Boston real estate for sale or age in place?

Byline – John Ford Boston Beacon Hill Condo Broker 137 Charles St. Boston, MA 02114

Boston Condos for Sale and Apartments for Rent

Boston real estate for sale or age in place?

Some have suggested that empty nest households – those aged 55 and older living with no children with at least two extra bedrooms and in place for at least a decade – could eventually flood the housing market with their homes and help make homes more affordable. However, data indicates that this demographic is unlikely to make a meaningful impact over the coming years, especially in the most expensive markets.

Nationwide, there were roughly 20.9 million of these empty nest households in 2022, up modestly from 20.2 million in 2017.

All else equal, in order for empty nest households to make a meaningful contribution to lowering house prices, their numbers must exceed the number of families that currently need their own housing and those that will want or need homes in the future. In addition, because relative affordability varies so widely across the country, this potential supply of homes would need to be concentrated in markets with the worst housing shortages to make a dent. Unfortunately, this future supply coming from empty-nest households doesn’t line up with the areas of greatest need on the map.

The number of empty nest households does exceed the number of families in need of housing: by 2.6 times.

There were 20.9 million empty nest households in 2022 compared to 8.1 million families living with non-relatives that were likely in need of their own unit, and that surplus has grown over time. From 2017 to 2022, the number of families doubling up — living with non-relatives — grew by 500,821. During that same period, the number of empty nest households increased by 703,892.

The problem: Most empty nest households can be found in already relatively more affordable markets. These are areas where housing is already more available, the rate of doubling up with non-relatives is much lower, and they’re located far from where the crush of current young workers choose to live.

A flood of currently owner-occupied homes hitting the market as their current owners pass away or otherwise vacate their homes will NOT solve housing affordability challenges, especially in high demand housing markets.

A silver tsunami is likely to have a larger impact in regions like Pittsburgh and Cleveland. Younger residents have tended to leave these areas to pursue better job opportunities elsewhere, leaving older generations to make up a larger share of those who remain. Young workers choose to live near productive job centers and on the coasts, areas that have much lower populations of older retired individuals holding back housing supply in the first place.

Among the 50 largest metropolitan areas, Pittsburgh, New Orleans, Detroit, Buffalo, Cleveland were the markets with the largest gap between the potential housing supply from empty nest households and potential demand from younger residents. But these are already relatively more affordable markets with fewer home buying age workers to begin with.

In expensive coastal markets with strong job centers where home buying age workers choose to live — like Austin, Seattle and Denver — there are fewer empty nest households to begin with.

As a result, the impact of a future increase in supply coming from the existing housing stock owned by older individuals would likely have a smaller impact on affordability in expensive high demand coastal markets. Without the promise of remote work or investments that improve work prospects and raise the desirability of Midwest markets, it is unlikely that we will see a big shift in migration patterns towards markets full of empty nesters.

Rather, the fix for affordability challenges remains a strong supply expansion coming from newly built homes. Zillow research shows that housing shortages were the most severe in markets with more land use restrictions. In addition to promoting denser construction, removing barriers to homeownership that aren’t related to income — credit assistance programs, down payment assistance or help with closing costs, for example — would likely improve access to homeownership.

https://www.zillow.com/research/empty-nesters-affordability-34636/

_____________________________________________________________________

Boston real estate for sale or age in place?

In today’s world of rising housing costs, many buyers are looking for ways to still be able to buy a home. Some of them have found a solution in multi-generational living.

Multi-generational living is when two or more adult generations live together under one roof. This includes siblings, parents, or even grandparents. Here’s an in-depth look at why more buyers are choosing this option today, so you can see if it may be right for you too.

