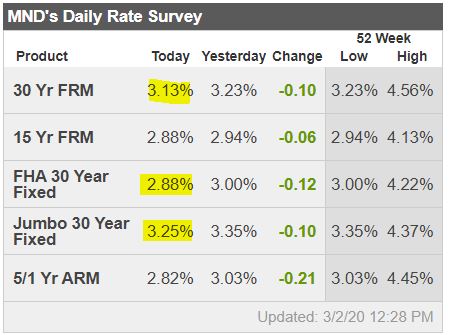

Mortgage rates officially hit all-time lows this morning.

When rates are this low and when they’ve fallen this fast, the question of locking vs floating is about as prevalent as I ever see it. The easiest advice for those willing to take some risk is to float and continue to watch Treasury yields (specifically, the 10yr). Since mortgage rates have been lagging so badly, they should be able to hold fairly steady for a day or two even if the 10yr signals a bounce. Of course this requires preparation and planning. Be sure your mortgage is ready to lock and to have a realistic idea of your ability to make that happen in a matter of a few hours or less on any given day. In other words, if you’re floating, make a “locking game-plan” with your friendly neighborhood mortgage professional.

Request Form

This content is currently unavailable. Please check back later or contact the site's support team for more information.