures coming onto the market.

There Are Far Fewer Boston Condos for Sale Today, so Prices Won’t Crash

Because there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), that caused home prices to fall dramatically. But today, there’s an inventory shortage – not a surplus.

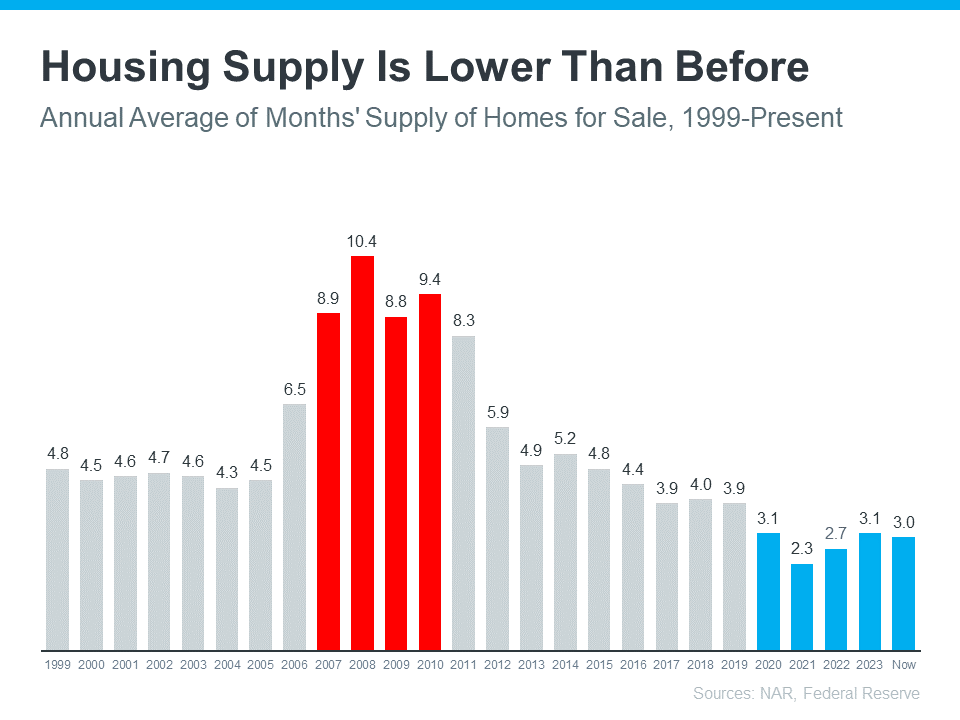

The graph below uses data from the National Association of Realtors (NAR) and the Federal Reserve to show how the months’ supply of homes available now (shown in blue) compares to the crash (shown in red):

Today, unsold inventory sits at just a 3.0-months’ supply. That’s compared to the peak of 10.4 month’s supply back in 2008. That means there’s nowhere near enough inventory on the market for home prices to come crashing down like they did back then.

People Are Not Using Their Homes as ATMs Like They Did in the Early 2000s

Back in the lead up to the housing crash, many homeowners were borrowing against the equity in their homes to finance new cars, boats, and vacations. So, when prices started to fall, as inventory rose too high, many of those homeowners found themselves underwater.

But today, homeowners are a lot more cautious. Even though prices have skyrocketed in the past few years, homeowners aren’t tapping into their equity the way they did back then.