Reasons To Buy a Multi-Generational Home

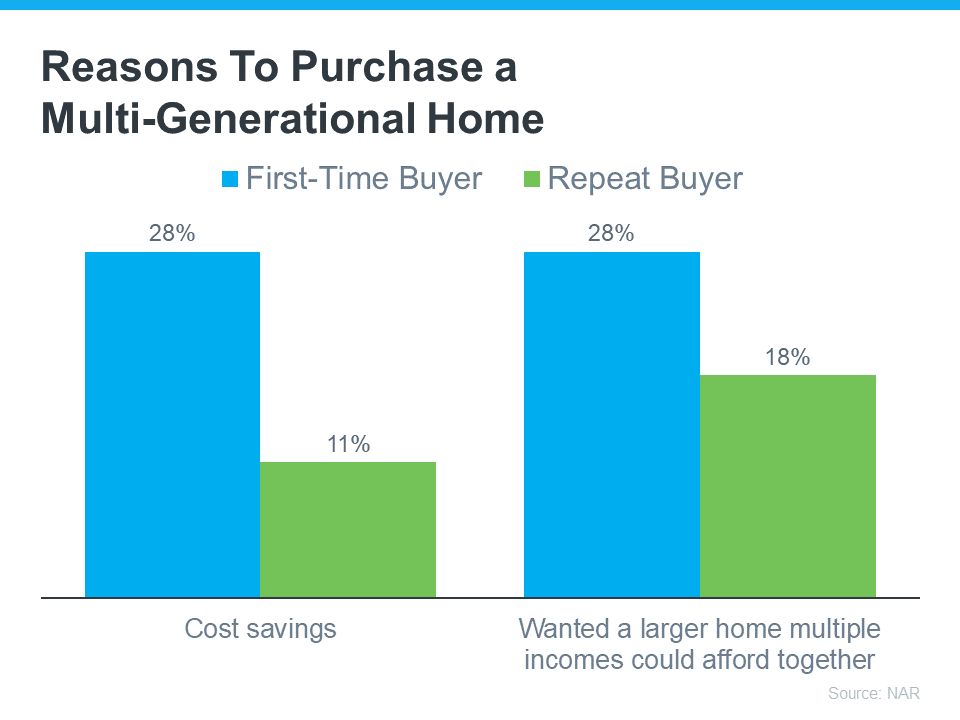

According to a recent study by the National Association of Realtors (NAR), the top two reasons people are opting for multi-generational homes today have to do with affordability (see graph below):

Cost Savings: About 28% of first-time buyers and 11% of repeat buyers are deciding on a multi-generational home to save on costs. By pooling their resources, households can share the financial responsibilities like mortgage payments, utilities, property taxes, and maintenance, to make homeownership more affordable. This is especially helpful for first-time homebuyers who may be finding it tough to afford a home on their own in today’s market.

More Space: Another 28% of first-time buyers and 18% of repeat buyers are doing it because they want a larger home they couldn’t afford on their own. For some of the repeat buyers who listed this as a main motivator, it could be because they find themselves taking care of older parents while also welcoming back young adults who’ve returned to the nest. With everyone chipping in and combining their incomes, suddenly, that big dream home with more space is within reach. As the Triangle Business Journal explains:

“Choosing multi-gen living allows people to purchase a home much larger than they could afford on their own by leveraging the combined income, credit and a down payment of those that they will be occupying the home with.”

Lean on an Expert

If you’re interested in this too, partner with a local real estate agent. Finding the perfect multi-generational home isn’t as simple as shopping for a regular house. That’s because there are more people with even more opinions and needs that should be considered.

You’ve got to make sure everyone has their own space, find room for shared household time, and possibly even create adaptable areas for older relatives. It’s a puzzle, and the pieces need to fit just right. Your real estate agent has the expertise and local knowledge to help you find that home where everyone can be comfortable without breaking the bank. As MoneyGeek.com puts it:

“Having a good multigenerational property can improve the prospects of success when living with loved ones. A multigenerational home should fit the specific needs of most family members regardless of age or health. Speaking to a real-estate agent can help you gain clarity and locate a fit.”

Bottom Line

Buying a multi-generational home can be a smart way to tackle some of today’s affordability challenges. When you team up to share expenses, you can make your dream of homeownership more attainable. If this sounds like an option for you and your loved ones, let’s connect to help you find a home that’s the perfect fit.

Updated: Boston condo for sale website 2023

____________________________________________________________________________________________________

Around the coast, the housing stock is finite – there isn’t any more room to build new houses. Whether they knew it or not at the time, everyone has bought their ‘forever’ home and aging-in-place has become the natural trend. The higher prices and rates have locked out the majority of possible home buyers, but there still aren’t enough homes to sell – evidenced by the relatively low inventory.

A month ago, there were 466 houses for sale between Carlsbad and La Jolla, and today we’re down to 422 active listings – in an era where other areas are reporting a surge in inventory. There is a real push to build granny flats to create more housing, but that isn’t going to help the resale market. In fact, the building of ADUs will actually make the real estate market WORSE by keeping more seniors aging in place and limiting the resale inventory.

Higher rates and prices will only continue the shift of homeownership being for the elite – only.

From the AARP:

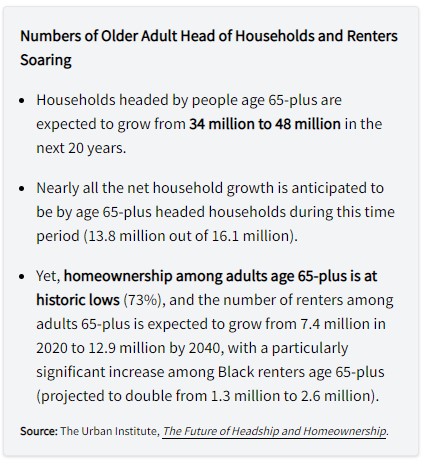

The COVID-19 pandemic has altered how people think about their lives and homes – which has collided with exponential growth in the number of older heads of households and renters. These trends highlight the urgent need to rapidly increase and improve the age-friendly and affordable community and housing options.

AARP’s 2021 Home and Community Preferences survey found that over three-quarters (77%) of adults age 50 and older want to remain in their homes as they age. This desire is consistent across the lifespan with 63% of adults overall saying the same. The number of older adults wanting to remain in their homes as they age has remained relatively consistent for more than a decade and was not impacted by the pandemic.

Increasing the number of multigenerational households, providing more options like accessory dwelling units (ADUs) or “in-law units”, and encouraging renovations that support aging-in-place are all critical to support this desire.

Aging-In-Place Remodeling

In this blog post, I’ll outline the most common remodeling projects for those individuals who prefer to age in place rather than purchasing a downtown high-rise condo with all the bells and whistles that meet their needs as they get older.

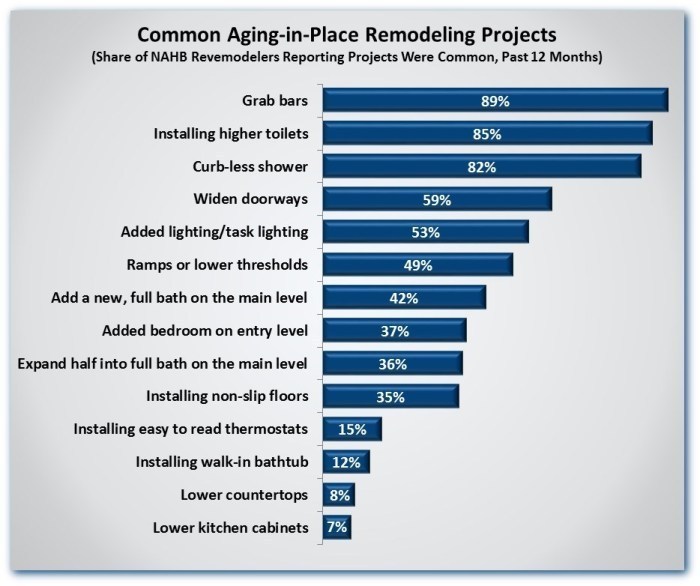

When it comes to the most sought-after aging-in-place projects, bathrooms dominate the top spot.

In a recent NAHB survey, more than eight out of 10 reported installing grab bars (89%), higher toilets (85%) and curbless showers (82%) made the list as the most common aging-in-place projects.

Another item that made the list; widening doorways was the next most-common project on the list, came in at a distance 59%, followed by added lighting.

NAHB senior economist Paul Emrath provides more details in this Eye on Housing blog post.