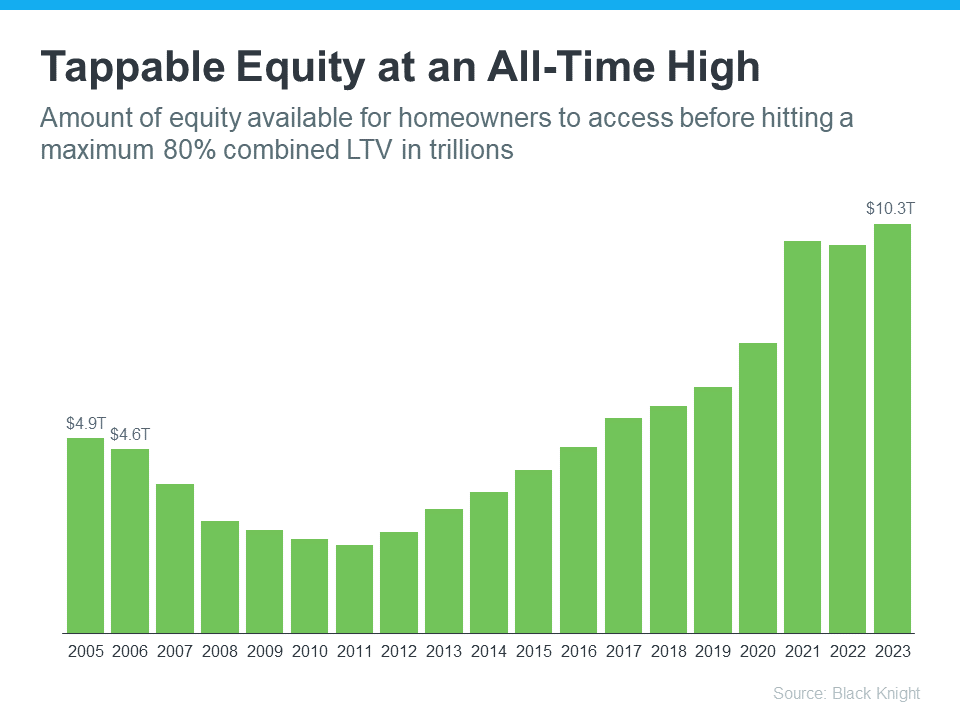

Black Knight reports that tappable equity (the amount of equity available for homeowners to access before hitting a maximum 80% loan-to-value ratio, or LTV) has actually reached an all-time high:

That means, as a whole, homeowners have more equity available than ever before. And that’s great. Homeowners are in a much stronger position today than in the early 2000s. That same report from Black Knight goes on to explain:

“Only 1.1% of mortgage holders (582K) ended the year underwater, down from 1.5% (807K) at this time last year.”

And since homeowners are on more solid footing today, they’ll have options to avoid foreclosure. That limits the number of distressed properties coming onto the market. And without a flood of inventory, prices won’t come tumbling down.

Boston Condos for Sale and the Bottom Line

While you may be hoping for something that brings prices down, that’s not what the data tells us is going to happen. The most current research clearly shows that today’s market is nothing like it was last time.

_________________________

No! We’re not going to have a Boston real estate crash.

I had a conversation last night, she was a well educated professional and the subject was regarding the real estate market. The conversation was very pleasant, but she had one flaw that irritated me. She would always jump to conclusions before investigating all the possibilities.

I agreed with her that the COVID-19 has had an impact on the Boston real estate market and in particular the Boston condo market and the Beacon Hill apartment rental market. But the real estate market is NOT on some inevitable road to Armageddon.

After going through the latest job numbers, the retail sales numbers that even impressed most economists, along with other economic indicators that would impact the Boston condo for sale market. She began to see the Boston real estate market in a new light.

I must confess its easy to jump to conclusions without reviewing all possibilities. I’m reminded of a blog post that Seth Godin wrote:

I tried to recharge the lithium battery that works with my drill. After twenty minutes, the charger said the battery had failed.

Fortunately, I have a second battery. I put that into the charger and it also showed a failure.

Neither battery had failed. The charger had.

Boston Real Estate for Sale

Updated: Boston Real Estate Blog 2024

Click here: Back Bay luxury condos for sale and sales data

Boston Back Bay Condos for Sale

Sorry we are experiencing system issues. Please try again.

![]()

Click Here: Back to Boston Real Estate Home Search

Ford Realty – Boston Real Estate Google Reviews 2024